Official Power of Attorney Template for California State

In California, the Power of Attorney form serves as a crucial legal document that empowers individuals to designate someone else to make decisions on their behalf. This arrangement can be particularly important in situations where a person may become incapacitated or unable to manage their affairs. The form allows for a range of powers, which can include managing financial transactions, making healthcare decisions, and handling real estate matters. Importantly, the document can be tailored to suit specific needs, enabling the principal to grant limited or broad authority to the agent. Furthermore, California law outlines specific requirements for the validity of the Power of Attorney, including the necessity for the principal's signature and, in some cases, notarization. Understanding the nuances of this form is essential for ensuring that personal wishes are honored and that the appointed agent acts in the best interest of the principal. By taking the time to create a Power of Attorney, individuals can provide peace of mind for themselves and their loved ones, knowing that their affairs will be managed according to their preferences if the need arises.

Misconceptions

Understanding the California Power of Attorney form is crucial for making informed decisions. However, several misconceptions can lead to confusion. Here are five common misconceptions:

- It is only for financial matters. Many believe that a Power of Attorney (POA) can only handle financial transactions. In reality, a POA can also cover healthcare decisions, legal matters, and other personal affairs.

- Once signed, it cannot be revoked. Some think that signing a POA is a permanent decision. However, you can revoke or change your POA at any time as long as you are mentally competent.

- Only lawyers can create a Power of Attorney. While consulting a lawyer can be beneficial, it is not mandatory. Individuals can create a valid POA using templates or forms available online.

- All Power of Attorney forms are the same. This is a common misunderstanding. Different types of POAs exist, each serving specific purposes, such as durable, medical, or limited POAs. Choosing the right type is essential.

- Agents have unlimited power. Many fear that granting a POA gives agents unchecked authority. In fact, the powers granted can be limited and specified in the document, ensuring control over what the agent can do.

Being aware of these misconceptions can help you navigate the process more effectively. Make informed choices when it comes to your Power of Attorney needs.

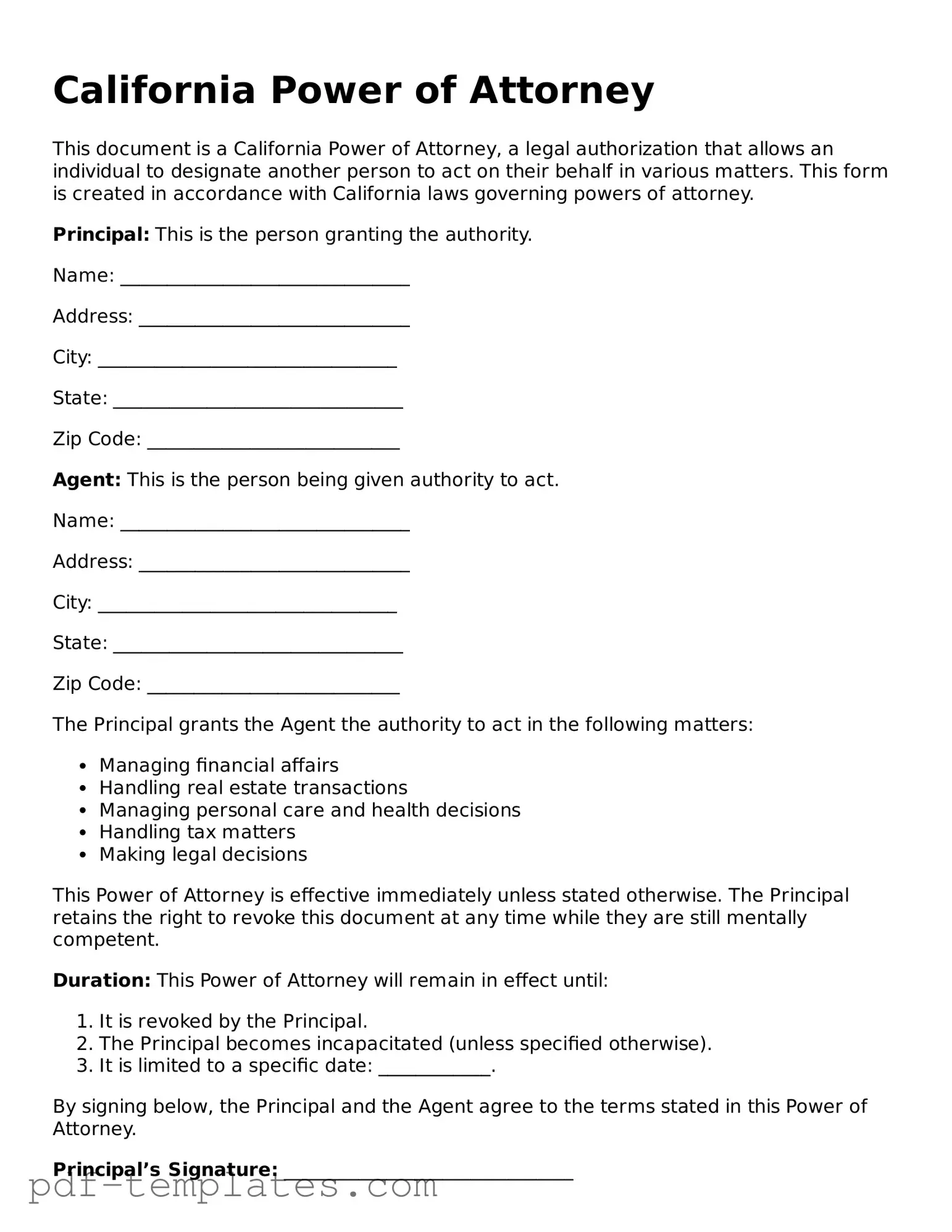

California Power of Attorney: Usage Instruction

Filling out the California Power of Attorney form is an important step in designating someone to act on your behalf in financial or legal matters. After completing the form, ensure that you have it signed and notarized to make it legally binding.

- Obtain the California Power of Attorney form. You can download it from a reliable legal website or visit a local legal office.

- Read through the form carefully to understand the sections you need to fill out.

- In the first section, provide your full name and address. This is the information of the person granting the power.

- Next, fill in the name and address of the person you are appointing as your agent. This person will act on your behalf.

- Specify the powers you wish to grant your agent. You can choose general powers or specific ones based on your needs.

- Indicate any limitations on the powers you are granting, if applicable.

- Sign and date the form in the designated area. Ensure your signature matches your legal name.

- Have the form notarized. This step is crucial for the form to be legally valid.

- Make copies of the signed and notarized form for your records and for your agent.

Common mistakes

-

Not clearly identifying the principal. It is important to include the full name and address of the person granting the power of attorney.

-

Failing to specify the powers granted. The form should clearly outline what decisions the agent can make on behalf of the principal.

-

Not signing the form properly. The principal must sign the document in the appropriate section, and it may need to be witnessed or notarized.

-

Choosing an unsuitable agent. Selecting someone who is not trustworthy or capable of handling the responsibilities can lead to problems.

-

Leaving sections blank. All relevant sections should be completed to avoid confusion about the powers granted.

-

Not updating the form when circumstances change. It is crucial to revise the document if there are changes in relationships or health status.

-

Ignoring state-specific requirements. Each state has its own rules regarding power of attorney forms, so it is essential to follow California’s guidelines.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | A Power of Attorney (POA) is a legal document that allows one person to act on behalf of another in legal or financial matters. |

| Governing Law | In California, the Power of Attorney is governed by the California Probate Code, specifically sections 4000-4545. |

| Types of POA | California recognizes several types of POA, including General, Durable, and Limited Power of Attorney. |

| Durability | A Durable Power of Attorney remains effective even if the principal becomes incapacitated, unlike a regular POA. |

| Agent's Authority | The agent's authority can be broad or limited, depending on how the document is drafted. |

| Signing Requirements | For a California Power of Attorney to be valid, it must be signed by the principal and notarized or witnessed by two individuals. |

| Revocation | The principal can revoke the Power of Attorney at any time, as long as they are mentally competent. |

| Agent's Responsibilities | The agent must act in the best interest of the principal and keep accurate records of all transactions made on their behalf. |

| Use Cases | Common uses for a Power of Attorney include managing finances, making healthcare decisions, and handling real estate transactions. |

Dos and Don'ts

When filling out the California Power of Attorney form, it is essential to approach the task with care and attention to detail. This document grants someone the authority to act on your behalf in various matters, so accuracy is crucial. Here are seven important dos and don’ts to keep in mind:

- Do clearly identify yourself and the person you are appointing as your agent. Include full names and addresses.

- Do specify the powers you are granting. Be clear about what decisions your agent can make on your behalf.

- Do date and sign the form in the presence of a notary public or witnesses, as required by California law.

- Do review the completed form carefully to ensure all information is accurate and complete.

- Don't leave any sections blank. Unfilled areas can lead to confusion or misinterpretation of your intentions.

- Don't appoint someone who may have conflicting interests or who you do not trust to act in your best interest.

- Don't forget to provide copies of the signed document to your agent and any relevant institutions, such as banks or healthcare providers.

Similar forms

The California Advance Healthcare Directive is similar to the Power of Attorney in that it allows individuals to designate someone to make medical decisions on their behalf. This document combines a power of attorney for healthcare with a living will, outlining preferences for medical treatment in situations where the individual cannot communicate their wishes. Both documents require clear identification of the principal and the agent, ensuring that the designated person understands the authority granted to them.

The Durable Power of Attorney is another document that shares similarities with the California Power of Attorney. It remains effective even if the principal becomes incapacitated. This type of power of attorney can cover a wide range of financial and legal decisions, allowing the agent to manage the principal's affairs without interruption. Like the California version, it must be signed and witnessed to be valid.

The Financial Power of Attorney focuses specifically on financial matters, allowing an agent to handle banking, investments, and property transactions. While the California Power of Attorney can encompass both financial and healthcare decisions, the Financial Power of Attorney is tailored for those who wish to delegate only financial responsibilities. Both documents require the principal to be of sound mind when signing and must be executed according to state laws.

The Living Will is closely related to the California Advance Healthcare Directive but serves a more specific purpose. It outlines an individual's preferences regarding end-of-life care and medical treatments in situations where they cannot express their wishes. While the Power of Attorney grants authority to an agent, the Living Will communicates the principal's desires directly to healthcare providers, ensuring that their choices are respected.

The Revocable Trust is a legal document that allows an individual to place their assets into a trust during their lifetime, with the ability to modify or revoke it at any time. Similar to the Power of Attorney, it facilitates the management of assets and can help avoid probate. However, while the Power of Attorney designates someone to act on behalf of the principal, a trust holds and manages the assets directly.

The Healthcare Proxy is another document that allows an individual to appoint someone to make medical decisions on their behalf. It is similar to the California Power of Attorney in that it focuses on healthcare decisions. The proxy acts in accordance with the principal's wishes and best interests, ensuring that their healthcare preferences are honored when they are unable to communicate them.

The Springing Power of Attorney activates only under specific conditions, such as the principal's incapacitation. This feature differentiates it from the California Power of Attorney, which can be effective immediately or upon a certain event. Both documents require careful drafting to ensure clarity regarding when the authority is granted and the powers bestowed upon the agent.

The Special Power of Attorney grants authority to an agent for specific tasks or transactions, rather than general authority. This contrasts with the California Power of Attorney, which can provide broad powers. Both documents require the principal to clearly outline the scope of authority granted to the agent to avoid misunderstandings.

The Medical Power of Attorney is specifically designed for healthcare decisions, allowing an agent to make medical choices on behalf of the principal. It is similar to the California Power of Attorney for healthcare, as both documents focus on medical decision-making. However, the Medical Power of Attorney may not include end-of-life preferences, which are typically addressed in a separate Living Will or Advance Healthcare Directive.

The Guardianship Document appoints a guardian for a minor or an incapacitated adult, similar to how a Power of Attorney designates an agent for decision-making. While the Power of Attorney allows for the management of affairs, a guardianship involves a court process to establish the guardian's authority. Both documents aim to protect the interests of individuals who cannot manage their own affairs.

Check out Popular Power of Attorney Forms for Different States

Florida Power of Attorney - This form enables you to appoint someone to manage your affairs if you are unable to do so.

Pa Power of Attorney Form - It is important to choose an agent who will act in the principal's best interests.