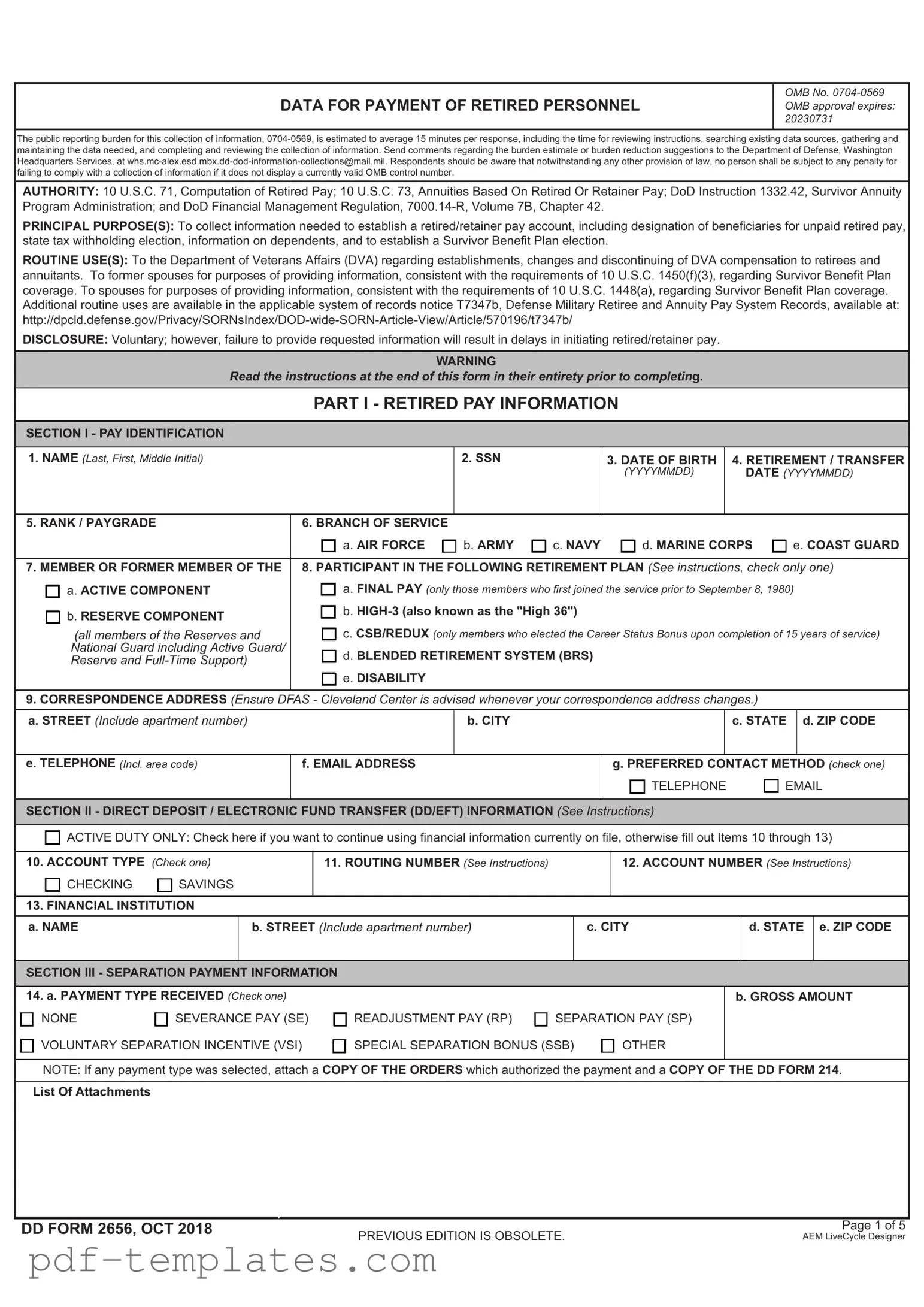

Get DD 2656 Form in PDF

The DD 2656 form plays a crucial role in the lives of military service members and their families, serving as a key document for establishing benefits and entitlements. This form is primarily used to apply for retirement pay and to designate beneficiaries for various benefits, including life insurance and survivor benefits. It is essential for ensuring that service members receive the financial support they have earned throughout their service. The form captures vital information, such as personal details, service history, and the selection of payment options. Completing the DD 2656 accurately is critical, as it can impact the financial security of both the service member and their loved ones. Understanding the nuances of this form can empower service members to make informed decisions about their retirement and benefits, ultimately enhancing their transition to civilian life.

Misconceptions

The DD 2656 form is an important document for service members and their families, yet several misconceptions surround it. Understanding the truth behind these misunderstandings can help ensure that individuals properly complete the form and access the benefits they deserve. Below is a list of ten common misconceptions about the DD 2656 form, along with clarifications for each.

-

Misconception 1: The DD 2656 form is only for retired service members.

This form is not limited to retirees. It is used by active duty, reserve, and retired service members to designate beneficiaries for various benefits.

-

Misconception 2: Completing the DD 2656 form is optional.

While it may seem optional, submitting this form is crucial for ensuring that benefits are distributed according to the service member's wishes.

-

Misconception 3: The DD 2656 form can only be filled out once.

Service members can update the form as their circumstances change, such as marriage, divorce, or the birth of a child.

-

Misconception 4: The form is only for financial benefits.

In addition to financial designations, the DD 2656 form also addresses health care benefits and other entitlements.

-

Misconception 5: The DD 2656 form must be submitted in person.

While submitting in person is an option, the form can also be mailed or submitted electronically, depending on the specific military branch's policies.

-

Misconception 6: There is a time limit for submitting the DD 2656 form after retirement.

There is no strict deadline for submitting the form post-retirement. However, it is advisable to complete it promptly to ensure that beneficiaries are designated without delay.

-

Misconception 7: Only the service member can fill out the DD 2656 form.

While the service member typically completes the form, they can receive assistance from family members or legal representatives if needed.

-

Misconception 8: The DD 2656 form is the same for all branches of the military.

Each branch may have slight variations in the form or its requirements, so it is essential to refer to the appropriate version for the specific branch.

-

Misconception 9: Once the DD 2656 form is submitted, it cannot be changed.

Changes can be made after submission. Service members should keep their information up to date to reflect their current situation.

-

Misconception 10: The DD 2656 form is not legally binding.

While the form serves as a guide for benefit distribution, it is important to understand that it holds legal significance in determining beneficiary rights.

By addressing these misconceptions, service members and their families can navigate the complexities of the DD 2656 form with greater confidence and clarity.

DD 2656: Usage Instruction

Filling out the DD 2656 form is an important step in managing your benefits. After completing the form, you will need to submit it to the appropriate office for processing. Make sure to double-check all the information for accuracy before sending it in.

- Begin by downloading the DD 2656 form from the official website or obtain a hard copy from your local military office.

- Fill in your personal information at the top of the form, including your full name, Social Security number, and contact details.

- Provide your military service details, such as your branch of service, rank, and dates of service.

- Complete the section regarding your marital status. Indicate whether you are married, single, or widowed, and provide the necessary details for your spouse if applicable.

- List your dependent information, including names and birth dates of any children or other dependents.

- Fill out the financial information section, including your bank account details for direct deposit, if applicable.

- Review the form for any errors or missing information. Ensure that all required fields are completed.

- Sign and date the form at the designated area to certify that the information provided is accurate.

- Make a copy of the completed form for your records before submission.

- Submit the form to the appropriate office, either by mail or in person, as instructed on the form.

Common mistakes

-

Incomplete Information: Many individuals fail to provide all required information on the DD 2656 form. This includes missing personal details such as Social Security numbers or dates of birth. Incomplete forms can delay processing and lead to complications.

-

Incorrect Signatures: Some people overlook the importance of signing the form correctly. If the signature does not match the name provided or if it’s missing altogether, the form may be rejected. Always double-check that the signature is present and matches the printed name.

-

Not Updating Information: Life changes such as marriage, divorce, or the birth of a child can affect the information on the DD 2656 form. Failing to update this information can result in incorrect benefits being issued or delays in processing.

-

Ignoring Instructions: Each section of the form comes with specific instructions. Some individuals skip over these directions, leading to errors. It’s crucial to read and follow the instructions carefully to ensure all sections are completed accurately.

File Specifics

| Fact Name | Description |

|---|---|

| Purpose | The DD Form 2656 is used to designate beneficiaries for military retirement benefits. |

| Who Uses It | This form is primarily used by members of the U.S. Armed Forces and their eligible dependents. |

| Submission Timing | It should be submitted upon retirement or when a service member wants to change their beneficiary designations. |

| Key Sections | The form includes sections for personal information, beneficiary details, and election of coverage. |

| Signatures Required | It must be signed by the service member and, if applicable, the spouse or beneficiaries. |

| State-Specific Forms | Some states may have additional forms or requirements based on local laws governing military benefits. |

| Governing Laws | Federal laws, such as the Uniformed Services Former Spouses' Protection Act, govern the distribution of military retirement benefits. |

| Updating Information | Service members can update their beneficiary information at any time by resubmitting the form. |

| Accessibility | The form is available online through the official Department of Defense website for easy access. |

| Importance of Accuracy | Accurate completion of the form is crucial to ensure that benefits are distributed according to the service member's wishes. |

Dos and Don'ts

When filling out the DD 2656 form, which is essential for establishing eligibility for retirement benefits, it’s important to approach the task with care. Here are some key dos and don’ts to consider:

- Do read the instructions thoroughly before starting. Understanding the requirements can save you time and prevent mistakes.

- Do provide accurate personal information. Double-check your name, Social Security number, and other identifying details.

- Do use black or blue ink when filling out the form. This ensures that your entries are clear and legible.

- Do keep a copy of the completed form for your records. This can be useful for future reference or follow-up.

- Don't leave any required fields blank. Missing information can delay processing and may require you to resubmit the form.

- Don't rush through the form. Taking your time can help you avoid careless errors that could complicate your application.

- Don't forget to sign and date the form before submission. An unsigned form is considered incomplete.

Similar forms

The DD Form 214 is a critical document that serves as a certificate of release or discharge from active duty in the military. Similar to the DD 2656, which is used for retirement benefits, the DD 214 outlines the service member’s time in the military, including the type of discharge received. Both forms require accurate personal information and are essential for establishing eligibility for various benefits. When transitioning from military to civilian life, the DD 214 is often required for job applications and accessing veteran services.

The VA Form 21-526EZ is another document that closely resembles the DD 2656 in its purpose of facilitating benefits for veterans. This form is specifically for applying for disability compensation and pension benefits from the Department of Veterans Affairs. Like the DD 2656, it requires detailed personal and service-related information. Both forms help ensure that veterans receive the benefits they are entitled to, although the VA Form 21-526EZ focuses more on disability claims rather than retirement benefits.

The SF 50, or Notification of Personnel Action, is a document used by federal employees that details their employment status. While the DD 2656 pertains to military retirement, the SF 50 serves a similar function for civilian federal employees by documenting their employment history, pay rates, and benefits eligibility. Both forms are essential for verifying a person's service and ensuring they receive appropriate retirement or separation benefits.

The Form SF 1199A, also known as the Direct Deposit Sign-Up Form, is used to authorize direct deposit of federal payments. Similar to the DD 2656, which helps set up retirement payments, the SF 1199A ensures that individuals receive their benefits directly into their bank accounts. Both documents require accurate banking information and personal identification to facilitate timely and secure payments.

The Form W-4 is used by employees to determine the amount of federal income tax withholding from their paychecks. While not directly related to military retirement, it shares a common theme with the DD 2656 in that both forms require personal financial information to ensure proper benefit distribution. Both documents play a vital role in managing financial obligations and ensuring that individuals receive the correct amount of benefits or pay.

The Form 1099-R is used to report distributions from retirement accounts. Like the DD 2656, which establishes eligibility for retirement benefits, the 1099-R provides crucial information about the amounts withdrawn from retirement plans. Both forms are essential for tax reporting and financial planning, ensuring that individuals understand their retirement income and any associated tax liabilities.

The Form 8880, Credit for Qualified Retirement Savings Contributions, is used to claim a tax credit for contributions made to retirement accounts. While the DD 2656 focuses on establishing retirement benefits, the 8880 incentivizes saving for retirement. Both documents highlight the importance of retirement planning, albeit from different perspectives—one from a benefits distribution angle and the other from a savings encouragement angle.

When navigating the complexities of military and veteran documentation, it is essential to consider various forms, including the DD 2656, which streamlines access to benefits for service members. For comprehensive ease in managing all related paperwork, you may refer to All California Forms for guidance on essential documentation and processes necessary for both military and civilian legal matters.

Lastly, the Form 4506-T allows individuals to request a transcript of their tax return. This document is essential for verifying income and tax information, similar to how the DD 2656 verifies military service for retirement benefits. Both forms are critical in ensuring that individuals can access necessary financial information, whether for tax purposes or to confirm eligibility for benefits.

Other PDF Forms

Aia Statement of Qualifications - Using the A305 form promotes transparency between parties.

Puppy Health Guarantee Template - Buyer initials confirm agreement to the terms outlined on page one.

To secure your business's future in a commercial space, it’s vital to understand the intricacies of a professional Commercial Lease Agreement template that outlines the essential terms. For more information on how to properly manage your property leasing, refer to this resource: thorough Commercial Lease Agreement guide.

Bf Application Google Form - Enjoys sharing playful banter and much laughter.