Employee Loan Agreement Document

When employees find themselves in need of financial assistance, an Employee Loan Agreement form serves as a crucial tool for both employers and employees. This form outlines the terms and conditions under which an employer provides a loan to an employee, ensuring clarity and protection for both parties involved. Key aspects of the agreement include the loan amount, interest rate, repayment schedule, and any applicable fees. Additionally, the form typically specifies the consequences of default, which can include wage deductions or other legal remedies. By detailing these elements, the agreement fosters transparency and helps maintain a positive working relationship. Furthermore, it is essential for employers to adhere to relevant regulations and company policies when drafting this document, as compliance can prevent misunderstandings and potential disputes down the line. Ultimately, the Employee Loan Agreement form not only facilitates financial support but also reinforces the trust and accountability that are vital in the employer-employee relationship.

Misconceptions

Misconceptions about the Employee Loan Agreement form can lead to confusion for both employers and employees. Here are ten common misunderstandings:

- All loans are interest-free. Many believe that employee loans do not incur interest. However, some agreements may include interest rates, which should be clearly outlined in the document.

- Only full-time employees can qualify for a loan. Part-time employees may also be eligible for loans, depending on the company’s policy. It is important to check the specific terms of the agreement.

- Loan agreements are not legally binding. In fact, these agreements are legally enforceable documents. Both parties must adhere to the terms outlined within.

- Employees can borrow any amount they want. Companies typically set limits on loan amounts based on various factors, including salary and tenure.

- Loan repayment terms are flexible and negotiable. While some companies may offer flexibility, the terms are usually fixed and should be followed as stated in the agreement.

- Defaulting on a loan has no consequences. Defaulting can lead to serious repercussions, such as deductions from paychecks or legal action, depending on the terms of the agreement.

- All loans are automatically approved. Approval is not guaranteed. Employers often review applications and may deny requests based on company policies or the employee’s financial history.

- Employees can use loan funds for any purpose. Some agreements specify that funds must be used for certain expenses, such as medical bills or education costs.

- Loan agreements are only necessary for large sums. Even small loans should be documented to protect both the employee and the employer.

- There is no need to keep records of loan agreements. It is crucial for both parties to retain copies of the agreement for future reference and to ensure compliance with the terms.

Understanding these misconceptions can help ensure that both employees and employers navigate the Employee Loan Agreement process more effectively.

Employee Loan Agreement: Usage Instruction

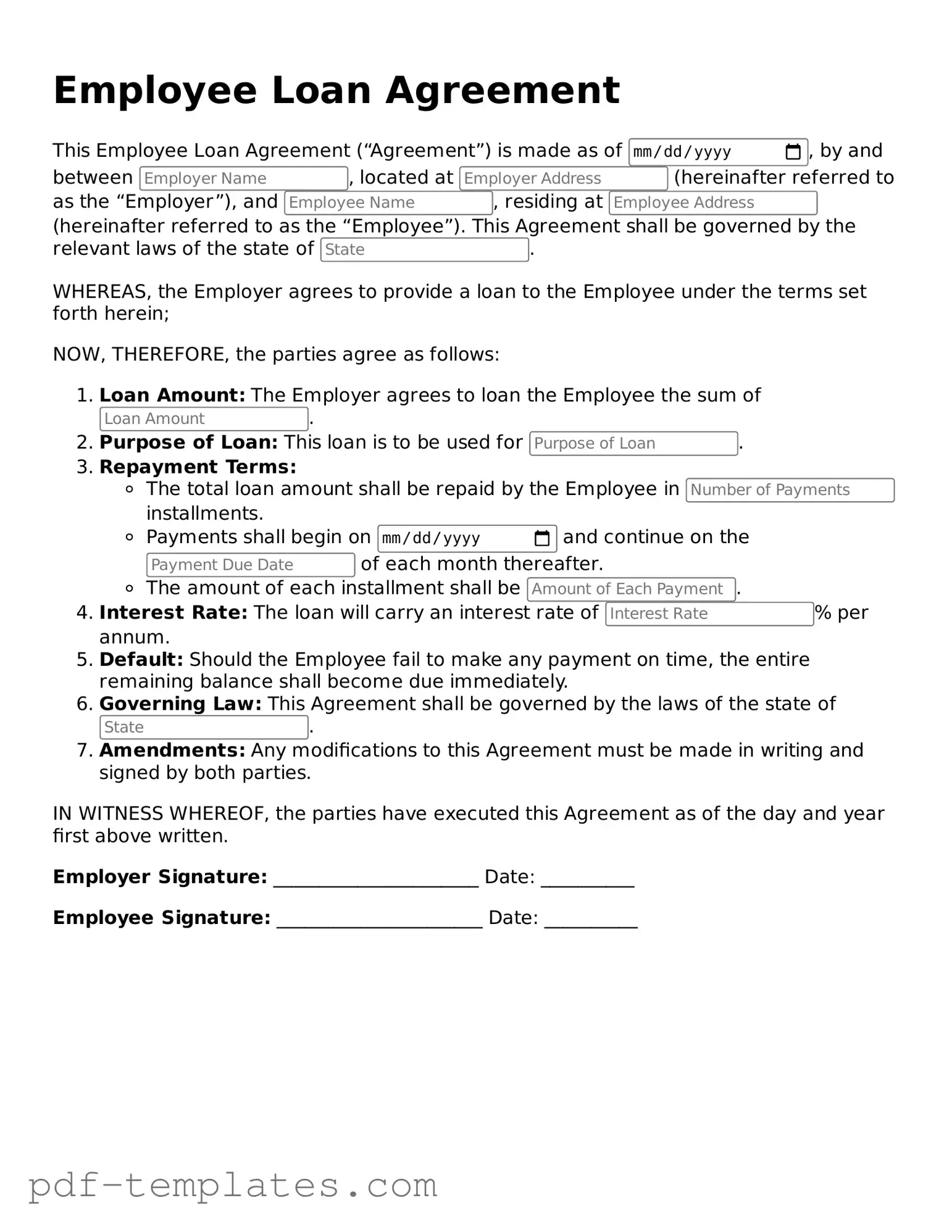

After gathering all necessary information and ensuring that you have the form in front of you, it’s time to fill out the Employee Loan Agreement form. This form is essential for documenting the terms of the loan between the employer and the employee. Follow these steps carefully to complete the form accurately.

- Begin by entering the date at the top of the form. This should be the date on which the agreement is being signed.

- Next, fill in the employee's full name. Make sure to use the name as it appears on official documents.

- Provide the employee's job title and department. This helps to identify the employee within the organization.

- Enter the loan amount. Be clear and precise with the figures to avoid any confusion later on.

- Specify the purpose of the loan. This could include categories such as medical expenses, home repairs, or education costs.

- Indicate the repayment terms. This includes the payment schedule, interest rate (if applicable), and the total duration of the loan.

- Fill in the employee's signature line. The employee must sign and date the agreement to acknowledge acceptance of the terms.

- Finally, include the signature of the authorized representative from the employer's side. This should also be dated to confirm the agreement.

Once you have completed the form, review it for accuracy before submitting it to the appropriate department. Keeping a copy for your records is always a good practice.

Common mistakes

-

Incomplete Personal Information: Many individuals forget to fill out all required personal details, such as their full name, address, and employee ID. Missing this information can delay the processing of the loan.

-

Incorrect Loan Amount: A common mistake is entering the wrong loan amount. Double-checking the figures is essential to ensure accuracy.

-

Failure to Read Terms: Some employees skip reading the loan terms and conditions. Understanding the repayment schedule and interest rates is crucial before signing.

-

Not Providing Required Documentation: Applicants often overlook the need to attach supporting documents, such as proof of income or identification. This omission can lead to delays or denials.

-

Ignoring Signature Requirements: A signature is necessary to validate the agreement. Forgetting to sign or provide a witness signature can invalidate the form.

-

Incorrect Contact Information: Providing outdated or incorrect contact details can hinder communication regarding the loan status. Always verify that your contact information is current.

-

Not Keeping a Copy: After submitting the form, failing to keep a copy for personal records is a common oversight. Retaining a copy can be helpful for future reference.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | An Employee Loan Agreement is a document that outlines the terms under which an employer loans money to an employee. |

| Purpose | This agreement serves to protect both the employer and the employee by clearly stating the repayment terms and conditions. |

| Repayment Terms | It typically includes details about the repayment schedule, interest rates, and any penalties for late payments. |

| Governing Law | The agreement is subject to state-specific laws, which can vary. For example, in California, it is governed by the California Civil Code. |

| Confidentiality | Many agreements include clauses that protect the confidentiality of the loan terms, ensuring that sensitive information remains private. |

| Employee Eligibility | Eligibility for receiving a loan may depend on factors such as employment status, tenure, and financial need. |

| Default Consequences | If an employee defaults on the loan, the agreement may outline specific actions the employer can take, such as wage garnishment. |

| Modification Clause | Many agreements contain a modification clause that allows for changes to the terms, provided both parties agree in writing. |

Dos and Don'ts

When filling out an Employee Loan Agreement form, it’s important to be careful and thorough. Here are some things you should and shouldn’t do:

- Do read the entire form before starting.

- Do provide accurate personal information.

- Do clearly state the loan amount you are requesting.

- Do understand the repayment terms before signing.

- Do ask questions if anything is unclear.

- Don't rush through the form.

- Don't leave any required fields blank.

- Don't exaggerate your financial situation.

- Don't sign without reading the agreement.

- Don't forget to keep a copy for your records.

Similar forms

An Employee Loan Agreement is quite similar to a Personal Loan Agreement. Both documents outline the terms under which money is lent to an individual, specifying the loan amount, interest rates, repayment schedule, and any consequences for defaulting. In both cases, the lender seeks to protect their investment while ensuring that the borrower understands their obligations. The key difference lies in the context; a Personal Loan Agreement is generally used between individuals or financial institutions, while an Employee Loan Agreement is specific to the employer-employee relationship.

A Credit Agreement also shares similarities with an Employee Loan Agreement. Like the Employee Loan Agreement, a Credit Agreement details the terms of borrowing, including the amount, interest rates, and repayment terms. However, Credit Agreements are often broader and can encompass various forms of credit, such as lines of credit or credit cards, whereas an Employee Loan Agreement is specifically tailored for loans provided by an employer to an employee.

The Promissory Note is another document that closely resembles an Employee Loan Agreement. Both documents serve as a written promise to repay a loan. A Promissory Note typically includes the loan amount, interest rate, and repayment terms. However, it is usually less detailed than an Employee Loan Agreement, which may include additional clauses that address employment status and specific conditions tied to the loan.

An Installment Loan Agreement is also akin to an Employee Loan Agreement. Both types of agreements involve borrowing a set amount of money that is to be repaid in regular installments over a specified period. The main distinction is that Installment Loan Agreements are often used for larger purchases, such as cars or homes, while Employee Loan Agreements are generally smaller and more focused on assisting employees with personal financial needs.

A Lease Agreement can be compared to an Employee Loan Agreement in that both documents outline the terms of a financial arrangement. While a Lease Agreement is specifically for renting property, it includes terms like payment amounts, duration, and responsibilities, similar to how an Employee Loan Agreement specifies the loan terms. Both agreements aim to clarify expectations between parties to prevent misunderstandings.

An Employment Contract may also have similarities with an Employee Loan Agreement. Both documents establish a formal relationship between an employer and an employee, detailing rights and responsibilities. While an Employment Contract focuses on job duties and compensation, it may include clauses about loans or advances, particularly if financial support is part of the employment package.

A Mortgage Agreement shares some characteristics with an Employee Loan Agreement as well. Both involve borrowing money with a repayment plan. However, a Mortgage Agreement specifically pertains to real estate and includes collateral in the form of the property itself. In contrast, an Employee Loan Agreement typically does not require collateral, focusing instead on the employee's promise to repay.

Understanding the various types of loan agreements is essential for both borrowers and lenders to ensure clarity and compliance with financial obligations. For those interested in creating a legally binding document tailored to their needs, resources like formcalifornia.com/ provide valuable templates and guidance to help navigate the complexities of loan agreements and protect the interests of all parties involved.

A Business Loan Agreement can be compared to an Employee Loan Agreement in terms of structure and purpose. Both agreements detail the terms of a loan, including the amount, interest rate, and repayment schedule. However, a Business Loan Agreement is aimed at businesses seeking funding for operations or growth, while an Employee Loan Agreement is intended to assist individual employees with personal financial needs.

Lastly, a Loan Modification Agreement is somewhat similar to an Employee Loan Agreement. Both documents deal with the terms of a loan, but a Loan Modification Agreement specifically alters the existing terms of a loan, such as the interest rate or repayment schedule. In contrast, an Employee Loan Agreement is typically created at the outset of a loan and does not involve changes to previously established terms.