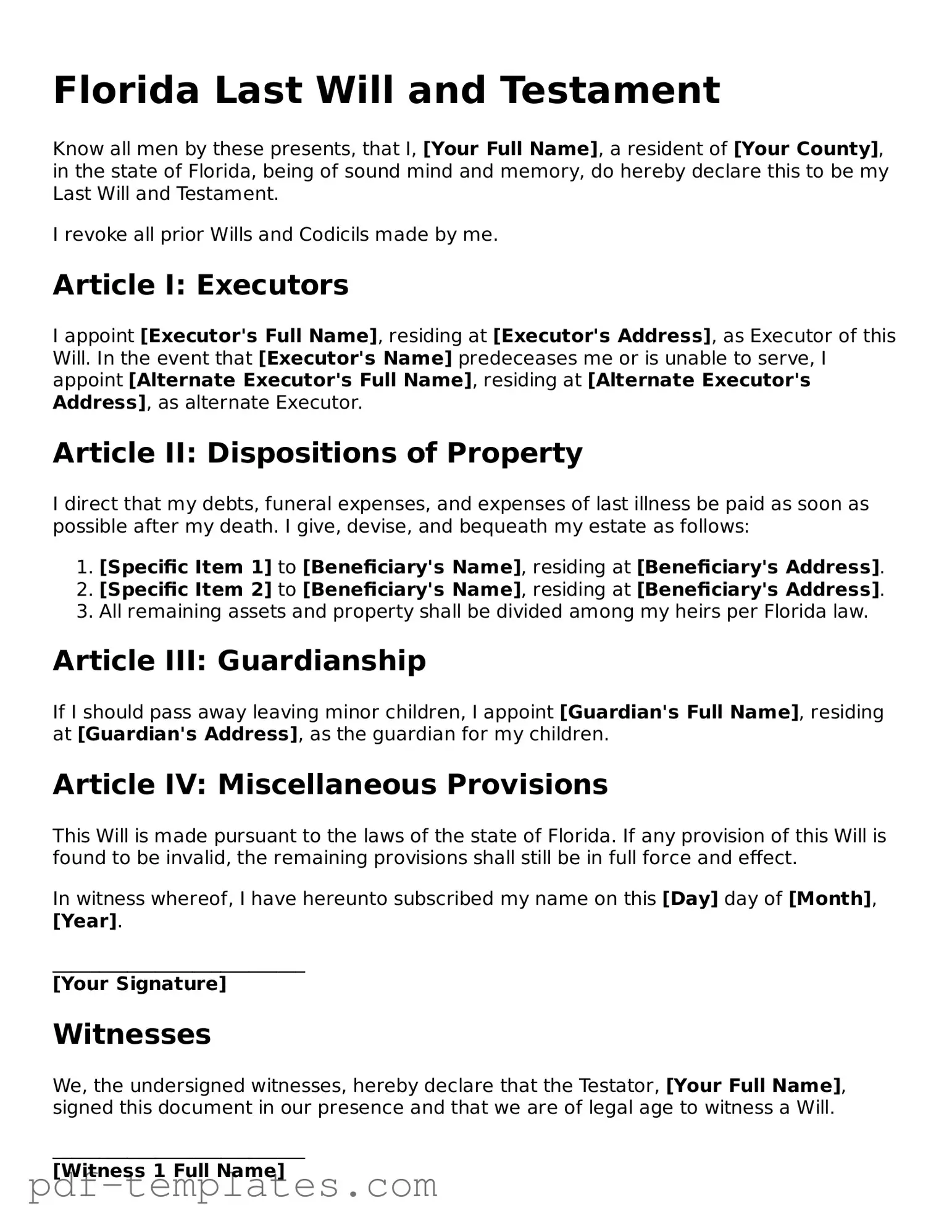

Official Last Will and Testament Template for Florida State

Creating a Last Will and Testament is a crucial step in ensuring that your wishes are honored after your passing. In Florida, this legal document serves as a guide for how your assets will be distributed, who will care for your minor children, and who will manage your estate. The Florida Last Will and Testament form includes essential components such as the designation of an executor, the identification of beneficiaries, and specific instructions regarding your property. It also outlines any funeral arrangements you may prefer, allowing you to express your final wishes clearly. Understanding the requirements and structure of this form can help you navigate the process with confidence, ensuring that your intentions are respected and upheld. Whether you have significant assets or just a few personal belongings, having a will is an important step in planning for the future and providing peace of mind for your loved ones.

Misconceptions

Understanding the Florida Last Will and Testament form is essential for anyone looking to plan their estate. However, several misconceptions can lead to confusion. Here are six common myths debunked:

- Myth 1: A handwritten will is not valid in Florida.

- Myth 2: You need a lawyer to create a will in Florida.

- Myth 3: A will automatically goes into effect upon signing.

- Myth 4: All assets must go through probate.

- Myth 5: A will can dictate where you are buried.

- Myth 6: Once a will is created, it cannot be changed.

This is incorrect. Florida recognizes handwritten wills, also known as holographic wills, as valid if they are signed by the testator and the material provisions are in their handwriting.

While having a lawyer can be beneficial, it is not a legal requirement. Individuals can create their own wills using the Florida Last Will and Testament form, provided they meet the necessary legal criteria.

This is misleading. A will only takes effect after the testator's death. Until then, it can be changed or revoked at any time.

This is not true. Certain assets, such as those held in a living trust or joint ownership properties, can bypass the probate process, allowing for a quicker distribution.

This misconception arises from the belief that a will can cover all post-death arrangements. However, burial instructions are typically not enforceable through a will in Florida.

This is false. A will can be amended or revoked at any time as long as the testator is mentally competent. Regular updates are encouraged to reflect life changes.

Florida Last Will and Testament: Usage Instruction

Completing your Florida Last Will and Testament is an important step in ensuring your wishes are honored after your passing. Once you have filled out the form, you will need to sign it in front of witnesses to make it legally binding. Follow these steps to fill out the form accurately.

- Begin by entering your full name at the top of the form. Make sure it matches your identification documents.

- Next, provide your current address. This should be your permanent residence.

- Identify your family members. List your spouse, children, and any other dependents you wish to mention. Include their full names and relationships to you.

- Designate an executor. This is the person who will carry out the terms of your will. Write their full name and address.

- Specify your beneficiaries. These are the individuals or organizations who will receive your assets. Clearly state their names and the specific assets they will inherit.

- Detail any specific bequests. If you want to leave particular items to certain people, list those items and their recipients here.

- Include a residuary clause. This addresses any remaining assets not specifically mentioned in the will. State who will receive these assets.

- Sign the document at the designated area. Your signature must be in your own handwriting.

- Have at least two witnesses sign the will. They must be present when you sign and should also provide their names and addresses.

- Consider adding a self-proving affidavit if you want to simplify the probate process. This step is optional but can be beneficial.

Common mistakes

-

Not signing the will properly. In Florida, a will must be signed by the person creating it, known as the testator. If the will is not signed, it may not be considered valid.

-

Failing to have witnesses. Florida law requires at least two witnesses to sign the will. If this step is overlooked, the will may not hold up in court.

-

Using outdated forms. Laws change, and so do legal forms. Using an old version of the Last Will and Testament form can lead to complications.

-

Not being clear about beneficiaries. It's important to clearly identify who will receive assets. Vague language can cause disputes among heirs.

-

Neglecting to update the will. Life changes, such as marriage, divorce, or the birth of a child, may require updates to the will. Failing to do so can result in unintended distributions.

-

Forgetting to include a self-proving affidavit. While not required, adding a self-proving affidavit can simplify the probate process and help avoid challenges to the will's validity.

PDF Features

| Fact Name | Description |

|---|---|

| Governing Law | The Florida Last Will and Testament is governed by Florida Statutes, Chapter 732. |

| Age Requirement | To create a valid will in Florida, the individual must be at least 18 years old. |

| Witness Requirement | A Florida will must be signed by at least two witnesses who are present at the same time. |

| Signature Requirement | The testator must sign the will at the end, or another person can sign it in their presence and at their direction. |

| Holographic Wills | Florida recognizes holographic wills, which are handwritten and signed by the testator, but they must still meet certain criteria. |

| Revocation of Previous Wills | Creating a new will automatically revokes any previous wills unless stated otherwise in the new document. |

Dos and Don'ts

When filling out the Florida Last Will and Testament form, it is essential to follow certain guidelines to ensure that your wishes are clearly expressed and legally valid. Below is a list of things you should and shouldn't do.

- Do clearly identify yourself in the document, including your full name and address.

- Do specify that this document is your Last Will and Testament.

- Do list your beneficiaries explicitly, detailing who will receive your assets.

- Do appoint an executor who will manage your estate after your passing.

- Don't use vague language; be precise about your wishes to avoid confusion.

- Don't forget to sign the document in the presence of at least two witnesses.

- Don't use a will that is not compliant with Florida laws, as this may render it invalid.

Similar forms

The Florida Last Will and Testament is often compared to a Living Will. While a Last Will outlines how a person's assets should be distributed after death, a Living Will focuses on medical decisions. It specifies an individual's preferences regarding life-sustaining treatments in the event they become incapacitated. Both documents serve to express personal wishes, but they do so in different contexts—one for after death and the other for medical care while living.

Another document similar to the Last Will is the Durable Power of Attorney. This legal instrument allows a person to designate someone else to make financial or legal decisions on their behalf. Like a Last Will, it is a means of ensuring that one’s wishes are honored. However, the Durable Power of Attorney takes effect during a person's lifetime, whereas a Last Will only comes into play after death.

The Revocable Living Trust also shares similarities with the Last Will. Both documents are used for estate planning, but a Revocable Living Trust can help avoid probate, allowing for a more seamless transfer of assets. It provides the grantor with control over their assets while alive and specifies how those assets should be managed and distributed after death, similar to the directives found in a Last Will.

A Healthcare Proxy is another document that resembles the Last Will. This legal form allows individuals to appoint someone to make healthcare decisions on their behalf if they are unable to do so. While the Last Will deals with asset distribution, the Healthcare Proxy focuses on medical choices, ensuring that a person's health care preferences are respected.

The Codicil is a supplementary document that modifies an existing Last Will. It allows individuals to make changes without creating an entirely new will. This can include altering beneficiaries, changing asset distributions, or updating executor information. Like the Last Will, a Codicil must meet specific legal requirements to be valid, ensuring that the testator's intentions are clear.

To ensure a smooth transfer of your property without the need for probate, consider utilizing a helpful resource such as the Texas Transfer-on-Death Deed form guide. This form simplifies the estate planning process by allowing you to designate beneficiaries who will receive your real estate upon your passing.

Lastly, the Letter of Instruction serves as a companion document to the Last Will. While it is not legally binding, it provides guidance to the executor and loved ones about the deceased's wishes, such as funeral arrangements, account information, and personal messages. This document complements the Last Will by offering additional context and clarity regarding the deceased’s intentions.

Check out Popular Last Will and Testament Forms for Different States

Will Template Washington State - Allows flexibility in naming multiple beneficiaries for certain assets.

Simple Will Form Pennsylvania - Allows for the establishment of a trust, making management easier for heirs.

The completion of the Asurion F-017-08 MEN form is essential for customers seeking to navigate the insurance claim process for their electronic devices. By doing so, you ensure a swift evaluation of your request, allowing you to receive assistance with your device promptly. For your convenience, you can access the necessary documentation at pdftemplates.info/asurion-f-017-08-men-form/ before filling out the form.

Will Legal - Provides clarity to reduce potential disputes among heirs.