Official Durable Power of Attorney Template for Florida State

In Florida, the Durable Power of Attorney form serves as a critical legal instrument that empowers individuals to designate someone they trust to manage their financial and legal affairs in the event they become incapacitated. This form not only provides clarity regarding the scope of authority granted to the agent but also ensures that the principal's wishes are respected during times of vulnerability. It can cover a wide range of responsibilities, from handling banking transactions and managing real estate to making healthcare decisions. Importantly, the durable aspect of this power of attorney means that it remains effective even if the principal is no longer able to make decisions for themselves. Understanding the nuances of this form is essential for anyone looking to safeguard their interests and ensure that their affairs are handled according to their preferences. As life can be unpredictable, having a Durable Power of Attorney in place is not just a precaution; it is a proactive step towards securing peace of mind for both the principal and their loved ones.

Misconceptions

Understanding the Florida Durable Power of Attorney form is essential for effective estate planning. However, several misconceptions can lead to confusion and potentially costly mistakes. Here are seven common misconceptions:

- It only applies to financial decisions. Many believe that a Durable Power of Attorney is limited to financial matters. In reality, it can also cover health care decisions if specified.

- It becomes invalid if I become incapacitated. This is false. The "durable" aspect means that it remains in effect even if you become incapacitated.

- Any adult can serve as my agent. While you can choose anyone, they must be an adult and capable of making decisions. Some restrictions apply.

- I cannot revoke it once it's signed. This is not true. You can revoke a Durable Power of Attorney at any time, as long as you are mentally competent.

- It is only necessary for the elderly. Young adults can also benefit from this form. Life is unpredictable, and anyone can face unexpected situations.

- My agent can do anything they want with my money. Your agent must act in your best interest and follow the guidelines you set forth in the document.

- I don’t need witnesses or notarization. In Florida, a Durable Power of Attorney must be signed in the presence of two witnesses and notarized to be valid.

Being aware of these misconceptions can help ensure that your Durable Power of Attorney serves its intended purpose effectively. Take the time to understand the implications of this important document.

Florida Durable Power of Attorney: Usage Instruction

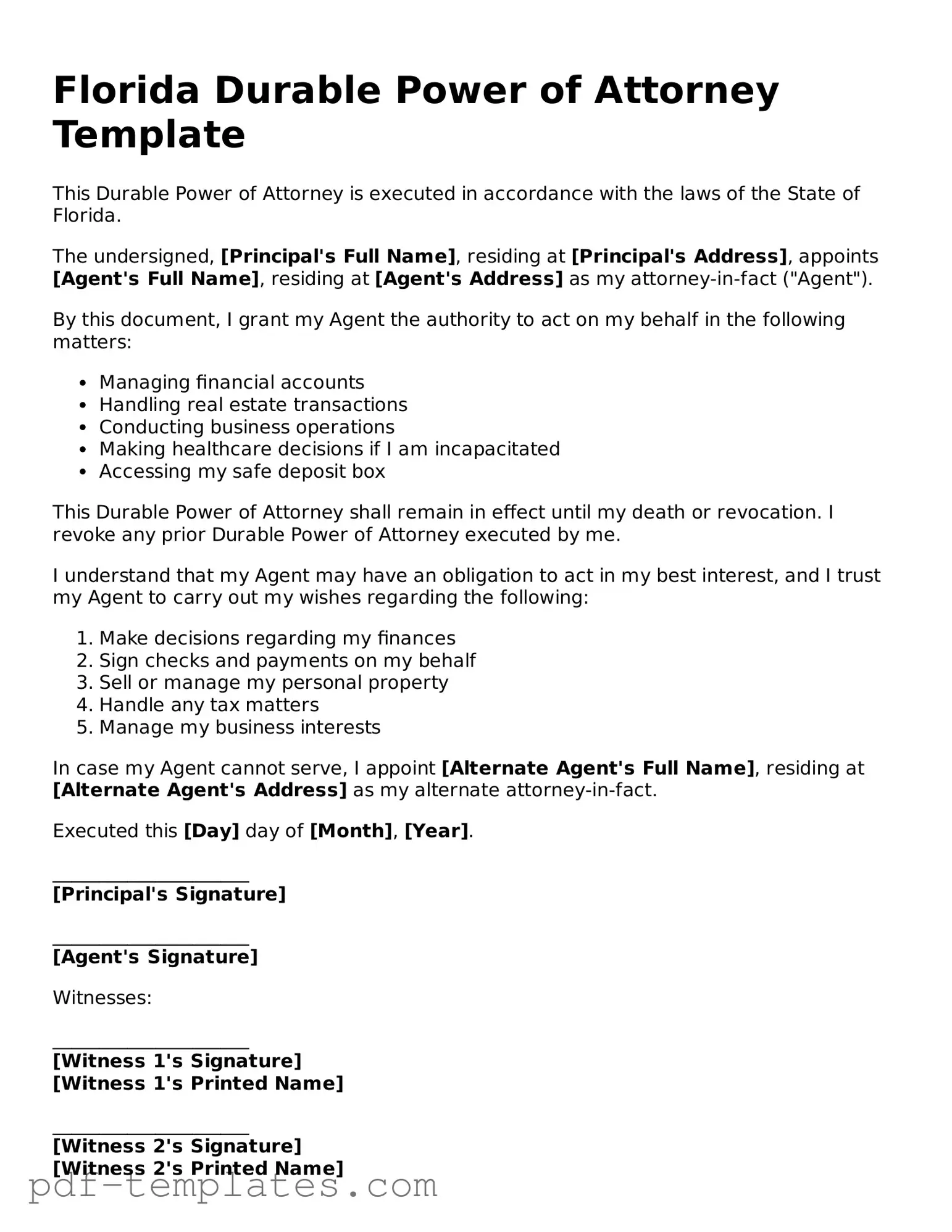

Filling out the Florida Durable Power of Attorney form is a straightforward process. Once completed, this document allows you to designate someone to make decisions on your behalf in financial or legal matters. Follow these steps to ensure that your form is filled out correctly.

- Obtain the Florida Durable Power of Attorney form. You can find it online or at a local legal office.

- Read through the form carefully to understand the sections you need to complete.

- In the first section, provide your full legal name and address as the principal.

- Next, identify the agent you are appointing. Write their full name and address.

- Decide if you want to grant your agent broad powers or limit their authority. Indicate your choice on the form.

- In the designated area, specify any limitations or special instructions regarding the agent’s powers.

- Sign and date the form in the presence of a notary public. Ensure the notary also signs and stamps the document.

- Make copies of the completed form for your records and for your agent.

Common mistakes

-

Not Choosing the Right Agent: Many people select someone they trust, but they might not consider whether that person is capable of handling financial matters responsibly. Choosing an agent who understands your wishes and has the ability to manage your affairs is crucial.

-

Failing to Specify Powers: The form allows you to specify which powers you grant to your agent. Some individuals leave this section blank, which can lead to confusion or misuse of authority. Clearly outline the powers you wish to grant.

-

Not Including Successor Agents: If your primary agent is unable or unwilling to act, having a successor agent is important. Omitting this can leave your affairs in limbo.

-

Ignoring Witness and Notary Requirements: In Florida, the Durable Power of Attorney must be signed in the presence of two witnesses and a notary public. Failing to follow these requirements can invalidate the document.

-

Using Outdated Forms: Laws and regulations can change. Using an outdated form may not comply with current legal standards, potentially leading to complications.

-

Not Reviewing the Document Regularly: Life circumstances change, and so do your needs. Regularly reviewing and updating your Durable Power of Attorney ensures it reflects your current wishes.

-

Overlooking the Importance of Communication: Failing to discuss your wishes with your agent can create misunderstandings. Open communication ensures that your agent understands your values and preferences.

-

Assuming It’s Only Needed for Elderly Individuals: Many people believe that a Durable Power of Attorney is only necessary for older adults. However, anyone over the age of 18 can benefit from having one in place.

PDF Features

| Fact Name | Details |

|---|---|

| Definition | A Durable Power of Attorney (DPOA) allows an individual to appoint someone else to manage their financial and legal affairs, even if they become incapacitated. |

| Governing Law | The Florida Durable Power of Attorney form is governed by Florida Statutes Chapter 709. |

| Durability | The term "durable" means that the authority granted remains effective even if the principal is unable to make decisions due to mental or physical incapacity. |

| Agent's Authority | The appointed agent can perform a wide range of tasks, including managing bank accounts, paying bills, and making investment decisions. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are mentally competent. |

| Witness Requirements | The form must be signed in the presence of two witnesses and a notary public to be valid in Florida. |

| Limitations | Some actions, such as making medical decisions or changing beneficiaries on life insurance policies, may require a separate document. |

| Importance | Having a Durable Power of Attorney in place can provide peace of mind, ensuring that someone you trust can make decisions on your behalf when needed. |

Dos and Don'ts

When filling out the Florida Durable Power of Attorney form, it's essential to approach the process with care. This document grants someone the authority to make decisions on your behalf, so accuracy and clarity are crucial. Here’s a list of ten things you should and shouldn’t do during this process:

- Do choose a trusted individual as your agent. This person will have significant authority over your financial and legal matters.

- Don't rush through the form. Take your time to ensure all information is accurate and complete.

- Do specify the powers you wish to grant. Be clear about what decisions your agent can make.

- Don't leave blank spaces on the form. Fill in all required fields to avoid confusion later.

- Do consider having a witness present when you sign the document. This can help validate the form if questions arise later.

- Don't use vague language. Clearly outline your wishes to prevent misunderstandings.

- Do keep a copy of the completed form in a safe place. You may need to refer to it in the future.

- Don't forget to inform your agent about their responsibilities. They should know what to expect and how to act on your behalf.

- Do review the form periodically. Life changes, and your wishes may evolve over time.

- Don't neglect to consult a legal professional if you have questions. Their guidance can help you navigate any complexities.

Similar forms

The Florida Durable Power of Attorney form shares similarities with the General Power of Attorney. Both documents allow an individual, known as the principal, to designate someone else, referred to as the agent, to make decisions on their behalf. The key difference lies in the durability; while a General Power of Attorney becomes ineffective if the principal becomes incapacitated, a Durable Power of Attorney remains in effect during such circumstances, ensuring that the agent can continue to act on the principal's behalf without interruption.

Another document akin to the Durable Power of Attorney is the Healthcare Proxy. This form specifically grants authority to an individual to make medical decisions for the principal if they are unable to do so. Like the Durable Power of Attorney, the Healthcare Proxy is designed to remain valid even if the principal loses capacity. Both documents ensure that the principal's wishes are respected and that their chosen representative can act when necessary.

The Living Will is also similar, as it outlines the principal's preferences regarding medical treatment in situations where they cannot communicate their wishes. While the Durable Power of Attorney allows an agent to make decisions, a Living Will provides specific instructions about end-of-life care. Together, these documents ensure that an individual's healthcare preferences are honored, both through direct representation and written directives.

A Trust Agreement shares some characteristics with the Durable Power of Attorney, particularly regarding the management of assets. A Trust allows an individual to transfer their assets to a trustee, who manages them for the benefit of designated beneficiaries. While the Durable Power of Attorney enables an agent to manage assets on behalf of the principal, a Trust is a more permanent arrangement that can provide benefits during and after the principal's lifetime.

The Advance Directive is another related document that combines elements of both the Living Will and the Healthcare Proxy. It allows individuals to express their healthcare preferences and designate an agent to make medical decisions. Similar to the Durable Power of Attorney, an Advance Directive remains valid even if the principal becomes incapacitated, ensuring that their healthcare wishes are respected.

The Financial Power of Attorney is closely related to the Durable Power of Attorney, focusing specifically on financial matters. This document grants an agent the authority to manage the principal's financial affairs, such as paying bills, handling investments, and filing taxes. While both forms provide similar powers, the Financial Power of Attorney may be more limited in scope, focusing solely on financial decision-making rather than encompassing broader powers.

The Medical Power of Attorney is another document that parallels the Durable Power of Attorney. This form specifically allows an individual to appoint someone to make medical decisions on their behalf if they become incapacitated. While the Durable Power of Attorney can cover a wide range of decisions, the Medical Power of Attorney is solely focused on healthcare matters, ensuring that the principal's medical preferences are honored.

The Guardianship Petition can also be seen as related, although it serves a different purpose. This document is filed in court to request the appointment of a guardian for an individual who is unable to make decisions for themselves. While the Durable Power of Attorney allows individuals to choose their agents, a Guardianship Petition involves a legal process to appoint someone to act on behalf of the incapacitated person, often seen as a last resort when no other options are available.

Lastly, the Revocable Living Trust is similar in that it allows for the management and distribution of assets during and after the principal's lifetime. This document can be altered or revoked by the principal at any time, providing flexibility. Like the Durable Power of Attorney, it ensures that assets are handled according to the principal's wishes, but it does so through a trust structure rather than through an agent's authority.

Check out Popular Durable Power of Attorney Forms for Different States

How to Get Power of Attorney in Ny - This arrangement helps avoid confusion and ensures your wishes are honored without delay.

Pennsylvania Durable Power of Attorney Form - It’s important to keep the Durable Power of Attorney in a secure yet accessible location.

Washington State Power of Attorney - Reduces potential stress on loved ones during difficult times.