Official Gift Deed Template for California State

In California, the Gift Deed form serves as a vital legal instrument for individuals wishing to transfer property ownership without the exchange of money. This form is particularly important for those looking to gift real estate to family members, friends, or charitable organizations. A properly executed Gift Deed not only facilitates the transfer but also helps to clarify the donor's intentions, ensuring that the recipient receives the property free of any financial obligations. Key elements of the form include the names of both the donor and the recipient, a clear description of the property being gifted, and the donor's declaration of intent to make the gift. Additionally, the form must be signed by the donor and, in some cases, notarized to confirm its authenticity. Understanding the nuances of the Gift Deed is essential, as it can impact tax implications and future ownership rights. By exploring the intricacies of this form, individuals can navigate the gifting process with greater confidence and legal clarity.

Misconceptions

Understanding the California Gift Deed form is essential for anyone considering transferring property as a gift. However, several misconceptions can lead to confusion. Here are seven common misconceptions about the California Gift Deed form, along with clarifications.

-

A Gift Deed is only for family members.

This is not true. While many people use a Gift Deed to transfer property to family, it can also be used to give property to friends, charities, or any individual.

-

You do not need to record a Gift Deed.

Recording the Gift Deed with the county recorder’s office is essential to make the transfer official. Failing to do so may lead to disputes about ownership in the future.

-

A Gift Deed eliminates all tax implications.

While a Gift Deed may not trigger immediate income taxes, it can have implications for gift taxes and capital gains taxes when the property is sold later.

-

You can use a Gift Deed for any type of property.

This is partially true. While real estate can be gifted, personal property like vehicles or jewelry requires different forms and procedures.

-

A Gift Deed is the same as a Sale Deed.

This misconception can lead to legal issues. A Gift Deed transfers property without payment, while a Sale Deed involves a financial transaction.

-

Once a Gift Deed is executed and recorded, revoking it can be complicated. It often requires legal action or specific circumstances to undo the transfer.

-

Gift Deeds can vary based on specific circumstances and property types. It’s important to use the correct form that meets California’s legal requirements.

By understanding these misconceptions, individuals can navigate the process of transferring property as a gift more effectively and avoid potential pitfalls.

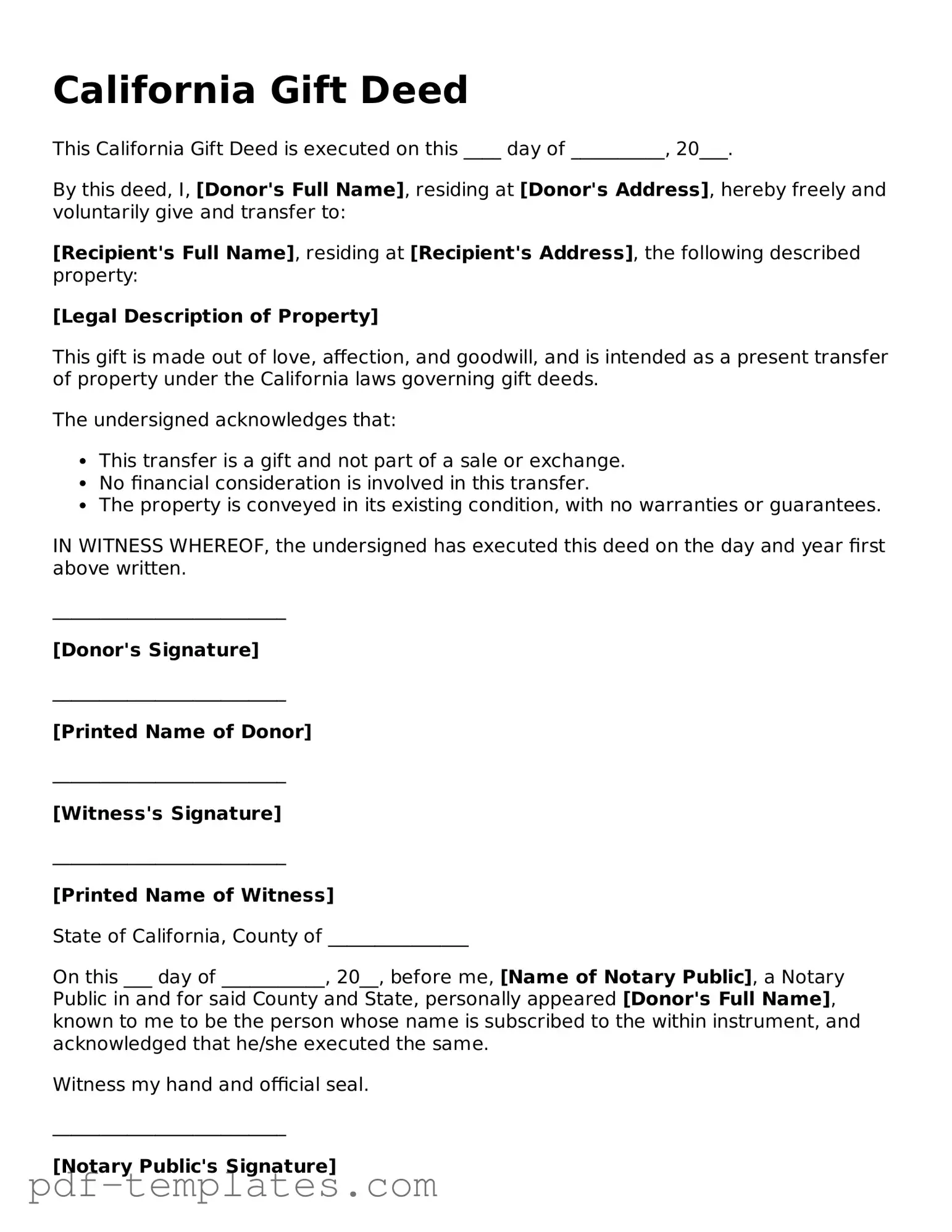

California Gift Deed: Usage Instruction

After gathering the necessary information and documents, you can proceed to fill out the California Gift Deed form. This form is essential for transferring property ownership as a gift. Ensure that all details are accurate to avoid any complications during the transfer process.

- Obtain the California Gift Deed form from a reliable source, such as a legal website or local government office.

- Fill in the names of the grantor (the person giving the gift) and the grantee (the person receiving the gift) in the designated fields.

- Provide the current address of both the grantor and grantee. Ensure that the addresses are complete and accurate.

- Describe the property being gifted. Include details such as the property address, parcel number, and any other identifying information.

- State the relationship between the grantor and the grantee. This information helps clarify the nature of the gift.

- Indicate whether the property is being given with or without any conditions attached.

- Sign the form in the presence of a notary public. The notary will verify your identity and witness your signature.

- Have the grantee sign the form as well, if required by local regulations.

- Make copies of the completed form for both the grantor and grantee for their records.

- File the original Gift Deed with the county recorder’s office where the property is located to complete the transfer.

Common mistakes

-

Incorrectly Identifying the Parties: One common mistake is failing to accurately identify the giver (grantor) and the receiver (grantee) of the gift. Ensure that full legal names are used, as well as correct addresses. Any ambiguity can lead to complications later.

-

Omitting Property Description: The property being gifted must be described in detail. Many people forget to include specific information like the parcel number or a clear physical description. This omission can create confusion about what is actually being transferred.

-

Not Including Consideration: While a gift deed typically involves no payment, it's important to include a statement that the transfer is made for love and affection or another reason. Leaving this section blank may raise questions about the intent of the transfer.

-

Failure to Sign and Date: The deed must be signed by the grantor. Sometimes, people forget to sign or date the document. A missing signature or date can invalidate the deed, making it ineffective.

-

Neglecting Notarization: In California, a gift deed must be notarized to be legally binding. Some individuals skip this step, thinking it's unnecessary. Without notarization, the deed may not be accepted by the county recorder's office.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | A California Gift Deed is a legal document used to transfer property ownership as a gift without any payment. |

| Governing Law | The Gift Deed is governed by California Civil Code Section 11911. |

| Parties Involved | The deed involves a donor (the giver) and a donee (the receiver). |

| Requirements | The deed must be in writing, signed by the donor, and notarized. |

| Consideration | No monetary consideration is required for a gift deed. |

| Tax Implications | Gift tax may apply, depending on the value of the property transferred. |

| Recording | To be effective against third parties, the deed should be recorded with the county recorder's office. |

| Revocation | A gift deed cannot be revoked after it is executed and delivered unless the donor retains some interest in the property. |

| Legal Advice | Consulting an attorney is recommended to ensure compliance with all legal requirements. |

Dos and Don'ts

When filling out the California Gift Deed form, it's important to follow specific guidelines to ensure accuracy and compliance. Here are six things you should and shouldn't do:

- Do provide accurate information about the donor and recipient.

- Do include a clear description of the property being gifted.

- Do sign the form in the presence of a notary public.

- Do check for any local requirements that may apply.

- Don't leave any sections blank; fill in all required fields.

- Don't forget to submit the form to the county recorder's office after signing.

Similar forms

The California Gift Deed is often compared to a Quitclaim Deed. Both documents serve the purpose of transferring property, but they differ in intent and the nature of the transfer. A Quitclaim Deed conveys whatever interest the grantor has in the property without any warranties regarding the title. It is commonly used among family members or in situations where the parties trust one another. In contrast, a Gift Deed explicitly indicates that the transfer is a gift, which can have tax implications and signifies a more formalized intent to relinquish ownership without compensation.

Another document similar to the Gift Deed is the Warranty Deed. While both serve to transfer ownership, a Warranty Deed provides a guarantee that the grantor holds clear title to the property and has the right to transfer it. This type of deed protects the grantee against future claims to the property. Unlike the Gift Deed, which does not offer such protections, a Warranty Deed is often used in sales transactions where the buyer seeks assurance regarding the property's title.

The Bargain and Sale Deed also bears similarities to the Gift Deed. This type of deed transfers property without any warranties against encumbrances, much like a Quitclaim Deed. However, it implies that the grantor has some interest in the property. In the context of a Gift Deed, the intent is to give the property freely, while a Bargain and Sale Deed suggests a more transactional nature, even if no money changes hands.

A Leasehold Deed is another document that can be likened to a Gift Deed, particularly when it involves transferring the rights to use a property for a specified period. While a Gift Deed transfers full ownership, a Leasehold Deed grants temporary rights to the lessee. The intent behind both documents can reflect a desire to provide access or benefits to another party, though the nature of the rights conveyed differs significantly.

For those interested in a rewarding career with Trader Joe's, completing the application form is essential and can be found at https://documentonline.org/blank-trader-joe-s-application/. This form serves as a key step in presenting one's qualifications and experiences, ultimately enhancing the likelihood of joining this beloved grocery chain.

The Joint Tenancy Deed is similar in that it can involve the transfer of property between parties, often family members. This deed creates a joint ownership structure where each party has equal rights to the property. While a Gift Deed typically involves a unilateral transfer with no expectation of return, a Joint Tenancy Deed indicates a shared ownership that could complicate the dynamics of property rights and responsibilities.

In some contexts, a Deed of Trust may also be compared to a Gift Deed. While fundamentally different in purpose—serving primarily as a security instrument for a loan—a Deed of Trust involves the transfer of property interests to a trustee for the benefit of a lender. In a sense, both documents involve the transfer of rights, but the Deed of Trust is more focused on securing obligations rather than gifting property outright.

The Special Warranty Deed is another document that can be likened to a Gift Deed. It conveys property with a limited warranty, meaning the grantor only guarantees the title against claims arising during their ownership. This contrasts with the full warranty of a Warranty Deed. While both documents facilitate the transfer of property, the Special Warranty Deed does not provide the same level of assurance to the grantee as a Gift Deed does regarding the intent of the transfer.

A Transfer on Death Deed (TOD) is similar to a Gift Deed in that it allows property to pass to a beneficiary without going through probate. This document enables the property owner to retain control during their lifetime while designating who will receive the property upon their death. Unlike a Gift Deed, which transfers ownership immediately, a TOD deed only takes effect after the owner's passing, reflecting a different approach to property transfer.

Lastly, a Revocable Living Trust can be viewed as a document related to the Gift Deed. Although it does not transfer property in the same manner, a Revocable Living Trust allows individuals to manage and designate their assets during their lifetime and beyond. Property placed in the trust can be distributed to beneficiaries without the need for probate, similar to how a Gift Deed facilitates the transfer of property directly to a recipient. Both documents reflect a desire to control the distribution of assets, albeit through different mechanisms.

Check out Popular Gift Deed Forms for Different States

Texas Gift Deed Pdf - The recipient of a gift is generally not obligated to reciprocate, underlining the nature of generosity inherent in a Gift Deed.

Completing a General Power of Attorney form ensures that your financial matters are managed according to your wishes, even when you cannot do so yourself, making it essential for those who may face unforeseen circumstances. For additional resources and templates to assist in this process, you can refer to All California Forms.

Gift of Deed in Virginia - This document formalizes the transfer of ownership as a gift.