Get CBP 6059B Form in PDF

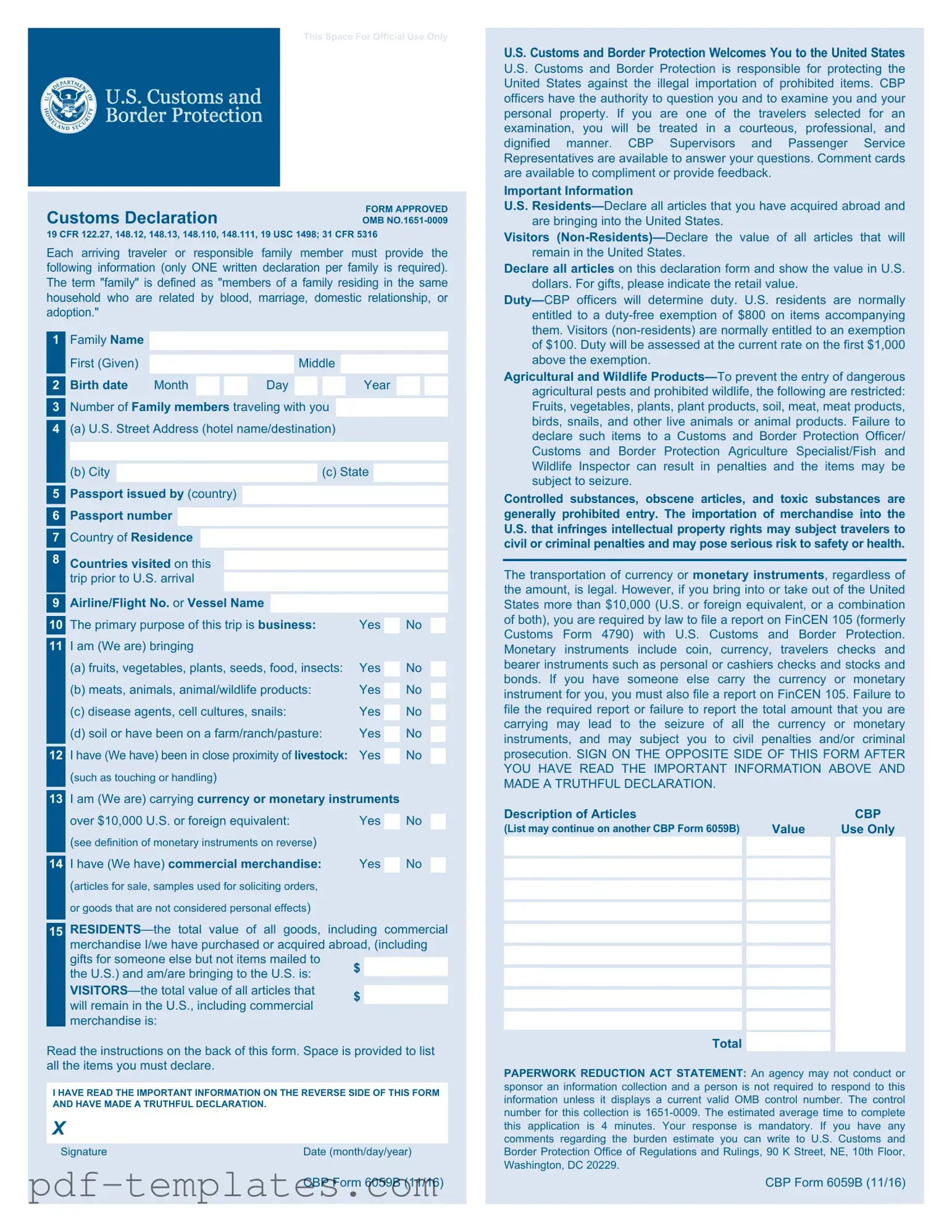

The CBP 6059B form plays a crucial role for travelers entering the United States. This form is designed to collect essential information about individuals arriving from abroad. It helps U.S. Customs and Border Protection (CBP) assess the eligibility of travelers for entry and ensures compliance with various regulations. Travelers are required to disclose information regarding their citizenship, the purpose of their visit, and any items they are bringing into the country. Additionally, the form includes questions about potential agricultural products and currency amounts, which helps prevent the introduction of harmful pests and diseases. Understanding how to accurately complete the CBP 6059B form is vital for a smooth entry process and can prevent unnecessary delays at the border.

Misconceptions

The CBP 6059B form, also known as the Customs Declaration form, is often misunderstood. Here are ten common misconceptions about this form:

- It is only for U.S. citizens. Many believe that only U.S. citizens need to fill out the CBP 6059B form. In reality, all travelers entering the United States, regardless of their nationality, must complete this form.

- It is not necessary for children. Some people think that children do not need to fill out the form. However, every individual, including minors, must have a completed CBP 6059B form.

- It can be completed after arriving in the U.S. Many assume that they can fill out the form upon arrival. In fact, it is advisable to complete the form before reaching U.S. customs to expedite the process.

- Only items over a certain value need to be declared. Some travelers believe they only need to declare items above a specific dollar amount. However, all goods and items must be declared, regardless of their value.

- There is a limit on how many forms can be filled out. Some think there is a cap on the number of forms one can submit. In truth, each traveler must submit their own form, and there is no limit on the number of forms for a group traveling together.

- It is a complicated form. While the CBP 6059B form may seem daunting, it is relatively straightforward. It asks for basic information and a list of items being brought into the country.

- It is only for items purchased abroad. Many people believe the form only applies to items bought outside the U.S. However, it also requires disclosure of gifts, souvenirs, and items received while traveling.

- Customs officials do not check the forms. Some travelers think that customs officials overlook the forms. In reality, customs agents review the forms carefully and may ask questions based on the information provided.

- Once submitted, the form cannot be changed. Some believe that any errors on the form are permanent. However, travelers can correct mistakes by informing customs officials upon arrival.

- It is only necessary for air travel. Many think the form is required only for those arriving by plane. In fact, it is necessary for all modes of entry, including land and sea travel.

Understanding these misconceptions can help travelers navigate the customs process more smoothly. Filling out the CBP 6059B form accurately is essential for a hassle-free entry into the United States.

CBP 6059B: Usage Instruction

Completing the CBP 6059B form is a straightforward process that requires careful attention to detail. This form is essential for travelers entering the United States, and accuracy is crucial to ensure a smooth entry experience. Follow the steps below to fill out the form correctly.

- Begin by obtaining a blank CBP 6059B form. This form can be found online or may be provided by your airline or at the port of entry.

- At the top of the form, fill in your full name as it appears on your passport or travel document.

- Next, provide your date of birth in the specified format (MM/DD/YYYY).

- Indicate your gender by checking the appropriate box.

- In the section for citizenship, write your country of citizenship.

- Provide your passport number in the designated space.

- Fill in the expiration date of your passport, also in the format (MM/DD/YYYY).

- Complete the address in the United States where you will be staying, including the city and state.

- List the name and address of the person or organization you will be visiting, if applicable.

- In the next section, declare any items you are bringing into the U.S. that may be subject to restrictions or duties.

- Finally, sign and date the form at the bottom to certify that all information provided is accurate.

After completing the form, keep it handy for presentation to U.S. Customs and Border Protection upon arrival. Ensure you have all necessary documents ready for a seamless entry process.

Common mistakes

When filling out the CBP 6059B form, individuals may encounter several common mistakes. Awareness of these errors can help ensure a smoother process. Below is a list of ten mistakes that people often make:

- Inaccurate Personal Information

- Providing incorrect names, dates of birth, or passport numbers can lead to complications.

- Failure to Sign the Form

- Not signing the form can result in rejection or delays in processing.

- Missing Required Fields

- Omitting essential information, such as flight details or purpose of travel, can hinder the application.

- Using Incomplete or Incorrect Addresses

- Providing an incomplete or wrong address can create issues with communication and processing.

- Not Double-Checking for Typos

- Simple typographical errors can lead to misunderstandings or delays.

- Neglecting to Review Instructions

- Failing to read the instructions carefully can result in misunderstandings of the requirements.

- Incorrectly Declaring Items

- Not accurately declaring items being brought into the country can lead to fines or confiscation.

- Ignoring Currency Limits

- Exceeding the currency limit without proper declaration can cause complications at customs.

- Providing Outdated Information

- Using old or expired information can invalidate the form.

- Not Keeping a Copy

- Failing to keep a copy of the completed form can make it difficult to address any issues that arise later.

By avoiding these common mistakes, individuals can help ensure that their experience with the CBP 6059B form is as smooth as possible. Attention to detail is key.

File Specifics

| Fact Name | Description |

|---|---|

| Purpose | The CBP 6059B form is used by travelers entering the United States to declare items they are bringing into the country. |

| Who Must File | All travelers, including U.S. citizens and foreign visitors, must complete this form when arriving in the U.S. from abroad. |

| Submission Method | The form can be submitted electronically or in paper format upon arrival at a U.S. port of entry. |

| Legal Requirement | Filing the CBP 6059B is mandated by U.S. Customs and Border Protection regulations to ensure compliance with customs laws. |

Dos and Don'ts

When filling out the CBP 6059B form, it’s important to be mindful of certain practices to ensure a smooth experience. Here’s a list of things you should and shouldn’t do:

- Do read the instructions carefully before starting.

- Do provide accurate information about yourself and your travel plans.

- Do use clear and legible handwriting if filling out the form by hand.

- Do double-check your entries for any mistakes.

- Do ask for help if you’re unsure about any part of the form.

- Don’t leave any required fields blank.

- Don’t provide false information or omit important details.

- Don’t rush through the form; take your time to ensure accuracy.

- Don’t forget to sign and date the form where required.

- Don’t ignore any additional documentation that may be needed.

By following these guidelines, you can help ensure that your experience with the CBP 6059B form is as smooth as possible.

Similar forms

The CBP 6059B form, also known as the Customs Declaration form, shares similarities with the CBP 7507 form, which is the In-Bond Application. Both documents are essential for travelers entering the United States. The CBP 7507 is specifically used for goods that are imported under bond, while the 6059B focuses on declaring personal items and currency. Each form requires detailed information about the items being brought into the country, ensuring compliance with U.S. customs regulations. Both documents serve to facilitate the customs process and ensure that travelers are aware of their obligations when entering the U.S.

When dealing with property transfers, understanding the legal documents involved is essential, much like how travelers must complete necessary forms for customs. For instance, a California Quitclaim Deed form facilitates the swift transfer of real estate interests without warranty, often among family. It serves a specific purpose, similar to how travelers must declare items using the CBP 6059B form for compliance. For those seeking more information on Quitclaim Deed procedures, the resource available at formcalifornia.com can provide valuable guidance.

Another document akin to the CBP 6059B is the CBP Form 214, which is used for the Temporary Importation under Bond (TIB). This form is designed for goods that are temporarily brought into the U.S. for a specific purpose, such as repair or exhibition. Like the 6059B, the CBP Form 214 requires detailed descriptions of the items and their intended use. This ensures that customs officials can track the temporary entry of goods and verify that they will be exported again. Both forms aim to streamline the customs process while maintaining regulatory compliance.

The CBP Form 7501, known as the Entry Summary, also bears resemblance to the CBP 6059B. This form is utilized for formal entry of goods into the U.S. and requires comprehensive details about the merchandise, including value and classification. While the 6059B is primarily for personal declarations, the 7501 is focused on commercial imports. Both forms are critical for ensuring that customs duties are assessed accurately and that items comply with U.S. laws. They share the common goal of facilitating lawful entry into the country.

Additionally, the CBP Form I-94, Arrival/Departure Record, is similar to the CBP 6059B in that it is used by travelers entering the United States. The I-94 form documents the arrival and departure of non-U.S. citizens and is essential for tracking their immigration status. While the 6059B focuses on customs declarations, the I-94 is more concerned with immigration details. Both forms must be completed accurately to ensure compliance with U.S. regulations, making them vital for travelers.

Lastly, the CBP Form 3299, Declaration for Free Entry of Unaccompanied Articles, is another document that aligns with the CBP 6059B. This form is used when individuals are sending personal effects or household goods to the U.S. without accompanying them. Similar to the 6059B, the CBP Form 3299 requires a declaration of the items being imported, along with their value and purpose. Both forms are intended to ensure that individuals comply with customs regulations while facilitating the movement of personal property into the country.

Other PDF Forms

How to Travel With a Dog Internationally - Pets traveling abroad may have additional requirements.

Understanding the intricacies of a New York General Power of Attorney form is essential for those looking to designate an agent for their financial needs. This document empowers the agent to act on behalf of the principal in almost any legal transaction, highlighting the importance of clarity regarding its implications and the agent's responsibilities. For those interested in this process, you can view the document to get more details and ensure you fully grasp its provisions.

Acord 130 - The Acord 130 provides a structure for uniform data collection in the insurance industry.