Official Prenuptial Agreement Template for California State

When couples decide to marry, they often consider how a prenuptial agreement can protect their interests and clarify their financial responsibilities. In California, a prenuptial agreement, commonly referred to as a prenup, serves as a legal document that outlines the distribution of assets and debts in the event of a divorce or separation. This agreement allows both parties to define their property rights and financial obligations before entering into marriage. Key aspects of the California Prenuptial Agreement form include the identification of separate and community property, provisions for spousal support, and the handling of debts incurred during the marriage. Additionally, the form must be executed voluntarily by both parties, ensuring that each person fully understands the terms and implications of the agreement. By addressing these important issues ahead of time, couples can foster open communication and set a solid foundation for their future together.

Misconceptions

Many individuals considering a California Prenuptial Agreement may hold misconceptions that could impact their understanding and decision-making. Below are seven common misconceptions explained.

- Prenuptial agreements are only for the wealthy. Many people believe that only those with significant assets need a prenup. In reality, anyone can benefit from a prenuptial agreement, regardless of financial status. It can help clarify expectations and protect both parties.

- Prenuptial agreements are unromantic. Some think that discussing a prenup signals a lack of trust or love. However, having a clear agreement can actually foster open communication and strengthen a relationship by setting mutual expectations.

- All prenuptial agreements are the same. This is not true. Prenuptial agreements can be tailored to fit the specific needs and circumstances of each couple. It is essential to customize the agreement to reflect individual situations.

- Prenuptial agreements are not enforceable. While there are specific requirements for enforceability, a well-drafted prenuptial agreement is legally binding in California. It is crucial to follow the proper legal guidelines to ensure validity.

- You cannot change a prenuptial agreement once it is signed. While a prenup is a contract, it can be modified or revoked if both parties agree. Regular reviews and updates can help keep the agreement relevant as circumstances change.

- Prenuptial agreements only cover financial assets. Although financial matters are a primary focus, prenuptial agreements can also address issues such as debt, property division, and even personal matters like responsibilities during marriage.

- You need a lawyer to create a prenuptial agreement. While it is highly recommended to consult a lawyer for legal advice, couples can prepare a prenup themselves. However, having legal assistance can ensure that the agreement meets all legal requirements and protects both parties.

Understanding these misconceptions can help couples make informed decisions about prenuptial agreements and ensure that their interests are protected.

California Prenuptial Agreement: Usage Instruction

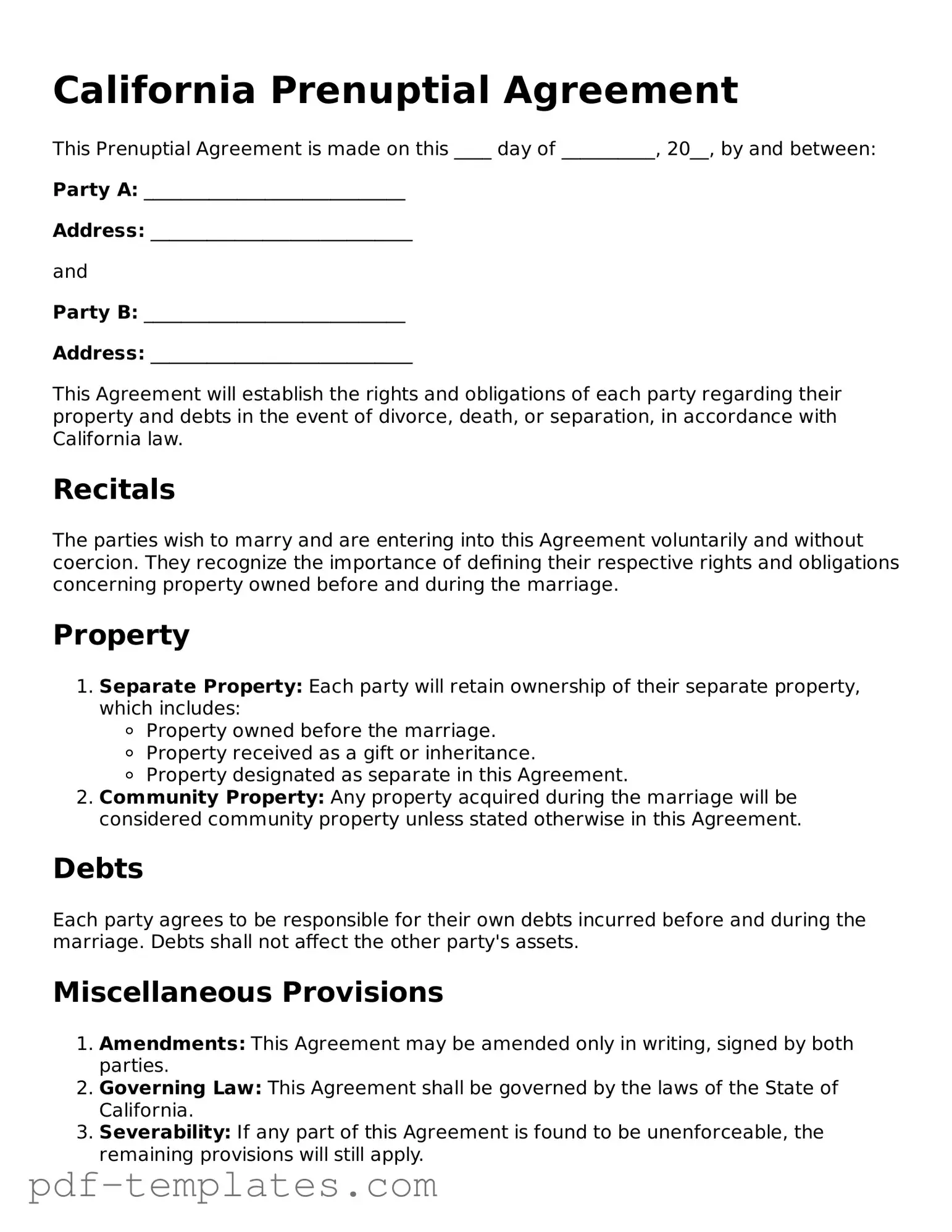

Completing the California Prenuptial Agreement form is an important step in preparing for your marriage. This document will outline the financial and property rights of each partner, helping to establish clarity and mutual understanding. Follow the steps below to fill out the form accurately.

- Obtain the form: Download the California Prenuptial Agreement form from a reliable legal website or obtain a physical copy from a legal office.

- Read the instructions: Carefully review any accompanying instructions to understand the requirements and implications of the agreement.

- Provide personal information: Fill in your full name and the full name of your partner at the top of the form.

- List assets: Clearly describe all assets owned by each party, including property, bank accounts, investments, and any other significant financial interests.

- Detail debts: Include all debts for both parties. This may consist of loans, credit card debt, or other financial obligations.

- Specify terms: Clearly outline the terms of the agreement, including how assets and debts will be handled in the event of divorce or separation.

- Include signatures: Both parties must sign the document in the presence of a notary public to ensure it is legally binding.

- Make copies: After notarization, make several copies of the signed agreement for each party and for legal records.

Common mistakes

-

Failing to Fully Disclose Assets and Debts: One of the most critical mistakes is not providing a complete and honest account of all assets and debts. Each party should list everything they own, including real estate, bank accounts, investments, and any liabilities. Incomplete disclosures can lead to the agreement being challenged in court.

-

Not Understanding the Legal Implications: Many individuals do not take the time to understand what a prenuptial agreement entails. It is essential to grasp how the agreement affects property rights and financial responsibilities. Without this understanding, individuals may agree to terms that do not serve their best interests.

-

Using Ambiguous Language: Clarity is vital in a prenuptial agreement. Vague terms can create confusion and lead to disputes in the future. Each clause should be straightforward, outlining specific rights and obligations to avoid misinterpretation.

-

Neglecting to Seek Legal Advice: Some individuals attempt to fill out the form without consulting a legal professional. This can result in overlooking important legal requirements or making errors that could invalidate the agreement. It is always wise to have a lawyer review the document to ensure it meets all legal standards.

PDF Features

| Fact Name | Details |

|---|---|

| Definition | A prenuptial agreement, often called a prenup, is a contract between two individuals before marriage that outlines the division of assets and responsibilities in the event of divorce or separation. |

| Governing Law | California Family Code Sections 1600-1617 govern prenuptial agreements in California. |

| Voluntary Agreement | Both parties must enter into the agreement voluntarily, without any coercion or undue pressure. |

| Full Disclosure | Each party is required to provide a fair and reasonable disclosure of their financial situation, including assets and debts. |

| Written Requirement | California law mandates that prenuptial agreements must be in writing to be enforceable. |

| Independent Counsel | While not required, it is highly recommended that both parties seek independent legal counsel to ensure their interests are protected. |

| Enforceability | A prenup can be challenged in court if it is deemed unfair or if one party did not understand the terms at the time of signing. |

| Modification and Revocation | Couples can modify or revoke a prenuptial agreement after marriage, but this must also be done in writing. |

Dos and Don'ts

When filling out the California Prenuptial Agreement form, it's important to keep a few key points in mind. Here’s a straightforward list of things to do and avoid.

- Do discuss your intentions openly with your partner.

- Do be honest about your financial situation.

- Do consult with a lawyer to ensure everything is clear.

- Do make sure both parties sign the agreement willingly.

- Do keep copies of the signed agreement for your records.

- Don't rush the process; take your time to understand everything.

- Don't hide any assets or debts from your partner.

- Don't use vague language; be specific about your terms.

- Don't forget to update the agreement if your financial situation changes.

Following these guidelines can help ensure that your prenuptial agreement is clear and fair for both parties.

Similar forms

A Cohabitation Agreement is similar to a prenuptial agreement in that it outlines the rights and responsibilities of partners who live together without being married. This document addresses property ownership, financial obligations, and other important aspects of the relationship. Like a prenuptial agreement, it can help prevent disputes by clearly defining terms before any conflicts arise.

A Postnuptial Agreement is another document that serves a purpose similar to a prenuptial agreement. It is created after a couple gets married and can cover similar topics, such as asset division and financial responsibilities. This agreement is useful for couples who may have experienced changes in their financial situation or who want to clarify their arrangements after marriage.

The USCIS I-864 form, also known as the Affidavit of Support, is a critical document used in family-based immigration processes. It serves as a pledge from a sponsor to financially support an immigrant, ensuring they will not become dependent on government assistance. This form is essential for those seeking permanent residency in the United States, binding the sponsor to specific financial obligations. For more details, you can visit documentonline.org/blank-uscis-i-864/.

A Divorce Settlement Agreement is created during the divorce process and addresses how the couple will divide their assets and responsibilities. This document shares similarities with a prenuptial agreement as both aim to clarify financial matters. However, while a prenuptial agreement is established before marriage, a divorce settlement is made after the relationship has ended.

A Property Settlement Agreement is often used in divorce cases to outline how marital property will be divided. This document is similar to a prenuptial agreement in that it addresses the division of assets and liabilities. Both documents help to clarify ownership and responsibilities, reducing the likelihood of disputes during or after the divorce process.

An Estate Plan is another document that can relate to a prenuptial agreement. While it primarily focuses on how a person's assets will be distributed after their death, it can also address how assets acquired during marriage will be handled. Both documents aim to protect individual interests and provide clarity regarding financial matters, whether during life or after death.

A Financial Disclosure Statement is a document that both parties may complete when entering into a prenuptial agreement. It lists each person's assets, debts, and income. This transparency is crucial for ensuring that both parties fully understand each other's financial situations. By sharing this information, couples can make informed decisions and avoid misunderstandings in their prenuptial agreement.

Check out Popular Prenuptial Agreement Forms for Different States

Virginia Prenuptial Contract - A prenuptial agreement can provide an organized way to approach financial planning.

Pennsylvania Prenuptial Contract - It may be customized to address specific needs of the couple.

Understanding the intricacies of the Request for Authorization for Medical Treatment (DWC Form RFA) is essential for employees navigating the California Division of Workers’ Compensation system, as it provides a structured way to request medical services following an occupational injury or illness. To aid in this process, it's helpful to review All California Forms, which offer further guidance and resources related to the necessary documentation and reporting required for an effective treatment request.

Florida Prenuptial Contract - A Prenuptial Agreement addresses spousal support arrangements.

Washington Prenuptial Contract - A clear prenup can enhance trust and transparency between partners.