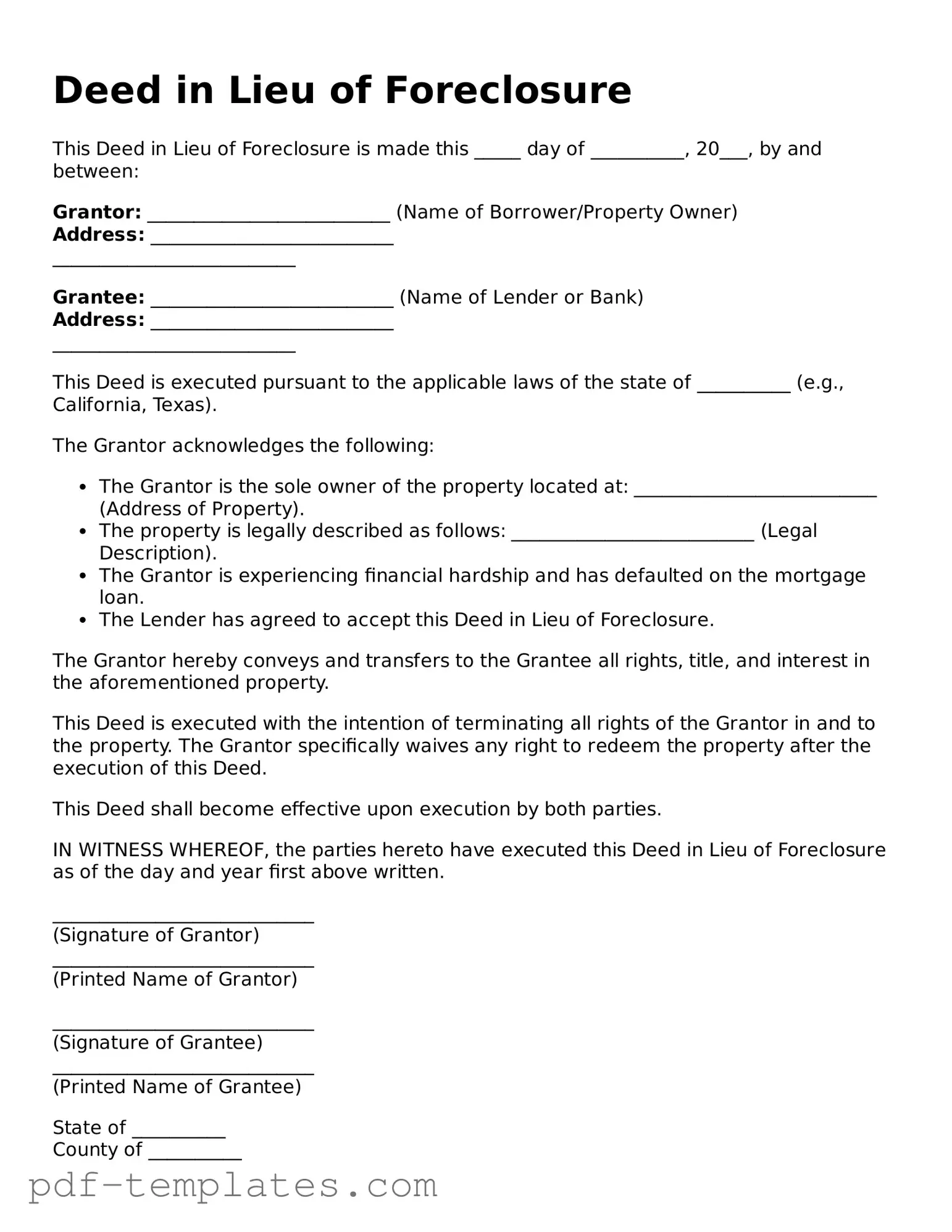

Deed in Lieu of Foreclosure Document

When homeowners face financial difficulties and find themselves unable to keep up with mortgage payments, they often explore various options to avoid foreclosure. One such option is the Deed in Lieu of Foreclosure. This legal process allows a homeowner to voluntarily transfer the ownership of their property back to the lender in exchange for the cancellation of the mortgage debt. By doing so, the homeowner can alleviate the stress and long-term consequences of foreclosure. The Deed in Lieu of Foreclosure form serves as a crucial document in this process, outlining the terms of the agreement between the homeowner and the lender. It typically includes important details such as the property description, the names of the parties involved, and any conditions that must be met for the transfer to take place. Additionally, the form often addresses issues related to potential deficiencies in the mortgage balance, which can impact the homeowner's financial future. Understanding this form is essential for anyone considering this option, as it can provide a pathway to a fresh start while minimizing the damage to one’s credit score.

Misconceptions

A Deed in Lieu of Foreclosure is often misunderstood. Here are five common misconceptions about this legal process.

-

It completely eliminates debt.

Many people believe that a Deed in Lieu of Foreclosure wipes out all mortgage debt. In reality, while it can relieve the homeowner of the property, it may not eliminate any remaining financial obligations, such as second mortgages or liens.

-

It is a simple process.

Some assume that transferring the property through a Deed in Lieu is straightforward. However, it often involves negotiations with the lender, documentation, and potential tax implications, making it more complex than it appears.

-

It has no impact on credit scores.

A common belief is that a Deed in Lieu does not affect credit scores. In truth, it can significantly damage credit ratings, similar to a foreclosure, and may remain on credit reports for several years.

-

It is available to everyone facing foreclosure.

Not everyone qualifies for a Deed in Lieu of Foreclosure. Lenders typically require borrowers to demonstrate financial hardship and may impose specific conditions that must be met before accepting this option.

-

It is a last resort.

Some think that a Deed in Lieu is only for those who have exhausted all other options. While it can be a last resort, it can also be a proactive choice for those looking to avoid the lengthy foreclosure process.

Deed in Lieu of Foreclosure - Customized for State

Deed in Lieu of Foreclosure: Usage Instruction

Once you have the Deed in Lieu of Foreclosure form ready, it's time to fill it out carefully. This document will need to be completed accurately to ensure a smooth process moving forward.

- Begin by entering the date at the top of the form.

- Provide the name of the property owner. This should be the individual or entity that holds the title to the property.

- Next, write the address of the property. Include the street address, city, state, and ZIP code.

- List the name of the lender or mortgage company. This is the institution that holds the mortgage on the property.

- Include the loan number associated with the mortgage. This helps identify the specific loan in question.

- State the reason for the deed in lieu. Be clear and concise about your situation.

- Sign the form where indicated. The property owner must provide their signature to validate the document.

- Have the form notarized. This adds an extra layer of verification to the document.

- Make copies of the completed form for your records. It's important to keep a copy for your personal files.

- Submit the form to the lender. Follow any specific instructions provided by the lender for submission.

After submitting the form, you will wait for the lender's response. They will review the information and let you know the next steps. Be prepared for further communication and potential follow-up actions.

Common mistakes

-

Incomplete Information: Failing to provide all required personal and property details can lead to delays or rejection of the deed.

-

Incorrect Signatures: Not having all necessary parties sign the document may invalidate it. Ensure all owners are included.

-

Not Consulting a Professional: Skipping legal or financial advice can result in misunderstandings about the implications of the deed.

-

Missing Notarization: Many jurisdictions require notarization. Failing to have the document notarized can render it unenforceable.

-

Ignoring Lender Requirements: Each lender may have specific requirements. Not following these can lead to complications.

-

Overlooking Tax Implications: Not understanding potential tax consequences can lead to unexpected financial burdens.

-

Failing to Keep Copies: Not retaining a copy of the completed deed can create issues if disputes arise later.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is an agreement where a borrower voluntarily transfers the title of their property to the lender to avoid foreclosure. |

| Benefits | This process can help borrowers avoid a lengthy foreclosure process and may have less impact on their credit score. |

| State-Specific Laws | Each state has its own laws governing Deeds in Lieu of Foreclosure. For example, in California, it is governed by California Civil Code Section 1475. |

| Requirements | Typically, borrowers must demonstrate financial hardship and provide necessary documentation to qualify for this option. |

Dos and Don'ts

When filling out the Deed in Lieu of Foreclosure form, it's essential to approach the process with care. Here are ten things to keep in mind:

- Do read the entire form carefully before filling it out. Understanding each section will help you provide accurate information.

- Don't rush through the process. Take your time to ensure that all details are correct and complete.

- Do gather all necessary documents, such as your mortgage agreement and identification, before starting the form.

- Don't leave any sections blank. If a section does not apply, indicate that clearly to avoid confusion.

- Do consult with a legal professional if you have any questions about the form or the implications of signing it.

- Don't sign the form until you fully understand its contents and consequences. This is a significant decision.

- Do keep a copy of the completed form for your records. Documentation is crucial for future reference.

- Don't forget to provide your current contact information. This ensures that the lender can reach you if necessary.

- Do check for any specific instructions from your lender regarding the submission of the form.

- Don't underestimate the importance of following up after submission. Confirm that your lender has received the form and understands your situation.

Similar forms

A Short Sale Agreement is a document that allows a homeowner to sell their property for less than the amount owed on their mortgage. This process requires the lender's approval, similar to a Deed in Lieu of Foreclosure. Both options aim to avoid the lengthy and often costly foreclosure process. In a short sale, the homeowner actively sells the property, while in a deed in lieu, the homeowner voluntarily transfers ownership back to the lender without selling it on the market. Both can help mitigate financial loss for the lender and provide a way for the homeowner to move on from an unaffordable mortgage.

A Loan Modification Agreement is another document that shares similarities with a Deed in Lieu of Foreclosure. This agreement involves changing the terms of an existing mortgage to make payments more manageable for the borrower. Like the deed in lieu, a loan modification can prevent foreclosure by providing the homeowner with a more sustainable repayment plan. However, while the deed in lieu relinquishes ownership of the property, a loan modification allows the homeowner to retain their home while adjusting their financial obligations.

A Forebearance Agreement is a temporary solution that allows homeowners to pause or reduce their mortgage payments for a specified period. This agreement can help homeowners avoid foreclosure by providing immediate relief. Much like a Deed in Lieu of Foreclosure, it serves as a tool for struggling homeowners, but it does not involve transferring property ownership. Instead, it focuses on giving the homeowner time to recover financially while keeping their home during the forbearance period.

In addition to these options, understanding the importance of proper documentation in transactions involving trailers is crucial. For instance, a Trailer Bill of Sale form is vital for ensuring the clear transfer of ownership, and you can find a blank version of this essential document at https://documentonline.org/blank-trailer-bill-of-sale, which can help mitigate any potential misunderstandings during the sale process.

A Bankruptcy Filing can also be compared to a Deed in Lieu of Foreclosure. When a homeowner files for bankruptcy, they can seek to eliminate or reorganize their debts, including their mortgage. This legal process can halt foreclosure proceedings temporarily. While a deed in lieu directly transfers ownership to the lender, bankruptcy provides the homeowner with an opportunity to address their debts and potentially keep their home, depending on the type of bankruptcy filed.

A Quitclaim Deed is a document that allows a property owner to transfer their interest in a property to another party without any warranties or guarantees. This document can be similar to a Deed in Lieu of Foreclosure in that both involve transferring property ownership. However, a quitclaim deed is often used in personal situations, such as transferring property between family members, rather than as a means to avoid foreclosure. Both documents simplify the transfer process but serve different purposes in the context of property ownership.

Finally, a Release of Mortgage is a document that indicates a mortgage has been paid off and the lender relinquishes their claim to the property. This document is similar to a Deed in Lieu of Foreclosure in that it signifies the end of a financial obligation related to the property. However, while a release of mortgage occurs after the debt has been fully satisfied, a deed in lieu allows the homeowner to hand over the property to the lender when they are unable to meet their mortgage obligations, providing a way to resolve the situation without going through foreclosure.

Additional Types of Deed in Lieu of Foreclosure Templates:

Property Gift Deed Rules - Be proactive in discussing the gift with the intended recipient.

To ensure that your legal documents are executed properly, utilizing the California Notary Acknowledgement form is essential. This form provides the necessary verification that the signer is who they claim to be and that they have willingly signed the document. For those in need of an array of pertinent documents, you can find an assortment of options, including the Notary Acknowledgement form, at All California Forms, which serves as a valuable resource for legal professionals and individuals alike.

Lady Bird Document - The deed maintains the property owner’s right to modify or revoke the deed during their lifetime.

Transfer on Death Deed California Common Questions - It can be especially beneficial in families with multiple heirs, reducing potential conflicts over property distribution.