Official Deed Template for Florida State

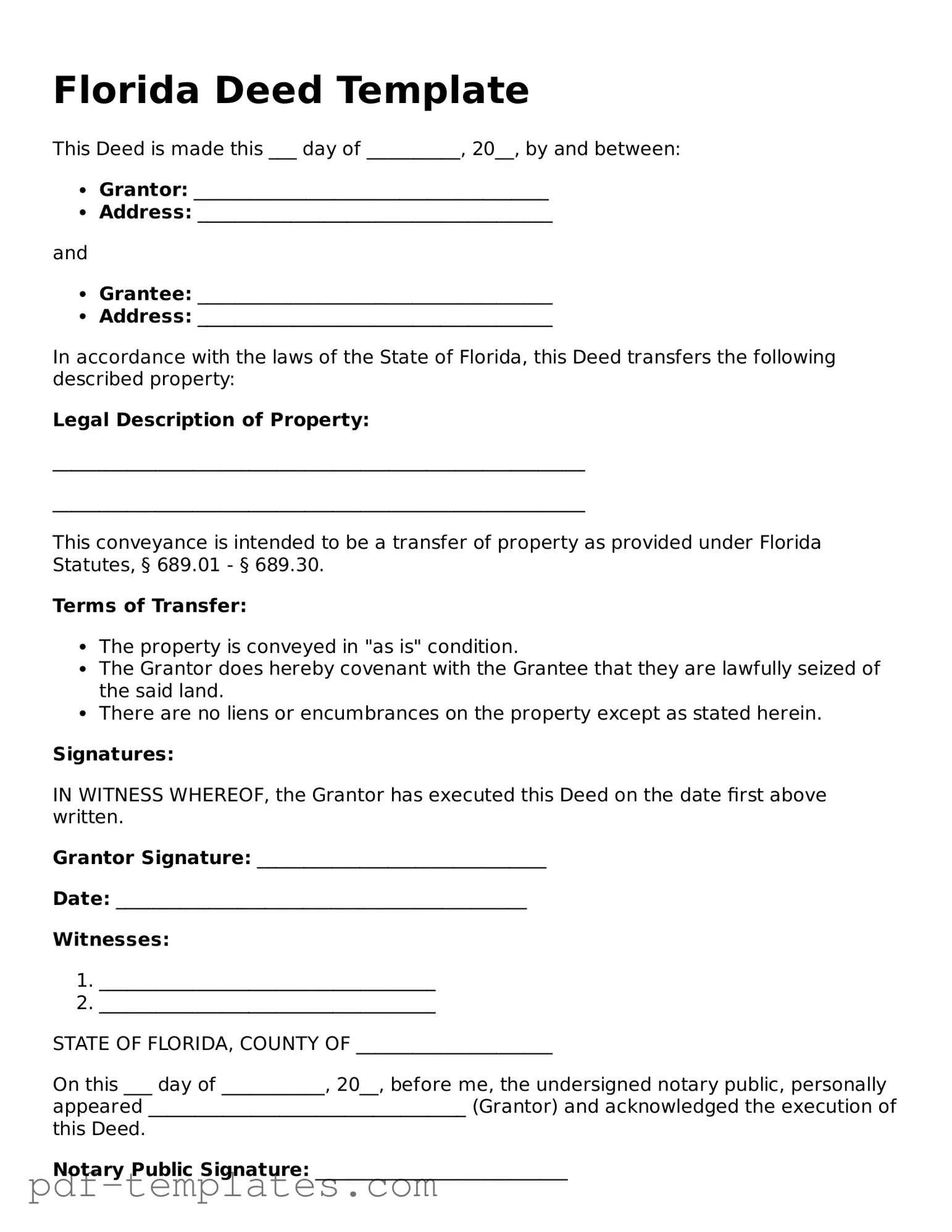

In Florida, the Deed form plays a crucial role in the process of transferring property ownership from one party to another. This legal document serves to establish and record the change in ownership, ensuring that the transaction is recognized by the state. Various types of deeds exist, including warranty deeds, quitclaim deeds, and special purpose deeds, each serving different purposes based on the nature of the transfer. Essential elements of the form include the names of the grantor and grantee, a legal description of the property, and the signature of the grantor, all of which are necessary for the deed to be valid. Additionally, the form may require notarization to enhance its authenticity and may need to be recorded with the county clerk’s office to provide public notice of the new ownership. Understanding the nuances of the Florida Deed form is vital for anyone involved in real estate transactions, as it helps protect the rights of both the buyer and seller while ensuring compliance with state laws.

Misconceptions

Understanding the Florida Deed form is essential for anyone involved in real estate transactions in the state. However, several misconceptions often arise. Here’s a breakdown of ten common misunderstandings:

- All deeds are the same. Many believe that all deed forms are interchangeable. In reality, different types of deeds serve specific purposes, such as warranty deeds, quitclaim deeds, and special warranty deeds.

- A deed must be notarized to be valid. While notarization is common and often required for recording, not all deeds need to be notarized to be legally binding.

- Once a deed is signed, it cannot be changed. This is not true. A deed can be amended or revoked, but the process must follow legal guidelines.

- Only lawyers can prepare a deed. Although lawyers can provide assistance, individuals can also prepare their own deeds, provided they follow state laws and requirements.

- A deed transfer is always instantaneous. Many assume that once a deed is signed, the transfer of ownership is immediate. However, recording the deed with the county is necessary for it to be effective against third parties.

- All property transfers require a deed. Some transfers, like those between spouses or through inheritance, may not require a deed in certain circumstances.

- Deeds are only necessary for selling property. Deeds are also needed for gifting property, transferring property into a trust, or changing ownership for any reason.

- Florida does not have specific deed requirements. Florida has distinct requirements regarding the content and format of deeds, including the necessity of including a legal description of the property.

- Once recorded, a deed cannot be challenged. While recording a deed provides public notice, it does not prevent challenges to the deed’s validity based on legal grounds.

- Deeds are only relevant at the time of sale. Deeds hold importance beyond the sale. They are vital for establishing ownership and can affect property taxes, estate planning, and more.

By clarifying these misconceptions, individuals can navigate the complexities of real estate transactions more effectively.

Florida Deed: Usage Instruction

After obtaining the Florida Deed form, you will need to complete it accurately to ensure proper transfer of property. Once the form is filled out, it must be signed and notarized before being filed with the appropriate county office.

- Begin by entering the grantor's name in the designated space. This is the person or entity transferring the property.

- Next, provide the grantee's name. This is the individual or entity receiving the property.

- Fill in the property description. This should include the legal description of the property, which can typically be found on the previous deed or tax documents.

- Indicate the consideration amount, which is the value exchanged for the property. This is often the sale price.

- Include the date of execution. This is the date when the grantor signs the deed.

- Sign the form in the presence of a notary public. The notary will verify your identity and witness your signature.

- Ensure that the notary public completes their section on the form, including their signature and seal.

- Finally, submit the completed deed to the appropriate county clerk's office for recording.

Common mistakes

-

Incorrect Property Description: Failing to provide a complete and accurate legal description of the property can lead to significant issues. Ensure that the description matches the one on the original deed or property tax records.

-

Missing Signatures: All necessary parties must sign the deed. Omitting a signature can invalidate the document, so double-check that everyone involved has signed.

-

Not Notarizing the Document: In Florida, a deed must be notarized to be legally binding. Neglecting this step can render the deed ineffective.

-

Incorrect Names: Spelling errors or using incorrect names for the grantor or grantee can create confusion. Always verify that names are spelled correctly and match legal identification.

-

Failure to Indicate the Type of Deed: Not specifying whether the deed is a warranty deed, quitclaim deed, or another type can lead to misunderstandings about the transfer of ownership rights.

-

Omitting the Date: Every deed should have a date. Leaving this blank can cause complications regarding the timing of the transfer.

-

Ignoring Local Requirements: Different counties may have specific requirements for deed submissions. Always check local regulations to ensure compliance.

-

Not Filing the Deed: After completing the deed, it must be filed with the appropriate county clerk’s office. Failing to do so means the transfer may not be recognized publicly.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | A Florida Deed form is a legal document used to transfer property ownership in the state of Florida. |

| Types of Deeds | Common types include Warranty Deed, Quit Claim Deed, and Special Warranty Deed. |

| Governing Law | The Florida Statutes, specifically Chapter 689, govern the creation and execution of deeds. |

| Execution Requirements | To be valid, the deed must be signed by the grantor and notarized. |

| Recording | Deeds should be recorded in the county where the property is located to provide public notice of ownership. |

| Consideration | A nominal consideration is often stated in the deed, but it is not required for validity. |

| Tax Implications | Property transfers may be subject to documentary stamp taxes in Florida. |

Dos and Don'ts

When filling out the Florida Deed form, it is crucial to adhere to specific guidelines to ensure the document is valid and legally binding. Below are essential dos and don'ts to consider.

- Do ensure all information is accurate and complete.

- Do sign the deed in the presence of a notary public.

- Do provide a clear legal description of the property.

- Do keep a copy of the completed deed for your records.

- Don't leave any required fields blank.

- Don't use abbreviations or informal language in the legal description.

- Don't forget to check local recording requirements.

- Don't submit the deed without proper notarization.

Similar forms

The Florida Deed form shares similarities with the Quitclaim Deed. Both documents are used to transfer property ownership, but they differ in the level of guarantee provided. A Quitclaim Deed transfers whatever interest the grantor has in the property without making any promises about the title's validity. This means that if the grantor has no legal claim, the recipient receives nothing. While the Florida Deed can also be a Quitclaim Deed, it often includes more assurances regarding the title, making it a more secure option for buyers.

Another document that resembles the Florida Deed is the Warranty Deed. Like the Florida Deed, a Warranty Deed is used to transfer ownership of real estate. However, the key difference lies in the guarantees provided by the seller. A Warranty Deed offers a full guarantee that the seller holds clear title to the property and has the right to sell it. This provides the buyer with more protection against future claims, making it a preferred choice for many real estate transactions.

The Bargain and Sale Deed is also akin to the Florida Deed. This type of deed implies that the seller has the right to sell the property but does not guarantee that the title is free from defects. It is a middle ground between a Quitclaim Deed and a Warranty Deed. While it does not offer the same level of protection as a Warranty Deed, it still provides more assurance than a Quitclaim Deed, making it a useful option in certain situations.

Understanding the complexities of various property documents such as deeds, easements, and agreements is crucial for a smooth transaction process. For those in California, it is essential to have access to reliable resources for important forms. You can find useful templates and samples, including the All California Forms, which can help clarify the requirements and assist in the drafting of your documents.

The Special Purpose Deed is another document that can be compared to the Florida Deed. This type of deed is often used for specific transactions, such as transferring property into a trust or conveying property between family members. While it serves a unique purpose, it still functions similarly to the Florida Deed in that it facilitates the transfer of ownership. However, the terms and conditions may vary based on the specific intent of the transaction.

The Trustee's Deed is also similar to the Florida Deed, especially in cases involving property held in a trust. A Trustee's Deed is used when a property is transferred by a trustee, often during the sale of trust property. While it serves a specific purpose, it shares the fundamental goal of transferring property ownership, much like the Florida Deed. The primary distinction is that a Trustee's Deed may not provide the same level of warranty regarding the title.

Lastly, the Personal Representative's Deed is comparable to the Florida Deed in the context of estate transactions. This deed is used when property is transferred from an estate to heirs or beneficiaries after a person has passed away. While it facilitates the transfer of ownership, it may not provide the same level of protection as a Warranty Deed. Instead, it focuses on ensuring that the property is conveyed according to the deceased person's wishes, similar to how the Florida Deed serves to formalize property transfers.

Check out Popular Deed Forms for Different States

Who Has the Deed to My House - The Deed can be a public document, available for anyone to review.

Conveyance Document Deed Washington State - Can impact estate taxes if property is gifted or sold below market value.

A cease and desist letter form, within the context of Florida law, serves as a formal request for an individual or entity to halt alleged illegal activities. This preliminary step, often utilized before pursuing legal action, aims to resolve disputes without entering a courtroom. For those interested in obtaining a cease and desist letter, resources like All Florida Forms can be invaluable. This legal instrument underscores the seriousness of the complainant's intentions and lays the groundwork for potential litigation if non-compliance ensues.

Pennsylvania Deed Transfer Form - Necessary for handling family property bequests in wills.

Sample Deed - A deed can be revocable or irrevocable based on terms.