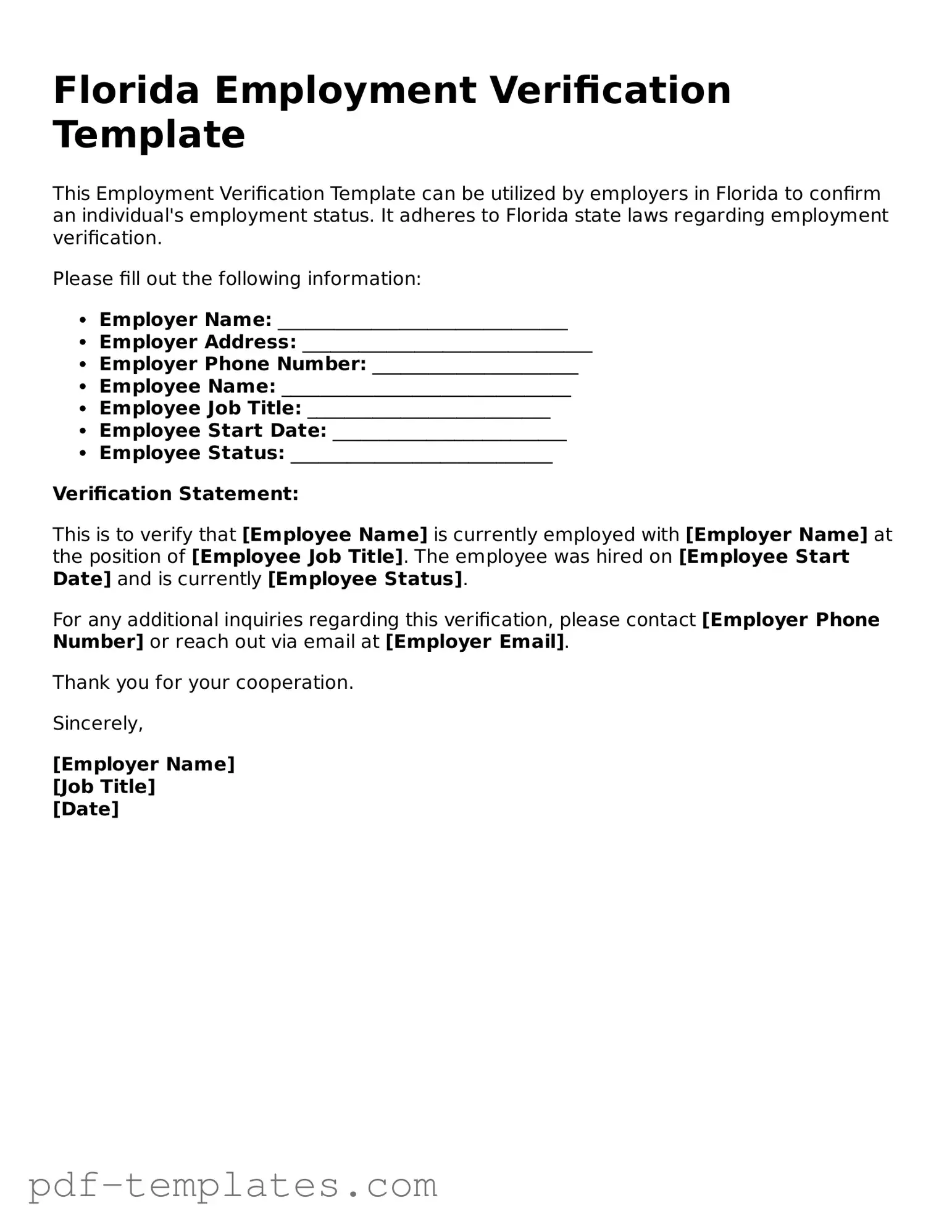

Official Employment Verification Template for Florida State

The Florida Employment Verification form serves as a crucial document for both employers and employees within the state. This form is primarily used to confirm an individual's employment status, job title, and the duration of their employment. Employers are required to provide accurate information, ensuring that the verification process is both efficient and reliable. The form typically includes sections for the employee's personal details, such as their name and Social Security number, alongside the employer's information. It also allows for the inclusion of additional remarks that may be pertinent to the verification process. Understanding the requirements and implications of this form is essential for maintaining compliance with state regulations and for facilitating smooth employment transitions. For employees, this document can be vital when seeking new job opportunities, applying for loans, or fulfilling other verification needs. Ensuring that the form is filled out correctly can help avoid delays and complications in various employment-related processes.

Misconceptions

Employment verification is a critical aspect of the hiring process in Florida, yet many misconceptions surround the Florida Employment Verification form. Understanding these myths can help both employers and employees navigate the verification process more effectively.

- Myth 1: The Florida Employment Verification form is only for new hires.

- Myth 2: Employers are required to use a specific format for the form.

- Myth 3: The form guarantees employment verification.

- Myth 4: Only large companies need to complete this form.

- Myth 5: The information provided on the form is confidential.

- Myth 6: Employees cannot dispute information on the form.

- Myth 7: The form must be completed by the employee.

- Myth 8: The Florida Employment Verification form is the same as a background check.

This is not true. While it is commonly used for new employees, the form can also be utilized for existing employees when verifying employment status or for other administrative purposes.

While it is advisable to follow a standard format for consistency, Florida law does not mandate a specific template. Employers can create their own version as long as it includes the necessary information.

Completing the form does not guarantee that an employee’s employment status will be verified. Factors such as incomplete information or discrepancies can lead to verification issues.

All employers, regardless of size, can benefit from using the Florida Employment Verification form. It helps maintain accurate records and ensures compliance with employment laws.

While certain details may be treated as sensitive, the information on the employment verification form can be disclosed under specific circumstances, especially if required by law.

Employees have the right to challenge any inaccuracies on the verification form. Open communication between employees and employers can resolve discrepancies effectively.

This is a common misconception. Employers typically complete the form, but employees should review the information to ensure accuracy before submission.

While both processes may involve verifying employment, they are distinct. A background check includes a broader range of information, such as criminal history, whereas the verification form focuses solely on employment status.

Florida Employment Verification: Usage Instruction

Completing the Florida Employment Verification form is an important step in confirming employment status. After filling out the form, it will need to be submitted to the appropriate party for processing. This ensures that the information provided is verified and can be used for various purposes, such as securing benefits or employment opportunities.

- Begin by downloading the Florida Employment Verification form from the official website or obtaining a physical copy.

- Carefully read through the instructions provided on the form to understand the required information.

- Fill in the employee's full name in the designated space at the top of the form.

- Provide the employee's Social Security number, ensuring accuracy to avoid any verification issues.

- Enter the employee's job title and department in the appropriate sections.

- Indicate the dates of employment, including the start date and, if applicable, the end date.

- Fill in the employer's name and contact information, including the company's address and phone number.

- Include the signature of the authorized representative from the employer's side, along with the date of signing.

- Review the completed form for any errors or omissions before submission.

- Submit the form to the requesting party, ensuring it is sent through the appropriate channels (mail, email, or fax, as required).

Common mistakes

-

Incomplete Information: Many individuals fail to provide all required fields. This can delay the verification process.

-

Incorrect Dates: Entering the wrong dates of employment is a common error. Accurate dates are crucial for verification.

-

Wrong Employer Details: Listing incorrect employer names or contact information can lead to confusion and delays.

-

Signature Issues: Forgetting to sign the form or using an illegible signature can invalidate the submission.

-

Not Providing Supporting Documents: Some people neglect to attach necessary documentation that backs up their claims.

-

Failure to Review: Skipping a final review before submission often results in overlooked mistakes.

-

Ignoring Instructions: Each form comes with specific instructions. Not following these can lead to errors.

-

Submitting Late: Delaying the submission can result in missed deadlines and complications in the employment process.

PDF Features

| Fact Name | Description |

|---|---|

| Purpose | The Florida Employment Verification form is used to confirm the employment status of an individual in the state of Florida. |

| Governing Law | This form is governed by Florida Statutes, specifically Section 443.101, which outlines employment verification requirements. |

| Required Information | Employers must provide details such as the employee's name, job title, and duration of employment. |

| Use Cases | This form is often used for background checks, loan applications, and other situations requiring proof of employment. |

| Submission | Completed forms are typically submitted to the requesting party, which could be a financial institution or another employer. |

Dos and Don'ts

When filling out the Florida Employment Verification form, it is important to follow specific guidelines to ensure accuracy and compliance. Below is a list of things you should and shouldn't do.

- Do read the instructions carefully before starting.

- Do provide accurate and complete information.

- Do double-check all entries for spelling and numerical errors.

- Do sign and date the form before submission.

- Do keep a copy of the completed form for your records.

- Don't leave any required fields blank.

- Don't use abbreviations that may cause confusion.

- Don't submit the form without verifying the recipient's requirements.

- Don't forget to include any necessary supporting documents.

Similar forms

The I-9 form, officially known as the Employment Eligibility Verification form, is a key document used in the hiring process across the United States. Like the Florida Employment Verification form, the I-9 is designed to confirm an employee’s identity and eligibility to work in the country. Employers must complete the I-9 for every new hire, ensuring that they have valid documentation, such as a passport or a driver's license, to verify their identity. This form emphasizes compliance with federal laws, making it a crucial counterpart to the Florida form in terms of employment verification.

The W-2 form, or Wage and Tax Statement, serves a different purpose but is also essential in the employment process. While the Florida Employment Verification form focuses on confirming employment status, the W-2 provides a summary of an employee's annual earnings and tax withholdings. Employers issue W-2 forms to their employees at the end of each tax year, which is used for filing income tax returns. Both documents are vital in establishing an employee's work history and financial information, linking them in the broader context of employment verification.

Check out Popular Employment Verification Forms for Different States

Texas Letter of Income Comfirmation - Helps potential employers verify a candidate's work history.

Free Employment Verification Letter - Provides assurance to prospective landlords regarding tenant income.