Get Cash Drawer Count Sheet Form in PDF

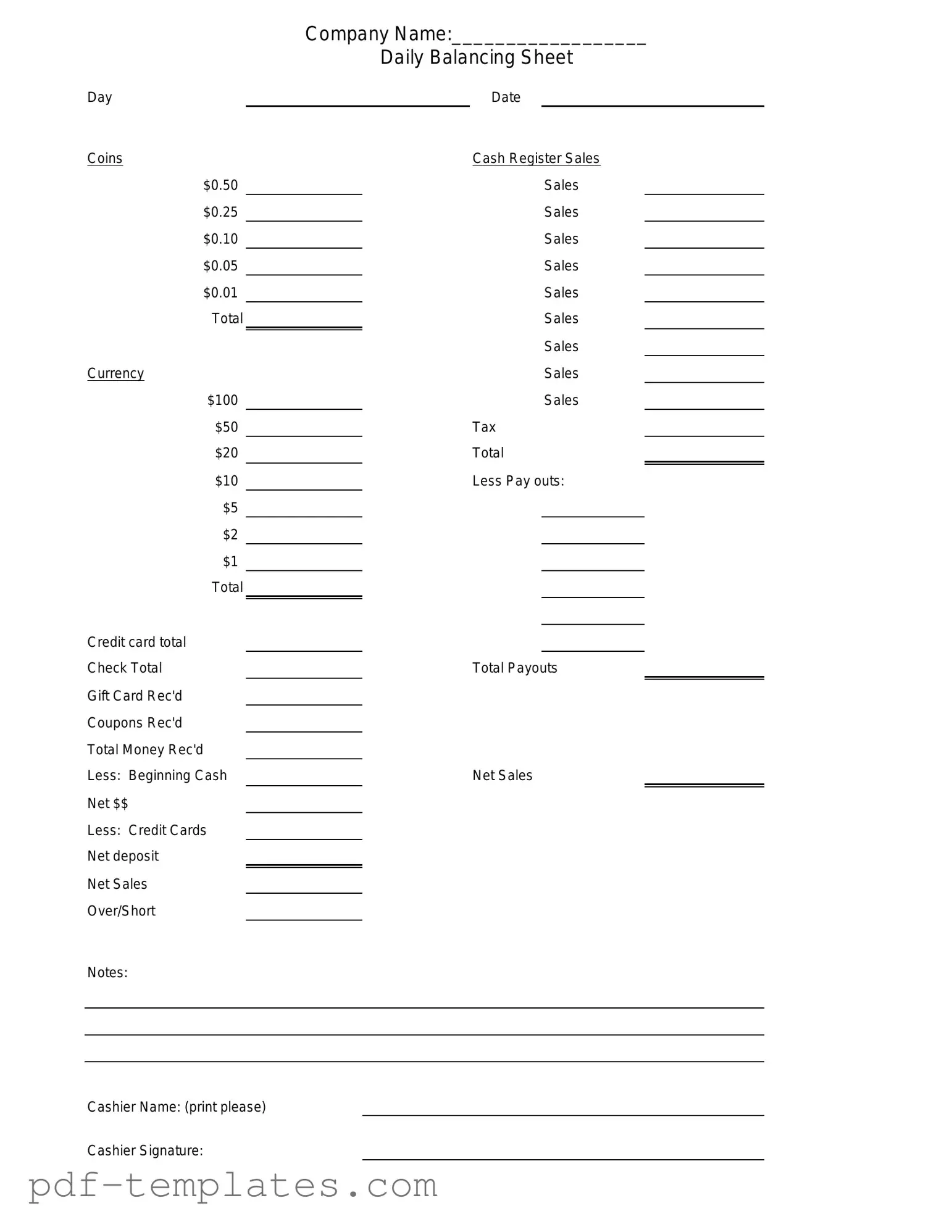

The Cash Drawer Count Sheet form is an essential tool for businesses that handle cash transactions, providing a systematic way to track and verify cash on hand. This form typically includes sections for recording the starting cash balance, cash sales, cash received from various sources, and any cash paid out. By documenting these figures, businesses can ensure accurate financial reporting and maintain transparency in their cash handling processes. Additionally, the form often features spaces for notes or discrepancies, allowing for easy identification of issues that may arise during cash counts. Regular use of the Cash Drawer Count Sheet not only promotes accountability among employees but also aids in preventing theft and errors, ultimately contributing to the overall financial health of the organization.

Misconceptions

The Cash Drawer Count Sheet is an important tool for managing cash flow in a business. However, several misconceptions about this form can lead to confusion. Below are five common misconceptions along with clarifications.

- It is only necessary for large businesses. Many believe that only large businesses need a Cash Drawer Count Sheet. In reality, any business that handles cash transactions can benefit from this form, regardless of size. It helps maintain accuracy and accountability.

- It is a one-time use form. Some think that the Cash Drawer Count Sheet is only needed for a single transaction. This is not true. The form should be used regularly, especially at the beginning and end of shifts, to ensure that cash balances are correct.

- It is only for cash sales. A common misconception is that this form is solely for tracking cash sales. However, it is also useful for recording cash received from other sources, such as refunds or cash deposits, providing a comprehensive view of cash flow.

- It is not important for audits. Some may underestimate the significance of the Cash Drawer Count Sheet during audits. On the contrary, having accurate and detailed records can be crucial for demonstrating financial integrity and transparency during an audit process.

- Anyone can fill it out. While it may seem straightforward, not everyone should fill out the Cash Drawer Count Sheet. It is best completed by trained staff who understand the importance of accuracy in financial reporting.

Cash Drawer Count Sheet: Usage Instruction

After gathering the necessary information, you will proceed to fill out the Cash Drawer Count Sheet form. This form is essential for accurately documenting the cash present in the drawer at the end of a shift or day. Ensuring accuracy is vital to maintain financial integrity and accountability.

- Begin by entering the date at the top of the form. This should reflect the day the count is being conducted.

- Next, write down your name or the name of the individual responsible for the cash drawer count.

- In the designated section, list each denomination of currency present in the cash drawer. This includes bills and coins.

- For each denomination, indicate the quantity of bills or coins counted. Be precise to avoid discrepancies.

- Calculate the total amount for each denomination by multiplying the quantity by the value of the denomination.

- Sum all the totals from each denomination to arrive at a grand total for the cash drawer.

- Finally, sign and date the form to verify that the count has been completed and is accurate.

Common mistakes

-

Inaccurate Totals: Many people fail to double-check their math. Mistakes in addition or subtraction can lead to discrepancies that affect the overall cash count.

-

Missing Signatures: It's common to overlook the requirement for signatures. Both the person counting the cash and the supervisor should sign the form to validate the count.

-

Incorrect Date Entry: Some individuals forget to enter the correct date. This can create confusion when reviewing past counts or reconciling records.

-

Omitting Denominations: Failing to list all cash denominations can lead to incomplete records. Each type of bill and coin should be accounted for to ensure accuracy.

File Specifics

| Fact Name | Description |

|---|---|

| Purpose | The Cash Drawer Count Sheet is used to record the amount of cash in a cash drawer at the beginning and end of a shift. |

| Importance | Accurate tracking of cash helps prevent discrepancies and potential theft, ensuring financial integrity. |

| Components | The form typically includes sections for recording cash amounts, checks, and other payment types. |

| Frequency of Use | This form is usually completed daily or at the end of each shift, depending on the business's cash handling policies. |

| Record Keeping | Maintaining these records is essential for audits and financial reviews, providing a clear cash flow history. |

| State-Specific Requirements | Some states may have specific regulations governing cash handling and record-keeping, which can influence the use of this form. |

| Accessibility | The form should be easily accessible to all employees responsible for cash handling to ensure compliance and accuracy. |

Dos and Don'ts

When filling out the Cash Drawer Count Sheet form, it is important to follow specific guidelines to ensure accuracy and compliance. Here are seven things to consider:

- Do: Verify the starting cash balance before counting.

- Do: Count all cash and coins in the drawer carefully.

- Do: Record the total amount clearly and accurately.

- Do: Double-check your calculations for errors.

- Don't: Rush through the counting process.

- Don't: Leave any sections of the form blank.

- Don't: Forget to sign and date the form after completion.

Similar forms

The Cash Register Reconciliation Sheet serves a similar purpose as the Cash Drawer Count Sheet. Both documents are used to verify the amount of cash in a register at the end of a shift or day. This sheet provides a detailed breakdown of sales and expenses, ensuring that the cash on hand matches the recorded transactions. By reconciling cash and sales, businesses can identify discrepancies and maintain accurate financial records.

The Daily Sales Report is another document that aligns closely with the Cash Drawer Count Sheet. This report summarizes the total sales for a specific day, including cash, credit card, and other payment methods. While the Cash Drawer Count Sheet focuses on cash, the Daily Sales Report provides a broader view of overall sales performance. Together, they offer a comprehensive picture of daily revenue and help in tracking financial trends.

The Petty Cash Log is a useful document that complements the Cash Drawer Count Sheet. It tracks small cash expenditures made for incidental expenses. While the Cash Drawer Count Sheet deals with larger cash transactions, the Petty Cash Log ensures that every dollar spent is accounted for. This log helps maintain transparency and accountability in cash handling practices within a business.

The Bank Deposit Slip is another document related to cash management. It is used when cash from the cash drawer is deposited into a bank account. Similar to the Cash Drawer Count Sheet, the Bank Deposit Slip outlines the amount of cash being deposited. Accurate completion of both documents is essential for ensuring that cash flow is properly managed and recorded.

The Cash Flow Statement provides a broader financial overview, making it similar to the Cash Drawer Count Sheet in its focus on cash management. While the Cash Drawer Count Sheet is specific to cash on hand, the Cash Flow Statement summarizes all cash inflows and outflows over a period. This document helps businesses understand their liquidity and financial health, making it a crucial tool for effective cash management.

Understanding the range of documentation required for effective financial management is essential for any business operation, and for those in California, having access to necessary forms can streamline this process significantly. Whether it’s tracking sales through various reports or ensuring compliance with rental agreements, familiarity with local documentation simplifies operations. For a comprehensive overview, you can refer to All California Forms that cater to these needs.

The Expense Report is another document that can be compared to the Cash Drawer Count Sheet. While the Cash Drawer Count Sheet focuses on cash received, the Expense Report tracks money spent on business-related expenses. Both documents are essential for maintaining accurate financial records, as they provide insights into cash inflows and outflows, allowing businesses to monitor their financial performance effectively.

Finally, the Inventory Count Sheet shares similarities with the Cash Drawer Count Sheet in terms of tracking assets. While the Cash Drawer Count Sheet monitors cash, the Inventory Count Sheet keeps tabs on physical goods. Both documents are vital for ensuring that what is recorded matches what is physically present, helping businesses maintain accurate records and avoid losses due to discrepancies.

Other PDF Forms

Printable Youth Baseball Evaluation Form - Range, speed, and strength are vital components of the player's evaluation.

If you are looking to expedite your tenant selection, a comprehensive Rental Application form will assist landlords in gathering vital information from interested applicants. To access the form and begin the process, please click on the following link: complete rental application process.

USCIS Form I-864 - USCIS may verify the sponsor's information against federal databases.

Time Card Templates - Complete this form for every pay cycle.