Get Florida Commercial Contract Form in PDF

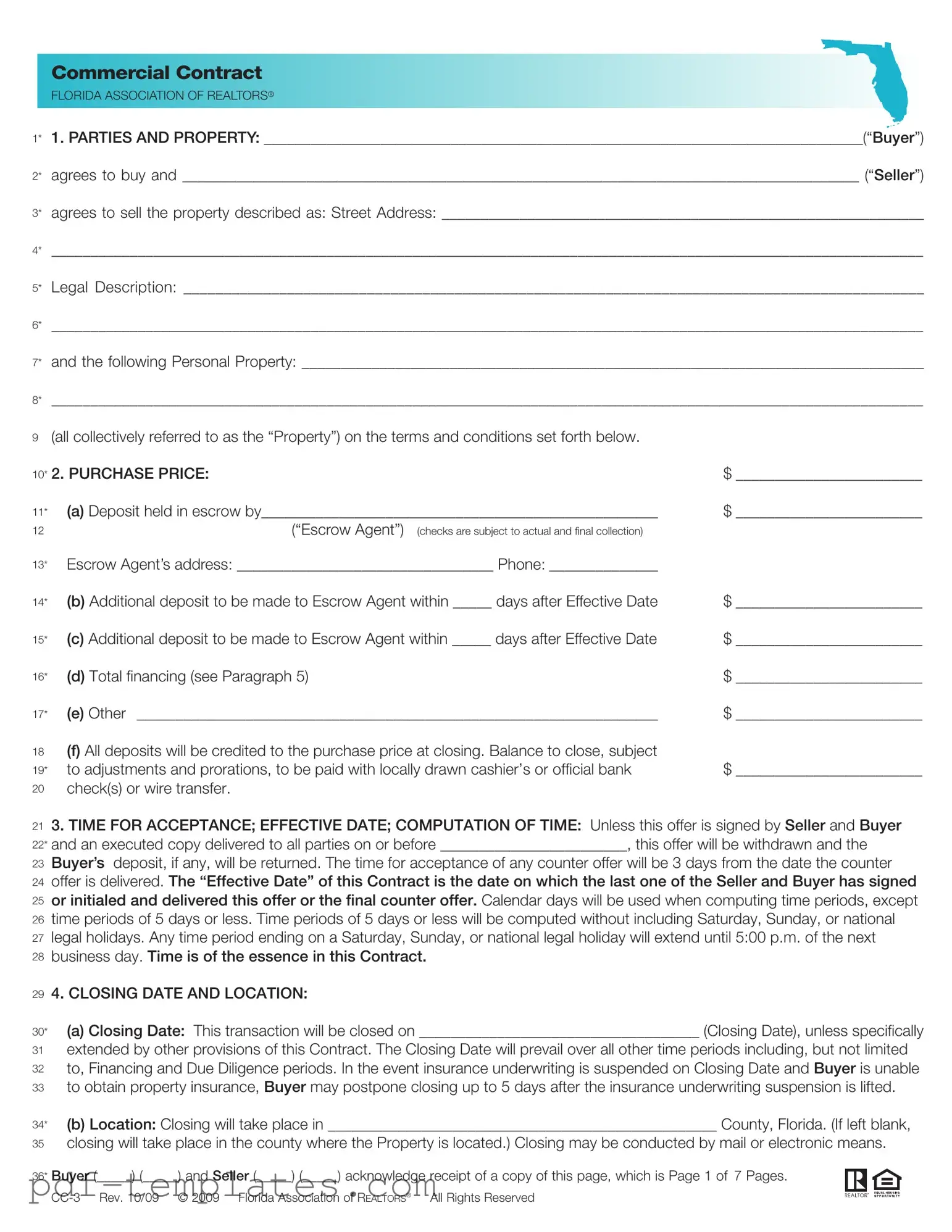

The Florida Commercial Contract form is a crucial document that facilitates the sale of commercial properties in the state. It outlines the agreement between the buyer and seller, detailing essential elements such as the parties involved, the property description, and the purchase price. This form also specifies the terms of the deposit, including escrow arrangements and timelines for acceptance. Key provisions address financing, allowing buyers to apply for loans while protecting their interests with contingencies. Additionally, the contract covers the condition of the property, ensuring that buyers understand what they are acquiring, often in an "as is" state, unless otherwise negotiated. Closing procedures, including timelines and responsibilities for both parties, are clearly defined to avoid misunderstandings. The document also incorporates legal protections, such as the handling of deposits in case of default and the process for resolving disputes. By providing a comprehensive framework, the Florida Commercial Contract form helps streamline transactions and supports a smoother real estate process for all parties involved.

Misconceptions

- Misconception 1: The Florida Commercial Contract form is only for large businesses.

- Misconception 2: The contract guarantees financing for the buyer.

- Misconception 3: The seller is responsible for all repairs before closing.

- Misconception 4: The closing date is flexible and can be changed easily.

This is not true. The form is designed for any commercial real estate transaction, regardless of the size of the business or property. Small businesses can also use this contract for their commercial dealings.

While the form outlines the buyer's obligation to seek financing, it does not guarantee that financing will be obtained. Buyers must still meet the lender's requirements and secure loan approval within the specified time frame.

This is a common misunderstanding. The contract typically states that the property is sold "as is," meaning the seller is not obligated to make repairs unless otherwise agreed upon in the contract.

In fact, the closing date is a critical component of the contract. It must be adhered to unless both parties agree to an extension in writing. This ensures that both the buyer and seller have clear expectations regarding the timeline of the transaction.

Florida Commercial Contract: Usage Instruction

Completing the Florida Commercial Contract form requires careful attention to detail. Each section must be filled out accurately to ensure clarity and compliance with the terms of the agreement. Follow these steps to complete the form correctly.

- Enter the names of the Buyer and Seller in the designated fields.

- Provide the street address and legal description of the property being sold.

- List any personal property included in the sale.

- Fill in the purchase price and details about the deposit, including the escrow agent’s information.

- Specify the time for acceptance and the effective date of the contract.

- Set the closing date and location, ensuring it aligns with the property's county.

- Indicate any third-party financing details, including amounts and terms.

- Describe the title transfer method and any relevant conditions regarding title defects.

- State the condition of the property and any inspections or due diligence periods.

- Outline the closing procedure, including possession and costs related to the transaction.

- Provide details regarding escrow agent responsibilities and potential defaults.

- Complete any additional disclosures required by law.

- Ensure all parties sign and date the form where indicated.

Common mistakes

-

Incomplete Information: Failing to fill in all required fields, such as the names of the Buyer and Seller, can render the contract invalid. It is essential to provide complete and accurate information.

-

Missing Legal Description: Not including a detailed legal description of the property can lead to confusion. A precise legal description is crucial for identifying the property in question.

-

Incorrect Purchase Price: Entering an incorrect purchase price or failing to specify the amount can create disputes. Ensure the purchase price is clearly stated and accurate.

-

Escrow Agent Details: Omitting the name and address of the escrow agent can delay the process. It is important to identify who will hold the deposit funds.

-

Ignoring Timeframes: Not adhering to specified timeframes for deposits, financing applications, or notices can jeopardize the agreement. Each deadline is critical to the contract's validity.

-

Failure to Specify Closing Date: Leaving the closing date blank or unspecified can lead to uncertainty. Clearly indicate when and where the closing will take place.

-

Neglecting Title Issues: Not addressing potential title defects or failing to provide evidence of title can lead to complications. It is essential to ensure that title issues are resolved before closing.

-

Overlooking Financing Contingencies: Failing to specify financing terms or neglecting to include contingencies can leave the Buyer vulnerable. It's important to outline financing requirements clearly.

-

Not Conducting Inspections: Skipping the due diligence period or inspections can result in unforeseen issues. Buyers should always conduct necessary inspections to assess property condition.

-

Inadequate Communication: Not keeping all parties informed about the status of the contract can lead to misunderstandings. Clear communication is essential throughout the process.

File Specifics

| Fact Name | Fact Description |

|---|---|

| Governing Law | The Florida Commercial Contract is governed by Florida law, ensuring compliance with state regulations. |

| Parties Involved | The contract identifies the Buyer and Seller, specifying their roles in the transaction. |

| Property Description | It includes detailed descriptions of the property, such as the street address and legal description. |

| Purchase Price | The contract outlines the total purchase price and details regarding deposits and payment methods. |

| Time for Acceptance | Buyers must have their offers accepted by the Seller within a specified timeframe to avoid withdrawal. |

| Closing Date | The contract establishes a closing date, which can only be extended under specific conditions. |

| Financing Contingency | Buyers are required to apply for third-party financing within a set period, ensuring they can afford the purchase. |

| Title Assurance | The Seller must convey marketable title free of liens, ensuring the Buyer receives clear ownership. |

| Property Condition | The property is sold "as is," meaning the Seller does not warrant its condition beyond marketability of title. |

| Default Provisions | In case of default, the contract specifies remedies for both Buyer and Seller, including deposit retention or refunds. |

Dos and Don'ts

Do's when filling out the Florida Commercial Contract form:

- Provide accurate information for all parties involved, including full names and addresses.

- Clearly describe the property, including the street address and legal description.

- Specify the purchase price and any deposits in the appropriate sections.

- Ensure all parties sign and date the contract to validate it.

Don'ts when filling out the Florida Commercial Contract form:

- Do not leave any sections blank; incomplete forms can lead to issues.

- Avoid using vague language; be specific about terms and conditions.

- Do not forget to check the appropriate boxes for financing and title options.

- Do not overlook the deadlines for acceptance and financing approvals.

Similar forms

The Florida Residential Purchase Agreement is similar to the Florida Commercial Contract form in that both documents outline the terms of a property transaction. They specify the parties involved, the property being sold, and the purchase price. Each agreement includes provisions for deposits, financing, and closing details. Both forms also address the condition of the property, allowing buyers to conduct inspections and due diligence. The key difference lies in the type of properties they govern, with the residential agreement focusing on homes and the commercial form applying to business properties.

The Florida Lease Agreement shares similarities with the Florida Commercial Contract form, especially regarding the terms and conditions of property use. Both documents outline the rights and responsibilities of the parties involved, including payment terms and duration of the agreement. They also address maintenance obligations and conditions for termination. While the Commercial Contract is for purchase transactions, the Lease Agreement focuses on renting, making it essential for landlords and tenants to understand their respective roles.

The Florida Real Estate Sales Contract is another document that aligns closely with the Florida Commercial Contract form. Both contracts serve to formalize the sale of property, detailing the purchase price, financing options, and any contingencies. They both require clear identification of the property and the parties involved. However, the Real Estate Sales Contract is typically used for residential transactions, while the Commercial Contract is tailored for business properties, reflecting the unique needs of each type of transaction.

The Florida Option to Purchase Agreement is similar in that it provides a framework for a potential buyer to secure the right to purchase a property at a later date. Like the Commercial Contract, it specifies the terms of the agreement, including the purchase price and duration of the option. Both documents require the buyer to make a deposit, which is often applied to the purchase price if the buyer decides to proceed. The key distinction is that the Option to Purchase Agreement grants the buyer the right but not the obligation to buy the property.

In a similar vein, understanding the nuances of independent contractor agreements is essential for those engaging in project-based work or freelance services. The clarity offered by a well-drafted agreement helps delineate the responsibilities and expectations for both parties involved. To learn more about what should be included in such agreements, refer to the detailed guidelines available at https://formcalifornia.com/.

The Florida Joint Venture Agreement can be compared to the Florida Commercial Contract form in that both involve multiple parties collaborating on a property transaction. Each document outlines the roles and responsibilities of the parties involved, including financial contributions and profit-sharing arrangements. The Joint Venture Agreement is typically used for investment purposes, while the Commercial Contract focuses on the sale of a specific property. Both require clear communication of terms to avoid disputes.

The Florida Business Purchase Agreement is another document that bears similarities to the Florida Commercial Contract form. Both agreements detail the terms of a transaction involving a business, including the sale of real estate, assets, and liabilities. They specify the purchase price and any financing arrangements. While the Commercial Contract focuses on the property aspect, the Business Purchase Agreement encompasses a broader scope, addressing the sale of the entire business operation, including its assets and goodwill.

The Florida Closing Statement is akin to the Florida Commercial Contract form in that it summarizes the financial aspects of a real estate transaction. Both documents detail the costs associated with the sale, including purchase price, deposits, and closing costs. The Closing Statement serves as a final accounting of the transaction, ensuring all parties are aware of their financial obligations. While the Commercial Contract outlines the terms of the sale, the Closing Statement provides a detailed breakdown of the financial transactions that take place at closing.

Other PDF Forms

Verizon File a Claim - Claims can be submitted for various types of coverage under Asurion plans.

When engaging in the purchase or sale of a boat in Florida, it is essential to utilize the appropriate documentation, such as the Florida Boat Bill of Sale. This form is not only a proof of ownership transfer but also encapsulates critical details like the vessel's specifications and the transaction amount. For those seeking to navigate the paperwork involved, resources like All Florida Forms can provide valuable assistance in ensuring compliance with state regulations.

How to File a Construction Lien in Florida - Completing the form accurately is vital to uphold its validity in legal matters.

Citi Bank Direct Deposit - Make payday easy with direct deposit services.