Get Citibank Direct Deposit Form in PDF

When it comes to managing finances, convenience is key. The Citibank Direct Deposit form is an essential tool for anyone looking to streamline their banking experience. This form allows individuals to authorize their employer or other income sources to deposit funds directly into their Citibank account. By using this form, you can ensure that your paychecks, government benefits, or other payments arrive promptly and securely without the need for physical checks. The form typically requires basic information such as your bank account number, routing number, and personal identification details. It's designed to be straightforward, making it easy for anyone to fill out. Additionally, the form often includes sections for both the employee and employer to confirm their agreement, ensuring that all parties are on the same page. With direct deposit, you gain peace of mind knowing that your money is safely deposited, allowing you to focus on your daily activities without the hassle of trips to the bank.

Misconceptions

Understanding the Citibank Direct Deposit form is essential for ensuring a smooth deposit process. However, several misconceptions can lead to confusion. Here are seven common misunderstandings:

-

Direct deposit is only for payroll.

Many people believe that direct deposit is exclusively for salary payments. In reality, it can also be used for government benefits, tax refunds, and other types of payments.

-

Once set up, direct deposit cannot be changed.

Some think that once they’ve established direct deposit, they cannot modify it. In fact, you can update your account information or switch to a different bank at any time.

-

The form is complicated and hard to fill out.

While the form may seem daunting, it is typically straightforward. Most sections require basic information, and clear instructions are usually provided.

-

Direct deposit is not secure.

Some individuals worry about the security of direct deposits. However, direct deposits are generally considered safer than paper checks, which can be lost or stolen.

-

All employers offer direct deposit.

It's a common misconception that every employer provides direct deposit options. Some smaller companies or specific industries may still rely on traditional payment methods.

-

Direct deposit means you get paid faster.

While direct deposit can streamline the payment process, it doesn’t necessarily mean you will receive your funds sooner. Payment timing still depends on your employer’s payroll schedule.

-

Once I submit the form, I won’t receive confirmation.

Many believe that submitting the form is a one-way process. In reality, most banks and employers will provide confirmation once the direct deposit setup is complete.

By addressing these misconceptions, individuals can better navigate the direct deposit process and enjoy its benefits.

Citibank Direct Deposit: Usage Instruction

Completing the Citibank Direct Deposit form is an important step to ensure your payments are deposited directly into your bank account. Once filled out, the form should be submitted to your employer or the relevant organization managing your payments. This process can help streamline your finances and ensure timely deposits.

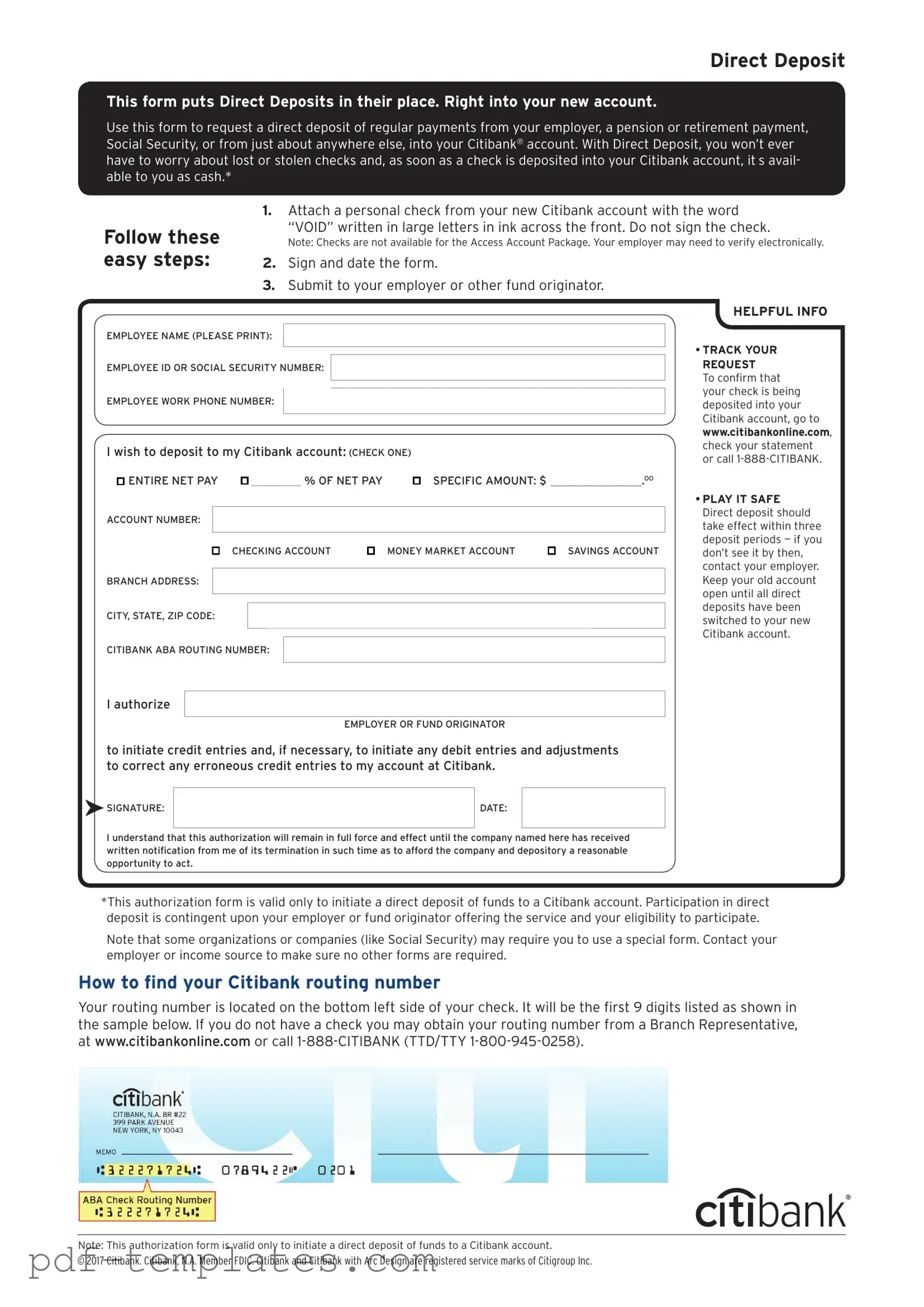

- Obtain the Citibank Direct Deposit form from your employer or download it from the Citibank website.

- Fill in your personal information, including your full name, address, and phone number.

- Provide your Citibank account number. This number is usually found on your bank statement or through your online banking account.

- Enter the routing number for Citibank. You can find this number on the bottom of your checks or by searching online.

- Indicate the type of account you are using for direct deposit (checking or savings).

- Sign and date the form to authorize the direct deposit.

- Submit the completed form to your employer or the organization responsible for processing your payments.

Common mistakes

-

Incorrect Account Number: One of the most common mistakes is entering the wrong account number. This can lead to delays or even misdirected deposits. Always double-check the number on your bank statement or online banking account.

-

Wrong Routing Number: Each bank has a unique routing number. Using an incorrect routing number can result in your funds being sent to the wrong institution. Make sure to verify this number with your bank.

-

Failure to Sign the Form: A signature is often required to authorize direct deposits. Neglecting to sign the form can cause processing delays. Ensure that you have signed and dated the form before submission.

-

Using a Closed Account: If you are trying to set up direct deposit to an account that has been closed, the funds will not be deposited. Confirm that your account is active and in good standing.

-

Not Updating Information: If you change banks or open a new account, it is crucial to update your direct deposit information. Failing to do so can result in missed payments. Regularly review your banking details to ensure accuracy.

File Specifics

| Fact Name | Details |

|---|---|

| Purpose | The Citibank Direct Deposit form is used to authorize automatic deposits into a bank account. |

| Eligibility | Individuals with a Citibank account can use this form to set up direct deposit. |

| Information Required | Account holder's name, account number, routing number, and employer information are needed. |

| Submission Process | The completed form must be submitted to the employer or the payor to initiate direct deposits. |

| Processing Time | It may take one to two pay cycles for direct deposits to begin after submission. |

| State-Specific Forms | Some states may have specific requirements for direct deposit forms governed by local laws. |

| Revocation | Account holders can revoke authorization at any time by notifying their employer in writing. |

| Security | Direct deposit is generally considered secure, reducing the risk of lost or stolen checks. |

| Customer Support | Citi offers customer support for issues related to direct deposit setup and inquiries. |

Dos and Don'ts

When filling out the Citibank Direct Deposit form, it is important to follow specific guidelines to ensure the process goes smoothly. Below are six recommendations on what to do and what to avoid.

- Do: Verify your personal information for accuracy.

- Do: Provide your bank account number and routing number clearly.

- Do: Sign and date the form before submission.

- Do: Keep a copy of the completed form for your records.

- Don't: Use a pencil; always fill out the form in ink.

- Don't: Forget to check for any required fields that must be completed.

Following these steps can help prevent delays in processing your direct deposit. Ensuring that all information is correct will facilitate a smooth transaction.

Similar forms

The Citibank Direct Deposit form shares similarities with the Payroll Authorization form. Both documents serve the purpose of facilitating the electronic transfer of funds from an employer to an employee's bank account. They require the employee's banking information, such as account number and routing number, ensuring that payments are directed accurately. Additionally, both forms often necessitate the employee's signature, indicating consent for the arrangement and confirming that the provided information is correct.

Another document that resembles the Citibank Direct Deposit form is the Automatic Payment Authorization form. This form allows individuals to authorize recurring payments, such as utility bills or subscriptions, directly from their bank accounts. Like the direct deposit form, it requires detailed banking information and the account holder's signature. Both documents aim to streamline financial transactions, reducing the need for physical checks and enhancing convenience for the account holder.

The Tax Refund Direct Deposit form is also similar in function and purpose. Individuals use this form to request that their tax refunds be deposited directly into their bank accounts, much like how employees receive their salaries. The form collects essential banking details and requires the taxpayer's signature, ensuring that the government can efficiently process the refund. This document highlights the growing trend of electronic payments in both employment and tax-related transactions.

Additionally, the Vendor Payment Authorization form shares key characteristics with the Citibank Direct Deposit form. Businesses often use this document to enable direct payments to vendors for goods and services rendered. Both forms require the vendor's banking information and a signature, ensuring that payments are made directly and securely. This process not only expedites transactions but also minimizes the risk of lost or delayed checks.

The Student Loan Direct Deposit form is another document that mirrors the Citibank Direct Deposit form. Students utilize this form to have their loan disbursements deposited directly into their bank accounts. Similar to the other forms, it collects banking details and requires a signature for authorization. This method simplifies the disbursement process, ensuring that students receive their funds quickly and efficiently, thus supporting their educational expenses.

The California Earthquake Authority form is crucial for California residents seeking protection from seismic risks, ensuring they have comprehensive coverage. This form requires detailed information from applicants, including personal and property details, and helps streamline the insurance application process. For those looking for additional important documentation related to this and other processes, they can find resources at All California Forms.

Finally, the Social Security Direct Deposit form aligns closely with the Citibank Direct Deposit form. Individuals use this document to authorize the Social Security Administration to deposit benefits directly into their bank accounts. Both forms require the recipient's banking information and a signature, ensuring that funds are transferred safely and without delay. This practice reflects a broader shift towards electronic payments in government services, enhancing accessibility for beneficiaries.

Other PDF Forms

Acord 130 - Producers need to be identified along with their contact information.

When transferring ownership of a trailer in Texas, it's crucial to utilize the correct documentation. For guidance on the process, refer to the informative article about the Texas Trailer Bill of Sale requirements. This ensures that both buyers and sellers are protected during the transaction.

Bbb File a Complaint - The promised timeline for service completion was not met by the company.