Get Erc Broker Market Analysis Form in PDF

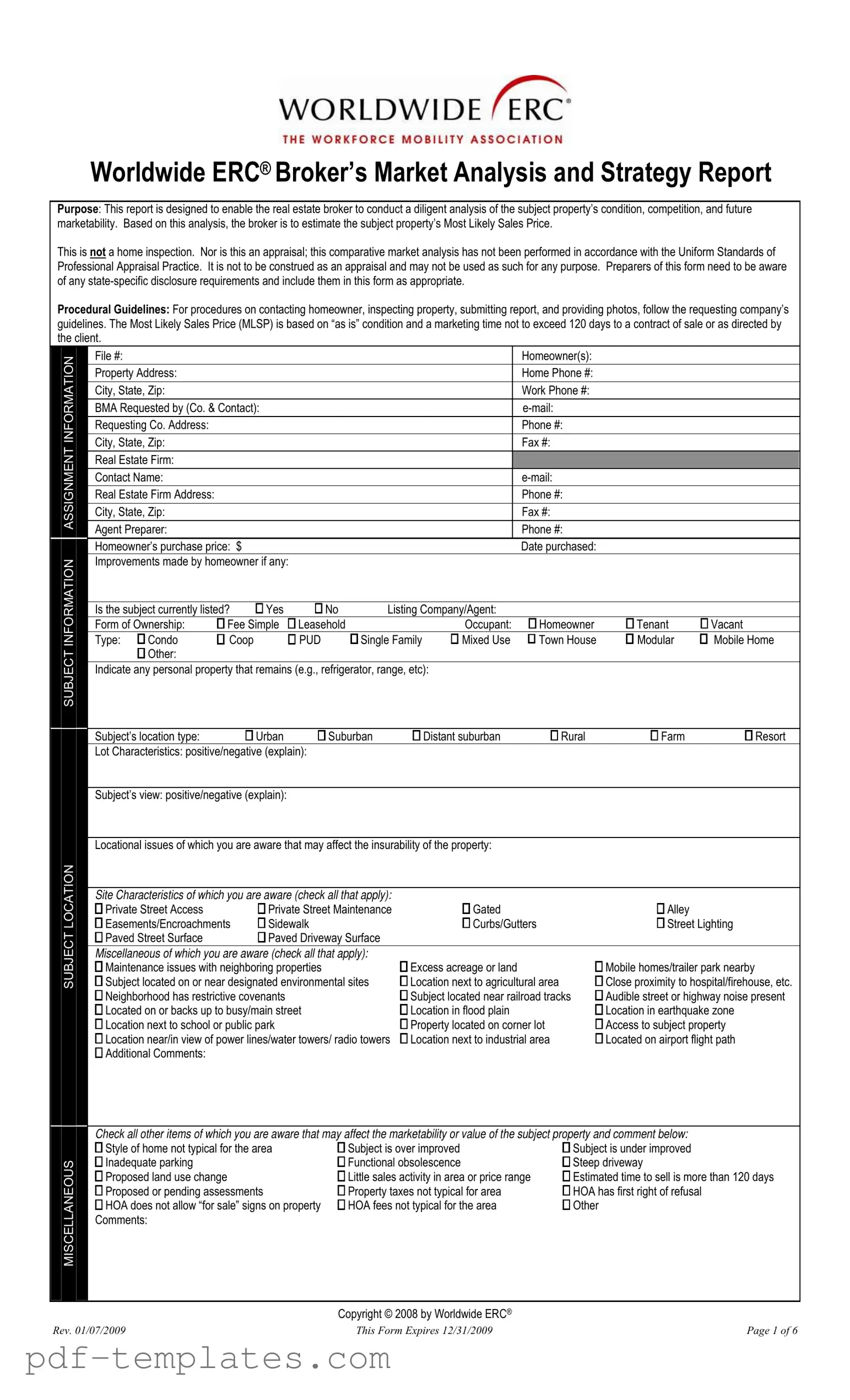

The Worldwide ERC® Broker’s Market Analysis and Strategy Report is a vital tool for real estate brokers looking to evaluate a property’s potential in the current market. This comprehensive form guides brokers through an in-depth examination of the property’s condition, its competitive landscape, and future marketability. By utilizing this analysis, brokers can estimate the property’s Most Likely Sales Price (MLSP), which is based on the property’s "as is" condition and a marketing timeframe that typically should not exceed 120 days. Importantly, this report is distinct from a home inspection or appraisal, as it does not adhere to the Uniform Standards of Professional Appraisal Practice. Brokers must also be mindful of state-specific disclosure requirements when completing the form. The report includes sections for detailed property information, including the homeowner's contact details, property characteristics, and any improvements made. It prompts brokers to evaluate the local market conditions, assess competing listings, and identify any factors that may influence the property’s insurability and marketability. By following the procedural guidelines outlined in the form, brokers can ensure a thorough and accurate analysis that benefits both the homeowner and potential buyers.

Misconceptions

- Misconception 1: The Erc Broker Market Analysis form is an appraisal.

- Misconception 2: The form includes a home inspection.

- Misconception 3: The Most Likely Sales Price is a guaranteed sale price.

- Misconception 4: All state-specific disclosure requirements are automatically included.

- Misconception 5: The analysis can be completed without client input.

- Misconception 6: The form can be used for any type of property.

- Misconception 7: The analysis is valid indefinitely.

- Misconception 8: The form guarantees a quick sale.

- Misconception 9: The form is only for real estate professionals.

- Misconception 10: This form is a substitute for legal advice.

This form is not an appraisal. It serves to provide a comparative market analysis to estimate a property's most likely sales price based on various factors, but it does not adhere to the standards required for formal appraisals.

The Erc Broker Market Analysis form does not function as a home inspection. While it may note observable conditions of the property, it is not intended to provide a thorough inspection report.

The Most Likely Sales Price is an estimate based on current market conditions. It does not guarantee the sale of the property at that price, as many factors can influence the final sale.

Preparers must be aware of and include any necessary state-specific disclosures themselves. The form does not automatically account for these requirements.

Client input is essential for accurate analysis. The homeowner's knowledge about the property, including any improvements made, is vital for a comprehensive assessment.

This form is tailored for specific types of properties and may not be suitable for all real estate transactions. Understanding the type of property being analyzed is important.

The form has an expiration date, and the information provided may become outdated. Regular updates are necessary to ensure accuracy.

While the analysis may estimate a marketing time frame, it cannot guarantee a sale within that period. Market conditions and buyer interest can vary significantly.

While primarily used by real estate brokers, homeowners can also benefit from understanding the analysis. It can empower them to make informed decisions regarding their property.

The Erc Broker Market Analysis form does not provide legal advice. Homeowners should consult with legal professionals for any legal concerns related to their property transactions.

Erc Broker Market Analysis: Usage Instruction

Completing the ERC Broker Market Analysis form requires careful attention to detail. Each section must be filled out accurately to ensure a thorough analysis of the property. This process involves gathering specific information about the property, its condition, and the surrounding market. Following the outlined steps will help streamline the process.

- Begin by entering the File Number, Homeowner(s), and Property Address at the top of the form.

- Fill in the Home Phone and Work Phone numbers for the homeowner.

- Provide details for the BMA Requested by section, including the company name and contact person, along with their e-mail and address.

- Complete the Real Estate Firm section with the firm's name, contact name, and their contact information.

- Document the Homeowner’s Purchase Price and the Date Purchased.

- Indicate any Improvements made by the homeowner, if applicable.

- State whether the subject property is currently listed, and if so, provide the Listing Company/Agent.

- Specify the Form of Ownership (e.g., Fee Simple, Leasehold) and Occupant type (e.g., Homeowner, Tenant, Vacant).

- Check the appropriate Type of property (e.g., Condo, Single Family, Town House) and any personal property that remains.

- Describe the Subject’s Location Type and note any Lot Characteristics that are positive or negative.

- Identify any Locational Issues that may affect insurability.

- Complete the Site Characteristics section by checking all applicable items.

- Note any Miscellaneous Issues that could affect marketability or value.

- Assess the Property Condition and check all relevant boxes, providing descriptions where necessary.

- Estimate costs for Recommended Repairs and Improvements for both interior and exterior items.

- List all required, customary, and additionally recommended inspections.

- Identify the most probable means of financing for the subject property and describe any financing concessions.

- Evaluate the Subject Neighborhood and broader market area, providing statistics and current conditions.

- Complete the Competing Listings and Comparable Sales sections with relevant data for similar properties.

Once all sections are filled out, review the form for accuracy. This ensures that the analysis reflects the true condition and marketability of the property. Submitting the completed form will facilitate the next steps in the evaluation process.

Common mistakes

-

Incomplete Information: Failing to fill out all required fields can lead to delays or inaccuracies in the analysis. Ensure every section is addressed, especially contact details and property specifics.

-

Misunderstanding Purpose: Some may confuse this form with an appraisal or inspection. Remember, this is a market analysis, not a formal appraisal.

-

Ignoring Local Regulations: Each state has unique disclosure requirements. Not adhering to these can result in legal complications.

-

Neglecting Condition Details: Underreporting or overlooking property condition issues can skew the estimated sales price. Be thorough in noting any damages or repairs needed.

-

Overlooking Market Trends: Failing to consider current market conditions, such as days on market or competition, can lead to unrealistic pricing estimates.

-

Inaccurate Comparables: Choosing inappropriate comparable sales can mislead the analysis. Select properties that are truly comparable in terms of size, location, and condition.

File Specifics

| Fact Name | Details |

|---|---|

| Purpose of the Form | The Erc Broker Market Analysis form helps real estate brokers assess a property's condition, competition, and future marketability to estimate its Most Likely Sales Price. |

| Not an Appraisal | This form is not a home inspection or an appraisal and should not be used as such. It does not comply with the Uniform Standards of Professional Appraisal Practice. |

| State-Specific Requirements | Preparers must be aware of and include any state-specific disclosure requirements, ensuring compliance with local laws. |

| Market Analysis Timeframe | The Most Likely Sales Price is based on the property's "as is" condition and assumes a marketing time not exceeding 120 days unless directed otherwise by the client. |

Dos and Don'ts

When filling out the ERC Broker Market Analysis form, follow these guidelines:

- Provide accurate and complete information for all fields.

- Contact the homeowner according to the requesting company’s guidelines.

- Include any state-specific disclosure requirements as necessary.

- Ensure that all property conditions are observed and reported honestly.

- Use the correct format for estimating the Most Likely Sales Price (MLSP).

- Document any improvements made by the homeowner clearly.

- Gather and include relevant market data for accurate analysis.

- Submit the form promptly to meet deadlines.

Avoid these common mistakes:

- Do not skip any sections of the form.

- Avoid making assumptions without evidence.

- Do not use vague language or unclear descriptions.

- Refrain from submitting outdated or irrelevant market data.

- Do not overlook any required inspections or disclosures.

- Never provide misleading or false information.

- Do not ignore the specific instructions provided by the requesting company.

- Avoid delays in submission that could impact the analysis process.

Similar forms

The Comparative Market Analysis (CMA) is a document frequently used in real estate transactions, similar to the ERC Broker Market Analysis form. A CMA helps real estate agents estimate the value of a property by comparing it to similar properties that have recently sold in the area. Like the ERC form, a CMA assesses the condition of the property, evaluates competition, and provides insights into market trends. However, a CMA is typically more informal and does not require the same level of detail or specific disclosures as the ERC form.

The Property Condition Disclosure Statement (PCDS) is another document that shares similarities with the ERC Broker Market Analysis form. The PCDS is provided by sellers to inform potential buyers about the condition of the property, including any known defects or issues. While the ERC form focuses on marketability and pricing, the PCDS emphasizes transparency regarding the property's condition. Both documents aim to protect parties involved in a real estate transaction by providing crucial information that may affect the sale.

When engaging in a transaction involving a recreational vehicle, it's essential to utilize the appropriate documentation, such as the Texas RV Bill of Sale, which is a legal document that records the transfer of ownership for an RV in Texas. This form is beneficial for both the seller and the buyer, as it encapsulates vital transaction details, ensuring that the transfer process is seamless. For comprehensive guidance on this document, you can visit documentonline.org/blank-texas-rv-bill-of-sale/, where further information is readily available to assist you in successfully navigating an RV sale.

The Appraisal Report is also comparable to the ERC Broker Market Analysis form, albeit with distinct differences. An appraisal report is a formal evaluation conducted by a licensed appraiser to determine a property's fair market value. While the ERC form estimates the Most Likely Sales Price based on market conditions and property specifics, an appraisal provides a more comprehensive analysis, often required by lenders for financing. Both documents serve to inform stakeholders about property value, but the appraisal is more standardized and regulated.

The Listing Agreement is yet another document that bears resemblance to the ERC Broker Market Analysis form. This agreement outlines the terms between a seller and a real estate broker, detailing how the property will be marketed and sold. Like the ERC form, it involves an assessment of the property’s condition and competitive positioning in the market. However, the Listing Agreement is more focused on the contractual relationship and obligations of the parties involved, whereas the ERC form is primarily concerned with market analysis and pricing strategies.

Other PDF Forms

CBP Declaration Form 6059B - Travelers should review their form for accuracy before submission.

When dealing with real estate transactions in California, it is essential to understand the significance of various forms, particularly the Quitclaim Deed, which can be utilized for seamless transfers. For those seeking to navigate the complexities of such documents, resources like All California Forms can provide essential guidance and templates to ensure proper execution and compliance with state laws.

Time Card Templates - Keep a copy of your submitted time card for records.