Official Durable Power of Attorney Template for California State

In California, the Durable Power of Attorney (DPOA) form serves as a crucial legal tool for individuals looking to ensure their financial and healthcare decisions are managed according to their wishes, even if they become incapacitated. This document allows you to designate a trusted person, known as your agent or attorney-in-fact, to handle specific matters on your behalf. Whether it’s managing bank accounts, making medical decisions, or overseeing property transactions, the DPOA empowers your chosen representative to act in your best interest when you cannot. Importantly, this form remains effective even if you become unable to make decisions due to illness or injury, providing peace of mind for you and your loved ones. It’s essential to understand the different types of powers you can grant, as well as the limitations you may wish to impose, ensuring your agent acts within the scope of your intentions. By taking the time to create a Durable Power of Attorney, you can safeguard your future and maintain control over your personal and financial affairs, all while alleviating potential stress for your family during challenging times.

Misconceptions

Understanding the California Durable Power of Attorney (DPOA) is crucial for anyone considering this important legal document. However, several misconceptions can lead to confusion. Here’s a list to help clarify some common misunderstandings.

- It only applies to financial matters. Many believe a DPOA is solely for financial decisions, but it can also cover healthcare choices if specified.

- It is only valid while the principal is alive. A DPOA remains effective even if the principal becomes incapacitated, which is one of its key features.

- Anyone can act as an agent. While you can choose almost anyone, the agent should be trustworthy and capable of handling the responsibilities involved.

- It automatically grants unlimited power. The authority of the agent is limited to what is explicitly stated in the DPOA document.

- Once signed, it cannot be revoked. A principal can revoke a DPOA at any time, as long as they are competent to do so.

- It must be notarized to be valid. While notarization is recommended, a DPOA can also be valid if it is signed by two witnesses, depending on the circumstances.

- It is only necessary for the elderly. People of all ages can benefit from a DPOA, especially those with health issues or those planning for the future.

- It is the same as a will. A DPOA is not a will. A will takes effect after death, while a DPOA is for decisions made during a person's lifetime.

- All DPOAs are the same. DPOAs can vary significantly based on individual needs and state laws, so it's important to tailor the document accordingly.

- It can only be used in California. While a California DPOA is governed by California law, it may still be recognized in other states, but it’s best to check local laws.

By addressing these misconceptions, individuals can make more informed decisions about establishing a Durable Power of Attorney in California. Always consider consulting with a legal professional for personalized advice.

California Durable Power of Attorney: Usage Instruction

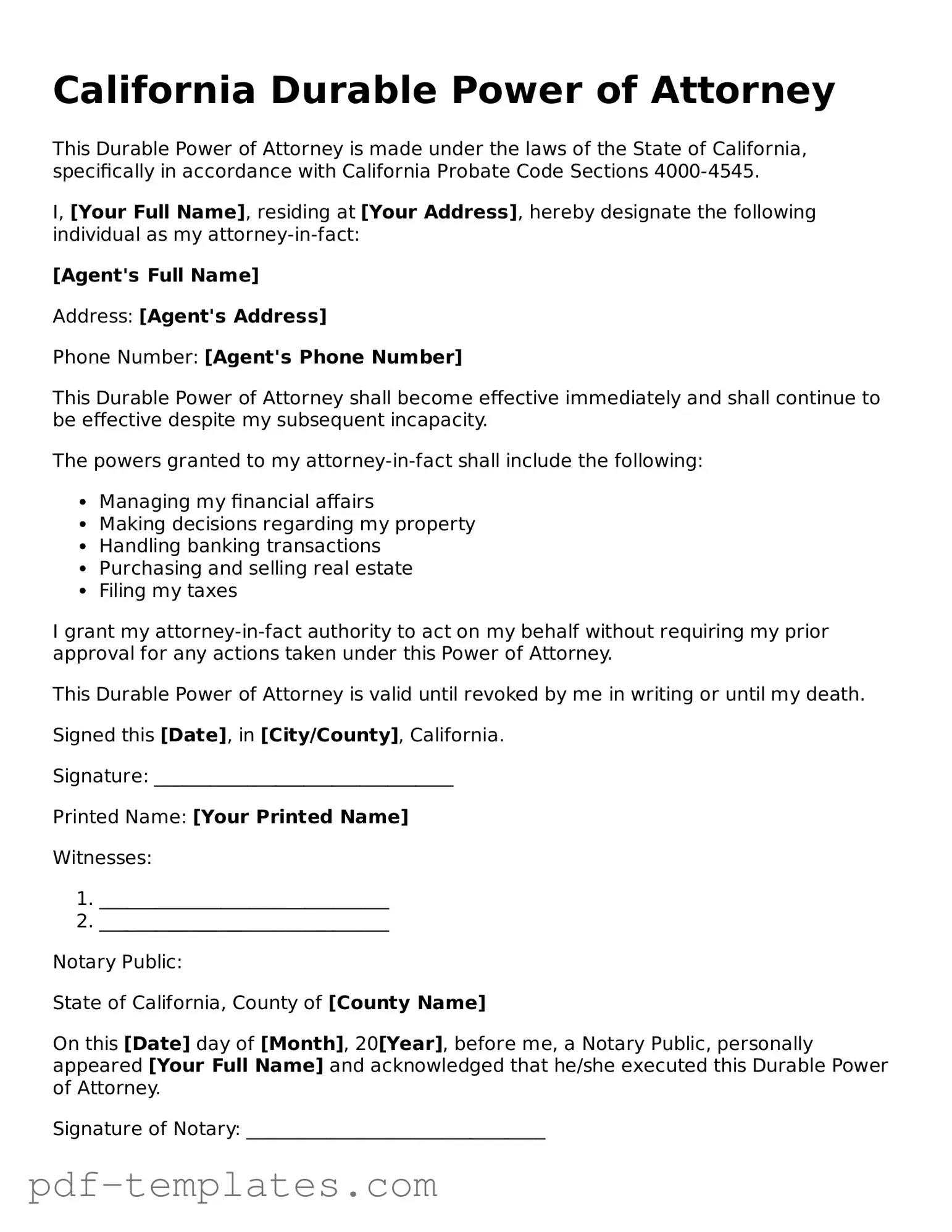

Filling out the California Durable Power of Attorney form is an important step in ensuring that your financial and legal matters are managed according to your wishes in the event that you become unable to do so yourself. Below are the steps to guide you through the process of completing this form.

- Obtain the California Durable Power of Attorney form. You can find it online or request a copy from a legal office.

- Begin by filling in your personal information at the top of the form. This includes your full name, address, and contact information.

- Identify the agent you wish to designate. This person will have the authority to act on your behalf. Include their full name, address, and contact information.

- Clearly specify the powers you are granting to your agent. You can choose general powers or limit them to specific areas, such as financial decisions or real estate transactions.

- Include any additional instructions or limitations regarding the authority of your agent, if necessary.

- Sign and date the form in the designated area. Your signature indicates that you understand and agree to the terms outlined in the document.

- Have the form notarized. This step is essential to ensure that the document is legally valid. The notary will verify your identity and witness your signature.

- Provide copies of the completed and notarized form to your agent, relevant family members, and any financial institutions or other parties that may need it.

Common mistakes

-

Not Specifying Powers Clearly: One common mistake is failing to clearly define the powers granted to the agent. Vague language can lead to confusion and potential disputes. It's essential to be specific about what decisions your agent can make on your behalf.

-

Choosing the Wrong Agent: Selecting an agent who may not act in your best interest can have serious consequences. It's crucial to choose someone trustworthy and reliable, as they will have significant control over your financial and legal matters.

-

Not Signing the Document Properly: A Durable Power of Attorney must be signed according to California law. Failing to sign in the presence of a notary public or witnesses can invalidate the document.

-

Overlooking the Agent’s Responsibilities: People often underestimate the responsibilities that come with being an agent. It is important for both the principal and the agent to understand these duties to avoid misunderstandings in the future.

-

Not Updating the Document: Life changes, and so should your Durable Power of Attorney. Failing to update the document after significant life events, such as marriage, divorce, or the death of a previous agent, can lead to complications.

-

Ignoring State-Specific Requirements: Each state has its own rules regarding Durable Power of Attorney forms. Ignoring California's specific requirements, such as the need for notarization, can render the document ineffective.

-

Neglecting to Discuss the Document with the Agent: Many people fill out the form without discussing it with their chosen agent. This can lead to surprises and confusion when the time comes to use the document. Open communication is key to ensuring everyone is on the same page.

PDF Features

| Fact Name | Details |

|---|---|

| Definition | A California Durable Power of Attorney form allows an individual (the principal) to designate another person (the agent) to make financial and legal decisions on their behalf, even if the principal becomes incapacitated. |

| Governing Law | The form is governed by the California Probate Code, specifically Sections 4000-4545. |

| Durability | This type of power of attorney remains effective even if the principal loses mental capacity, ensuring that the agent can continue to act on the principal's behalf. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, provided they are mentally competent to do so. A written notice of revocation must be delivered to the agent. |

Dos and Don'ts

When filling out the California Durable Power of Attorney form, it is essential to approach the task with care and attention. Here are some important dos and don'ts to consider:

- Do clearly identify yourself and the person you are designating as your agent.

- Do specify the powers you wish to grant your agent, ensuring they align with your intentions.

- Do sign the document in front of a notary public to validate it.

- Do keep a copy of the signed form for your records and provide copies to your agent.

- Do review the form periodically to ensure it reflects your current wishes.

- Don't use vague language that may lead to confusion about your intentions.

- Don't forget to date the document when you sign it.

- Don't assume that a verbal agreement is sufficient; written documentation is crucial.

- Don't overlook the importance of discussing your wishes with your agent beforehand.

Similar forms

The California Durable Power of Attorney (DPOA) form shares similarities with the General Power of Attorney (GPOA). Both documents allow an individual, known as the principal, to designate another person, referred to as the agent, to make decisions on their behalf. However, the key difference lies in durability. The GPOA may become invalid if the principal becomes incapacitated, while the DPOA remains effective even in such circumstances. This makes the DPOA particularly useful for long-term planning and healthcare decisions.

The Medical Power of Attorney (MPOA) is another document akin to the DPOA. This form specifically grants authority to an agent to make medical decisions for the principal if they are unable to do so themselves. While the DPOA can encompass a broader range of decisions, including financial matters, the MPOA focuses solely on healthcare. This distinction is crucial for individuals who want to ensure that their health-related wishes are respected during incapacitation.

Check out Popular Durable Power of Attorney Forms for Different States

How to Get Power of Attorney in Ny - A Durable Power of Attorney is an effective tool for avoiding guardianship proceedings.

Pennsylvania Durable Power of Attorney Form - If properly executed, this form can provide lasting benefits throughout your life.

Washington State Power of Attorney - Supports continuity in financial management when you're unavailable.