Official Last Will and Testament Template for California State

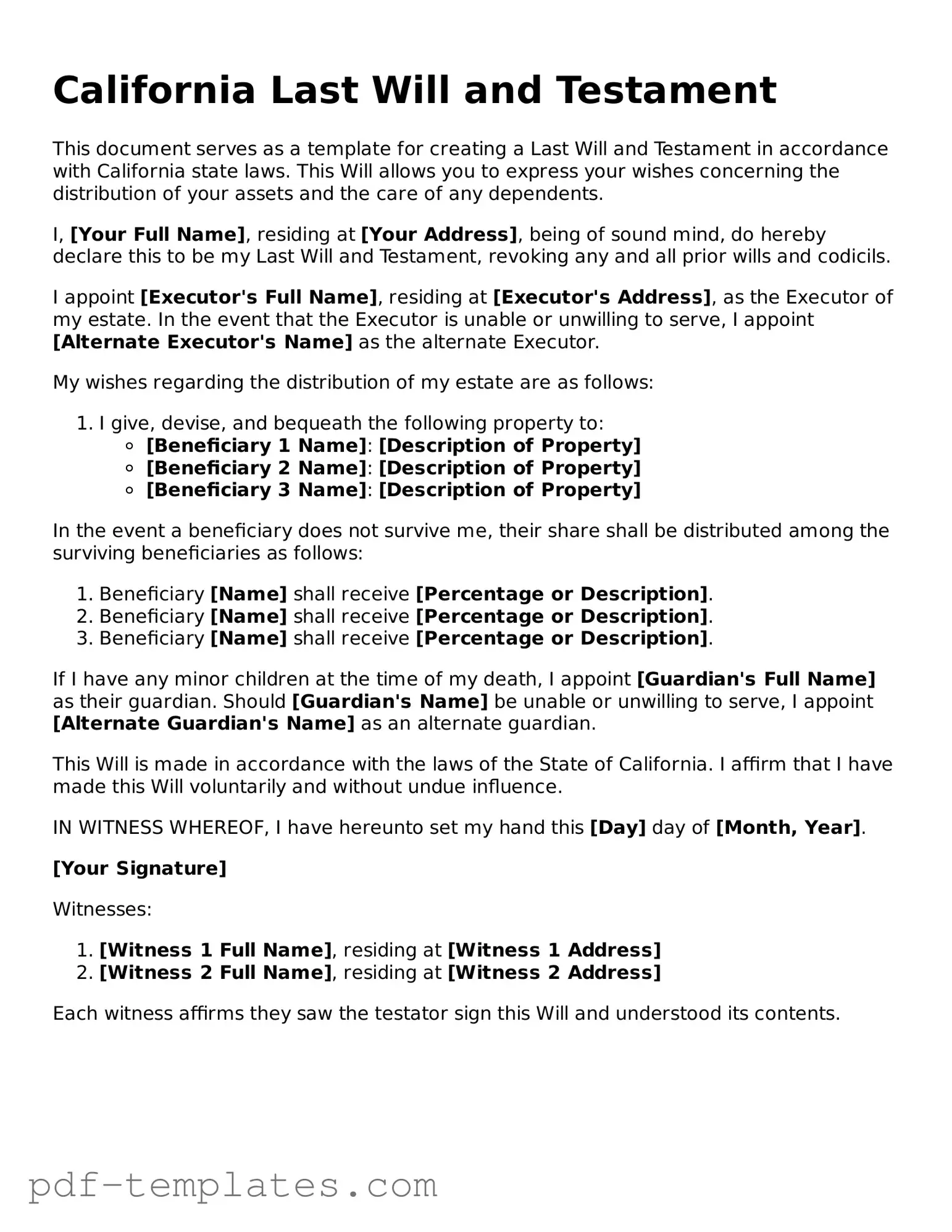

Creating a Last Will and Testament is an essential step in planning for the future, especially in California. This legal document outlines how a person's assets and property will be distributed after their passing. It also allows individuals to name guardians for minor children, ensuring that loved ones are cared for according to their wishes. In California, the form is straightforward, making it accessible for anyone looking to formalize their intentions. The document typically includes key sections such as the testator's information, a declaration of revocation of any previous wills, and detailed instructions for asset distribution. Additionally, it requires signatures from witnesses to validate the will, reinforcing its legal standing. Understanding the components of the California Last Will and Testament form can empower individuals to make informed decisions about their estate and provide peace of mind for their families.

Misconceptions

Understanding the California Last Will and Testament can be tricky. Here are some common misconceptions that people often have:

- Only wealthy individuals need a will. Many people think that only those with significant assets need a will. However, anyone can benefit from having a will, regardless of their financial situation.

- A will can only be changed after death. Some believe that once a will is created, it cannot be altered. In reality, individuals can modify their will at any time while they are still alive, as long as they are mentally competent.

- All property automatically goes to the spouse. Many assume that if someone dies, their spouse will automatically inherit everything. This is not always true. The distribution of assets can depend on various factors, including whether there is a will or how property is titled.

- Wills are only for distributing assets. While wills do outline how assets should be distributed, they can also name guardians for minor children and specify funeral arrangements.

- A handwritten will is not valid. Some people think that only formally typed wills are acceptable. In California, a handwritten will, known as a holographic will, can be valid if it meets certain criteria.

- Having a will avoids probate. Many believe that having a will means their estate will avoid the probate process. In California, a will still goes through probate, though it can help streamline the process.

- Witnesses are not necessary. Some think that a will can be valid without witnesses. In California, a will must be signed by at least two witnesses to be considered valid, unless it is a holographic will.

- Once a will is made, it’s set in stone. Many people believe that a will is permanent. However, it can be revoked or replaced at any time, as long as the person creating the will is of sound mind.

Clarifying these misconceptions can help individuals make informed decisions about their estate planning in California.

California Last Will and Testament: Usage Instruction

After obtaining the California Last Will and Testament form, the next steps involve carefully filling it out to ensure it reflects your wishes. Accuracy is crucial, as this document will guide the distribution of your assets and the appointment of guardianship if necessary. Follow the steps below to complete the form properly.

- Begin by writing your full name at the top of the form.

- Provide your current address, including city, state, and zip code.

- State your intention to create a last will and testament by including a declaration such as "This is my Last Will and Testament."

- List any previous wills or codicils you have created and clearly revoke them by stating, "I revoke all prior wills and codicils."

- Designate an executor by naming the person you trust to carry out your wishes.

- Detail how you want your assets distributed. Be specific about who receives what, including any percentages or specific items.

- If you have minor children, appoint a guardian for them, ensuring you have discussed this with the chosen individual.

- Include a clause for the payment of debts and expenses, stating that these should be settled before asset distribution.

- Sign and date the document at the bottom. Ensure your signature is clear and legible.

- Have at least two witnesses sign the document, confirming that you signed it in their presence.

- Finally, ensure that all parties involved receive copies of the will for their records.

Common mistakes

-

Not Clearly Identifying the Testator: It is essential to clearly state who is creating the will. Failing to include the full legal name and address can lead to confusion or disputes later.

-

Omitting Witness Signatures: California law requires at least two witnesses to sign the will. If this step is overlooked, the will may not be considered valid.

-

Failing to Update the Will: Life changes, such as marriage, divorce, or the birth of children, should prompt a review of the will. Not updating it can result in unintended distributions of assets.

-

Being Vague About Asset Distribution: Clearly detailing how assets should be divided is crucial. Ambiguities can lead to conflicts among beneficiaries, causing unnecessary stress and potential legal battles.

PDF Features

| Fact Name | Details |

|---|---|

| Definition | A Last Will and Testament is a legal document that outlines how a person's assets will be distributed after their death. |

| Governing Law | The California Probate Code governs the creation and execution of wills in California. |

| Requirements | To be valid, a will must be in writing, signed by the testator, and witnessed by at least two individuals. |

| Revocation | A will can be revoked by the testator at any time, typically through a new will or a written declaration. |

| Age Requirement | In California, the testator must be at least 18 years old to create a valid will. |

| Holographic Wills | California recognizes holographic wills, which are handwritten and do not require witnesses, provided they are signed by the testator. |

Dos and Don'ts

When filling out the California Last Will and Testament form, there are important guidelines to follow. Here’s a list of what you should and shouldn't do:

- Do ensure that you are of sound mind and at least 18 years old when creating your will.

- Do clearly identify yourself and your assets to avoid confusion.

- Do appoint an executor who will carry out your wishes as stated in the will.

- Do sign the document in the presence of at least two witnesses who are not beneficiaries.

- Don't use ambiguous language that could lead to misinterpretation of your intentions.

- Don't forget to update your will after major life changes, such as marriage or the birth of a child.

Similar forms

The California Living Trust is similar to a Last Will and Testament in that both documents allow individuals to dictate how their assets should be distributed after their death. However, a living trust can take effect during the person's lifetime, allowing for management of assets while they are still alive. Unlike a will, a living trust typically avoids probate, which can save time and money for beneficiaries.

A Durable Power of Attorney is another document that shares similarities with a Last Will and Testament. While a will addresses asset distribution after death, a durable power of attorney allows an individual to appoint someone to make financial or medical decisions on their behalf while they are still alive but incapacitated. This ensures that someone trusted manages affairs without needing court intervention.

A Health Care Directive, also known as an advance healthcare directive, is related to a Last Will and Testament in that it outlines an individual’s wishes regarding medical treatment in the event they become unable to communicate those wishes themselves. While a will deals with property distribution, a health care directive focuses on personal health decisions, ensuring that medical care aligns with the individual’s preferences.

A Revocable Trust is similar to a Last Will and Testament in that it allows individuals to manage their assets and determine how they will be distributed upon death. The key difference is that a revocable trust can be altered or revoked during the grantor's lifetime, providing flexibility in asset management. Like a living trust, it also avoids probate, making the transfer of assets smoother for beneficiaries.

Understanding the importance of a temporary Power of Attorney for a Child is crucial for parents who need to ensure their child is taken care of in their absence. This document allows designated adults to make necessary decisions when parents are unable, providing peace of mind during uncertain times.

A Codicil serves as an amendment to an existing Last Will and Testament. It allows individuals to make changes or additions without needing to create an entirely new will. This document must meet the same legal requirements as a will, ensuring that any modifications are valid and enforceable.

A Joint Will is another document that bears similarity to a Last Will and Testament. It is a single will executed by two individuals, typically spouses, that outlines the distribution of their combined assets. Unlike separate wills, a joint will can complicate changes in the future, as it may bind both parties to its terms unless both agree to amend it.

A Pour-Over Will works in conjunction with a living trust. It ensures that any assets not transferred to the trust during the individual's lifetime are "poured over" into the trust upon death. This type of will simplifies the estate distribution process, ensuring that all assets are managed according to the trust’s terms.

A Testamentary Trust is created within a Last Will and Testament and comes into effect upon the individual's death. It allows for the management of assets for beneficiaries, often used for minors or individuals who may not be ready to manage their inheritance. This type of trust provides ongoing management of assets, ensuring that they are used according to the deceased's wishes.

A Family Trust is similar to a Last Will and Testament in that it is designed to manage and distribute family assets. It allows for the creation of specific terms regarding how and when beneficiaries receive their inheritance. This document can help protect family assets from taxes and creditors, providing a structured approach to estate management.

Check out Popular Last Will and Testament Forms for Different States

Sample Will Form - A crucial document for anyone wishing to manage their estate proactively."

Simple Will Form Pennsylvania - Offers a chance to leave instructions about digital assets and online accounts.

To ensure compliance and maintain the validity of your practice, it is crucial for cosmetologists to complete the renewal process promptly. The Cosmetology License Renewal California form must be filled out accurately, as failure to do so can lead to serious legal consequences. For further guidance on obtaining the necessary forms, you may visit All California Forms, which offers a comprehensive resource for professionals in need of these important documents.

Will Legal - Can be modified as life circumstances change, ensuring relevance.

Simple Will in Florida - Helps minimize potential conflicts among family members during a difficult time.