Official Transfer-on-Death Deed Template for California State

The California Transfer-on-Death Deed form offers a straightforward way for property owners to transfer their real estate to beneficiaries without the need for probate. This legal tool is particularly beneficial for individuals looking to streamline the process of passing on their property upon death, ensuring that loved ones receive their inheritance efficiently and with minimal hassle. By completing this form, property owners can specify who will inherit their property, allowing them to maintain control over their assets during their lifetime. The form must be properly executed and recorded to be valid, and it allows for flexibility, as owners can revoke or change the deed at any time before their passing. Understanding the nuances of this deed is essential for anyone considering it as part of their estate planning strategy, as it can significantly impact how property is transferred and the financial implications for beneficiaries. In California, this deed is a valuable option for those seeking to simplify their estate management and reduce the burden on their heirs.

Misconceptions

When it comes to estate planning in California, the Transfer-on-Death Deed (TOD) form is often misunderstood. Here are five common misconceptions about this important legal tool.

-

Misconception 1: The TOD deed avoids probate entirely.

While a TOD deed allows property to pass directly to beneficiaries without going through probate, it does not eliminate the need for probate in all situations. If the property owner has other assets that require probate, those assets will still go through the process.

-

Misconception 2: A TOD deed is only for real estate.

Many people believe that the TOD deed applies only to real property. However, it is specifically designed for real estate, and other types of assets, such as bank accounts or personal property, require different estate planning tools.

-

Misconception 3: The property is transferred immediately upon signing the TOD deed.

Some individuals think that signing the TOD deed means the property is transferred to the beneficiary right away. In reality, the transfer occurs only upon the death of the property owner, allowing them to retain full control during their lifetime.

-

Misconception 4: A TOD deed can be used to transfer property to multiple beneficiaries.

This is not accurate. A TOD deed allows for the designation of a single beneficiary for each deed. If a property owner wishes to transfer to multiple individuals, they must create separate TOD deeds for each beneficiary.

-

Misconception 5: A TOD deed can be revoked at any time without formalities.

While it is true that a TOD deed can be revoked, it must be done formally. The property owner must execute a new deed or a revocation document to ensure that the change is legally recognized.

Understanding these misconceptions is crucial for anyone considering the use of a Transfer-on-Death Deed in California. Proper knowledge can help individuals make informed decisions about their estate planning needs.

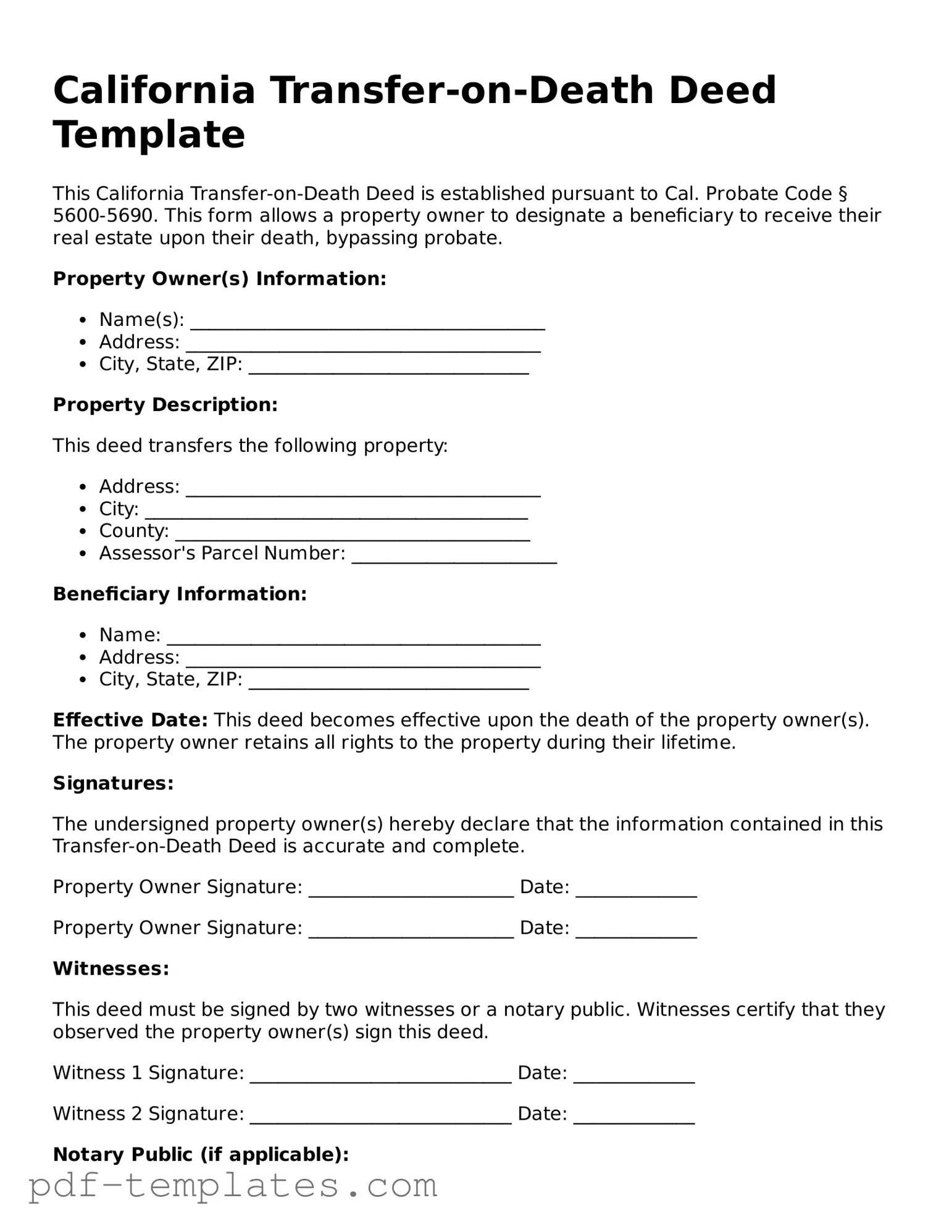

California Transfer-on-Death Deed: Usage Instruction

Once you have the California Transfer-on-Death Deed form, you will need to fill it out carefully. Ensure that all information is accurate to avoid any issues later on. Follow these steps to complete the form.

- Start by entering the date at the top of the form.

- Provide the name of the property owner. This is the person transferring the property.

- List the address of the property being transferred. Include the street address, city, and zip code.

- Include the legal description of the property. This can usually be found on the property deed.

- Identify the beneficiary. This is the person who will receive the property after the owner’s death.

- Fill in the beneficiary's address. Make sure it is complete and accurate.

- Sign the form in the designated area. The owner must sign it to make it valid.

- Have the form notarized. A notary public needs to witness the signature.

- File the completed deed with the county recorder’s office where the property is located. This step is crucial for the deed to take effect.

After completing these steps, the form should be properly filed to ensure the transfer of property takes place as intended. Keep a copy for your records.

Common mistakes

-

Incorrect Property Description: One of the most common mistakes is failing to accurately describe the property. This includes using vague terms or not providing the correct legal description. Always ensure the property is clearly identified to avoid future disputes.

-

Not Naming Beneficiaries: Some individuals neglect to name a beneficiary or mistakenly list the wrong person. It is essential to clearly identify who will receive the property upon the owner's death to prevent confusion.

-

Omitting Signatures: A Transfer-on-Death Deed must be signed by the property owner. Forgetting to sign or having an incomplete signature can render the deed invalid. Always double-check for necessary signatures.

-

Failing to Notarize: In California, the deed requires notarization. Skipping this step can lead to issues with the deed's acceptance. Ensure that a qualified notary public witnesses the signing.

-

Improper Filing: After completing the deed, it must be filed with the county recorder's office. Some people forget this step or file it incorrectly. It is crucial to follow the proper procedures for filing to ensure the deed is legally recognized.

-

Not Understanding Revocation: Individuals often overlook the fact that a Transfer-on-Death Deed can be revoked. Failing to understand how to properly revoke or amend the deed can lead to unintended consequences.

-

Ignoring State Laws: Each state has specific laws regarding Transfer-on-Death Deeds. Some individuals may not be aware of California's unique requirements. Familiarizing oneself with state regulations is essential to ensure compliance.

PDF Features

| Fact Name | Details |

|---|---|

| Definition | A Transfer-on-Death (TOD) Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The California Transfer-on-Death Deed is governed by California Probate Code Sections 5600-5693. |

| Eligibility | Only real property, such as land or buildings, can be transferred using a TOD Deed. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries in the deed. |

| Revocation | A TOD Deed can be revoked at any time by the property owner through a written document. |

| Recording Requirement | The deed must be recorded with the county recorder's office to be effective. |

| No Immediate Transfer | The transfer of property does not occur until the death of the property owner. |

| Tax Implications | Beneficiaries may receive a step-up in basis for tax purposes, which can reduce capital gains taxes. |

| Legal Assistance | While not required, consulting an attorney is advisable to ensure proper execution and understanding of the deed. |

Dos and Don'ts

When filling out the California Transfer-on-Death Deed form, it's crucial to follow specific guidelines to ensure the document is valid and meets your intentions. Here are ten important dos and don'ts to consider:

- Do ensure you are eligible to use the Transfer-on-Death Deed. This deed is available only for certain types of properties.

- Do provide accurate and complete information about the property, including its legal description.

- Do include the full names of all beneficiaries you wish to designate.

- Do sign the deed in the presence of a notary public to validate the document.

- Do record the deed with the county recorder's office where the property is located.

- Don't forget to check local regulations that might affect the deed's validity.

- Don't use vague language when describing the property or beneficiaries.

- Don't neglect to keep a copy of the recorded deed for your records.

- Don't assume that verbal agreements with beneficiaries are sufficient; always document your intentions in writing.

- Don't wait too long to record the deed, as delays can complicate the transfer process.

Similar forms

The California Transfer-on-Death Deed (TOD Deed) shares similarities with a will, particularly in how both documents facilitate the transfer of property upon an individual’s death. A will outlines the decedent's wishes regarding the distribution of their assets, including real estate, to designated beneficiaries. Like a TOD Deed, a will must be executed according to state laws, and it typically goes through probate, which is a legal process that validates the will and oversees the distribution of assets. However, the TOD Deed allows for the direct transfer of property without the need for probate, providing a more streamlined and often quicker method for beneficiaries to acquire ownership of the property. This distinction can significantly reduce the time and costs associated with the transfer process after death.

To begin your homeschooling process confidently, it's important to understand the significance of a formal declaration. Consider reviewing this guide on how the Texas Homeschool Letter of Intent can assist you in navigating the requirements efficiently.

Check out Popular Transfer-on-Death Deed Forms for Different States

Transfer on Death Deed Washington Form - A common misconception is that this deed affects taxes; typically, it does not create any immediate tax consequences.

Understanding the nuances of traffic accident reporting is essential for every driver in California, particularly when it comes to the completion of the CA DMV SR1 form. This form is vital for documenting accidents that result in personal injury, death, or property damage exceeding $1,000. To ensure you have all the necessary paperwork in order, you may refer to All California Forms for comprehensive resources and support in filling out the required documentation accurately and timely.

Pennsylvania Transfer on Death Deed Form - Beneficiaries named in the Transfer-on-Death Deed do not acquire any ownership or interest in the property until the owner's death.

Transfer on Death Deed Texas Form Free - The deed can help ensure that property remains within the family, minimizing outside claims.

Where Can I Get a Tod Form - Beneficiaries are not responsible for the property’s mortgage or unpaid taxes until the owner's death.