Get Cg 20 10 07 04 Liability Endorsement Form in PDF

The CG 20 10 07 04 Liability Endorsement form plays a crucial role in commercial general liability insurance by extending coverage to additional insured parties, such as owners, lessees, or contractors. This endorsement modifies the existing policy, ensuring that specified individuals or organizations are protected against certain liabilities arising from bodily injury, property damage, or personal and advertising injury. Coverage applies only when these incidents result from the actions or omissions of the insured or their representatives while performing ongoing operations for the additional insured at designated locations. However, it is important to note that the coverage is limited by legal provisions and any contractual obligations that may dictate the extent of the insurance. Furthermore, specific exclusions are outlined, particularly concerning injuries or damages that occur after the completion of work or when the work has been put to its intended use. The endorsement also stipulates that the limits of insurance for the additional insured will not exceed what is required by contract or the policy's available limits, ensuring clarity and consistency in coverage. Understanding these key aspects is essential for both policyholders and additional insureds to navigate their responsibilities and protections effectively.

Misconceptions

Misconceptions about the CG 20 10 07 04 Liability Endorsement can lead to confusion regarding coverage and responsibilities. Here are five common misunderstandings:

- All parties involved are automatically covered. Many believe that simply being listed as an additional insured guarantees coverage. However, coverage only applies to specific liabilities arising from the acts or omissions of the primary insured during ongoing operations for the additional insured.

- The endorsement provides unlimited coverage. Some assume that the endorsement increases the insurance limits. In reality, the coverage for additional insureds is limited to the lesser of the amount required by a contract or the available policy limits.

- Coverage applies after all work is completed. There is a misconception that coverage is available even after the project is finished. The endorsement specifies that coverage does not apply to bodily injury or property damage occurring after all work related to the project has been completed.

- Additional insureds are covered for any incident. It is often thought that additional insureds are protected from all types of claims. However, the endorsement only covers liabilities related to bodily injury, property damage, or personal and advertising injury directly linked to the primary insured’s actions.

- All contractual obligations are covered. Some individuals believe that any requirement in a contract for additional insured status will automatically be met. The endorsement clarifies that coverage will not exceed what is stipulated in the contract, ensuring that it aligns with the agreed terms.

Cg 20 10 07 04 Liability Endorsement: Usage Instruction

Filling out the CG 20 10 07 04 Liability Endorsement form requires careful attention to detail. This form is essential for adding additional insured parties to a commercial general liability policy. Completing it accurately ensures that all necessary parties are covered under the terms of the policy.

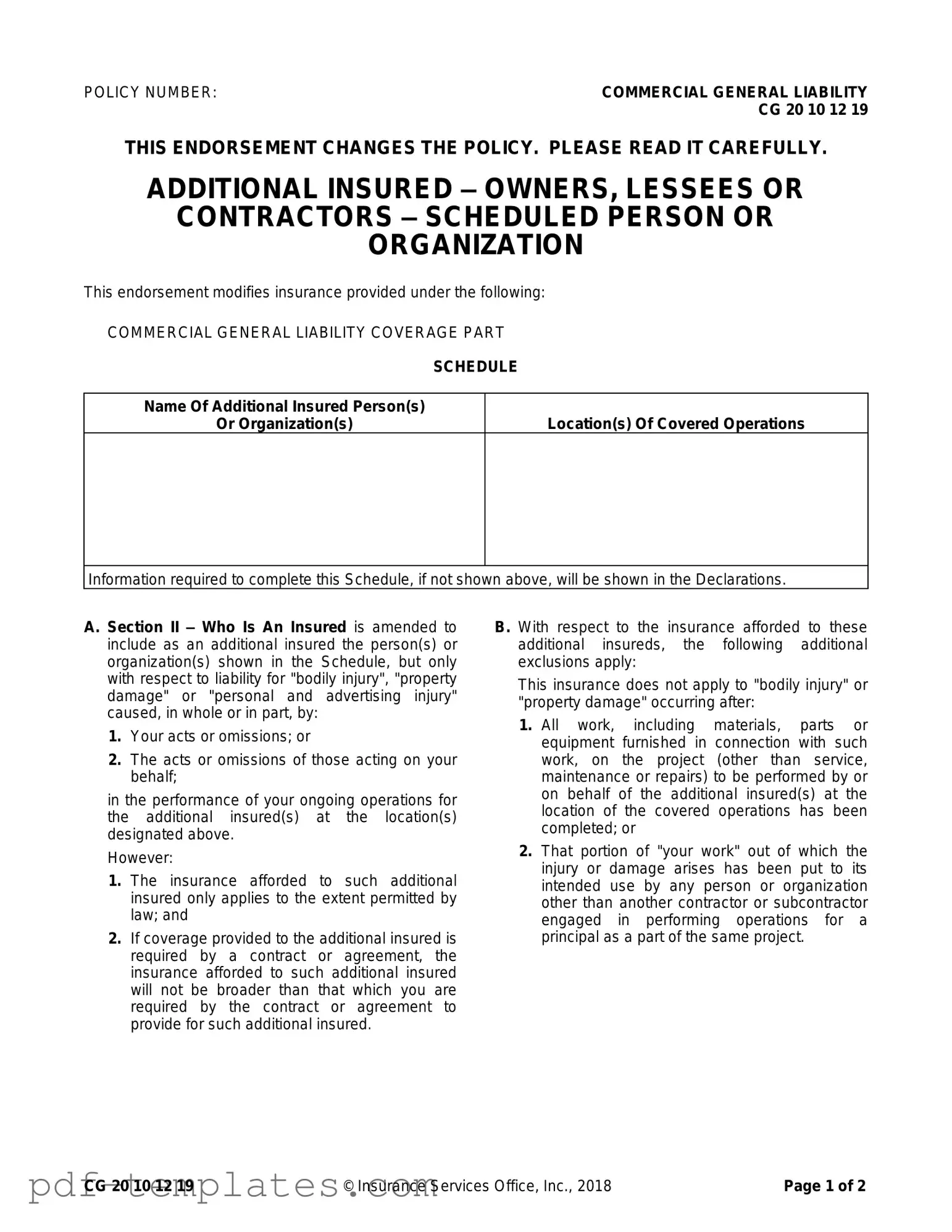

- Locate the Policy Number: At the top of the form, find the section labeled "POLICY NUMBER." Enter your specific policy number here.

- Identify Additional Insureds: In the section titled "Name Of Additional Insured Person(s) Or Organization(s)," list the names of the individuals or organizations you wish to add as additional insureds.

- Specify Locations: In the "Location(s) Of Covered Operations" section, provide the addresses or descriptions of the locations where the covered operations will take place.

- Review the Declarations: If any information required to complete the schedule is not included in the form, check the Declarations page of your policy for additional details.

- Check for Required Contracts: If coverage for the additional insured is mandated by a contract, ensure that the coverage provided does not exceed what the contract specifies.

- Understand Exclusions: Familiarize yourself with the exclusions that apply to the additional insureds, particularly regarding when coverage ceases.

- Final Review: Before submitting the form, double-check all entries for accuracy and completeness to avoid any issues with coverage.

Common mistakes

-

Incomplete Information: One common mistake is failing to provide all necessary details in the "Name Of Additional Insured Person(s) Or Organization(s)" section. Omitting this information can lead to coverage gaps.

-

Incorrect Location Entries: Listing the wrong location in the "Location(s) Of Covered Operations" can result in denied claims. It is crucial to ensure that the specified locations match the operations being covered.

-

Misunderstanding Coverage Scope: Many individuals misunderstand the extent of coverage provided to additional insureds. The coverage only applies to liability arising from specific acts or omissions, which must be clearly understood.

-

Ignoring Exclusions: Failing to read and comprehend the exclusions outlined in the endorsement can lead to unexpected surprises. Notably, the endorsement does not cover injuries occurring after the completion of work, which is a critical detail.

-

Contractual Obligations Misalignment: People often neglect to align the coverage with contractual requirements. If the endorsement's coverage is broader than what the contract stipulates, it may lead to complications during claims.

-

Limitations on Coverage: Many overlook the limits of insurance provided to additional insureds. The maximum payout is determined by either the contract requirement or the policy limits, whichever is lower, which is essential to keep in mind.

File Specifics

| Fact Name | Description |

|---|---|

| Purpose | This endorsement adds additional insured status for owners, lessees, or contractors, covering liability for bodily injury, property damage, or personal and advertising injury. |

| Coverage Conditions | Coverage applies only if the injury or damage is caused by the acts or omissions of the named insured or those acting on their behalf during ongoing operations. |

| Exclusions | Insurance does not cover bodily injury or property damage occurring after all work on the project is completed or after the work has been put to its intended use. |

| Limitations | The maximum payment for additional insureds is limited to the lesser of the amount required by contract or the available limits of insurance. |

Dos and Don'ts

When filling out the CG 20 10 07 04 Liability Endorsement form, it's important to follow certain guidelines to ensure accuracy and compliance. Here are four key do's and don'ts:

- Do double-check the policy number to ensure it matches your existing coverage.

- Do clearly list the names of all additional insured persons or organizations in the designated space.

- Don't leave any required fields blank, as this may delay processing or lead to coverage issues.

- Don't assume that the coverage provided is automatically broader than what is required by your contract; review your agreements carefully.

Similar forms

The CG 20 10 07 04 Liability Endorsement form is similar to the Additional Insured Endorsement (CG 20 10). This form allows a policyholder to add another party as an additional insured under their general liability policy. Like the CG 20 10 07 04, it provides coverage for bodily injury, property damage, and personal and advertising injury caused by the policyholder's actions or those acting on their behalf. The primary difference lies in the specific limitations and exclusions that may apply, which can vary based on the circumstances of the coverage.

The CG 20 37 form, known as the Additional Insured - Owners, Lessees, or Contractors form, is also comparable. It provides similar coverage to that of the CG 20 10 07 04 but is specifically tailored for contractors and property owners. This form ensures that both parties are protected in case of claims arising from the contractor's work. The key similarity is the provision of additional insured status, while the differences may include specific language related to the types of operations covered.

Understanding various insurance endorsements, including the CG 20 10 07 04, is crucial for businesses operating in California, especially when dealing with liability coverage. To ensure compliance and proper documentation, it's important to familiarize yourself with necessary forms, such as the All California Forms, which provide essential resources for effective business practices in the state.

The CG 20 11 form, which is the Additional Insured - Managers or Lessors of Premises, shares similarities with the CG 20 10 07 04 in that it extends coverage to managers or lessors of premises. This endorsement protects those who manage or lease property from liability claims related to the insured's operations. Both forms address the need for additional insured status, but the CG 20 11 focuses more on premises-related risks.

The CG 20 33 form, titled Additional Insured - Construction Project, is another relevant document. It provides coverage for additional insureds specifically involved in construction projects. Like the CG 20 10 07 04, it addresses liability for bodily injury and property damage. However, it is tailored to the unique risks associated with construction activities, making it distinct in its application while maintaining similar coverage principles.

The CG 20 18 form, known as the Additional Insured - Blanket form, offers a broader scope of coverage. It allows for multiple additional insureds to be covered under a single endorsement. This is similar to the CG 20 10 07 04 in that it provides liability coverage for third parties. However, the blanket nature of this endorsement makes it particularly useful for businesses that frequently engage with various clients or projects.

The CG 24 04 form, titled Additional Insured - Vendors, is also comparable. It extends coverage to vendors who sell products or services related to the insured's operations. Like the CG 20 10 07 04, it protects against liability claims. The main difference lies in the specific relationship and types of claims covered, with the CG 24 04 focusing on vendor-related activities.

The CG 20 09 form, known as the Additional Insured - Joint Venture, is another similar document. It provides coverage for additional insureds who are part of a joint venture with the policyholder. This endorsement ensures that all parties involved in the joint venture are protected against liability claims, similar to the coverage provided in the CG 20 10 07 04. However, it specifically addresses the nuances of joint venture relationships.

The CG 20 36 form, titled Additional Insured - State or Political Subdivision, is also relevant. This endorsement extends coverage to state or political subdivisions when they are involved in a contract with the insured. Like the CG 20 10 07 04, it provides liability protection, but it is tailored to the unique requirements of governmental entities, making it distinct in its application.

The CG 20 14 form, known as the Additional Insured - Real Estate Management, offers similar coverage for real estate management companies. It provides protection against liability claims that may arise from the insured's operations. While both forms serve to add additional insureds, the CG 20 14 is specifically designed for real estate management scenarios, making it different in focus.

Finally, the CG 20 08 form, titled Additional Insured - Contractors, is comparable as well. This endorsement specifically covers contractors who work on behalf of the insured. Like the CG 20 10 07 04, it provides coverage for liability claims related to bodily injury and property damage. The distinction lies in its focus on contractor relationships and the specific terms that may apply to those situations.

Other PDF Forms

Home Daycare Child Care Receipt Template - The receipts can be helpful for budgeting and financial planning.

If you are in the market for equine transactions, understanding the significance of a well-prepared Horse Bill of Sale document is vital. This thorough Horse Bill of Sale form guide provides crucial insights and ensures a smooth transfer between parties.

How Many Pages Does a Passport Have - Submit your form at a passport acceptance facility or agency.

Texas Hub Certification - Helps in understanding the full picture of membership at any moment.