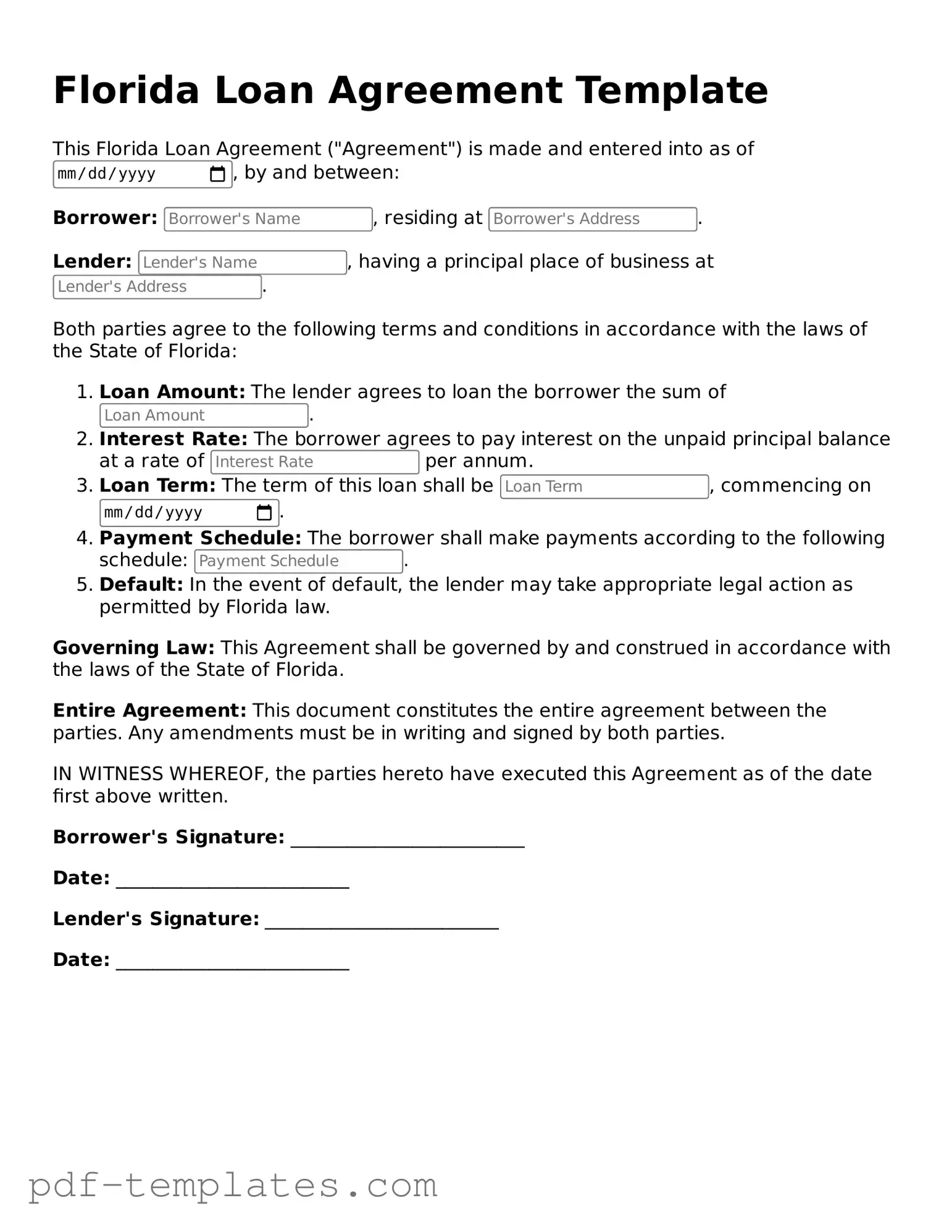

Official Loan Agreement Template for Florida State

In Florida, a Loan Agreement form serves as a vital document that outlines the terms and conditions of a loan between a lender and a borrower. This form typically includes essential details such as the loan amount, interest rate, repayment schedule, and any collateral involved. It is designed to protect both parties by clearly defining their rights and responsibilities. Additionally, the agreement may specify late fees, default terms, and the governing law, which is particularly important in case of disputes. By laying out these aspects in writing, the Loan Agreement helps to prevent misunderstandings and provides a clear framework for the loan transaction. Understanding the components of this form can empower individuals and businesses alike to engage in lending activities with confidence and clarity.

Misconceptions

When it comes to the Florida Loan Agreement form, many people harbor misconceptions that can lead to confusion or even legal issues. Understanding these myths is crucial for anyone entering into a loan agreement. Below are some common misconceptions, along with clarifications to help you navigate this important document.

- All loan agreements are the same. This is false. Each loan agreement can vary significantly based on the terms negotiated between the lender and borrower. It's essential to read each agreement carefully.

- You don’t need to read the fine print. Many believe that the main points are enough. However, the fine print often contains critical details about fees, penalties, and other obligations.

- Verbal agreements are sufficient. Relying on verbal promises can be risky. A written agreement provides legal protection and clarity for both parties involved.

- Loan agreements are only for large amounts. This is not true. Even small loans can benefit from a formal agreement to ensure both parties understand the terms.

- You can change the terms after signing. Once signed, altering the terms typically requires mutual consent and a formal amendment. Changes without agreement can lead to disputes.

- All loan agreements must be notarized. While notarization can add an extra layer of authenticity, it is not always a requirement for a loan agreement to be legally binding in Florida.

- If you miss a payment, it’s not a big deal. Missing a payment can have serious consequences, including late fees and damage to your credit score. It’s crucial to communicate with your lender if you foresee issues.

- You can ignore the loan agreement once the money is received. This misconception can lead to serious repercussions. The terms of the agreement remain in effect until the loan is fully repaid.

Addressing these misconceptions can help you make informed decisions and protect your financial interests. Always consider consulting with a legal professional when entering into any loan agreement to ensure you fully understand your rights and responsibilities.

Florida Loan Agreement: Usage Instruction

Completing the Florida Loan Agreement form requires careful attention to detail. By following these steps, you can ensure that the form is filled out correctly and completely, which is essential for a valid agreement between the parties involved.

- Begin by entering the date at the top of the form. This date should reflect when the agreement is being signed.

- Next, fill in the names and addresses of both the borrower and the lender. Make sure to include full legal names and current addresses.

- Specify the loan amount in the designated section. This should be the total sum being borrowed.

- Indicate the interest rate applicable to the loan. Clearly state whether it is fixed or variable.

- Provide the repayment terms. This includes the payment schedule, the duration of the loan, and any grace periods if applicable.

- Detail any collateral being offered as security for the loan, if applicable. This section should describe the collateral clearly.

- Include any additional terms or conditions that both parties have agreed upon. This may cover late fees, prepayment penalties, or other specific agreements.

- Both parties must sign and date the form at the bottom. Ensure that the signatures are legible and that the date reflects when the agreement was signed.

Once the form is filled out, it is advisable to keep copies for both the borrower and the lender. This ensures that both parties have access to the terms of the agreement for future reference.

Common mistakes

-

Incomplete Information: Failing to fill out all required fields can lead to delays or rejection of the application.

-

Incorrect Personal Details: Providing inaccurate names, addresses, or contact information can cause significant issues in communication.

-

Missing Signatures: Not signing the agreement where indicated is a common oversight that can invalidate the document.

-

Incorrect Loan Amount: Entering the wrong loan amount can create confusion and may result in financial discrepancies.

-

Ignoring Terms and Conditions: Not reading or understanding the terms can lead to unexpected obligations or penalties.

-

Failure to Provide Supporting Documents: Omitting necessary documentation, such as proof of income or identification, can stall the approval process.

-

Not Reviewing for Errors: Skipping a final review can allow typos or mistakes to go unnoticed, which may complicate matters later.

-

Using Outdated Forms: Utilizing an old version of the loan agreement can result in non-compliance with current regulations.

-

Neglecting to Seek Clarification: Not asking questions about unclear sections can lead to misunderstandings and issues down the line.

PDF Features

| Fact Name | Description |

|---|---|

| Purpose | The Florida Loan Agreement form is used to outline the terms and conditions of a loan between a lender and a borrower in Florida. |

| Governing Law | Florida law governs the loan agreement, specifically under Chapter 687 of the Florida Statutes. |

| Parties Involved | The form identifies the lender and borrower, ensuring both parties are clearly defined. |

| Loan Amount | The specific amount being borrowed is clearly stated in the agreement, which is crucial for both parties. |

| Interest Rate | The agreement specifies the interest rate applicable to the loan, which can be fixed or variable. |

| Repayment Terms | Details about how and when the loan will be repaid are included, providing clarity for both parties. |

| Default Consequences | The form outlines the consequences of defaulting on the loan, ensuring both parties understand the risks involved. |

Dos and Don'ts

When filling out a Florida Loan Agreement form, it is essential to approach the task with care and attention to detail. Below is a list of important dos and don’ts to help ensure that the process goes smoothly.

- Do read the entire agreement carefully before filling it out.

- Do provide accurate and complete information.

- Do check for any specific requirements related to the type of loan you are applying for.

- Do sign and date the form where indicated.

- Don’t leave any sections blank unless instructed to do so.

- Don’t use abbreviations or shorthand that could lead to confusion.

- Don’t rush through the process; take your time to ensure accuracy.

- Don’t hesitate to ask for clarification if you do not understand any part of the agreement.

By following these guidelines, you can help ensure that your Loan Agreement form is completed correctly and efficiently. This will facilitate a smoother transaction and help avoid potential delays or issues down the line.

Similar forms

The Florida Loan Agreement form shares similarities with a Promissory Note. Both documents outline the terms under which money is borrowed and specify the repayment obligations of the borrower. A Promissory Note is a more straightforward document that focuses on the borrower's promise to repay the loan amount, including interest rates and payment schedules. While the Loan Agreement may include additional terms such as collateral and conditions for default, the Promissory Note serves as a simpler acknowledgment of the debt itself.

Another document similar to the Florida Loan Agreement is the Mortgage Agreement. This document is used when a borrower secures a loan with real property as collateral. Like the Loan Agreement, the Mortgage Agreement details the terms of the loan, including the amount borrowed, interest rates, and repayment terms. However, the Mortgage Agreement also includes provisions regarding foreclosure and the lender's rights in case of default, making it more complex than a standard Loan Agreement.

The Florida Loan Agreement also resembles a Security Agreement. This document is utilized when a borrower pledges specific assets as collateral for a loan. Both the Loan Agreement and Security Agreement outline the terms of the loan, including repayment schedules and interest rates. However, the Security Agreement focuses on the collateral itself, detailing the rights of the lender to seize the pledged assets if the borrower defaults. This adds a layer of protection for the lender that is not typically found in a standard Loan Agreement.

For those looking to establish authority in decision-making, understanding the significance of a General Power of Attorney form is crucial. It empowers an individual to appoint an agent, allowing them to manage finances and make important choices when the principal cannot do so. To explore this form further, consider reviewing the comprehensive General Power of Attorney document available here.

Lastly, the Florida Loan Agreement is akin to a Line of Credit Agreement. This document allows borrowers to access funds up to a specified limit, rather than receiving a lump sum. Both agreements outline the terms of borrowing, including interest rates and repayment schedules. However, a Line of Credit Agreement typically provides more flexibility, allowing borrowers to withdraw and repay funds as needed, whereas a Loan Agreement usually involves fixed payments over a set period. This distinction highlights the different structures of borrowing arrangements available to consumers.

Check out Popular Loan Agreement Forms for Different States

Free Promissory Note Template Texas - It can provide a framework for modifying terms if necessary.

To navigate the complexities of the mechanics lien process in California efficiently, it is advisable to consult All California Forms, which provide essential templates and guidelines for properly filing these crucial documents, ensuring that contractors and suppliers can secure their rights to payment without unnecessary legal complications.