Official Operating Agreement Template for California State

When starting a business in California, particularly a limited liability company (LLC), one of the most important documents to consider is the Operating Agreement. This essential form outlines the management structure and operational procedures of the LLC, serving as a roadmap for its members. It details the roles and responsibilities of each member, how profits and losses will be distributed, and the process for making important business decisions. Additionally, the Operating Agreement addresses what happens if a member wants to leave the company or if new members join. By clearly defining these aspects, the agreement helps prevent misunderstandings and disputes among members, ensuring smoother operations. While California law does not require an Operating Agreement for an LLC, having one in place is highly recommended to protect the interests of all members and provide clarity in various situations. Understanding the key elements of this form can empower business owners to create a solid foundation for their venture.

Misconceptions

Many people have misunderstandings about the California Operating Agreement form. These misconceptions can lead to confusion and mistakes when forming a business entity. Here are seven common misconceptions:

- It is only necessary for large businesses. Many believe that only large companies need an Operating Agreement. In reality, even small businesses benefit from having one. It outlines management structure and operational procedures, which are crucial for any business size.

- It is a legally required document. Some think that an Operating Agreement is mandatory in California. While it is not required by law, it is highly recommended. Having one can help avoid disputes among members and clarify roles.

- It cannot be changed once created. There is a belief that an Operating Agreement is set in stone. In fact, it can be amended as needed. Members can agree to changes, allowing the document to evolve with the business.

- It only covers financial matters. Some assume that the Operating Agreement focuses solely on finances. However, it also addresses management roles, decision-making processes, and member responsibilities, providing a comprehensive framework for the business.

- All members must sign the agreement. There is a misconception that every member must sign the Operating Agreement for it to be valid. While it is best practice to have all members sign, the agreement can still be effective if it is adopted by a majority.

- It is the same as the Articles of Organization. Many confuse the Operating Agreement with the Articles of Organization. The Articles establish the business with the state, while the Operating Agreement governs internal operations and member relations.

- It can be a verbal agreement. Some think that a verbal agreement suffices. However, having a written Operating Agreement is essential. It provides clarity and serves as a reference point in case of disputes.

Understanding these misconceptions can help ensure that business owners in California create effective Operating Agreements that support their operations and protect their interests.

California Operating Agreement: Usage Instruction

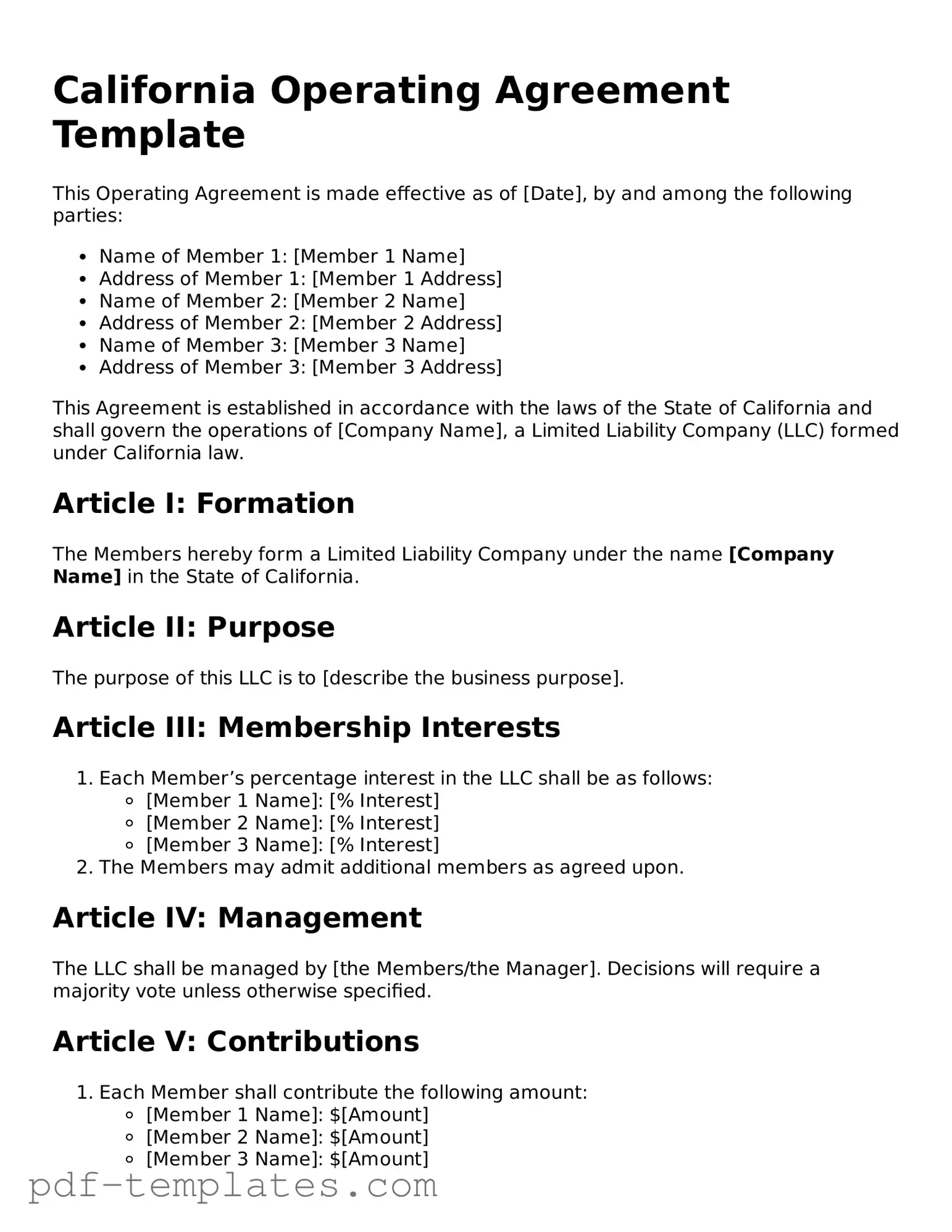

After gathering the necessary information, you are ready to fill out the California Operating Agreement form. This document is essential for outlining the structure and rules of your limited liability company (LLC). Follow these steps carefully to ensure that all required sections are completed accurately.

- Begin by entering the name of your LLC at the top of the form. Ensure that the name matches the one registered with the state.

- Next, provide the principal office address. This should be a physical location where your business is conducted.

- List the names and addresses of all members of the LLC. Each member's role and contribution should be clearly stated.

- Define the management structure of your LLC. Indicate whether it will be member-managed or manager-managed.

- Outline the purpose of the LLC. A brief description of the business activities will suffice.

- Specify the duration of the LLC. You can choose to have it exist indefinitely or for a specific term.

- Detail the capital contributions of each member. Include both cash and non-cash contributions, if applicable.

- Include provisions for profit and loss distribution. Clearly explain how profits and losses will be shared among members.

- Address the process for adding or removing members in the future. This should include any necessary voting requirements.

- Finally, have all members sign and date the agreement. This signifies their acceptance of the terms outlined in the document.

With the form completed and signed, you can proceed to keep it with your business records. It’s advisable to consult with a legal professional to ensure compliance with all regulations and to address any specific needs your LLC may have.

Common mistakes

-

Not including all members: It’s important to list all members of the LLC. Omitting a member can lead to confusion and potential disputes later on.

-

Incorrect member information: Ensure that names and addresses are accurate. Errors can cause issues with legal notices and communications.

-

Failure to define roles: Clearly outline each member's role and responsibilities. This helps prevent misunderstandings about who is in charge of what.

-

Not addressing profit distribution: Specify how profits and losses will be shared among members. Without this, disputes may arise over financial matters.

-

Ignoring amendment procedures: Include a process for making changes to the agreement. This ensures that the document can be updated as needed.

-

Missing a signature: All members must sign the agreement. A missing signature can render the document ineffective.

-

Neglecting state requirements: Familiarize yourself with California’s specific requirements for operating agreements. Failing to comply can lead to legal complications.

PDF Features

| Fact Name | Details |

|---|---|

| Purpose | The California Operating Agreement outlines the management structure and operating procedures of a Limited Liability Company (LLC). |

| Governing Law | This agreement is governed by the California Corporations Code, specifically sections related to LLCs. |

| Members | All members of the LLC should be included in the agreement, detailing their rights and responsibilities. |

| Flexibility | California allows LLCs to customize their Operating Agreements to fit their specific needs. |

| Not Mandatory | While an Operating Agreement is not required by law in California, it is highly recommended for clarity and protection. |

| Dispute Resolution | The agreement can include provisions for resolving disputes among members, which can help avoid costly litigation. |

| Amendments | Members can amend the Operating Agreement as needed, ensuring it remains relevant to the LLC's operations. |

| Tax Treatment | The Operating Agreement can specify how profits and losses are allocated among members for tax purposes. |

Dos and Don'ts

When filling out the California Operating Agreement form, it's important to follow specific guidelines to ensure accuracy and compliance. Here are five things you should and shouldn't do:

- Do read the entire form carefully before starting.

- Don't leave any required fields blank.

- Do provide accurate information about all members and their roles.

- Don't use vague language; be clear and precise in your descriptions.

- Do review the completed form for errors before submission.

Similar forms

The California Operating Agreement is similar to a Partnership Agreement, which outlines the roles, responsibilities, and profit-sharing arrangements among partners in a business. Like the Operating Agreement, a Partnership Agreement serves as a foundational document that governs the internal operations of the partnership. Both documents aim to clarify expectations and protect the interests of the parties involved. They detail how decisions are made, how profits and losses are distributed, and the procedures for adding or removing partners, ensuring smooth operations and minimizing disputes.

For those looking to establish an agreement for room rentals, a thorough understanding of the detailed Texas Room Rental Agreement form is beneficial. This form clarifies the expectations and responsibilities of both the landlord and tenant, ensuring that all terms of the rental arrangement are well-defined from the outset.

Another document that shares similarities with the California Operating Agreement is the Bylaws of a corporation. Bylaws establish the rules for managing a corporation, including the roles of directors and officers, meeting protocols, and voting procedures. Just as an Operating Agreement governs the structure and operations of a limited liability company (LLC), Bylaws provide a framework for corporate governance. Both documents serve to protect the rights of members or shareholders and promote transparency in decision-making processes.

The Shareholder Agreement is also akin to the California Operating Agreement. This document is designed for corporations and outlines the rights and obligations of shareholders. It covers aspects such as share transfers, voting rights, and dispute resolution. Similar to an Operating Agreement, a Shareholder Agreement aims to prevent misunderstandings among shareholders and provide a clear roadmap for handling various situations that may arise during the life of the corporation. Both documents are essential for maintaining order and clarity in business relationships.

Lastly, the Membership Agreement resembles the California Operating Agreement in its purpose and structure. A Membership Agreement is often used by organizations that have members rather than owners, such as non-profits or cooperatives. It details the rights and responsibilities of members, how decisions are made, and the processes for admitting new members or removing existing ones. Like the Operating Agreement, this document seeks to establish a clear understanding among all parties involved, ensuring that everyone is on the same page regarding their roles and contributions.

Check out Popular Operating Agreement Forms for Different States

Create an Operating Agreement - This document can help prevent misunderstandings between members regarding business operations.

The registration process for out-of-state attorneys seeking to serve as in-house counsel in California is crucial, and it is essential to follow the specified steps to ensure compliance with state regulations. For those interested in more information, resources, and other necessary documentation, you can refer to All California Forms, which provide detailed guidance on the requirements and procedures involved.

How to Create an Operating Agreement - The Operating Agreement can establish guidelines for record-keeping and accounting practices.

Llc Set Up - It is essential for partnerships and multi-member LLCs.