Get Cash Receipt Form in PDF

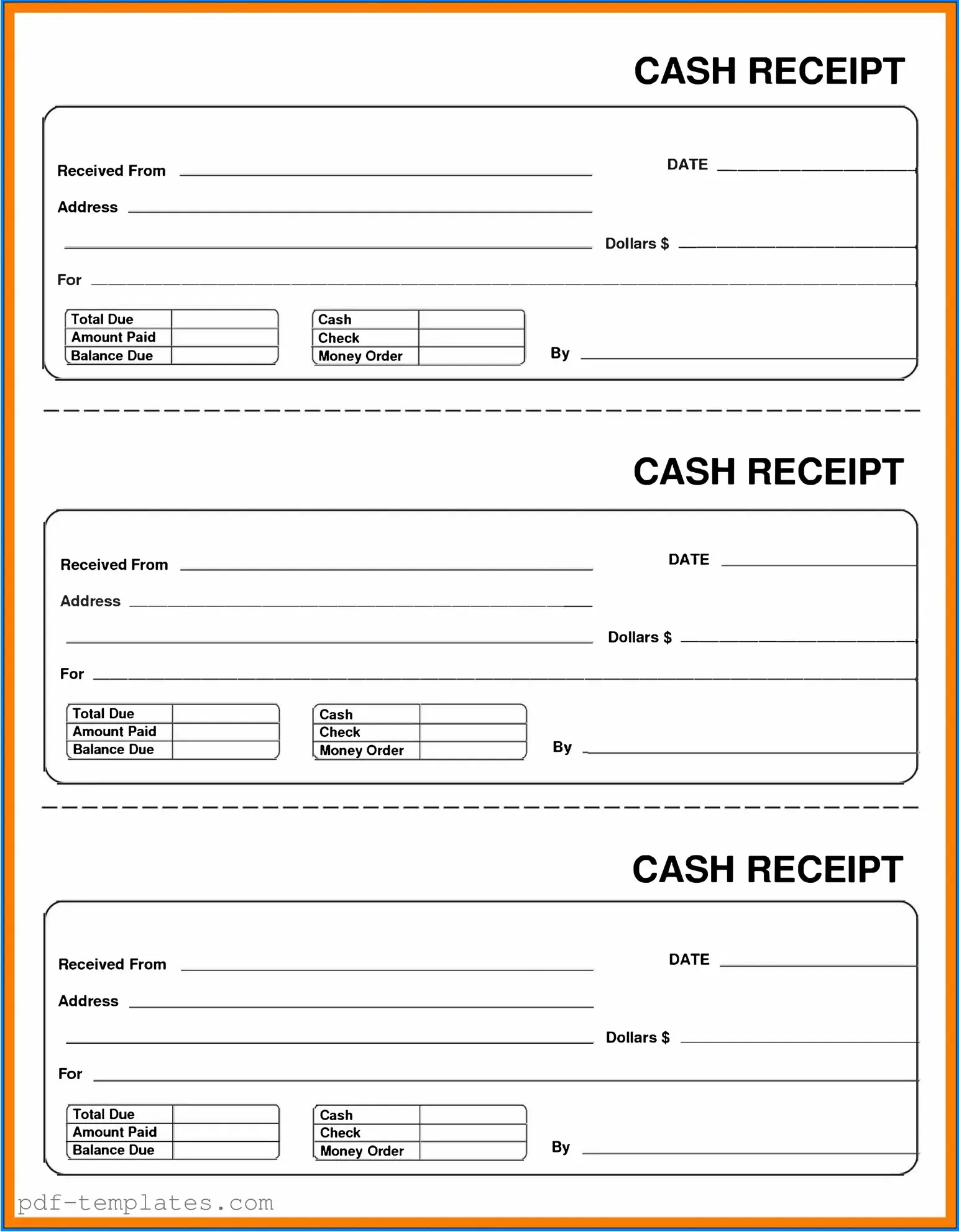

The Cash Receipt form plays a crucial role in the financial management of businesses, providing a clear and organized way to document incoming cash transactions. This form typically includes essential details such as the date of the transaction, the name of the individual or entity making the payment, and a description of the goods or services rendered. Additionally, it captures the amount received, the method of payment—whether cash, check, or electronic transfer—and may also include a unique receipt number for tracking purposes. By standardizing the process of recording cash inflows, the Cash Receipt form helps businesses maintain accurate financial records, ensures accountability, and simplifies the reconciliation of accounts. Its use is not limited to any specific industry; from retail stores to service providers, various organizations rely on this form to enhance their financial transparency and operational efficiency.

Misconceptions

Misconceptions about the Cash Receipt form can lead to confusion and errors in financial transactions. Here are eight common misunderstandings, along with explanations to clarify them.

-

All cash transactions require a Cash Receipt form. This is not true. Only transactions that involve cash payments that need to be documented require this form. Not every cash transaction will necessitate a receipt.

-

The Cash Receipt form is only for businesses. Individuals can also use this form. Anyone receiving cash payments, whether for personal or business reasons, can benefit from having a record of the transaction.

-

Once a Cash Receipt form is filled out, it cannot be changed. While it is best to avoid alterations, corrections can be made if necessary. Just ensure that any changes are clearly noted and initialed by the person making the correction.

-

A Cash Receipt form is not necessary for small amounts. This is a misconception. Even small amounts should be documented to maintain accurate financial records and for accountability purposes.

-

Only the payer needs a copy of the Cash Receipt form. Both the payer and the payee should retain a copy. This ensures that both parties have a record of the transaction for future reference.

-

Cash Receipt forms are only used in retail settings. This is incorrect. Various industries, including service providers and freelancers, also use Cash Receipt forms to document payments.

-

The Cash Receipt form is the same as an invoice. These are different documents. An invoice requests payment, while a Cash Receipt confirms that payment has been received.

-

Cash Receipt forms are outdated and no longer needed. In reality, they remain a vital tool for record-keeping. They help prevent disputes and provide a clear trail of transactions.

Cash Receipt: Usage Instruction

Once you have the Cash Receipt form in front of you, it's important to complete it accurately to ensure proper record-keeping. This form will be submitted for processing, so attention to detail is essential. Follow the steps below to fill it out correctly.

- Begin by entering the date of the transaction in the designated field.

- Next, write the name of the person or organization making the payment.

- In the following section, specify the amount of cash received.

- Indicate the purpose of the payment in the provided space.

- If applicable, include any reference number or invoice number related to the payment.

- Sign the form in the signature line to validate the receipt.

- Finally, review all entries for accuracy before submitting the form.

Common mistakes

-

Incomplete Information: Many individuals fail to provide all required details, such as the date, amount, and purpose of the payment. This can lead to confusion and delays in processing.

-

Incorrect Amounts: Double-checking the amount received is crucial. Mistakes in writing the amount can result in financial discrepancies.

-

Missing Signatures: Some people forget to sign the form. Without a signature, the receipt may not be considered valid.

-

Wrong Payment Method: Indicating the incorrect method of payment (cash, check, credit card) can create issues in record-keeping and reconciliation.

-

Neglecting to Keep Copies: Not making a copy of the completed form can lead to loss of important records. Always keep a copy for your own files.

-

Failure to Provide Contact Information: Omitting contact details can hinder communication if there are questions about the transaction.

-

Using Incorrect Dates: Entering the wrong date can cause confusion regarding when the payment was made, affecting financial records.

-

Not Following Instructions: Ignoring specific instructions on the form can lead to errors. Always read the guidelines carefully before filling out the receipt.

File Specifics

| Fact Name | Description |

|---|---|

| Purpose | The Cash Receipt form is used to document the receipt of cash payments for goods or services. |

| Components | Typically includes the date, amount received, payer's information, and purpose of payment. |

| Record Keeping | This form serves as an official record for both the payer and the payee, aiding in financial tracking. |

| State-Specific Forms | Some states may have specific requirements or formats for cash receipt documentation. |

| Governing Laws | In California, for example, the form must comply with the California Commercial Code. |

| Signature Requirement | A signature from the person receiving the payment is often required to validate the transaction. |

| Digital Versions | Many organizations now utilize digital cash receipt forms for ease of use and storage. |

Dos and Don'ts

When filling out the Cash Receipt form, it’s important to follow certain guidelines to ensure accuracy and compliance. Here are some dos and don’ts to keep in mind:

- Do: Ensure all information is accurate and complete.

- Do: Use clear and legible handwriting or type the information.

- Do: Double-check the amounts and details before submitting.

- Do: Keep a copy of the completed form for your records.

- Don't: Leave any fields blank unless specified.

- Don't: Use correction fluid or tape on the form.

- Don't: Alter any information after the form has been submitted.

- Don't: Forget to sign and date the form where required.

Similar forms

The Cash Receipt form is quite similar to the Invoice. An invoice is a document that a seller provides to a buyer, detailing the products or services rendered along with the amount owed. Both documents serve as proof of a transaction. However, while an invoice requests payment, a cash receipt confirms that payment has been received. This distinction is crucial for accounting purposes, as it helps businesses track income and manage cash flow effectively.

Another document that shares similarities with the Cash Receipt form is the Sales Receipt. A sales receipt is typically issued at the point of sale and serves as immediate proof of purchase. Like the cash receipt, it acknowledges that payment has been made. However, sales receipts are often used in retail environments and may include additional details like sales tax, discounts, and return policies, making them more comprehensive for consumers.

Next, consider the Payment Voucher. This document is used to authorize payment to a vendor or supplier. Similar to a cash receipt, it confirms that a payment has been made. However, a payment voucher usually includes details about the reason for the payment, such as invoices being settled or reimbursements being processed. This makes it particularly useful for businesses managing multiple payments.

The Deposit Slip is another document that resembles the Cash Receipt form. A deposit slip is used when depositing cash or checks into a bank account. It serves as a record of the transaction, similar to how a cash receipt confirms payment. However, deposit slips are primarily used in banking transactions, while cash receipts are more common in retail or service industries.

Then there’s the Acknowledgment of Receipt. This document is often used in various business contexts to confirm that a party has received goods or services. Like a cash receipt, it serves as proof of a transaction. However, an acknowledgment of receipt may not always include payment details, focusing instead on the receipt of items or services.

The Credit Memo is also comparable to the Cash Receipt form. A credit memo is issued to indicate a reduction in the amount owed by a customer, often due to returns or billing errors. While a cash receipt confirms payment received, a credit memo signifies that a payment has been adjusted or refunded. Both documents play a vital role in maintaining accurate financial records.

Understanding the nuances of financial documents is crucial for maintaining organized transactions. Professionals in various industries must ensure that all records, including receipts and vouchers, are meticulously documented to avoid discrepancies. For beauty industry professionals looking to renew their licenses, it’s vital to manage documentation uniformly. This is where the All California Forms come into play, providing essential resources to ensure compliance and streamline the renewal process.

Another similar document is the Receipt for Payment. This is often used in various transactions, especially in service industries. It serves as confirmation that a payment has been made, much like a cash receipt. However, a receipt for payment may not always include detailed information about the transaction, focusing instead on the payment itself.

The Remittance Advice is also worth mentioning. This document is sent by a customer to a supplier, indicating that a payment has been made. Similar to a cash receipt, it serves as proof of payment. However, remittance advices are often used in business-to-business transactions, providing details on what invoices are being paid, which is not typically included in a cash receipt.

Lastly, the Statement of Account can be compared to the Cash Receipt form. A statement of account summarizes all transactions between a business and its customer over a specific period. While a cash receipt documents a single transaction, a statement of account provides a broader view of the customer's financial interactions with the business. Both are essential for maintaining clear financial records, but they serve different purposes.

Other PDF Forms

How to Write a Payroll Check - This document is vital for addressing any payroll discrepancies that may arise.

The Asurion F-017-08 MEN form is a crucial document used for processing specific insurance claims related to electronic devices. This form serves as a formal request for assistance, ensuring that customers receive the support they need for their devices in a timely manner. To get started, fill out the form by visiting pdftemplates.info/asurion-f-017-08-men-form.

What Is 1098 Tax Form - Make sure payments are directed to the correct servicer as specified on the form.