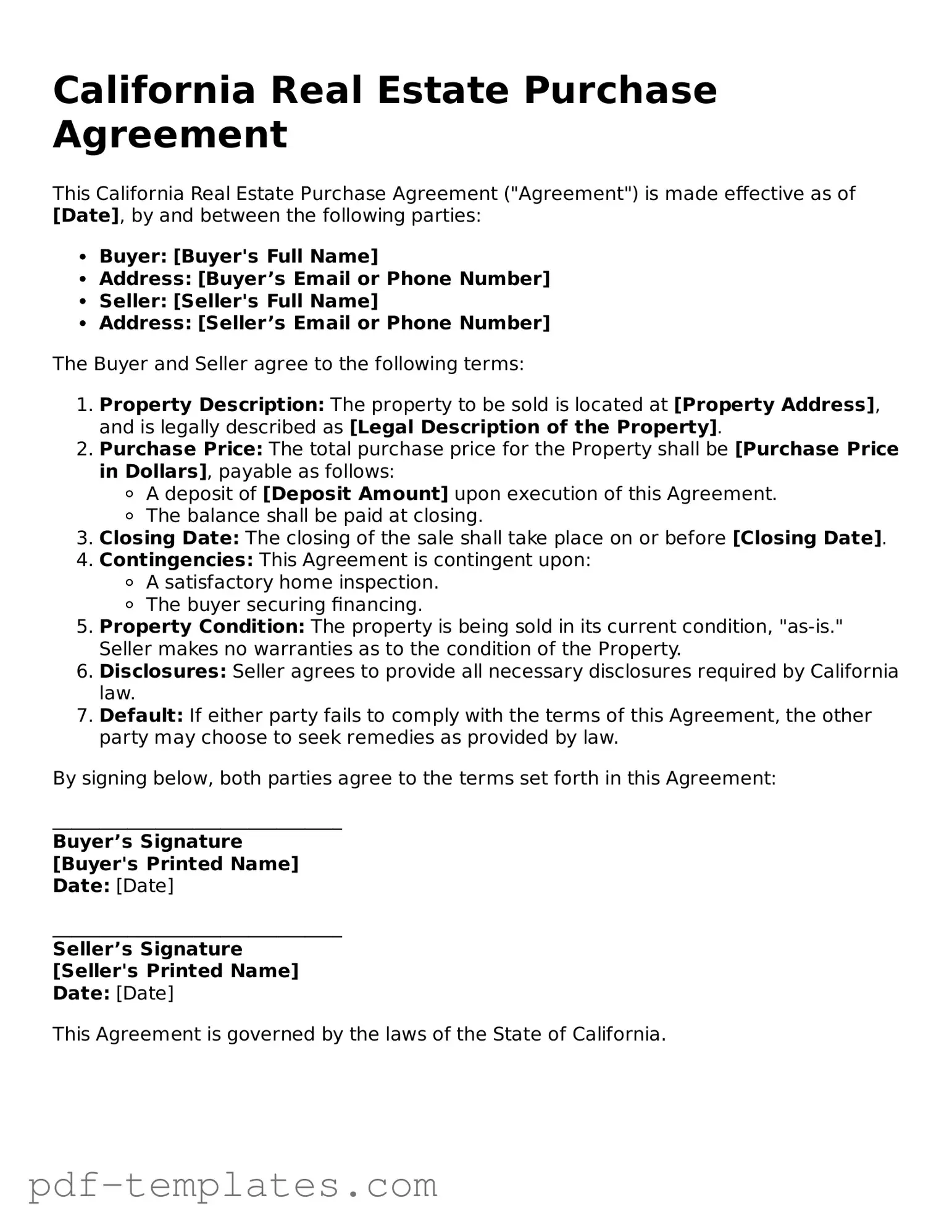

Official Real Estate Purchase Agreement Template for California State

The California Real Estate Purchase Agreement form is a crucial document in the home buying process, serving as a roadmap for both buyers and sellers. This legally binding agreement outlines the terms and conditions of the sale, ensuring that all parties are on the same page. Key aspects of the form include the purchase price, financing details, and contingencies that protect the interests of both the buyer and seller. Additionally, it specifies the closing date and any included fixtures or personal property, which can often lead to confusion if not clearly defined. The form also addresses the responsibilities for repairs and inspections, providing a framework for how these issues will be handled during the transaction. Understanding each component of this agreement is essential for navigating the complexities of real estate transactions in California, ultimately leading to a smoother buying or selling experience.

Misconceptions

Understanding the California Real Estate Purchase Agreement (RPA) is crucial for anyone involved in a property transaction. However, several misconceptions can lead to confusion. Here are eight common misunderstandings about the RPA.

- The RPA is a one-size-fits-all document. Many believe that the RPA can be used for any type of real estate transaction. In reality, it may need to be tailored to fit specific circumstances, such as the type of property or the unique terms of the sale.

- Signing the RPA means the sale is finalized. Some individuals think that once they sign the RPA, the deal is done. However, the agreement is often contingent upon various conditions, such as inspections and financing approvals.

- The RPA guarantees a successful sale. It's a common misconception that simply using the RPA ensures that the property will sell. The agreement is a tool, but many factors, including market conditions and buyer interest, play a role in the outcome.

- All terms are negotiable. While many aspects of the RPA can be negotiated, some terms are standard and may not be flexible. Understanding which terms can be changed is essential for effective negotiation.

- The RPA does not require legal advice. Some buyers and sellers think they can navigate the RPA without professional guidance. However, consulting with a legal expert can help clarify obligations and rights, reducing the risk of misunderstandings.

- Once submitted, the RPA cannot be changed. People often believe that after submitting the RPA, no changes can be made. In fact, amendments can be made if both parties agree, allowing for adjustments as needed.

- The RPA is only for residential properties. Many assume that the RPA is limited to residential real estate. However, it can also be used for commercial properties, making it a versatile tool in various transactions.

- Filling out the RPA is straightforward and requires no assistance. While the form may seem simple, it includes many details that can be easily overlooked. Seeking help can ensure that all necessary information is accurately provided.

By addressing these misconceptions, individuals can approach the California Real Estate Purchase Agreement with a clearer understanding, leading to smoother transactions.

California Real Estate Purchase Agreement: Usage Instruction

Once you have the California Real Estate Purchase Agreement form in hand, you are ready to begin the process of filling it out. This form serves as a crucial document in any real estate transaction, detailing the terms and conditions agreed upon by both the buyer and the seller. Follow these steps carefully to ensure that all necessary information is accurately provided.

- Identify the Parties: Fill in the names and contact information of both the buyer(s) and seller(s). This includes full legal names and addresses.

- Property Information: Enter the address of the property being sold. Include any necessary legal descriptions if required.

- Purchase Price: Clearly state the total purchase price of the property. Specify the amount in both numerical and written form.

- Deposit Amount: Indicate the amount of the initial deposit. This is typically a percentage of the purchase price.

- Financing Terms: Outline how the buyer plans to finance the purchase. Include details about loans, if applicable.

- Contingencies: Specify any contingencies that must be met for the sale to proceed, such as inspections or financing approvals.

- Closing Date: State the proposed closing date for the transaction. This is when ownership will officially transfer.

- Signatures: Ensure that both parties sign and date the agreement. This confirms their acceptance of the terms outlined in the document.

After completing these steps, review the form carefully to check for any errors or missing information. It’s essential to keep a copy for your records and provide the other party with their own copy as well.

Common mistakes

-

Neglecting to Specify the Purchase Price: One of the most common mistakes is failing to clearly state the purchase price. This figure should be prominently displayed and agreed upon by both parties. Without a specified amount, the agreement can lead to confusion and disputes later on.

-

Omitting Contingencies: Contingencies are essential clauses that protect buyers and sellers. Common contingencies include home inspections, financing, and appraisal conditions. When these are omitted, buyers may find themselves locked into a deal that isn’t in their best interest.

-

Incorrectly Identifying the Parties: It’s crucial to accurately identify all parties involved in the transaction. This includes full legal names and any relevant entities. Incorrect identification can lead to legal complications and may jeopardize the validity of the agreement.

-

Failure to Include Important Dates: Important dates, such as the closing date and the date for contingencies to be satisfied, should never be overlooked. Missing these deadlines can result in the loss of the opportunity to proceed with the purchase or sale.

-

Not Reviewing the Entire Agreement: Many individuals rush through the form without thoroughly reviewing all sections. Each clause serves a purpose, and overlooking even minor details can have significant consequences. It’s advisable to read the entire agreement carefully and seek clarification on any ambiguous language.

PDF Features

| Fact Name | Description |

|---|---|

| Governing Law | The California Real Estate Purchase Agreement is governed by California state law. |

| Standardized Form | This agreement is a standardized form used throughout California to facilitate real estate transactions. |

| Parties Involved | The form outlines the parties involved, typically the buyer and seller, along with their legal names and contact information. |

| Property Description | A detailed description of the property being sold, including address and legal description, is required. |

| Purchase Price | The agreement specifies the purchase price, which is negotiated between the buyer and seller. |

| Contingencies | Buyers can include contingencies, such as financing or inspection, which must be satisfied before the sale is finalized. |

| Closing Date | The form states the anticipated closing date, marking when the transaction is expected to be completed. |

| Earnest Money | Buyers typically provide earnest money as a deposit to demonstrate their serious intent to purchase. |

| Disclosure Requirements | Sellers must provide necessary disclosures regarding the property, including any known defects or issues. |

| Signatures | Both parties must sign the agreement for it to be legally binding, indicating their acceptance of the terms. |

Dos and Don'ts

When filling out the California Real Estate Purchase Agreement form, it's important to follow certain guidelines to ensure accuracy and compliance. Here are some key do's and don'ts to keep in mind:

- Do read the entire form carefully before filling it out.

- Do provide accurate information regarding the property and parties involved.

- Do include all necessary signatures and dates.

- Do consult with a real estate agent or attorney if you have questions.

- Don't leave any sections blank unless instructed to do so.

- Don't use abbreviations or shorthand that may cause confusion.

- Don't rush through the process; take your time to ensure everything is correct.

Following these guidelines will help facilitate a smoother transaction and reduce the likelihood of issues arising later on.

Similar forms

The California Residential Purchase Agreement is similar to the Commercial Purchase Agreement. Both documents outline the terms of a real estate transaction, including purchase price, contingencies, and closing dates. While the Residential Purchase Agreement focuses on residential properties, the Commercial Purchase Agreement caters to commercial real estate transactions, detailing specific considerations relevant to business properties.

Another similar document is the Lease Agreement. While a Purchase Agreement facilitates the sale of property, a Lease Agreement establishes the terms under which a tenant may occupy a property. Both documents address critical elements such as payment terms, duration, and responsibilities of the parties involved. However, a Lease Agreement is temporary, while a Purchase Agreement typically leads to ownership transfer.

As businesses navigate the complexities of real estate transactions, it is crucial to be aware of various forms that impact the purchasing process, including the All California Forms, which can provide essential documentation like the California Resale Certificate, ensuring compliance and clarity in buying and selling properties while adhering to tax regulations.

The Option to Purchase Agreement shares similarities with the Purchase Agreement. This document grants a potential buyer the right to purchase a property at a predetermined price within a specific timeframe. Like the Purchase Agreement, it outlines terms and conditions but emphasizes the buyer's option rather than an obligation to buy.

The Seller's Disclosure Statement is also related to the Purchase Agreement. This document provides essential information about the property's condition and any known issues. While the Purchase Agreement includes terms of sale, the Seller's Disclosure ensures transparency and helps buyers make informed decisions based on the property's status.

Another related document is the Escrow Agreement. This agreement outlines the process of holding funds and documents by a neutral third party until all conditions of the Purchase Agreement are met. Both documents work together to ensure a smooth transaction, with the Escrow Agreement providing security and clarity during the closing process.

The Counteroffer is a crucial document in real estate negotiations. When a buyer or seller disagrees with the terms of the initial Purchase Agreement, a counteroffer is made to propose new terms. This document is similar in that it continues the negotiation process, ultimately leading to a mutually agreed-upon Purchase Agreement.

Lastly, the Real Estate Agency Agreement is akin to the Purchase Agreement in that it establishes a formal relationship between a buyer or seller and their real estate agent. This document outlines the agent's responsibilities and the commission structure. While it does not directly involve the sale of property, it plays a critical role in facilitating the Purchase Agreement by ensuring that both parties have professional representation throughout the transaction.

Check out Popular Real Estate Purchase Agreement Forms for Different States

New York Real Estate Contract - Clear communication about terms in the agreement can foster a better working relationship.

The USCIS I-9 form is a document used by employers to verify the identity and employment authorization of individuals hired for work in the United States. This form is essential for complying with federal regulations, ensuring that all employees meet the necessary criteria to work legally. For further information and to find a blank version of the form, you can visit documentonline.org/blank-uscis-i-9/, which provides useful resources to help both employers and employees navigate the hiring process more effectively.

Realestate Purchase Agreement - Can provide options for closing online or in person based on preferences.