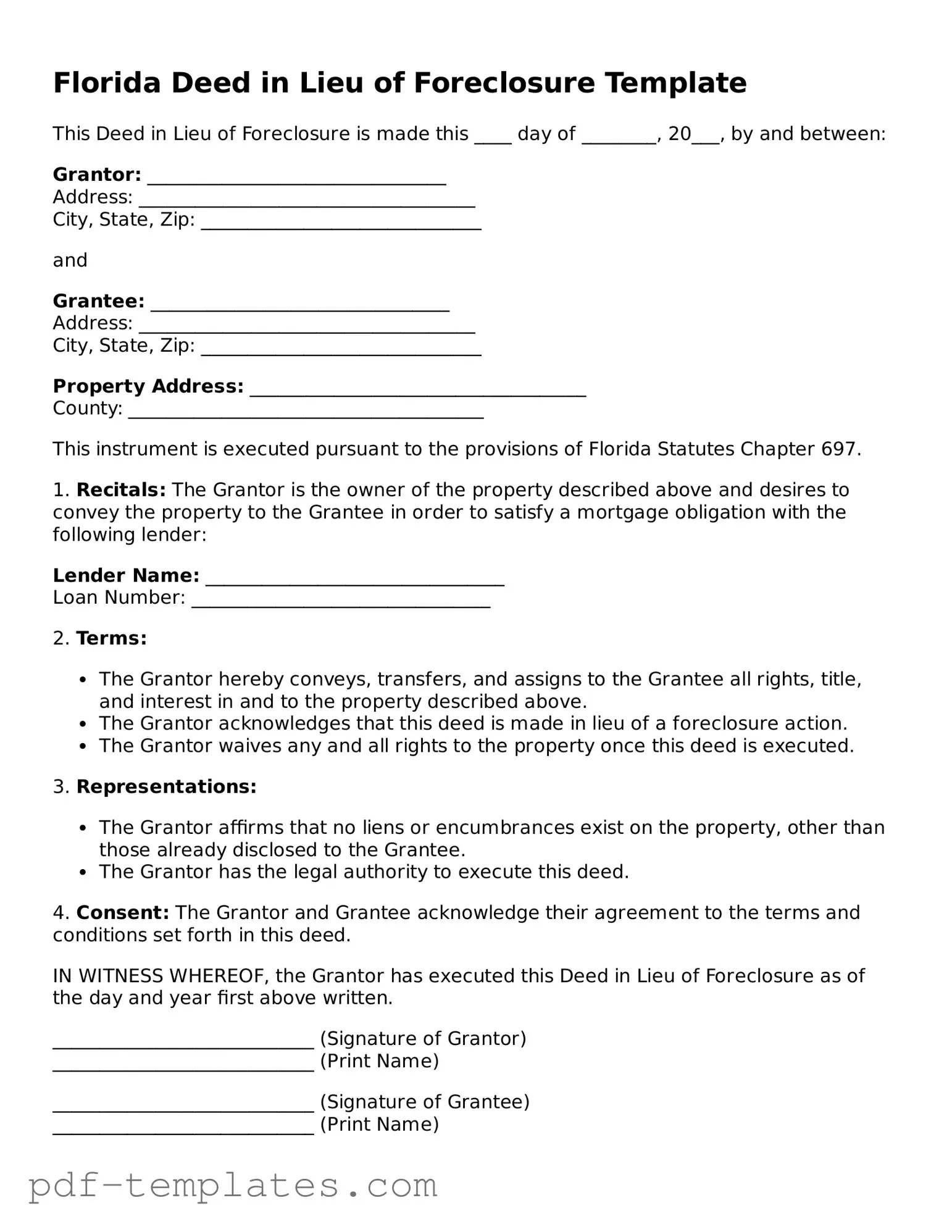

Official Deed in Lieu of Foreclosure Template for Florida State

In the state of Florida, homeowners facing financial difficulties may explore various options to avoid foreclosure, one of which is the Deed in Lieu of Foreclosure. This legal process allows a homeowner to voluntarily transfer ownership of their property back to the lender, thereby settling the mortgage debt without the lengthy and often stressful foreclosure proceedings. The form associated with this process outlines essential information, including the names of the parties involved, a description of the property, and any existing liens or encumbrances. By signing this document, the homeowner relinquishes their rights to the property while the lender agrees to release them from further liability for the mortgage. Additionally, it is crucial for homeowners to understand the implications of this decision, as it can affect their credit score and future borrowing potential. The Deed in Lieu of Foreclosure can serve as a viable alternative for those looking to navigate the complexities of financial hardship while minimizing the impact on their lives.

Misconceptions

Understanding the Florida Deed in Lieu of Foreclosure can be challenging, especially with the many misconceptions that surround it. Here are eight common misunderstandings that people often have:

-

It eliminates all debt associated with the property.

Many believe that signing a deed in lieu of foreclosure wipes out all debts related to the property. In reality, while it may relieve the borrower of the mortgage obligation, other debts, such as second mortgages or liens, may still exist.

-

It is a quick and easy process.

Some assume that a deed in lieu of foreclosure is a simple solution to avoid foreclosure. However, the process can be lengthy and requires negotiation with the lender, which may involve paperwork and waiting periods.

-

It will not affect credit scores.

Many homeowners think that opting for a deed in lieu of foreclosure will not impact their credit. Unfortunately, this is not the case. It can still negatively affect credit scores, though typically less severely than a foreclosure.

-

It is the same as a short sale.

Some people confuse a deed in lieu of foreclosure with a short sale. While both options involve relinquishing the property, a short sale requires selling the home for less than the mortgage balance, whereas a deed in lieu transfers ownership directly to the lender.

-

All lenders accept deeds in lieu of foreclosure.

Not every lender is willing to accept a deed in lieu of foreclosure. Some may prefer to proceed with foreclosure proceedings, making it essential to check with the lender regarding their policies.

-

It absolves the borrower from all liability.

Borrowers often believe that signing a deed in lieu of foreclosure completely frees them from liability. In some cases, lenders may still pursue the borrower for any remaining deficiency balance after the property is sold.

-

It is a public record.

While a deed in lieu of foreclosure is recorded in public records, many think it is automatically visible to everyone. However, the details may not be as easily accessible or understood by the general public.

-

It is a guaranteed way to avoid foreclosure.

Some homeowners believe that a deed in lieu of foreclosure is a foolproof method to prevent foreclosure. However, the lender must agree to the deed, and they may have other preferences or solutions they want to explore first.

Addressing these misconceptions can help homeowners make more informed decisions about their options when facing financial difficulties related to their property.

Florida Deed in Lieu of Foreclosure: Usage Instruction

After completing the Florida Deed in Lieu of Foreclosure form, you will need to submit it to the appropriate parties involved in the foreclosure process. This may include your lender and the county clerk's office. Ensure that you keep copies of all documents for your records.

- Obtain the Florida Deed in Lieu of Foreclosure form from a reliable source.

- Fill in the name of the grantor, which is typically the property owner.

- Provide the name of the grantee, usually the lender or financial institution.

- Enter the property address, including the city and county.

- Include the legal description of the property. This can usually be found on your property tax statement or deed.

- Sign the form in the designated area. Ensure that all signatures are dated.

- Have the document notarized. A notary public will need to witness your signature.

- Make copies of the completed form for your records.

- Submit the original form to your lender and file it with the county clerk's office.

Common mistakes

-

Incorrect Property Description: Failing to provide a complete and accurate description of the property can lead to significant issues. This description should include the legal description, not just the address.

-

Not Including All Necessary Parties: It is essential to ensure that all parties with an interest in the property, such as co-owners or spouses, are included in the deed. Omitting anyone can result in legal complications.

-

Improper Signatures: Each party must sign the document in the appropriate places. A missing signature or an incorrect name can invalidate the deed.

-

Failure to Notarize: A deed in lieu of foreclosure typically requires notarization. Without a notary's signature, the document may not be legally binding.

-

Ignoring Lien Holders: If there are other liens on the property, it is crucial to address them. Not doing so may result in unresolved debts that could complicate the transfer.

-

Missing Legal Advice: Attempting to fill out the form without consulting a legal professional can lead to errors. Understanding the implications of a deed in lieu of foreclosure is vital.

-

Not Understanding Tax Implications: Many individuals overlook the potential tax consequences of transferring property through a deed in lieu of foreclosure. This oversight can lead to unexpected financial burdens.

-

Failing to Retain Copies: After completing the deed, it is important to keep copies for personal records. Losing documentation can create problems in the future.

PDF Features

| Fact Name | Details |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal process where a homeowner voluntarily transfers ownership of their property to the lender to avoid foreclosure. |

| Governing Law | In Florida, the deed in lieu of foreclosure is governed by state laws, including Florida Statutes Chapter 697. |

| Eligibility | Homeowners facing financial difficulties and unable to make mortgage payments may qualify for a deed in lieu of foreclosure. |

| Process | The homeowner must negotiate with the lender and complete necessary paperwork to initiate the deed in lieu process. |

| Benefits | A deed in lieu can help homeowners avoid the lengthy foreclosure process and minimize damage to their credit score. |

| Risks | Homeowners may still be liable for any deficiency balance if the property sells for less than the mortgage amount. |

| Tax Implications | There may be tax consequences related to the cancellation of debt, which homeowners should discuss with a tax advisor. |

| Impact on Credit | While a deed in lieu is less damaging than foreclosure, it will still negatively impact the homeowner's credit score. |

| Alternatives | Homeowners should consider alternatives such as loan modifications or short sales before opting for a deed in lieu. |

| Legal Advice | It is advisable for homeowners to seek legal counsel to understand their rights and obligations throughout the process. |

Dos and Don'ts

When filling out the Florida Deed in Lieu of Foreclosure form, it is essential to follow certain guidelines to ensure the process is smooth and legally binding. Here are four things to do and not to do:

- Do: Ensure all property information is accurate, including the legal description and address.

- Do: Review the document thoroughly before signing to confirm all terms are understood.

- Do: Obtain necessary signatures from all parties involved, including spouses if applicable.

- Do: Consider consulting with a legal professional to clarify any uncertainties.

- Don't: Leave any sections of the form blank, as this can lead to delays or complications.

- Don't: Sign the document without proper identification and witnessing, if required.

- Don't: Ignore any outstanding liens or encumbrances on the property that may affect the deed.

- Don't: Rush the process; take the time needed to ensure all details are correct.

Similar forms

A mortgage release is a document that releases a borrower from the obligation to repay a mortgage loan. Similar to a deed in lieu of foreclosure, it allows the borrower to transfer property back to the lender, effectively ending the mortgage agreement. This document is often used when the borrower can no longer afford the property but wants to avoid the lengthy foreclosure process. The lender benefits by receiving the property without the need for a court proceeding, which can save time and money.

A short sale agreement is another document that resembles a deed in lieu of foreclosure. In a short sale, the homeowner sells the property for less than what is owed on the mortgage, with the lender's approval. Like a deed in lieu, a short sale helps the homeowner avoid foreclosure. Both options allow the borrower to relieve themselves of the financial burden, but a short sale involves selling the home rather than transferring it directly to the lender.

Understanding the various financial options available to homeowners is crucial, especially when considering documents like the General Power of Attorney form. This legal tool empowers an appointed agent to make financial decisions on behalf of the principal, which can be incredibly beneficial during times of financial distress. For those in California, resources such as All California Forms provide essential information and templates that can aid in these situations, ensuring that individuals have the support they need to navigate their financial challenges effectively.

A foreclosure notice is another document that relates to the process of foreclosure, though it serves a different purpose. This notice is sent to the borrower when the lender begins the foreclosure process. While a deed in lieu of foreclosure is an attempt to avoid that process altogether, the foreclosure notice signifies that the lender is moving forward with reclaiming the property due to non-payment. Both documents are part of the broader conversation about property ownership and financial responsibility.

Lastly, a bankruptcy filing can be compared to a deed in lieu of foreclosure. When a homeowner files for bankruptcy, they can often protect their assets, including their home, from foreclosure. This legal process can provide relief from debt and allow the homeowner to negotiate new terms with creditors. While a deed in lieu of foreclosure involves voluntarily giving up the property, bankruptcy can provide a way to keep the home while addressing financial difficulties.

Check out Popular Deed in Lieu of Foreclosure Forms for Different States

Deeds in Lieu of Foreclosure - The deed transfers all ownership rights to the lender, who then typically assumes responsibility for managing the property.

The Loan Servicer Might Agree to Put the Foreclosure on Hold to Give You Some Time to Sell Your Home - A careful review of the property title is essential before finalizing a Deed in Lieu of Foreclosure.

The Trader Joe's application form is a vital document for job seekers wishing to join this beloved grocery chain. It outlines necessary information about potential employees and provides an opportunity to showcase their unique skills and experience. Completing the form accurately can significantly increase the chances of landing a position at one of their stores, and you can find the form at https://documentonline.org/blank-trader-joe-s-application.

The Loan Servicer Might Agree to Put the Foreclosure on Hold to Give You Some Time to Sell Your Home - This process can restore privacy for homeowners compared to public foreclosure proceedings.