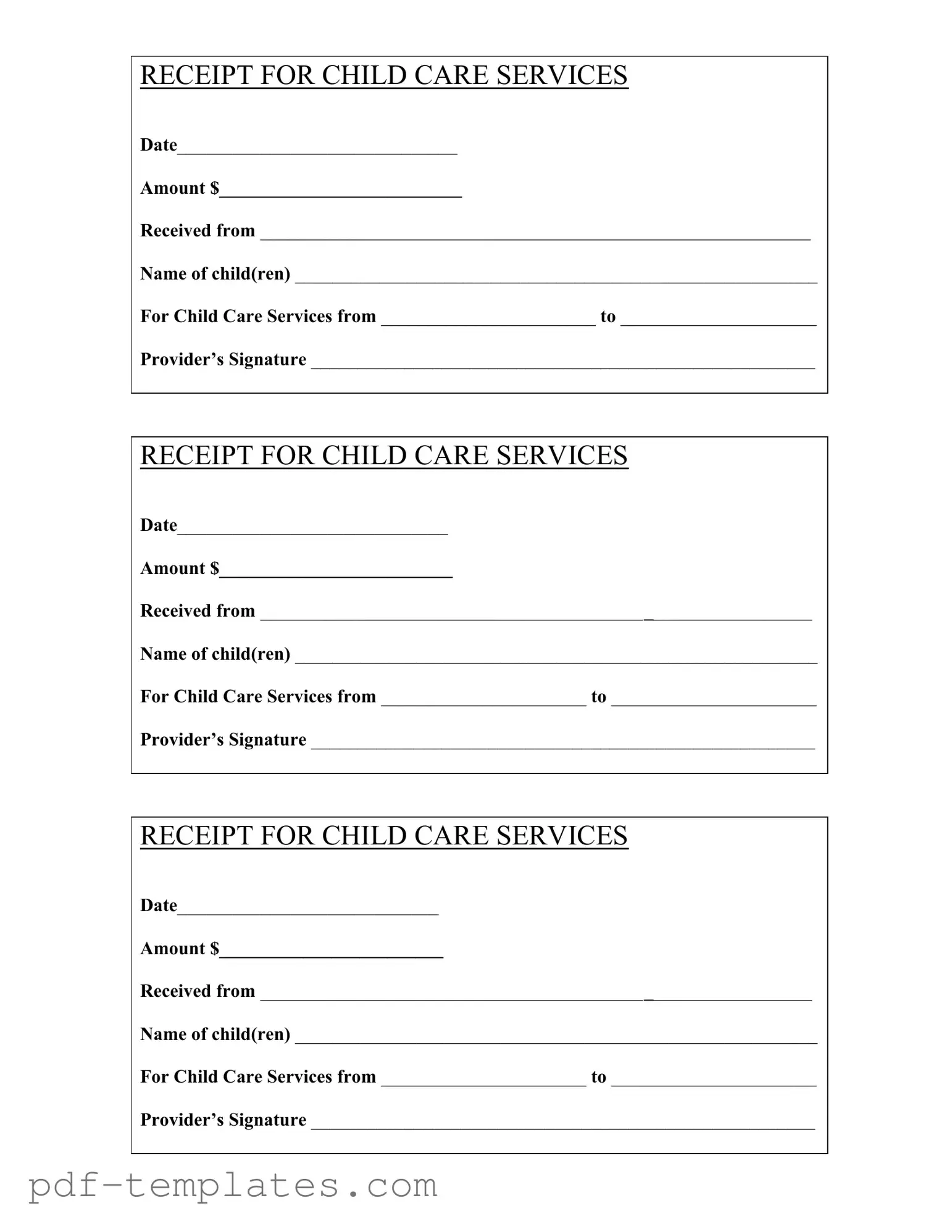

Get Childcare Receipt Form in PDF

The Childcare Receipt form serves as an important document for parents and childcare providers alike. It captures essential details regarding the services rendered, including the date of service, the total amount paid, and the names of the children receiving care. Each receipt includes a space for the provider's signature, which adds an element of verification to the transaction. Additionally, the form specifies the period during which childcare services were provided, ensuring clarity for both parties. By documenting these key aspects, the Childcare Receipt form helps maintain accurate records for financial and tax purposes, while also fostering transparency in the childcare arrangement.

Misconceptions

Here are nine common misconceptions about the Childcare Receipt form:

- Only licensed providers can issue receipts. Many believe that only licensed childcare providers can provide receipts. However, any individual or organization offering childcare services can issue a receipt, regardless of licensing status.

- The receipt must be printed. Some assume that receipts must be printed documents. In reality, electronic receipts are acceptable as long as they contain all required information.

- Receipts are only needed for tax purposes. While receipts are useful for tax deductions, they also serve as proof of payment and can help resolve disputes regarding services rendered.

- All information on the receipt is optional. It is a misconception that all fields on the receipt are optional. Essential details, such as the date, amount, and names, must be filled out to ensure the receipt is valid.

- Only one receipt is needed for multiple children. Some believe a single receipt can cover multiple children. In fact, separate receipts should be issued for each child to maintain clear records.

- Providers do not need to keep copies of receipts. It is often thought that providers can discard receipts after issuing them. In truth, providers should keep copies for their records and potential audits.

- Receipts can be altered after issuance. Many think it is acceptable to change details on a receipt after it has been issued. This practice is discouraged, as it can lead to disputes and issues with accountability.

- Receipts are only for full payment. Some individuals believe receipts are only necessary for full payments. However, receipts should also be provided for partial payments to maintain accurate records.

- The Childcare Receipt form is the same for all states. There is a common misconception that the form is standardized across all states. In reality, requirements can vary, so it is important to check local regulations.

Childcare Receipt: Usage Instruction

After gathering the necessary information, you are ready to fill out the Childcare Receipt form. This form will need to be completed accurately to ensure proper documentation of childcare services provided. Follow these steps carefully to fill out the form correctly.

- Date: Write the current date in the space provided.

- Amount: Enter the total amount received for childcare services.

- Received from: Fill in the name of the individual or entity that made the payment.

- Name of child(ren): List the names of the children receiving care.

- For Child Care Services from: Indicate the start date of the childcare services.

- to: Enter the end date of the childcare services.

- Provider’s Signature: Sign the form to confirm the receipt of payment.

Common mistakes

-

Missing Dates: Failing to fill in the dates for child care services can lead to confusion. Make sure to include both the start and end dates clearly.

-

Incorrect Amount: Double-check the amount received. Errors in this section can cause discrepancies when claiming expenses or for tax purposes.

-

Incomplete Provider Information: Ensure the provider’s name and signature are included. An incomplete receipt may not be accepted by tax authorities.

-

Neglecting Child's Name: Always list the names of the child or children receiving care. Omitting this information can render the receipt invalid.

-

Using Incorrect Format: Follow the specified format for writing amounts and dates. Inconsistencies can lead to misunderstandings.

-

Multiple Receipts for One Payment: Avoid issuing multiple receipts for a single payment. This can complicate record-keeping and audits.

-

Not Keeping Copies: Failing to keep a copy of the receipt for your records can be a mistake. Always retain a copy for your personal documentation.

-

Ignoring Local Regulations: Different states may have specific requirements for child care receipts. Familiarize yourself with local laws to ensure compliance.

File Specifics

| Fact Name | Description |

|---|---|

| Date of Service | The form requires the date when the childcare services were provided. This helps in tracking the specific period of care. |

| Amount Paid | The form includes a section to specify the amount paid for childcare services. This is crucial for both the provider and the parent for financial records. |

| Recipient Information | It asks for the name of the person who received the services. This ensures that the payment is linked to the correct individual. |

| Child's Name | The form requires the names of the child or children receiving care. This helps to identify the specific services rendered. |

| Provider's Signature | A signature from the childcare provider is necessary. This serves as proof that the services were rendered and payment was received. |

Dos and Don'ts

When filling out the Childcare Receipt form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are five things you should and shouldn't do:

- Do fill in all required fields completely. Each section is important for record-keeping.

- Do double-check the dates for the childcare services. Correct dates help avoid confusion.

- Do provide the total amount received clearly. This ensures transparency in financial transactions.

- Do include the names of all children receiving care. This helps in identifying the services rendered.

- Do sign the form at the bottom. Your signature validates the receipt.

- Don't leave any fields blank unless specified. Incomplete forms may cause issues later.

- Don't use abbreviations or shorthand. Clarity is key in official documents.

- Don't forget to use the correct format for dates and amounts. Consistency is crucial.

- Don't alter the form after it has been filled out. Changes can lead to disputes.

- Don't forget to keep a copy of the receipt for your records. Documentation is important for future reference.

Similar forms

The first document similar to the Childcare Receipt form is the Medical Receipt. This document serves as proof of payment for medical services rendered. Like the childcare receipt, it includes the date of service, the amount paid, and the name of the patient. It may also feature the provider's signature, confirming that the service was provided. Both documents are essential for individuals seeking reimbursement from insurance companies or for tax purposes.

Another comparable document is the Rent Receipt. This receipt is issued by landlords to tenants, confirming that rent has been paid for a specific period. It typically includes the date of payment, the amount received, and the tenant's name. Similar to the childcare receipt, it serves as proof of payment and can be used for record-keeping or tax deductions related to housing expenses.

The Tuition Receipt is also akin to the Childcare Receipt. Educational institutions provide this document to students or parents to confirm payment of tuition fees. It includes the date, amount paid, and the name of the student. Both receipts are crucial for individuals claiming education-related tax credits or deductions, as they provide necessary documentation of expenses incurred.

In addition, the Donation Receipt is another document that shares similarities. Charitable organizations issue this receipt to donors, acknowledging their contributions. It contains the date of the donation, the amount given, and the donor's name. Like the childcare receipt, it serves as proof for tax purposes, allowing donors to claim deductions for their charitable contributions.

In the realm of documentation related to financial transactions, it's essential to have reliable forms. One such critical document is the California Rental Application form, which serves to screen potential tenants before leasing property. This form gathers important details like employment and rental history, ensuring a thorough evaluation of applicants. For those looking for comprehensive resources, All California Forms provide a variety of legally compliant templates to facilitate the rental process.

The Invoice is another document that resembles the Childcare Receipt. Businesses issue invoices to clients for services rendered or products sold. An invoice lists the date, amount due, and details about the transaction. While an invoice may request payment, a childcare receipt confirms that payment has already been made, serving as a record for both parties involved.

The Payment Confirmation Email is also similar in function. This document is typically sent electronically and confirms that a payment has been processed. It includes the date, amount, and recipient's name. Like the childcare receipt, it serves as proof of a completed transaction and can be used for personal record-keeping or financial management.

Lastly, the Service Agreement can be considered similar. This document outlines the terms of service between a provider and a client, including payment details. While it may not serve as a receipt itself, it often includes a section for payment confirmation. Both documents are important for establishing a clear understanding of the services provided and the financial obligations involved.

Other PDF Forms

Guardianship Paperwork - The form can set the stage for longer-term custody discussions if needed.

Test Drive Form - Completing the odometer reading is part of the vehicle checkout process.

For those seeking an understanding of the legal transaction process, the necessary Mobile Home Bill of Sale documentation is indispensable. This form not only protects the interests of both parties involved, but also consolidates important transaction information, making it a valuable resource in Texas mobile home sales.

Puppy Health Record - Engage in informed discussions with breeders about your puppy's background.