Official Lady Bird Deed Template for Florida State

The Florida Lady Bird Deed, a unique estate planning tool, offers homeowners a way to transfer property while retaining control during their lifetime. This deed allows property owners to designate beneficiaries who will inherit the property automatically upon their death, avoiding the often lengthy and costly probate process. One of its key features is the ability to maintain full rights to the property, including the right to sell, lease, or mortgage it without needing the consent of the beneficiaries. This flexibility is particularly beneficial for those who want to ensure their heirs receive the property without the complications that can arise from traditional methods of transfer. Additionally, the Lady Bird Deed can provide certain tax advantages, as it may help in avoiding gift taxes. Understanding the intricacies of this deed can empower homeowners to make informed decisions about their estate planning needs.

Misconceptions

Understanding the Florida Lady Bird Deed form can be challenging, and several misconceptions often arise. Below are seven common misunderstandings about this important estate planning tool.

-

It is only for elderly individuals.

Many believe that the Lady Bird Deed is exclusively for seniors. In reality, it can benefit anyone looking to manage their property and ensure a smooth transfer to heirs.

-

It avoids probate entirely.

While a Lady Bird Deed can simplify the transfer of property and potentially avoid some probate issues, it does not eliminate the probate process in all situations.

-

It requires a lawyer to create.

Although consulting a lawyer is advisable for legal advice, individuals can create a Lady Bird Deed on their own. However, ensuring it meets all legal requirements is crucial.

-

It cannot be changed once executed.

This misconception is false. A Lady Bird Deed can be revoked or modified at any time while the grantor is still alive and competent.

-

It is only applicable to residential properties.

Some think that the Lady Bird Deed only applies to homes. In fact, it can be used for various types of real estate, including vacant land and rental properties.

-

It automatically transfers all property upon death.

While the Lady Bird Deed does facilitate the transfer of property upon death, it is essential to ensure that all conditions are met for the deed to be effective.

-

There are no tax implications.

This belief is misleading. Transferring property via a Lady Bird Deed may have tax consequences, including potential capital gains tax, which should be carefully considered.

By addressing these misconceptions, individuals can make informed decisions about using a Lady Bird Deed as part of their estate planning strategy.

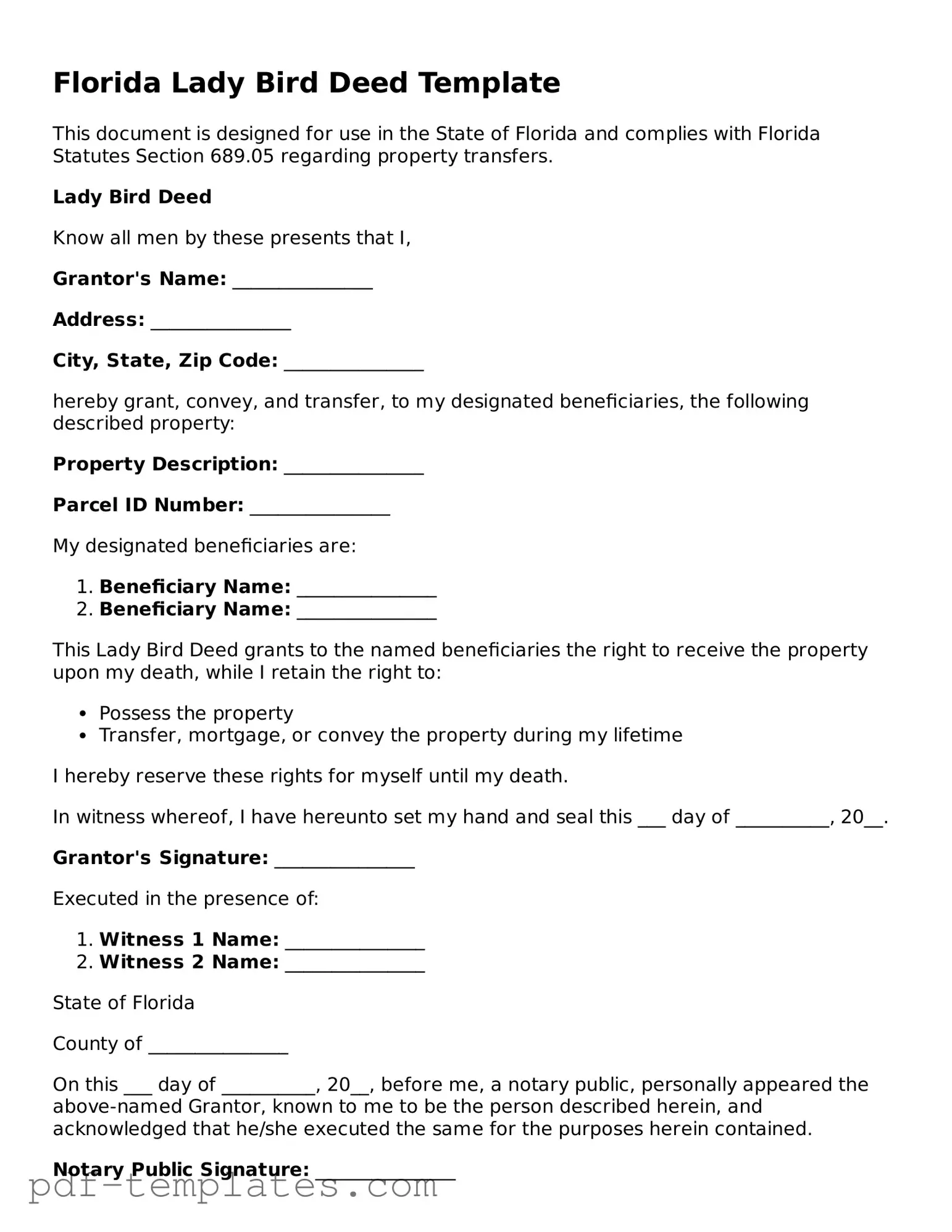

Florida Lady Bird Deed: Usage Instruction

Completing the Florida Lady Bird Deed form is a straightforward process. This deed allows you to transfer property to a beneficiary while retaining control during your lifetime. Follow these steps to ensure that the form is filled out correctly.

- Begin by obtaining the Lady Bird Deed form. You can find it online or at a local legal office.

- At the top of the form, fill in the name of the property owner. This should be the person who currently holds the title to the property.

- Next, provide the address of the property being transferred. Include the street address, city, state, and zip code.

- Identify the beneficiary or beneficiaries. Write their full names, as they will be the individuals receiving the property.

- Specify the relationship between the property owner and the beneficiaries. This could be a spouse, child, friend, etc.

- Indicate whether the property owner wishes to retain the right to sell or change the deed during their lifetime. This is a critical aspect of the Lady Bird Deed.

- Sign the form in the designated area. The signature should be the same as the name listed at the top of the form.

- Have the form notarized. A notary public will verify your identity and witness your signature.

- After notarization, file the completed deed with the county clerk’s office where the property is located. This step is essential for the deed to be legally recognized.

Once the form is filled out and filed, you can rest assured that your wishes regarding the property are documented. Make sure to keep a copy for your records and inform the beneficiaries about the deed's existence.

Common mistakes

-

Incomplete Information: Failing to provide all necessary details can lead to delays or invalidation of the deed. Ensure all fields are filled out accurately.

-

Incorrect Property Description: Using vague or incorrect descriptions of the property can cause confusion. It is crucial to include the full legal description, not just the address.

-

Not Identifying All Parties: Omitting names of all parties involved, including beneficiaries, can create legal issues. Each individual should be clearly identified.

-

Failure to Sign and Date: Neglecting to sign and date the form can render it invalid. All required signatures must be present for the deed to be legally binding.

-

Improper Witnessing: Not having the deed properly witnessed can lead to challenges in its enforcement. Ensure that the witnessing requirements are met according to Florida law.

-

Not Recording the Deed: Failing to record the deed with the county clerk can result in complications regarding property rights. Recording is essential for public notice.

-

Ignoring Tax Implications: Overlooking potential tax consequences of transferring property can lead to unexpected liabilities. It is advisable to consult a tax professional.

-

Not Consulting Legal Advice: Attempting to fill out the form without professional guidance can result in mistakes. Consulting a lawyer can help ensure compliance with legal requirements.

PDF Features

| Fact Name | Details |

|---|---|

| Definition | A Florida Lady Bird Deed allows a property owner to transfer their property to a beneficiary while retaining control during their lifetime. |

| Governing Law | The Lady Bird Deed is governed by Florida Statutes, specifically Chapter 732, which covers the laws of wills and estates. |

| Benefits | This deed helps avoid probate, allowing for a smoother transfer of property upon the owner's death. |

| Revocability | The property owner can revoke or change the deed at any time before their death. |

| Tax Implications | Using a Lady Bird Deed may help in maintaining the property’s tax basis, which can benefit the beneficiary. |

| Eligibility | Any Florida resident who owns real property can create a Lady Bird Deed. |

Dos and Don'ts

When filling out the Florida Lady Bird Deed form, it's essential to follow certain guidelines to ensure the document is valid and meets your needs. Here’s a straightforward list of dos and don'ts:

- Do clearly identify the property you are transferring.

- Do include the full legal names of all grantors and grantees.

- Do check for accuracy in spelling and information throughout the form.

- Do ensure that the form is signed in the presence of a notary public.

- Do record the deed with the county clerk's office after completion.

- Don't leave any blank spaces on the form; fill in all required fields.

- Don't use informal names or nicknames for the parties involved.

- Don't forget to include any necessary witnesses, if required.

- Don't assume that a verbal agreement is sufficient; written documentation is crucial.

By following these guidelines, you can help ensure that your Lady Bird Deed is properly executed and legally binding.

Similar forms

The Florida Lady Bird Deed shares similarities with a traditional warranty deed. Both documents transfer ownership of real property. A warranty deed guarantees that the seller has a clear title to the property and will defend that title against any claims. However, the Lady Bird Deed allows the property owner to retain certain rights during their lifetime, such as the right to live in the property and the ability to sell it without the beneficiary's consent. This makes it a more flexible option for those looking to manage their estate while still enjoying their property.

Another document akin to the Lady Bird Deed is the revocable living trust. Like the Lady Bird Deed, a revocable living trust allows property owners to maintain control over their assets while planning for the future. Both documents can help avoid probate, which simplifies the transfer of property upon death. However, a living trust requires the property owner to transfer the title of their property into the trust, whereas a Lady Bird Deed allows the owner to keep the title in their name while designating beneficiaries.

A quitclaim deed is also comparable to the Lady Bird Deed. Both serve to transfer ownership of property, but they do so in different ways. A quitclaim deed transfers whatever interest the grantor has in the property, without any guarantees about the title. This means that if the grantor does not have a clear title, the grantee may end up with nothing. In contrast, the Lady Bird Deed ensures that the grantor retains rights to the property during their lifetime, providing more security for the original owner.

In the realm of California real estate, understanding the various legal documents is essential for effective property management. Landlords often utilize the California Rental Application form to ensure a smooth leasing process by gathering vital information from potential tenants. This tool, similar to estate planning instruments, emphasizes the importance of thorough evaluation and pre-screening. For landlords looking to standardize their approach, resources such as All California Forms provide indispensable guidance in maintaining compliance with housing regulations while safeguarding their interests.

The life estate deed is another document that resembles the Lady Bird Deed. Both types of deeds allow an individual to retain rights to a property while designating a beneficiary to inherit it after their death. With a life estate deed, the original owner has the right to use the property for their lifetime, but they cannot sell or mortgage it without the consent of the remainderman. The Lady Bird Deed, however, grants the owner more flexibility, allowing them to sell or change beneficiaries without needing permission.

Lastly, the enhanced life estate deed is similar to the Lady Bird Deed in that it allows for the transfer of property while retaining certain rights. This type of deed allows the owner to live in the property and maintain control during their lifetime, similar to the Lady Bird Deed. The key difference lies in the specific language and the legal implications that come with each. The enhanced life estate deed may not provide the same level of flexibility as the Lady Bird Deed, particularly regarding the ability to sell the property without the beneficiaries’ involvement.

Check out Popular Lady Bird Deed Forms for Different States

Lady Bird Deed Texas Form - A Lady Bird Deed ensures improved clarity and control over assets compared to a standard will.

The ADP Pay Stub form is a document that employees receive, detailing their earnings and deductions for each pay period. It serves as a crucial tool for understanding compensation, withholding taxes, and other financial information. For more details and assistance, you can refer to the information available at https://pdftemplates.info/adp-pay-stub-form.