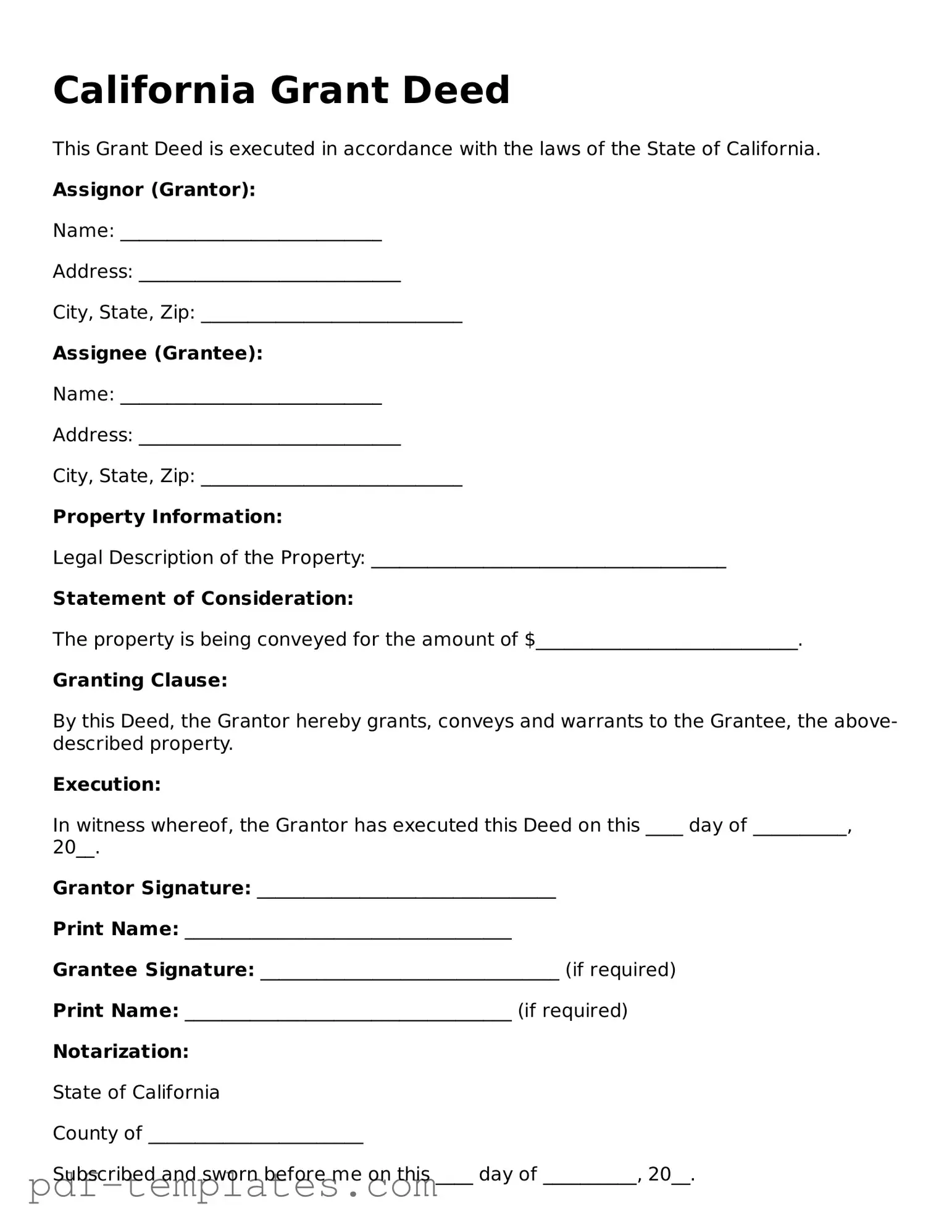

Official Deed Template for California State

In California, the Deed form serves as a crucial document in the transfer of real property ownership, encapsulating essential details that protect the interests of both the buyer and the seller. This form typically includes vital information such as the names of the parties involved, a clear description of the property being transferred, and the legal terms under which the transfer occurs. It also outlines the type of deed being utilized, whether it’s a grant deed, quitclaim deed, or another variant, each carrying its own implications for the rights conveyed. Furthermore, the Deed form must be executed with the appropriate signatures and often requires notarization to ensure its validity. Understanding these components is vital for anyone involved in a property transaction, as they play a significant role in establishing clear ownership and preventing future disputes. By grasping the intricacies of the California Deed form, individuals can navigate the complexities of real estate transactions with greater confidence and security.

Misconceptions

Many people have misunderstandings about the California Deed form. Here are six common misconceptions:

- All deeds are the same. Different types of deeds serve different purposes. For example, a grant deed offers more protection to the buyer than a quitclaim deed, which transfers whatever interest the seller has without guarantees.

- Only a lawyer can prepare a deed. While attorneys can assist with complex transactions, many individuals can successfully prepare a deed on their own or with the help of a legal document preparer.

- A deed must be notarized to be valid. In California, a deed must be signed by the grantor and notarized to be recorded. However, it is valid even if it is not recorded, though recording provides public notice.

- Once a deed is signed, it cannot be changed. A deed can be revoked or modified through another deed, such as a new grant deed or a quitclaim deed, provided the proper procedures are followed.

- Only property owners can fill out a deed. Anyone can prepare a deed, but the grantor (the person transferring the property) must be the property owner. Others can assist in the preparation process.

- Deeds are only necessary for selling property. Deeds are also used for gifting property, transferring ownership between family members, or placing property in a trust.

Understanding these misconceptions can help you navigate the process of handling deeds in California more effectively.

California Deed: Usage Instruction

After completing the California Deed form, you will need to ensure it is signed and notarized before recording it with the county recorder's office. Follow these steps carefully to fill out the form correctly.

- Begin by entering the date at the top of the form.

- In the section labeled Grantor, provide the full name(s) of the person(s) transferring the property.

- Next, in the Grantee section, enter the full name(s) of the person(s) receiving the property.

- Fill in the property description. This should include the address and any legal description required.

- Indicate the consideration amount, which is the value exchanged for the property.

- Check the appropriate box to indicate whether the transfer is a gift or a sale.

- Sign the form in the Grantor's signature area. If there are multiple grantors, each must sign.

- Have the form notarized. The notary will verify the identities of the signers.

- Make copies of the completed deed for your records.

- Submit the original deed to the county recorder's office for recording.

Common mistakes

-

Not using the correct type of deed. California has different types of deeds, such as grant deeds and quitclaim deeds. Using the wrong type can lead to issues with property transfer.

-

Failing to include all required information. Essential details like the names of the grantor and grantee, property description, and the date of the transaction must be clearly stated.

-

Omitting signatures. Both the grantor and any required witnesses must sign the deed. Without signatures, the deed is not valid.

-

Not having the deed notarized. In California, most deeds must be notarized to be legally binding. Skipping this step can invalidate the document.

-

Inaccurate property description. A clear and precise legal description of the property is crucial. Errors can lead to disputes or challenges in ownership.

-

Incorrectly filling out the county recorder’s information. Each county may have specific requirements for how the deed should be presented for recording.

-

Neglecting to check for existing liens. Before transferring property, ensure that there are no outstanding liens or claims against it.

-

Using outdated forms. Laws and regulations can change. Always use the most current version of the deed form to avoid complications.

-

Not keeping copies. After filing the deed, it’s important to retain copies for personal records. This can be vital for future transactions or disputes.

-

Failing to understand tax implications. Transferring property can have tax consequences. Consult with a tax professional to understand potential liabilities.

PDF Features

| Fact Name | Details |

|---|---|

| Governing Law | The California Deed form is governed by the California Civil Code, specifically sections 880 through 892. |

| Types of Deeds | California recognizes several types of deeds, including Grant Deeds, Quitclaim Deeds, and Warranty Deeds. |

| Recording Requirements | To be legally effective, the deed must be recorded with the county recorder's office in the county where the property is located. |

| Signature Requirements | The deed must be signed by the grantor (the person transferring the property) and notarized to ensure its validity. |

Dos and Don'ts

When filling out the California Deed form, it is crucial to follow specific guidelines to ensure accuracy and legality. Here are ten essential dos and don'ts:

- Do double-check the names of all parties involved to ensure they are spelled correctly.

- Don't use abbreviations for names; write them out in full.

- Do clearly indicate the type of deed being executed (e.g., grant deed, quitclaim deed).

- Don't leave any required fields blank; fill out all sections completely.

- Do include the legal description of the property accurately.

- Don't forget to sign the deed in the presence of a notary public.

- Do provide the correct date of execution.

- Don't submit the form without checking for any errors or omissions.

- Do keep a copy of the completed deed for your records.

- Don't assume that the deed will be recorded automatically; follow up with the county recorder's office.

Similar forms

The California Grant Deed is similar to the Quitclaim Deed. Both documents are used to transfer ownership of real estate. However, while a Grant Deed provides certain guarantees about the title, a Quitclaim Deed transfers whatever interest the grantor has without any warranties. This means that if there are issues with the title, the grantee may have limited recourse. Individuals often use Quitclaim Deeds in situations involving family transfers or when the parties know each other well.

In understanding various property transfer documents, it is crucial to recognize the role of the California Resale Certificate, officially known as form CDTFA-230, which allows businesses to purchase items without sales tax when those items will be resold. This certificate's misuse can lead to serious penalties, making awareness of All California Forms essential for legal compliance and efficient business operations.

The Warranty Deed is another document that shares similarities with the California Grant Deed. Like the Grant Deed, the Warranty Deed guarantees that the grantor holds clear title to the property and has the right to transfer it. The key difference lies in the level of protection offered. A Warranty Deed provides more extensive assurances, including protection against any future claims to the title. This makes it a preferred choice in many real estate transactions where buyers want added security.

The Bargain and Sale Deed is also comparable to the California Grant Deed. This type of deed implies that the grantor has title to the property and the right to sell it, but it does not provide the same warranties as a Grant Deed. Essentially, it conveys ownership but leaves the buyer to assume the risk regarding any potential title defects. Buyers often encounter this type of deed in transactions involving foreclosures or tax sales.

The Special Purpose Deed is another document that can be likened to the California Grant Deed. This type of deed is used for specific transactions, such as transferring property from a trust or estate. While it serves a unique purpose, it still functions to convey ownership, similar to a Grant Deed. However, it may not include the same guarantees about the title, depending on the circumstances of the transfer.

A Trustee's Deed is also similar in that it is used to transfer property, particularly when a property is sold at a foreclosure auction. This deed is executed by a trustee and conveys title to the winning bidder. While it transfers ownership, it often comes with fewer protections than a Grant Deed. Buyers should be aware that they may be taking on risks associated with the title when acquiring property through a Trustee's Deed.

The Executor's Deed is another document that resembles the California Grant Deed. It is used when an executor of an estate sells property belonging to the deceased. This deed conveys ownership to the buyer, but it may not offer the same warranties as a Grant Deed. The buyer may need to conduct thorough due diligence to ensure they are aware of any potential title issues before proceeding with the purchase.

Finally, the Deed of Trust is also related to the California Grant Deed, although it serves a different purpose. This document is used in real estate financing, where the property acts as collateral for a loan. While it does not transfer ownership in the same way a Grant Deed does, it establishes a legal claim against the property until the loan is repaid. Understanding the distinctions between these documents is crucial for anyone involved in real estate transactions.

Check out Popular Deed Forms for Different States

Pennsylvania Deed Transfer Form - May convert a property from one type of ownership to another.

Florida Deed Form - Checking the accuracy of all parties' details on the Deed form is crucial to avoid future litigation.

This essential guide to understanding your Texas Living Will preferences ensures that your medical treatment aligns with your desires. By preparing this crucial document, you can ensure that your wishes are honored when you cannot voice them. For more information, visit the Texas Living Will form resources to get started on securing your healthcare decisions.

Conveyance Document Deed Washington State - Can create an impermissible lien if executed inaccurately.