Official Loan Agreement Template for California State

The California Loan Agreement form is a crucial document for anyone involved in lending or borrowing money in the state. This form outlines the terms and conditions of the loan, ensuring that both parties have a clear understanding of their rights and responsibilities. Key aspects of the agreement include the loan amount, interest rate, repayment schedule, and any fees associated with the loan. Additionally, it specifies the consequences of defaulting on the loan, providing a safety net for lenders. The form also allows for the inclusion of collateral, which can protect the lender’s investment. By detailing these important elements, the California Loan Agreement helps facilitate a smooth transaction and minimizes potential disputes between the borrower and lender.

Misconceptions

-

Misconception 1: The California Loan Agreement form is only for large loans.

This is not true. The form can be used for both small and large loans. It provides a structured way to outline the terms of any loan, regardless of the amount. Borrowers and lenders can benefit from having clear documentation, which helps avoid misunderstandings.

-

Misconception 2: The form is only applicable to personal loans.

While many people associate loan agreements with personal loans, the California Loan Agreement form is versatile. It can also be used for business loans, real estate transactions, and more. Its flexibility makes it a valuable tool for various lending situations.

-

Misconception 3: Once signed, the terms of the loan cannot be changed.

This is misleading. Although the loan agreement is a binding document, parties can negotiate changes to the terms if both agree. It is advisable to document any modifications in writing to ensure clarity and legal enforceability.

-

Misconception 4: A verbal agreement is sufficient without the form.

Relying solely on verbal agreements can lead to disputes and confusion. The California Loan Agreement form serves as a formal record of the terms agreed upon by both parties. It provides legal protection and clarity that verbal agreements often lack.

-

Misconception 5: The form is too complicated for the average person to understand.

While legal documents can seem daunting, the California Loan Agreement form is designed to be straightforward. It outlines essential terms in clear language, making it accessible for both borrowers and lenders. Understanding the form is crucial for ensuring that both parties are on the same page.

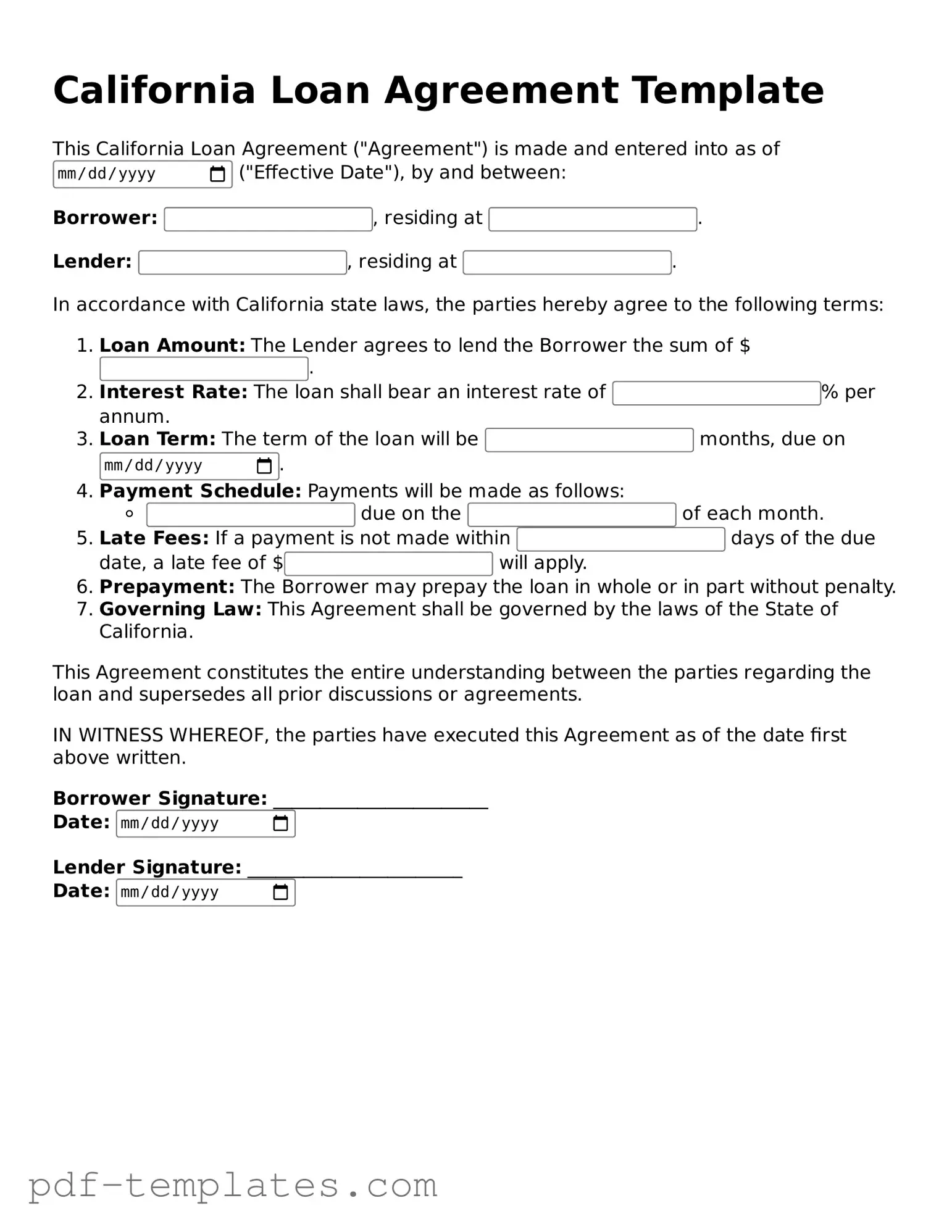

California Loan Agreement: Usage Instruction

Filling out the California Loan Agreement form requires careful attention to detail. Each section must be completed accurately to ensure that all parties understand their rights and obligations. Below are the steps to guide you through the process.

- Begin by entering the date at the top of the form. This is the date when the agreement is being created.

- Identify the parties involved in the loan. Fill in the names and addresses of both the lender and the borrower.

- Specify the loan amount. Clearly write the total amount being borrowed in both numerical and written form.

- Indicate the interest rate. Write down the percentage that will be charged on the loan amount.

- Detail the repayment terms. Include the start date for repayments, the frequency of payments (e.g., monthly), and the duration of the loan.

- Describe any collateral, if applicable. If the loan is secured by an asset, provide details about that asset.

- Include any additional terms or conditions. This may cover late fees, prepayment options, or other relevant stipulations.

- Both parties must sign and date the form. Ensure that signatures are clear and that the date of signing is included.

- Make copies of the completed form for both the lender and the borrower. This ensures that each party has a record of the agreement.

Common mistakes

-

Incomplete Information: One of the most common mistakes is failing to provide all required information. Each section must be filled out accurately. Missing details can lead to delays or even rejection of the loan.

-

Incorrect Dates: People often overlook the importance of accurate dates. Whether it’s the loan start date or the repayment schedule, errors can create confusion and potential legal issues.

-

Wrong Loan Amount: Entering an incorrect loan amount can have serious consequences. Make sure to double-check the numbers. An overestimated amount might lead to higher interest rates, while an underestimated amount could leave you short.

-

Missing Signatures: A signed agreement is crucial. Failing to sign the document, or not having all necessary parties sign, can invalidate the agreement.

-

Not Reading the Terms: Some individuals rush through the agreement without fully understanding the terms. Take the time to read and comprehend the obligations and rights outlined in the document.

-

Ignoring State Regulations: California has specific laws regarding loan agreements. Ignoring these regulations can result in unenforceable agreements. Familiarize yourself with state requirements before submitting the form.

PDF Features

| Fact Name | Description |

|---|---|

| Purpose | The California Loan Agreement form is used to outline the terms and conditions of a loan between a lender and a borrower. |

| Governing Law | This form is governed by the laws of the State of California, specifically under the California Civil Code. |

| Parties Involved | The form identifies two primary parties: the lender, who provides the funds, and the borrower, who receives the funds. |

| Loan Amount | The specific amount of money being loaned must be clearly stated in the agreement to avoid any misunderstandings. |

| Repayment Terms | Details regarding the repayment schedule, including interest rates and due dates, are essential components of the agreement. |

| Signatures | Both parties must sign the agreement to make it legally binding, indicating their acceptance of the terms. |

Dos and Don'ts

When filling out the California Loan Agreement form, it is essential to follow specific guidelines to ensure accuracy and compliance. Here are five important things to consider:

- Do read the entire form carefully before starting to fill it out.

- Do provide accurate and complete information to avoid delays.

- Do double-check all figures and calculations for correctness.

- Don't leave any required fields blank; this can lead to rejection.

- Don't use abbreviations or slang; clarity is crucial.

Similar forms

The California Loan Agreement form shares similarities with the Promissory Note. Both documents outline the terms of a loan, including the amount borrowed, interest rate, and repayment schedule. A Promissory Note is often a standalone document that emphasizes the borrower's promise to repay the loan, while the Loan Agreement may include additional terms and conditions that govern the relationship between the lender and borrower. This makes the Promissory Note more focused on the borrower's obligations, whereas the Loan Agreement provides a broader framework for the transaction.

Another document akin to the California Loan Agreement is the Security Agreement. A Security Agreement is used when a borrower pledges collateral to secure a loan. Similar to the Loan Agreement, it details the obligations of the borrower and the rights of the lender. However, the Security Agreement specifically addresses the collateral involved, outlining what happens if the borrower defaults. This added layer of security for the lender distinguishes it from the Loan Agreement, which may or may not involve collateral.

The USCIS I-864 form, also known as the Affidavit of Support, is a critical document used in family-based immigration processes. It serves as a pledge from a sponsor to financially support an immigrant, ensuring they will not become dependent on government assistance. This form is essential for those seeking permanent residency in the United States, binding the sponsor to specific financial obligations. For more information, you can visit https://documentonline.org/blank-uscis-i-864/.

The California Loan Agreement also resembles the Mortgage Agreement. A Mortgage Agreement is specifically used in real estate transactions where the property itself serves as collateral for the loan. Like the Loan Agreement, it outlines the terms of the loan, including the amount, interest rate, and repayment terms. However, the Mortgage Agreement includes specific provisions related to the property, such as what happens in the event of foreclosure. This makes it a more specialized version of a loan agreement tailored to real estate financing.

The Loan Agreement can be compared to the Line of Credit Agreement as well. A Line of Credit Agreement allows borrowers to access funds up to a certain limit, with the flexibility to borrow and repay multiple times. While both documents outline terms of borrowing, the Line of Credit Agreement is more dynamic, enabling borrowers to draw funds as needed. In contrast, the Loan Agreement typically involves a fixed amount borrowed at one time, with a defined repayment schedule.

In addition, the California Loan Agreement is similar to a Forbearance Agreement. A Forbearance Agreement is used when a borrower is struggling to meet repayment obligations and seeks temporary relief from the lender. Both documents involve negotiations between the borrower and lender regarding payment terms. However, the Forbearance Agreement focuses on modifying existing loan terms to provide immediate relief, while the Loan Agreement sets the initial terms of the loan.

Finally, the California Loan Agreement is akin to the Credit Card Agreement. A Credit Card Agreement outlines the terms under which a borrower can access credit through a credit card. Similar to the Loan Agreement, it includes interest rates, fees, and repayment terms. However, the Credit Card Agreement often includes revolving credit features, allowing borrowers to carry a balance and incur interest on unpaid amounts. This makes it more flexible but also more complex than a traditional Loan Agreement.

Check out Popular Loan Agreement Forms for Different States

Loan Agreement Template Florida - Provides options for refinancing or loan modifications in the future, if necessary.

The process of requesting medical treatment after a workplace injury can be complex, but it is essential to follow the necessary steps to ensure a quick recovery. The Request for Authorization for Medical Treatment (DWC Form RFA) plays a vital role in this process, as it allows employees to formally request medical services based on medical necessity. Including appropriate documentation, such as the Doctor’s First Report of Occupational Injury or Illness, helps to expedite the review process. For those navigating this procedure, resources such as All California Forms can provide valuable assistance in understanding the requirements and ensuring compliance with regulations.

Free Promissory Note Template Texas - It may stipulate the governing law for legal disputes.