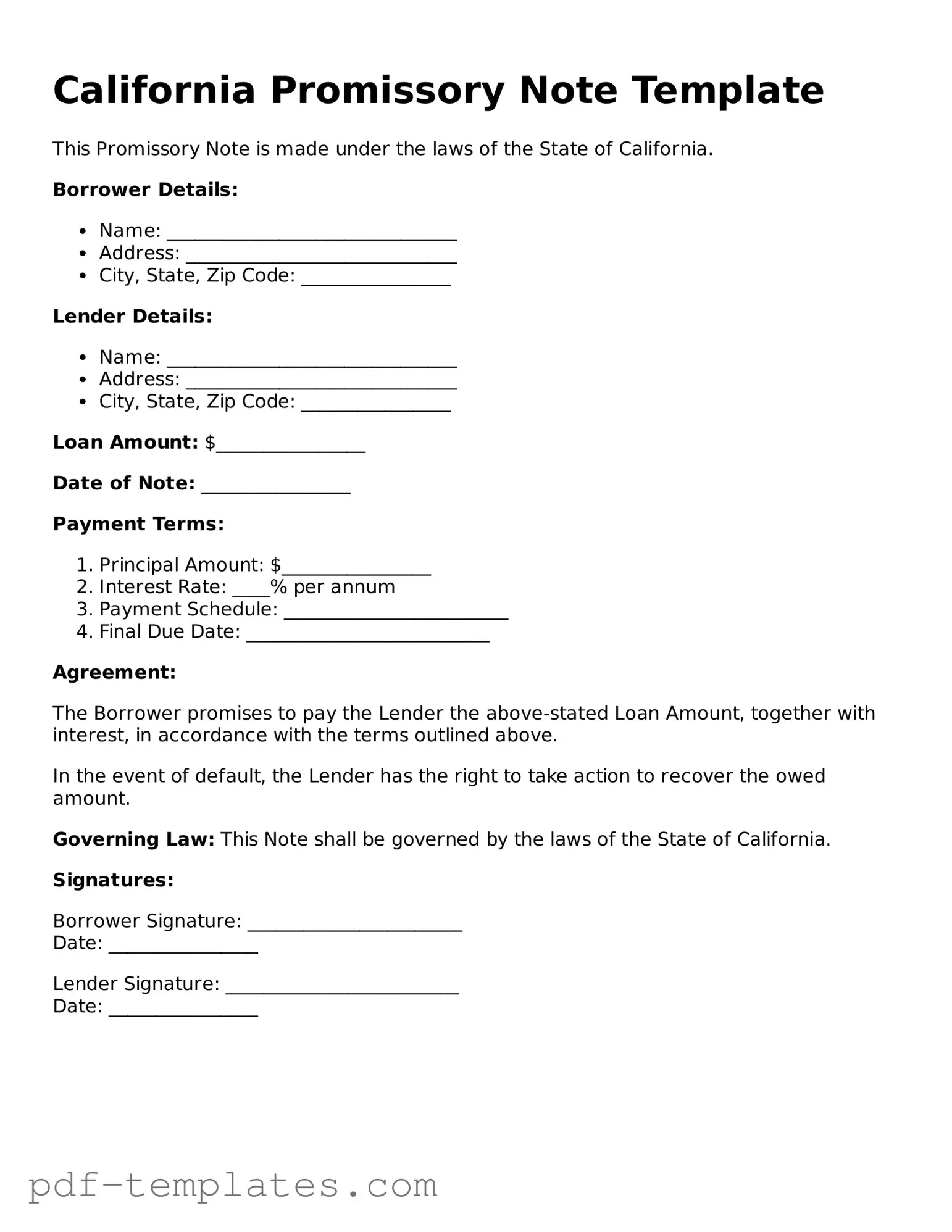

Official Promissory Note Template for California State

In the world of finance and personal lending, a California Promissory Note serves as a crucial document that outlines the terms of a loan agreement between a borrower and a lender. This form not only specifies the amount borrowed but also details the interest rate, repayment schedule, and any penalties for late payments. It creates a clear understanding of the obligations each party has, ensuring that both the lender and borrower are on the same page. The California Promissory Note is designed to protect the interests of both parties by providing a written record of the agreement, which can be essential in case of disputes. Additionally, it may include provisions for collateral, which can further secure the loan. Understanding the key components of this form is vital for anyone considering borrowing or lending money in California, as it lays the groundwork for a trustworthy financial relationship.

Misconceptions

Understanding the California Promissory Note form can be tricky. Here are six common misconceptions that people often have:

- All Promissory Notes are the same. Many believe that all promissory notes are identical. In reality, they can vary significantly based on terms, conditions, and state laws.

- A Promissory Note must be notarized. Some think that notarization is a requirement for all promissory notes. However, while notarization can add an extra layer of security, it is not legally required in California.

- Only banks can issue Promissory Notes. There’s a misconception that only financial institutions can create these documents. In fact, individuals can also draft and use promissory notes for personal loans.

- Promissory Notes are only for large loans. Many people assume that promissory notes are only necessary for significant amounts of money. However, they can be used for any amount, big or small.

- Verbal agreements are just as binding as written notes. Some believe that a verbal promise is enough. In reality, having a written promissory note provides clear evidence of the agreement and its terms.

- Once signed, a Promissory Note cannot be changed. It’s a common belief that a signed note is set in stone. In truth, parties can modify the terms, but any changes must be documented and agreed upon by both parties.

By clarifying these misconceptions, individuals can better navigate the use of promissory notes in California.

California Promissory Note: Usage Instruction

After obtaining the California Promissory Note form, it's essential to fill it out accurately to ensure all parties understand the terms of the agreement. Follow these steps carefully to complete the form correctly.

- Begin by entering the date at the top of the form. This should be the date on which the note is being executed.

- In the first blank, write the name of the borrower. This is the individual or entity receiving the loan.

- Next, fill in the address of the borrower. Include the street address, city, state, and zip code.

- In the section for the lender's information, write the name of the lender. This could be an individual or a financial institution.

- Provide the lender's address, ensuring to include the street address, city, state, and zip code.

- Specify the principal amount of the loan in the designated space. This is the total amount being borrowed.

- Indicate the interest rate that will apply to the loan. This should be expressed as a percentage.

- Fill in the repayment terms. Specify how long the borrower has to repay the loan and any specific payment schedule (e.g., monthly, quarterly).

- In the section for late fees, state the amount that will be charged if payments are not made on time.

- Lastly, both the borrower and lender should sign and date the form at the bottom to make it legally binding.

Once the form is completed and signed, ensure that both parties retain a copy for their records. This will provide clarity and serve as a reference in the future.

Common mistakes

-

Not including all necessary information: Failing to fill out essential details such as the names of the borrower and lender, the loan amount, and the interest rate can render the note incomplete.

-

Incorrectly stating the interest rate: Miscalculating or misrepresenting the interest rate can lead to disputes later. Ensure the rate is clear and accurate.

-

Omitting payment terms: Not specifying the repayment schedule, including due dates and payment amounts, can create confusion about when payments are expected.

-

Ignoring state laws: California has specific requirements for promissory notes. Ignoring these can affect the enforceability of the document.

-

Failing to sign: Both parties must sign the document. A lack of signatures can invalidate the note.

-

Not dating the note: Failing to include the date on which the note is executed can create ambiguity regarding the start of the loan period.

-

Using vague language: Ambiguous terms can lead to misunderstandings. Clear and precise language is essential for all terms and conditions.

-

Neglecting to keep copies: Not retaining copies of the signed note for both parties can lead to disputes over the terms of the agreement.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | A California Promissory Note is a written promise to pay a specific amount of money at a specified time. |

| Governing Law | The California Uniform Commercial Code (UCC) governs promissory notes in California. |

| Parties Involved | Typically, there are two parties: the borrower (maker) and the lender (payee). |

| Interest Rate | The note can specify an interest rate, which must comply with California usury laws. |

| Payment Terms | Payment terms can be flexible, including lump-sum payments or installments over time. |

| Default Clauses | Many notes include clauses detailing what happens in case of default, such as late fees or acceleration of payment. |

| Security | A promissory note can be unsecured or secured by collateral, depending on the agreement. |

| Enforceability | For the note to be enforceable, it must be signed by the borrower and include essential terms like the amount and payment schedule. |

Dos and Don'ts

When filling out the California Promissory Note form, it’s important to follow certain guidelines to ensure accuracy and compliance. Here are five things you should and shouldn't do:

- Do read the entire form carefully before starting to fill it out.

- Don't leave any required fields blank; incomplete forms may be rejected.

- Do use clear and legible handwriting or type your responses.

- Don't use abbreviations or unclear terms that might confuse the reader.

- Do double-check all figures and terms to ensure they are correct.

Similar forms

A California Promissory Note is similar to a Loan Agreement. Both documents outline the terms of a loan, including the amount borrowed, interest rate, and repayment schedule. However, while a promissory note is a simpler, more straightforward document that focuses primarily on the promise to repay, a loan agreement often includes additional terms and conditions, such as collateral requirements and default clauses. This makes a loan agreement more comprehensive, providing both parties with a clearer understanding of their rights and obligations.

Another document that shares similarities with a California Promissory Note is a Mortgage. A mortgage is a specific type of loan secured by real property. Like a promissory note, it includes the terms of repayment and the amount borrowed. However, a mortgage also involves a legal claim against the property, which means that if the borrower fails to repay, the lender can take possession of the property. This added layer of security distinguishes mortgages from standard promissory notes, which may not involve collateral.

Understanding the importance of a Power of Attorney for a Child can ensure that your child's needs are met in emergencies or unforeseen situations when primary caregivers are unavailable.

A Deed of Trust is also akin to a California Promissory Note. In fact, a deed of trust is often used in conjunction with a promissory note when real estate is involved. Similar to a mortgage, a deed of trust secures the loan with property. The borrower (trustor) conveys the property to a third party (trustee) until the loan is paid off. This document outlines the same basic repayment terms as a promissory note but adds the layer of a trustee to facilitate the loan process and protect the lender's interests.

Additionally, an IOU can be compared to a California Promissory Note. An IOU is a simple acknowledgment of a debt, often less formal than a promissory note. While both documents recognize that money is owed, an IOU typically lacks detailed repayment terms and conditions. It serves as a basic reminder of the debt, whereas a promissory note provides a more structured approach, including specifics on interest rates and payment schedules.

Lastly, a Credit Agreement is similar to a California Promissory Note in that both involve borrowing funds. A credit agreement is often used in business transactions and can cover multiple loans or credit lines. Like a promissory note, it outlines the terms of borrowing, but it can be much more complex, detailing various fees, covenants, and conditions that the borrower must adhere to. This makes credit agreements more suited for larger or ongoing borrowing needs compared to the straightforward nature of a promissory note.

Check out Popular Promissory Note Forms for Different States

Promissory Note Texas - The form may specify how disputes over payment will be resolved.

Understanding the details of the California Agreement Room form is crucial for both landlords and tenants, as it ensures that all parties are aware of their obligations and rights in the rental process. For comprehensive guidance, refer to All California Forms to obtain various relevant documents and resources.

Blank Promissory Note - A record of terms can simplify future repayment discussions.

Promissory Note Florida - Borrowers may need to provide collateral for secured promissory notes.

New York Promissory Note - With a Promissory Note, the borrower acknowledges their debt and agrees to the repayment terms.