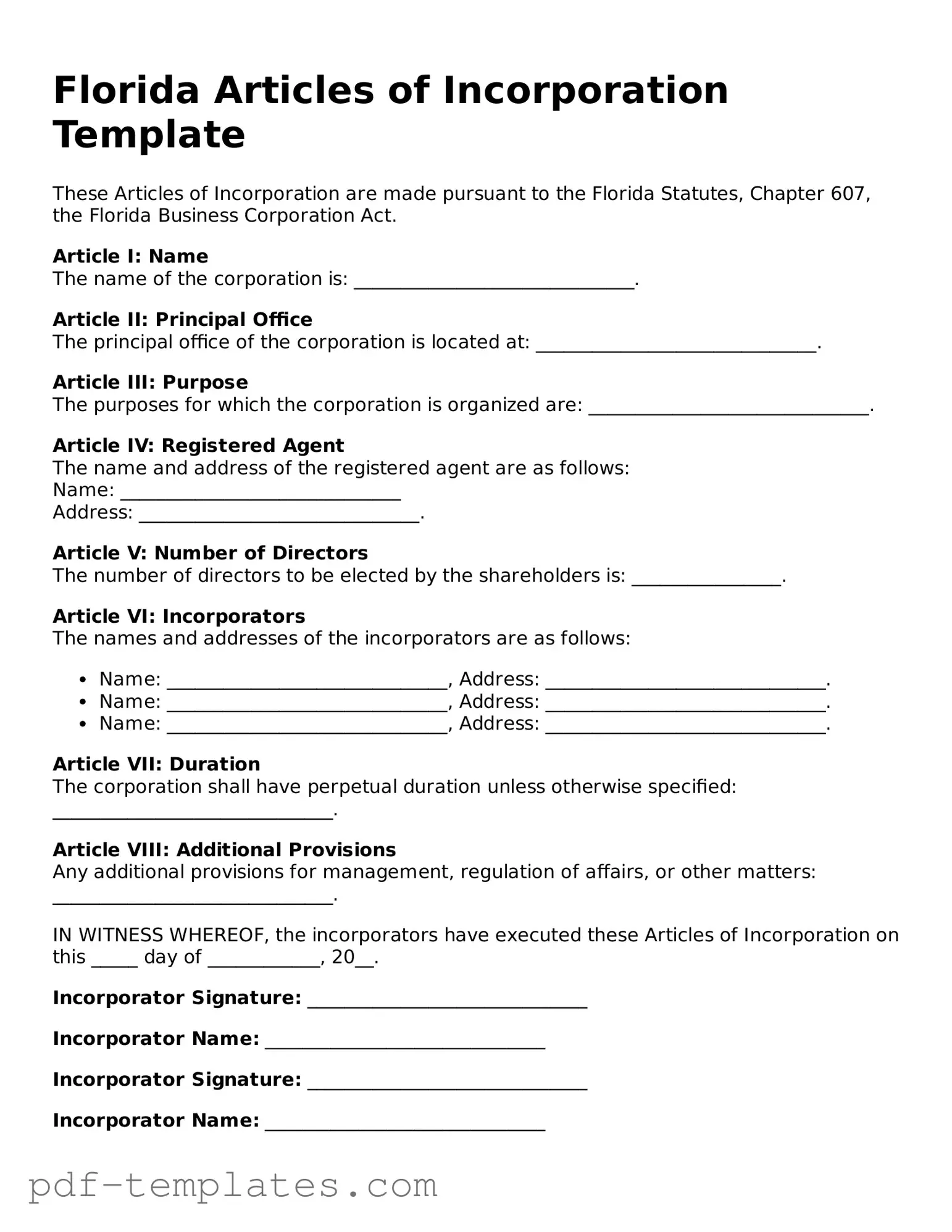

Official Articles of Incorporation Template for Florida State

The Florida Articles of Incorporation form serves as a foundational document for individuals seeking to establish a corporation within the state. This form is critical, as it outlines essential details about the corporation, including its name, principal office address, and the nature of its business activities. Additionally, it requires the identification of the registered agent, who acts as the official point of contact for legal matters. The form also mandates the inclusion of the corporation's duration, which may be perpetual or set for a specific term. Another significant aspect involves the designation of the corporation's initial directors and the structure of its shares, detailing the number of shares authorized and their par value, if applicable. Completing this form accurately is vital, as it ensures compliance with Florida's corporate laws and facilitates the legal recognition of the entity. By filing the Articles of Incorporation, founders initiate the process of establishing a distinct legal entity that can operate independently, enter into contracts, and provide limited liability protection to its owners.

Misconceptions

Understanding the Florida Articles of Incorporation form can be tricky. Here are some common misconceptions that people often have:

- All businesses must file Articles of Incorporation. Not every business entity needs to file. Sole proprietorships and partnerships do not require this form.

- Filing Articles of Incorporation guarantees tax-exempt status. Incorporating does not automatically mean your business will be tax-exempt. You must apply separately for that status.

- Once filed, Articles of Incorporation cannot be changed. This is incorrect. You can amend your Articles of Incorporation if your business needs change.

- Articles of Incorporation are the same as a business license. These are different documents. The Articles establish your business entity, while a business license allows you to operate legally.

- You can file Articles of Incorporation at any time. There are specific times when filing is most beneficial, such as before starting business operations or seeking funding.

- All information in the Articles of Incorporation is private. Some information, like the names of directors and officers, is public and can be accessed by anyone.

- Filing is a one-time process. Annual reports and fees are required to maintain your corporation’s good standing with the state.

- You don’t need a registered agent if you file Articles of Incorporation. A registered agent is required to receive legal documents on behalf of your corporation.

Being aware of these misconceptions can help you navigate the incorporation process more effectively.

Florida Articles of Incorporation: Usage Instruction

After gathering the necessary information, you are ready to fill out the Florida Articles of Incorporation form. This document is essential for establishing your business as a corporation in Florida. Completing it accurately is crucial for a smooth incorporation process. Follow these steps carefully to ensure all required information is provided.

- Begin by downloading the Florida Articles of Incorporation form from the Florida Division of Corporations website or obtain a physical copy.

- In the first section, enter the name of your corporation. Ensure it meets Florida naming requirements, such as including "Corporation," "Incorporated," or an abbreviation like "Inc."

- Next, provide the principal office address of your corporation. This must be a physical address in Florida, not a P.O. Box.

- Designate a registered agent. This person or business must have a physical address in Florida and be available during business hours to receive legal documents.

- Fill in the purpose of your corporation. A brief statement outlining your business activities is sufficient.

- Indicate the number of shares your corporation is authorized to issue. Specify the par value of these shares if applicable.

- List the names and addresses of the initial directors of the corporation. Include at least one director, and ensure they are at least 18 years old.

- Provide the name and address of the incorporator. This person is responsible for filing the Articles of Incorporation.

- Review the form for accuracy and completeness. Double-check names, addresses, and any numerical values.

- Sign and date the form. The incorporator must sign it, confirming the information is true and correct.

- Prepare the filing fee. Check the current fee on the Florida Division of Corporations website.

- Submit the completed form along with the filing fee. You can file online or send it by mail to the appropriate address.

Once submitted, your Articles of Incorporation will be processed by the state. You will receive confirmation of your filing, which is an important document for your corporation. Keep it in a safe place for future reference.

Common mistakes

-

Incorrect Name of the Corporation: Many people forget to check if their desired name is available. The name must be unique and not similar to existing businesses in Florida.

-

Missing Registered Agent Information: Every corporation needs a registered agent. Failing to provide the agent’s name and address can lead to delays.

-

Improper Purpose Statement: The purpose of the corporation must be clearly stated. A vague or overly broad statement can cause issues.

-

Inaccurate Number of Shares: It’s important to specify the number of shares the corporation is authorized to issue. Omitting this information or providing incorrect figures can create problems.

-

Not Including the Incorporators’ Names: The names and addresses of the incorporators must be included. Omitting this information can lead to rejection of the application.

-

Failure to Sign the Document: The Articles of Incorporation must be signed by at least one incorporator. Forgetting to sign can invalidate the submission.

-

Ignoring Filing Fees: Each submission requires a filing fee. Not including payment or sending the wrong amount can delay processing.

-

Not Using the Correct Form: Florida has specific forms for different types of corporations. Using the wrong form can lead to complications.

-

Neglecting to Review the Completed Form: Before submitting, it’s crucial to double-check all information. Errors can lead to rejection or delays.

PDF Features

| Fact Name | Description |

|---|---|

| Governing Law | The Florida Articles of Incorporation are governed by Chapter 607 of the Florida Statutes. |

| Purpose | This form is used to officially create a corporation in the state of Florida. |

| Filing Requirement | Filing the Articles of Incorporation with the Florida Division of Corporations is mandatory for incorporation. |

| Information Required | The form requires basic information such as the corporation's name, principal office address, and registered agent details. |

| Registered Agent | A registered agent must be designated to receive legal documents on behalf of the corporation. |

| Filing Fee | A filing fee is required when submitting the Articles of Incorporation, which varies based on the type of corporation. |

| Effective Date | The Articles of Incorporation can specify an effective date, which can be the date of filing or a future date. |

| Additional Provisions | Corporations may include additional provisions in the Articles, such as limitations on director liability or management structure. |

Dos and Don'ts

When completing the Florida Articles of Incorporation form, it is important to follow certain guidelines to ensure accuracy and compliance. Below is a list of things to do and avoid during this process.

- Do: Provide accurate and complete information in all sections of the form.

- Do: Use clear and legible handwriting or type the information if submitting a printed form.

- Do: Include the required filing fee with your submission.

- Do: Review the form for any errors or omissions before submitting it.

- Don't: Leave any required fields blank; this may delay processing.

- Don't: Use abbreviations or acronyms that are not widely recognized.

- Don't: Forget to include the name and address of the registered agent.

- Don't: Submit the form without checking the latest filing requirements, as they may change.

Similar forms

The Florida Articles of Incorporation is similar to the Certificate of Incorporation used in Delaware. Both documents serve as foundational paperwork for establishing a corporation. They outline essential information such as the corporation's name, purpose, and the number of authorized shares. The Delaware Certificate is particularly known for its flexibility and is often favored by businesses seeking favorable corporate laws, while Florida's version provides a straightforward process for local businesses.

Another comparable document is the Bylaws of a corporation. While the Articles of Incorporation establish the corporation’s existence, Bylaws provide the internal rules for governing the corporation. They cover topics such as the roles of officers, procedures for meetings, and voting rights. This document is crucial for ensuring that the corporation operates smoothly and in accordance with its own established rules.

The Operating Agreement for Limited Liability Companies (LLCs) shares similarities with the Articles of Incorporation. While the Articles are specific to corporations, the Operating Agreement serves a similar purpose for LLCs. It outlines the structure, management, and operational procedures of the LLC, ensuring that all members understand their rights and responsibilities. Both documents are essential for defining the framework of the business entity.

The Partnership Agreement is another document that resembles the Articles of Incorporation in its function. This agreement outlines the terms and conditions under which partners operate a business together. Like the Articles, it specifies the roles, responsibilities, and profit-sharing arrangements among partners. Both documents are vital for preventing disputes and ensuring clarity in business operations.

The Certificate of Formation is used in many states for LLCs and is akin to the Articles of Incorporation. This document officially establishes the existence of an LLC and includes details such as the name, registered agent, and purpose of the business. While the terminology may differ, both documents serve to formalize the creation of a business entity and provide a legal framework for its operations.

Lastly, the Statement of Information is a document required in some states that is similar in purpose to the Articles of Incorporation. This document provides updated information about the corporation, including its address, officers, and registered agent. While the Articles establish the corporation, the Statement of Information ensures that the state has current and accurate data about the business, promoting transparency and compliance with state laws.

Check out Popular Articles of Incorporation Forms for Different States

Ny Department of State - Designates the procedures for winding up the corporation’s affairs.

Articles of Organization Washington State - In some states, the Articles of Incorporation must be submitted with bylaws.