Durable Power of Attorney Document

The Durable Power of Attorney (DPOA) form serves as a vital tool in personal and financial planning, empowering individuals to designate someone they trust to make decisions on their behalf when they are unable to do so. This legal document not only allows for the management of financial affairs but also extends to healthcare decisions, ensuring that one's wishes are honored even in times of incapacity. It is essential to understand that the DPOA remains effective even if the principal becomes incapacitated, making it a crucial aspect of long-term planning. The form typically outlines the specific powers granted to the agent, which can range from handling bank transactions to making medical decisions. Additionally, it is important to note that the principal can revoke or modify the DPOA at any time, as long as they are of sound mind. Understanding the nuances of this form can provide peace of mind, knowing that trusted individuals will act in one’s best interest during challenging times.

Misconceptions

- Misconception 1: A Durable Power of Attorney is only for financial matters.

- Misconception 2: A Durable Power of Attorney is the same as a regular Power of Attorney.

- Misconception 3: Once I sign a Durable Power of Attorney, I lose control over my affairs.

- Misconception 4: I can only have one Durable Power of Attorney at a time.

- Misconception 5: A Durable Power of Attorney is only necessary for older adults.

- Misconception 6: I can create a Durable Power of Attorney without legal help.

This is not true. While many people use a Durable Power of Attorney for financial decisions, it can also grant authority for healthcare decisions. This allows someone to make medical choices on your behalf if you become unable to do so.

A Durable Power of Attorney remains effective even if you become incapacitated, unlike a regular Power of Attorney, which typically ends if you lose the ability to make decisions. This durability is crucial for long-term planning.

This is a common fear, but it is unfounded. You can still manage your own affairs as long as you are capable. The agent’s authority only kicks in when you are unable to make decisions.

It is possible to have multiple Durable Powers of Attorney, but it is essential to ensure they do not conflict with each other. Clear communication and documentation can help avoid confusion.

People of all ages can benefit from having a Durable Power of Attorney. Unexpected events, such as accidents or sudden illnesses, can happen at any time, making this document relevant for anyone.

While it is possible to draft a Durable Power of Attorney on your own, seeking legal advice can ensure that the document meets all legal requirements and truly reflects your wishes. A professional can help you avoid potential pitfalls.

Durable Power of Attorney - Customized for State

Durable Power of Attorney: Usage Instruction

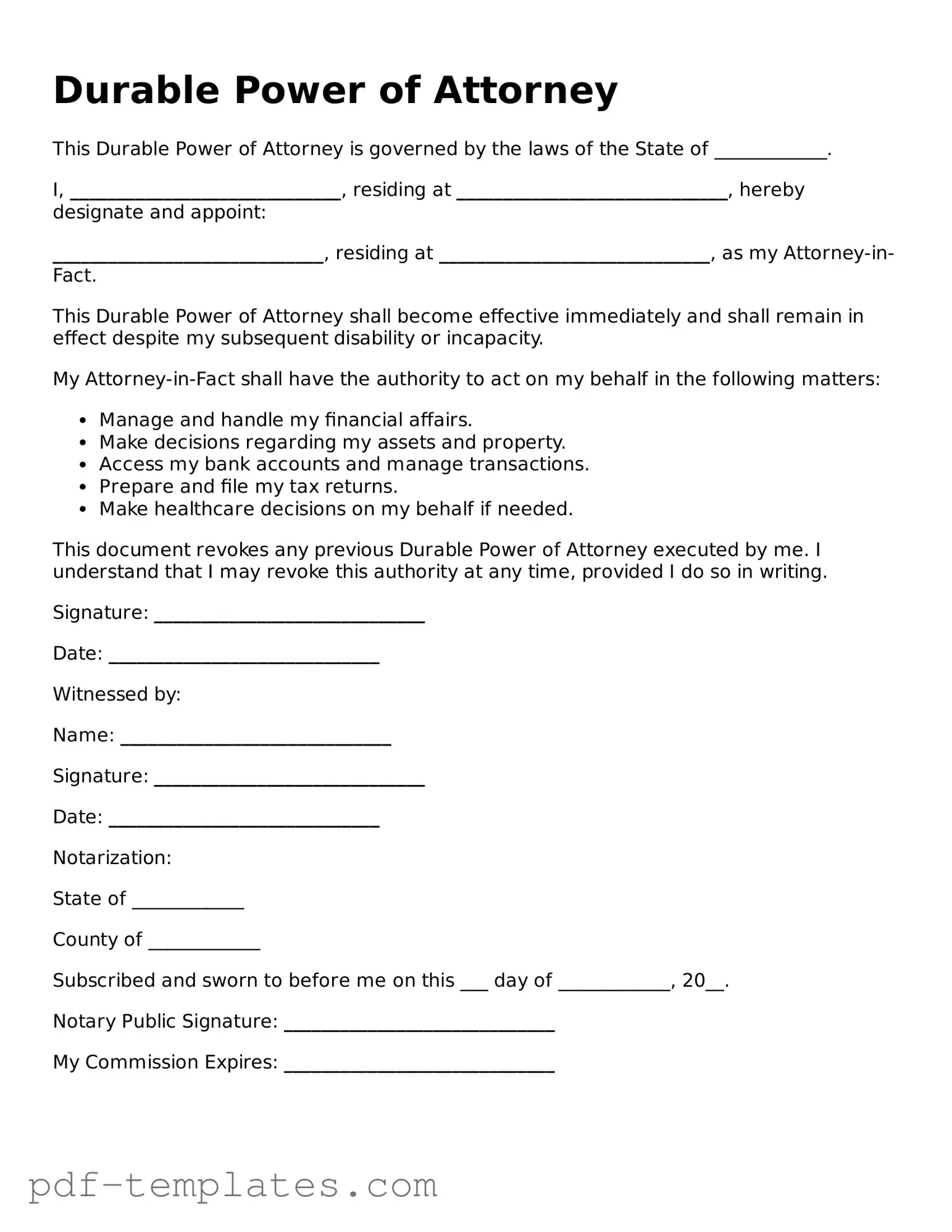

Filling out a Durable Power of Attorney form is an important step in ensuring your financial and medical decisions can be managed by someone you trust. The process is straightforward, and by following these steps, you can complete the form accurately.

- Obtain the Form: Start by downloading or requesting a Durable Power of Attorney form from a reliable source.

- Read the Instructions: Familiarize yourself with the form's instructions to understand what information is required.

- Identify Yourself: Fill in your full name, address, and contact information in the designated section.

- Choose Your Agent: Specify the person you are appointing as your agent. Include their full name, address, and relationship to you.

- Define Powers: Clearly outline the powers you wish to grant your agent. You can select specific powers or general ones.

- Include Successor Agents: If desired, name one or more successor agents who can act if your primary agent is unable to do so.

- Sign and Date: Sign the form in the appropriate section. Make sure to date it as well.

- Witness Requirements: Check if your state requires witnesses. If so, have them sign the form in the designated area.

- Notarization: If your state requires it, take the form to a notary public to have it notarized.

- Distribute Copies: Provide copies of the completed form to your agent, any successor agents, and relevant institutions.

Common mistakes

-

Not Specifying the Powers Granted: One common mistake is failing to clearly outline the specific powers that the agent will have. It's essential to detail whether the agent can handle financial matters, healthcare decisions, or both. Without this clarity, the agent may not have the authority to act when needed.

-

Choosing the Wrong Agent: Selecting an agent who does not understand your wishes or lacks the necessary skills can lead to complications. It is vital to choose someone trustworthy and capable of making decisions that align with your values and preferences.

-

Not Updating the Document: Life circumstances change. Failing to update the Durable Power of Attorney after significant life events, such as marriage, divorce, or the death of a previously designated agent, can render the document ineffective.

-

Not Signing and Dating the Document Properly: A Durable Power of Attorney must be signed and dated according to state laws. Neglecting to do so can invalidate the document. Always ensure that you follow the required procedures for your state.

-

Forgetting to Have Witnesses or Notarization: Some states require that the Durable Power of Attorney be witnessed or notarized. Omitting this step can lead to challenges in the document’s validity when it is needed.

-

Overlooking State-Specific Requirements: Each state has its own laws regarding Durable Power of Attorney forms. Ignoring these specific requirements can result in a document that does not hold up in legal situations.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | A Durable Power of Attorney (DPOA) allows an individual to designate someone to make decisions on their behalf, even if they become incapacitated. |

| Durability | The term "durable" indicates that the authority granted remains effective despite the principal's mental or physical incapacity. |

| State-Specific Forms | Each state has its own specific form for a DPOA. It is essential to use the correct form according to your state’s laws. |

| Governing Laws | In the United States, the Uniform Power of Attorney Act provides a framework, but each state may have additional regulations governing DPOAs. |

| Principal and Agent | The person granting the authority is known as the principal, while the individual receiving the authority is referred to as the agent or attorney-in-fact. |

| Scope of Authority | The DPOA can be tailored to grant broad or limited powers, depending on the principal's wishes. This can include financial or medical decisions. |

| Revocation | The principal can revoke a DPOA at any time as long as they are mentally competent, provided the revocation is executed in accordance with state law. |

Dos and Don'ts

When filling out a Durable Power of Attorney form, it's important to approach the task thoughtfully. Here’s a list of things you should and shouldn't do:

- Do read the entire form carefully before you start filling it out.

- Do clearly identify the person you are appointing as your agent.

- Do specify the powers you want to grant your agent in detail.

- Do sign the document in front of a notary public if required by your state.

- Don't rush through the form; take your time to ensure accuracy.

- Don't leave any blanks; fill in all required fields to avoid confusion.

- Don't forget to discuss your wishes with your agent before finalizing the document.

By following these guidelines, you can ensure that your Durable Power of Attorney form is completed correctly and reflects your intentions clearly.

Similar forms

The Durable Power of Attorney (DPOA) is similar to a General Power of Attorney (GPOA) in that both allow one person to act on behalf of another. However, the key difference lies in the durability of the authority granted. A GPOA typically becomes invalid if the principal becomes incapacitated, while a DPOA remains effective even if the principal can no longer make decisions. This makes the DPOA a crucial document for long-term planning, especially for those concerned about potential future health issues.

Another document that shares similarities with the DPOA is the Healthcare Power of Attorney. This form specifically grants authority to make medical decisions on behalf of someone who is unable to do so. Like the DPOA, it remains in effect even if the person becomes incapacitated. However, the Healthcare Power of Attorney focuses solely on health-related matters, whereas the DPOA can cover a broader range of financial and legal decisions.

The Living Will is also comparable to the Durable Power of Attorney, but it serves a different purpose. A Living Will outlines an individual’s wishes regarding medical treatment in situations where they cannot communicate their preferences. While the DPOA allows someone to make decisions on behalf of another, the Living Will directly expresses the individual’s own desires. Both documents are essential for ensuring that a person's wishes are respected during times of incapacity.

Similarly, a Trust can be likened to a Durable Power of Attorney in that both can manage assets and provide for someone’s financial needs. A Trust holds and manages assets for the benefit of another person, often avoiding probate. While a DPOA allows an agent to make decisions on behalf of the principal, a Trust can provide a more structured way to manage and distribute assets according to specific terms. Both documents serve to protect the interests of individuals when they can no longer manage their affairs.

Lastly, the Advance Directive is another document that shares some characteristics with the DPOA. An Advance Directive combines elements of a Living Will and a Healthcare Power of Attorney, allowing individuals to express their healthcare preferences and designate someone to make decisions for them. Like the DPOA, it remains effective during periods of incapacity. Both documents are crucial for ensuring that an individual’s healthcare choices are honored when they cannot advocate for themselves.

Additional Types of Durable Power of Attorney Templates:

Power of Attorney Florida for Child - Ensures continuity of care for a child during emergency situations.

Power of Attorney Dmv - A power of attorney can also aid in handling financial issues tied to your vehicle.