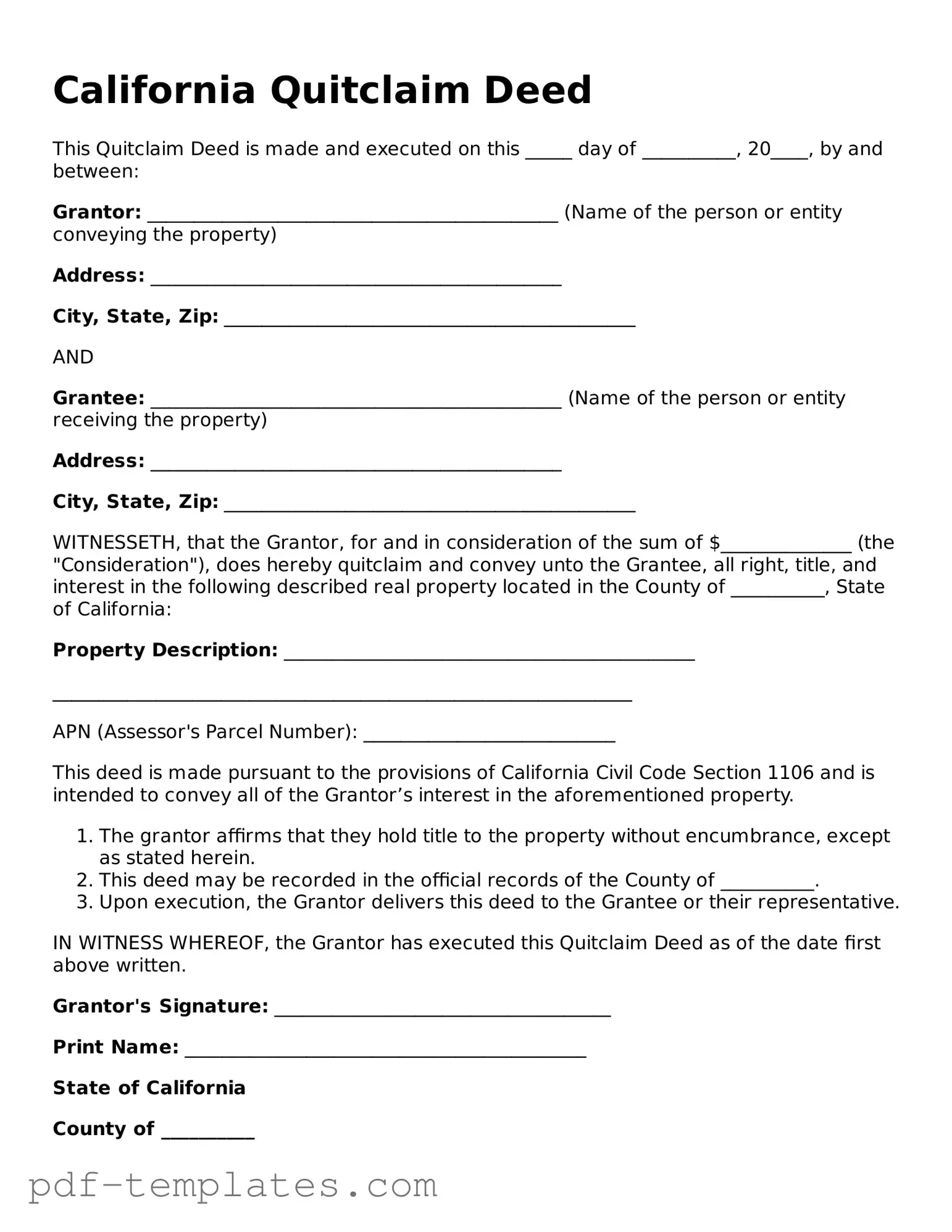

Official Quitclaim Deed Template for California State

In the realm of real estate transactions, the California Quitclaim Deed serves as a crucial tool for property owners wishing to transfer their interest in a property to another party without making any guarantees about the title's validity. This form is particularly useful in situations where the transferor—often a family member or a business partner—wants to relinquish their rights to the property quickly and without the complexities of a traditional sale. Unlike other types of deeds, a Quitclaim Deed does not involve a title search or an assurance that the property is free from liens or other encumbrances. Instead, it simply conveys whatever interest the grantor has at the time of the transfer. This makes it an ideal option for individuals who are transferring property between family members, settling estates, or clarifying ownership among co-owners. However, while the process may seem straightforward, it is essential to understand the implications of using this form, as it can affect future ownership rights and responsibilities. Knowing when and how to use a Quitclaim Deed can empower individuals to make informed decisions about their property and financial future.

Misconceptions

Many people misunderstand the California Quitclaim Deed form. Here are four common misconceptions:

- It transfers ownership of property without any warranties. A quitclaim deed does not guarantee that the person transferring the property has clear title. It simply conveys whatever interest the grantor has at the time of transfer.

- It is only used in divorce or estate situations. While quitclaim deeds are often used in these contexts, they can also serve various purposes, such as transferring property between family members or clearing up title issues.

- Once a quitclaim deed is signed, it cannot be revoked. A quitclaim deed can be revoked or challenged in certain circumstances, especially if fraud or undue influence is proven.

- It is a complicated legal document. In reality, a quitclaim deed is relatively straightforward. It requires basic information about the parties involved and the property being transferred.

California Quitclaim Deed: Usage Instruction

Once you have the California Quitclaim Deed form in hand, it’s time to fill it out. This form is essential for transferring property rights from one party to another. After completing the form, you'll need to ensure it's properly signed and filed with the appropriate county office to make the transfer official.

- Obtain the Form: Start by downloading the California Quitclaim Deed form from a reliable source or visiting your local county recorder's office.

- Fill in the Grantor's Information: Enter the full name and address of the person transferring the property. This individual is known as the grantor.

- Fill in the Grantee's Information: Next, provide the full name and address of the person receiving the property, referred to as the grantee.

- Describe the Property: Clearly describe the property being transferred. Include the address, parcel number, and any other identifying details.

- State the Consideration: Indicate the amount of money or value exchanged for the property. If it's a gift, you can write "for love and affection."

- Sign the Form: The grantor must sign the form in the presence of a notary public. This step is crucial for the validity of the deed.

- Notarization: Have the notary public complete their section, which includes their signature and seal, confirming that the grantor signed in their presence.

- File the Deed: Finally, take the completed and notarized deed to the county recorder's office where the property is located. Pay any required filing fees to officially record the deed.

Common mistakes

-

Incorrect Property Description: One of the most common mistakes is failing to provide a complete and accurate description of the property. This includes not specifying the correct address, parcel number, or legal description. A vague description can lead to confusion and potential disputes.

-

Missing Signatures: All parties involved in the transaction must sign the Quitclaim Deed. Omitting a signature can render the document invalid. It’s essential to double-check that everyone who needs to sign has done so.

-

Not Notarizing the Document: A Quitclaim Deed must be notarized to be legally binding. Failing to have the document notarized can prevent it from being accepted by the county recorder’s office.

-

Improper Completion of the Form: Using the wrong version of the form or not following the instructions carefully can lead to errors. Each section of the form must be filled out as required, and any mistakes can complicate the process.

-

Forgetting to Record the Deed: After completing the Quitclaim Deed, it’s crucial to file it with the appropriate county office. Neglecting to record the deed means the transfer of ownership may not be recognized legally.

-

Not Understanding the Implications: Some individuals fill out the form without fully understanding what a Quitclaim Deed entails. It’s important to recognize that this type of deed does not guarantee clear title, and it may not protect against future claims.

-

Ignoring State-Specific Requirements: Each state has its own rules regarding Quitclaim Deeds. Failing to comply with California’s specific requirements can lead to issues. It’s wise to review the state’s regulations before submitting the form.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed transfers ownership of property without any warranties. |

| Purpose | Used to transfer interest in real estate quickly and easily. |

| Governing Law | California Civil Code Sections 1091 and 1092 govern quitclaim deeds. |

| No Guarantees | The grantor does not guarantee that the title is clear. |

| Common Uses | Often used between family members or in divorce settlements. |

| Execution Requirements | The deed must be signed by the grantor and notarized. |

| Recording | Recording the deed with the county is recommended to protect rights. |

| Consideration | Consideration is not required but is often stated for clarity. |

| Tax Implications | Transferring property via quitclaim may have tax consequences. |

| Revocation | A quitclaim deed cannot be revoked once recorded, unless a new deed is issued. |

Dos and Don'ts

When filling out the California Quitclaim Deed form, it’s important to follow certain guidelines to ensure the process goes smoothly. Here are some dos and don’ts:

- Do ensure that all names are spelled correctly. This helps avoid any issues with the transfer of property.

- Do include the correct legal description of the property. This information is crucial for the deed to be valid.

- Do sign the form in front of a notary public. Notarization is often required for the deed to be legally recognized.

- Do keep a copy of the completed deed for your records. This will be helpful for future reference.

- Don't leave any sections blank. All required fields must be filled out to avoid delays.

- Don't use outdated forms. Always use the most current version of the Quitclaim Deed form.

- Don't forget to check local recording requirements. Each county may have specific rules for recording deeds.

- Don't rush the process. Take your time to ensure everything is accurate and complete.

Similar forms

A Grant Deed is quite similar to a Quitclaim Deed in that it transfers ownership of real property from one party to another. However, the key difference lies in the warranties provided. A Grant Deed guarantees that the seller has not only the right to sell the property but also that the property is free from any undisclosed encumbrances. This added layer of protection makes it a more secure option for buyers who seek assurance about their new property’s title.

A Warranty Deed offers even more protection than a Grant Deed. It provides a full guarantee that the seller holds clear title to the property and will defend against any claims. This document is often used in transactions where the buyer wants to ensure that they have absolute ownership without any past claims or liens. While a Quitclaim Deed simply transfers whatever interest the seller has, a Warranty Deed affirms the seller's commitment to a clear title.

A Bargain and Sale Deed is another document that resembles a Quitclaim Deed but with some distinctions. This type of deed implies that the seller has the right to sell the property but does not provide any warranties regarding the title. It’s often used in foreclosure sales or tax sales, where the seller may not have complete knowledge about the property’s history. Like the Quitclaim Deed, it transfers ownership without guaranteeing the absence of liens or claims.

A Special Warranty Deed is similar in that it transfers ownership of real estate, but it only warrants the title for the time the seller owned the property. This means that any issues arising before the seller’s ownership are not covered. This document is often used in commercial real estate transactions, where the seller may not want to take on the risk of past claims, making it a middle ground between a Quitclaim Deed and a Warranty Deed.

An Affidavit of Title is not a deed but is often used in conjunction with deeds to clarify the seller’s ownership status. This document is a sworn statement confirming that the seller has the right to sell the property and that there are no undisclosed liens or claims against it. While a Quitclaim Deed transfers interest without guarantees, an Affidavit of Title provides additional assurance to the buyer regarding the seller's ownership.

A Leasehold Deed conveys a property for a specified period, typically for leasing purposes. While a Quitclaim Deed transfers ownership outright, a Leasehold Deed allows the lessee to use the property for a set time while the lessor retains ownership. This type of document is common in rental agreements and can be beneficial for both parties when clear terms are established.

For individuals interested in acquiring a horse, utilizing a well-prepared document is vital. The process can start with understanding the importance of a comprehensive Horse Bill of Sale form, which you can find more about here.

Lastly, a Life Estate Deed is a unique form of property transfer that grants ownership to one person for their lifetime, after which the property passes to another designated individual. This differs from a Quitclaim Deed, which transfers ownership immediately and without conditions. A Life Estate Deed allows for continued use and enjoyment of the property while planning for future ownership, making it a valuable tool for estate planning.

Check out Popular Quitclaim Deed Forms for Different States

Florida Quit Claim Deed Rules - A quitclaim deed is often used in divorce settlements, where one spouse transfers their interest to another.

Quit Claim Deed Cost - This document is often used to clear up title issues.

The USCIS I-9 form is a critical document for employers, designed to verify the identity and employment authorization of individuals hired for work in the United States. To avoid any ambiguities, it is important to understand the form's requirements thoroughly, and one resource that can help is documentonline.org/blank-uscis-i-9/, which provides access to the blank USCIS I-9. This understanding aids both employers and employees in navigating the hiring process more effectively and ensures compliance with federal regulations.

Quitclaim Deed Form Pennsylvania - A Quitclaim Deed can be a valuable tool in informal agreements for property transfers among acquaintances.

How to File a Quitclaim Deed in Virginia - It can also help in transferring property to a business entity.