Get Employee Advance Form in PDF

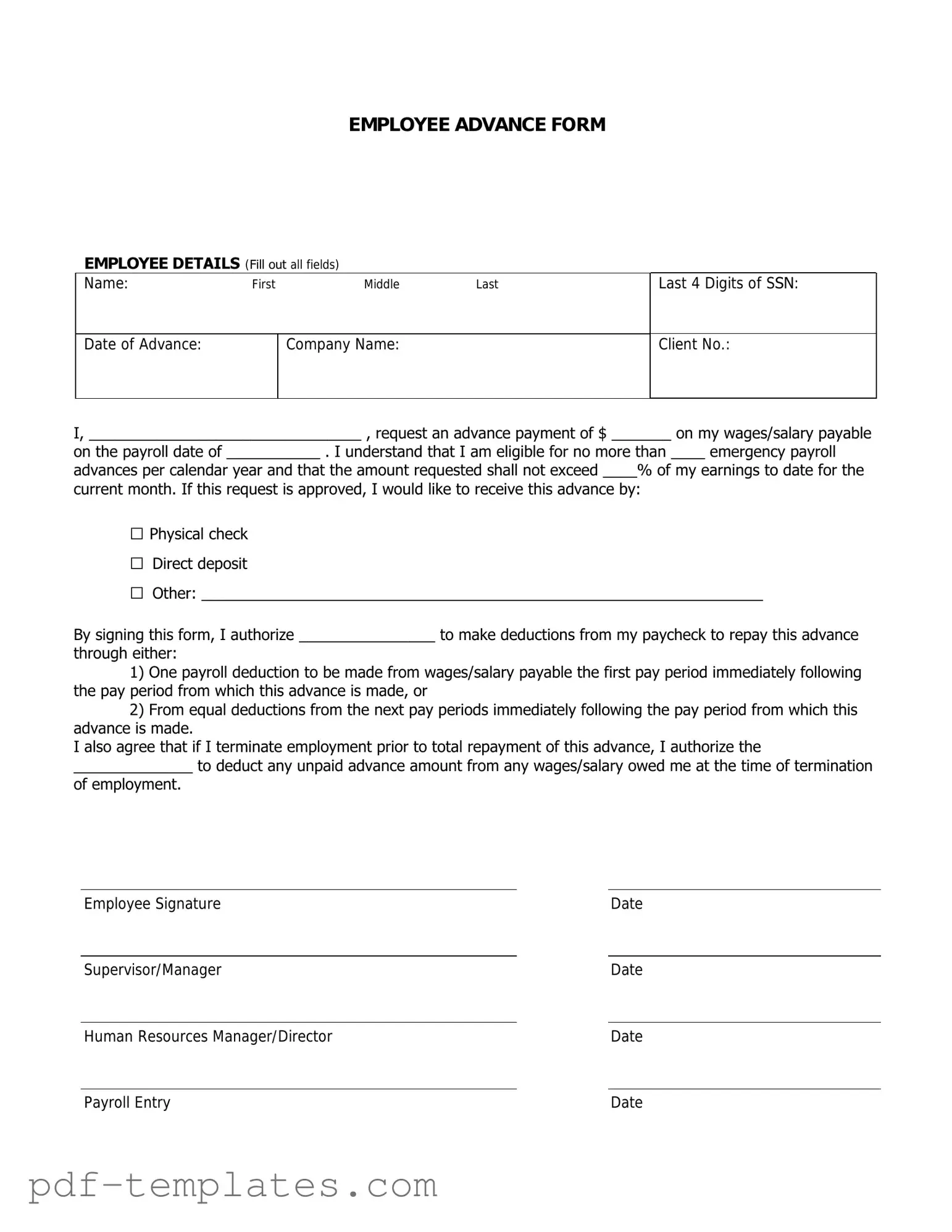

The Employee Advance form is a crucial document that facilitates the process of requesting financial assistance for employees facing unexpected expenses. This form typically outlines the necessary information required from the employee, including their name, department, and the amount requested. Additionally, it often requires a detailed explanation of the purpose for the advance, ensuring that the request is justified and aligns with company policies. Approval processes may vary, involving supervisors or HR personnel who assess the request based on established criteria. Timeliness is essential, as employees may need the funds urgently. Understanding how to properly complete and submit this form can significantly impact an employee's financial well-being and overall job satisfaction.

Misconceptions

Many employees may have misunderstandings about the Employee Advance form. Here are five common misconceptions:

-

Employee Advances are only for emergencies.

This is not true. While many people think advances are reserved for urgent situations, they can be used for various reasons, such as travel expenses or work-related purchases.

-

Submitting an advance request is a complicated process.

In reality, the process is straightforward. Most companies have a simple form that requires basic information, and approval usually follows quickly.

-

All advance requests are automatically approved.

This is a misconception. Approval depends on company policy and the specific circumstances of the request. Managers will review each request carefully.

-

Employees must pay back the full amount immediately.

This is often not the case. Many companies allow repayment through payroll deductions over time, making it easier for employees to manage their finances.

-

Using an advance will negatively impact my credit.

Employee advances do not typically affect personal credit scores. They are internal transactions between the employee and employer, not loans from financial institutions.

Employee Advance: Usage Instruction

Completing the Employee Advance form is an important step in requesting funds for work-related expenses. After filling out the form, it will be submitted for approval. Following that, you will receive notification regarding the status of your request.

- Begin by entering your full name in the designated field at the top of the form.

- Provide your employee identification number. This helps to ensure that your request is properly tracked.

- Fill in your department name to indicate where you work within the organization.

- Specify the date on which you are submitting the request. This is usually found in a designated box.

- Clearly outline the purpose of the advance in the section provided. Be specific about the expenses you plan to incur.

- Indicate the amount of money you are requesting. Make sure this amount aligns with the expenses you have detailed.

- Sign and date the form at the bottom to confirm that the information you provided is accurate and truthful.

- Submit the completed form to your supervisor or the designated financial officer for review and approval.

Common mistakes

-

Incomplete Information: Failing to fill out all required fields can lead to delays in processing the advance. Every section must be completed to ensure a smooth review.

-

Incorrect Amounts: Entering the wrong amount requested can cause confusion. Always double-check the figures to avoid discrepancies.

-

Lack of Justification: Not providing a clear reason for the advance can result in rejection. Be specific about why the funds are needed.

-

Missing Signatures: Omitting necessary signatures from the employee or supervisor can halt the approval process. Ensure all required approvals are obtained.

-

Incorrect Dates: Entering the wrong dates for the request or repayment can lead to misunderstandings. Check all dates for accuracy.

-

Failure to Attach Documentation: Not including supporting documents, such as receipts or estimates, can weaken the request. Attach all relevant information.

-

Ignoring Company Policy: Not adhering to company guidelines regarding advances can result in denial. Familiarize yourself with the rules before submitting.

-

Neglecting to Review: Skipping a final review of the form can lead to overlooked errors. Always take a moment to proofread before submission.

-

Submitting Late: Turning in the form after the deadline can jeopardize the request. Be mindful of timelines and submit promptly.

-

Using Inappropriate Language: Including informal or unprofessional language can reflect poorly on the request. Maintain a professional tone throughout the form.

File Specifics

| Fact Name | Description |

|---|---|

| Definition | The Employee Advance form is used to request an advance on future earnings by an employee. |

| Purpose | This form helps employees manage unexpected expenses by providing immediate financial support. |

| Eligibility | Typically, only full-time employees are eligible to request an advance. |

| Repayment Terms | Repayment is usually deducted from future paychecks, often over a specified period. |

| State-Specific Forms | Some states may require specific forms or additional documentation based on local laws. |

| Governing Laws | In California, for example, the form must comply with state labor laws regarding wage advances. |

| Approval Process | Supervisors or HR must review and approve the request before any funds are disbursed. |

| Limitations | There may be a cap on the amount that can be advanced, often a percentage of the employee's salary. |

| Tax Implications | Advances may be subject to tax withholdings, impacting the employee's net pay. |

| Documentation | Employees may need to provide receipts or proof of expenses for which the advance is requested. |

Dos and Don'ts

When filling out the Employee Advance form, it’s important to follow certain guidelines to ensure a smooth process. Here’s a list of things you should and shouldn’t do:

- Do read the form carefully before starting.

- Do provide accurate and complete information.

- Do double-check your calculations if any are required.

- Do keep a copy of the completed form for your records.

- Do submit the form to the appropriate department on time.

- Don't leave any required fields blank.

- Don't use unclear language or abbreviations that might confuse the reviewer.

- Don't forget to sign and date the form.

- Don't submit the form without verifying your expenses align with company policy.

Similar forms

The Employee Expense Reimbursement form serves a similar purpose as the Employee Advance form. Both documents are designed to facilitate financial transactions between employees and the organization. The Expense Reimbursement form allows employees to claim back money spent on behalf of the company, ensuring they are compensated for legitimate business expenses. Like the Employee Advance, it requires detailed documentation and justification for the expenses incurred, promoting transparency and accountability in financial dealings.

The Payroll Deduction Authorization form is another document that aligns closely with the Employee Advance form. This document allows employees to authorize deductions from their paychecks for various purposes, such as loan repayments or benefits contributions. Both forms require employee consent and often involve financial transactions that impact the employee's earnings. The Payroll Deduction Authorization ensures that employees are aware of and agree to any deductions, similar to how the Employee Advance form outlines the terms of an advance.

The Travel Authorization form is also comparable to the Employee Advance form. This document is used to obtain approval for business-related travel expenses before they are incurred. Like the Employee Advance, it involves planning for future expenditures and requires managerial approval. Both documents aim to ensure that employees are prepared for expenses while maintaining the organization's budgetary constraints and policies.

The Loan Agreement form shares similarities with the Employee Advance form as well. This document outlines the terms and conditions under which an employee may receive a loan from the employer. Both forms involve financial assistance provided to employees, often requiring a repayment plan. The Loan Agreement typically includes details about interest rates and repayment schedules, while the Employee Advance form focuses on the immediate financial support needed for business-related expenses.

The Purchase Order form is another document that bears resemblance to the Employee Advance form. It is used to request the purchase of goods or services and often requires approval from management. Both forms are integral to managing company finances and ensuring that expenditures align with company policies. The Purchase Order form initiates the procurement process, while the Employee Advance form facilitates immediate cash flow for employees on business-related matters.

The Requisition form is similar to the Employee Advance form in that it initiates a request for goods or services needed by the organization. Employees fill out this form to specify what they need, which then goes through an approval process. Both documents require justification for the request, ensuring that all expenditures are necessary and align with company policies. The Requisition form ultimately helps manage resources effectively, just as the Employee Advance form does for employee expenses.

Understanding the various forms that facilitate financial transactions within a business is essential, as seen with the Employee Advance form, which shares similarities with other documents like the Travel Expense Reimbursement form and the Mileage Reimbursement form. Employees must navigate these forms to ensure they manage funds effectively for operational needs. For further ease in documentation, one can refer to All California Forms to secure comprehensive resources tailored for various financial agreements and requests.

Lastly, the Timesheet form can be viewed as similar to the Employee Advance form. While primarily used to record hours worked, it also plays a crucial role in the financial aspect of employment. Employees must document their hours to ensure they are compensated accurately. Both forms require attention to detail and accurate reporting, as they directly affect an employee's financial relationship with the organization. Proper completion of the Timesheet form ensures that employees receive the correct payment, much like the Employee Advance form ensures they receive the necessary funds for business-related expenses.

Other PDF Forms

Tax Return Transcript - The transcript is useful for verifying information when preparing future tax returns.

In addition to being a vital part of the vehicle transfer process, a Trailer Bill of Sale form can often be found online, ensuring a hassle-free experience for both parties involved. For those looking for a straightforward template, you can access one at https://documentonline.org/blank-trailer-bill-of-sale/, which is designed to help facilitate the proper documentation needed for a successful transaction.

Profit and Loss Form - Can reveal profitability trends for specific products or services.