Official Employment Verification Template for California State

The California Employment Verification form is a vital document that serves multiple purposes in the employment process. This form is often required by employers to confirm the employment status of an individual, ensuring that all necessary information is accurately documented. It typically includes essential details such as the employee's job title, dates of employment, and salary information. Employers may use this form to verify a candidate's work history during the hiring process or to validate an employee's current status for various reasons, including loan applications or government assistance programs. Understanding how to properly complete and submit this form can help streamline the verification process, making it easier for both employers and employees to fulfill their obligations. By ensuring that all required information is provided, individuals can avoid potential delays and complications that may arise from incomplete or inaccurate submissions.

Misconceptions

When it comes to the California Employment Verification form, there are several misconceptions that can lead to confusion for both employers and employees. Understanding the truth behind these myths can help ensure a smoother verification process. Here are four common misconceptions:

- It is only for new hires. Many believe that the Employment Verification form is only necessary for new employees. In reality, it can also be used for existing employees when verifying their employment status for loans, leases, or other purposes.

- Employers can refuse to provide verification. Some think that employers have the right to deny verification requests. However, employers are generally required to provide accurate information regarding an employee's job title, employment dates, and salary, as long as the request complies with legal guidelines.

- Only certain employers need to complete the form. There is a misconception that only large companies or specific industries need to complete the Employment Verification form. In truth, any employer in California may be asked to provide this verification, regardless of their size or sector.

- The form is the same as the I-9 form. Many individuals confuse the Employment Verification form with the I-9 form, which is used for verifying an employee's eligibility to work in the U.S. While both forms serve a verification purpose, they are distinct documents with different requirements.

By clearing up these misconceptions, both employees and employers can navigate the employment verification process more effectively, ensuring that all parties are informed and compliant with the necessary regulations.

California Employment Verification: Usage Instruction

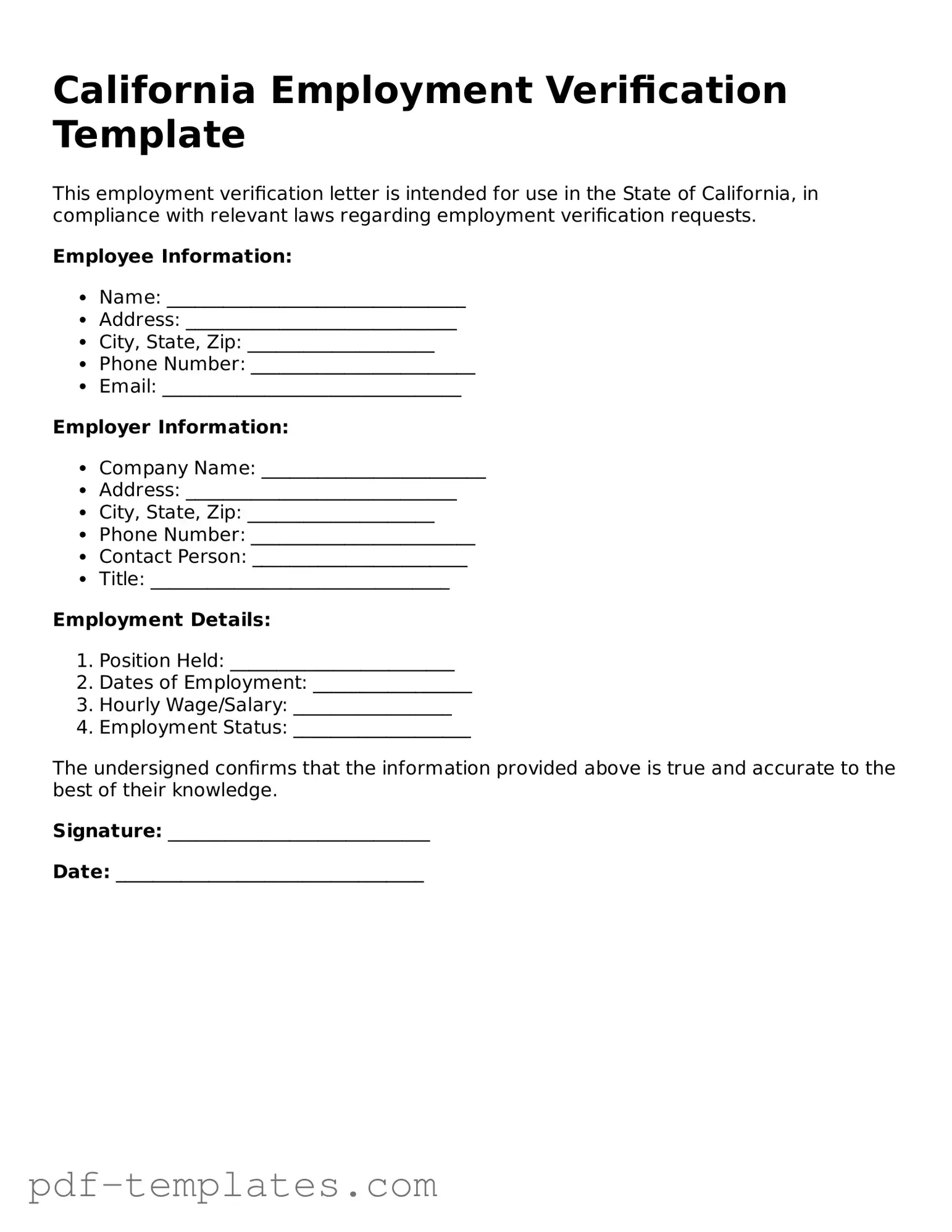

After obtaining the California Employment Verification form, the next step involves accurately completing the required fields. Ensure that all information is correct to avoid delays in processing. Follow the steps below to fill out the form properly.

- Begin by entering the employee's full name in the designated field.

- Provide the employee's Social Security Number (SSN) in the appropriate section.

- Fill in the employee's job title as it appears on their employment records.

- Indicate the start date of the employee's employment.

- Include the employee's current work address, ensuring it is complete and accurate.

- List the employee's hours of work per week.

- Specify the employee's current salary or hourly wage.

- Sign and date the form at the bottom to verify the accuracy of the information provided.

Common mistakes

-

Incomplete Information: Many individuals forget to fill out all required fields. This can lead to delays or even rejection of the form. Always double-check to ensure every section is completed.

-

Incorrect Dates: Providing inaccurate employment dates is a common error. Be sure to verify the start and end dates of employment. Mismatched dates can raise questions about employment history.

-

Omitting Job Titles: Failing to include the correct job title can lead to confusion. The job title helps clarify the role and responsibilities held during employment. Always include this detail.

-

Neglecting to Sign: Some people forget to sign the form. A signature is crucial as it confirms the accuracy of the information provided. Without it, the form may not be considered valid.

-

Providing Inaccurate Contact Information: Listing incorrect contact information for the employer can hinder the verification process. Make sure to provide up-to-date phone numbers and email addresses.

PDF Features

| Fact Name | Description |

|---|---|

| Purpose | The California Employment Verification form is used to confirm an employee's identity and eligibility to work in the United States. |

| Governing Law | This form is governed by California Labor Code Section 1171.5 and federal regulations under the Immigration Reform and Control Act (IRCA). |

| Required Information | Employers must collect specific information, including the employee's name, address, Social Security number, and employment start date. |

| Timing | Employers are required to complete the verification process within three days of the employee's start date. |

| Documentation | Employees must provide acceptable documents that establish both identity and employment eligibility, as outlined in the I-9 form. |

| Retention Period | Employers must retain the completed form for at least three years after the employee's hire date or one year after termination, whichever is longer. |

| Penalties | Failure to properly complete or retain the Employment Verification form can result in fines and legal penalties for employers. |

Dos and Don'ts

When filling out the California Employment Verification form, it’s important to be thorough and accurate. This form is often required for various purposes, including loan applications and rental agreements. Here’s a helpful list of dos and don’ts to guide you through the process.

- Do read the instructions carefully before starting. Understanding what information is needed can save you time and prevent mistakes.

- Do provide accurate and complete information. Double-check names, dates, and addresses to ensure everything is correct.

- Do sign and date the form. An unsigned form may be considered invalid, so don’t forget this crucial step.

- Do keep a copy for your records. Having a copy can be useful for future reference or if any questions arise.

- Don’t leave any required fields blank. If a section does not apply to you, indicate that with "N/A" or a similar notation.

- Don’t rush through the process. Taking your time helps to ensure that the form is filled out correctly and completely.

Similar forms

The California Employment Verification form is quite similar to the I-9 form, which is used by employers to verify an employee's identity and eligibility to work in the United States. Like the California Employment Verification form, the I-9 requires the employee to provide specific documentation that proves both their identity and their legal authorization to work. This document is essential for compliance with federal regulations, ensuring that employers do not hire individuals who are not legally permitted to work in the country.

Another document that bears resemblance to the California Employment Verification form is the W-2 form. While the W-2 is primarily used for tax purposes, it also serves as a verification of employment. Employers provide this form to employees at the end of each tax year, detailing the wages earned and taxes withheld. Both forms help establish a record of employment, although the W-2 focuses more on financial aspects rather than eligibility to work.

The Social Security Administration’s Form SS-5 is another document that shares similarities. This form is used to apply for a Social Security card, which is essential for employment verification. Like the California Employment Verification form, the SS-5 requires proof of identity and, in some cases, proof of citizenship or lawful immigration status. Both forms aim to ensure that the individual has the necessary credentials to work legally in the United States.

Additionally, the Form 1099 is comparable in that it is used to report income earned by independent contractors and freelancers. While it does not serve the same purpose as the California Employment Verification form, it acts as a verification of income received for services rendered. Both documents play a role in the overall employment verification process, albeit from different perspectives—one focusing on employee status and the other on income reporting.

The Employment Eligibility Verification (EEV) form, often referred to as the E-Verify, is also similar. This electronic system allows employers to verify the employment eligibility of their employees. Like the California Employment Verification form, the E-Verify process requires the submission of information that confirms an individual’s right to work in the U.S. Both forms are critical tools for employers to ensure compliance with employment laws.

The Federal Tax Form 941 is another document that relates to employment verification. This form is used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. While it serves a different function, it also verifies that an employer has employees and provides a record of employment for tax purposes, much like the California Employment Verification form does for employment status.

Similar to the California Employment Verification form, the Form 5500 is utilized for reporting purposes, specifically for employee benefit plans. This document provides information about the plan's financial condition, investments, and operations. While it pertains to benefits rather than employment status, both forms contribute to a comprehensive understanding of an individual's employment situation and the employer's compliance with regulations.

The Certificate of Employment is another document that serves a similar purpose. This certificate is issued by employers to verify an employee's work history and is often required for various applications, such as loans or visas. Like the California Employment Verification form, it confirms an individual’s employment status and can include details about their position, duration of employment, and salary.

Finally, the Pay Stub is comparable in that it provides a record of employment and earnings. It details the employee’s wages, deductions, and hours worked, serving as a tangible proof of employment. While it does not verify eligibility to work, it complements the California Employment Verification form by providing evidence of ongoing employment and financial compensation.

Check out Popular Employment Verification Forms for Different States

Job Verification Letter Template - Timeliness in returning the form is usually expected by requesters.