Official Deed in Lieu of Foreclosure Template for California State

In California, homeowners facing financial difficulties may find themselves exploring alternatives to foreclosure. One such option is the Deed in Lieu of Foreclosure, a legal tool that allows a homeowner to voluntarily transfer their property to the lender. This process can help avoid the lengthy and often stressful foreclosure proceedings. By signing this form, the homeowner relinquishes their rights to the property, and in return, the lender typically agrees to forgive the remaining mortgage balance. This arrangement can provide a fresh start for the homeowner and a quicker resolution for the lender. It’s important to understand the implications of this decision, as it may affect credit scores and future borrowing opportunities. Additionally, the form may require certain disclosures and conditions to be met, ensuring both parties are protected during the transaction. Knowing how to properly complete and file the Deed in Lieu of Foreclosure form can make a significant difference in navigating this challenging situation.

Misconceptions

Understanding the California Deed in Lieu of Foreclosure can be challenging, especially with the various misconceptions that surround it. Here are four common misunderstandings:

- Misconception 1: A Deed in Lieu of Foreclosure eliminates all debts related to the property.

- Misconception 2: This process is the same as a foreclosure.

- Misconception 3: Homeowners can easily qualify for a Deed in Lieu of Foreclosure.

- Misconception 4: A Deed in Lieu of Foreclosure will not impact the homeowner's credit score.

This is not entirely true. While a Deed in Lieu of Foreclosure allows homeowners to transfer ownership of the property to the lender, it does not automatically discharge all debts. If there are other liens or debts associated with the property, the homeowner may still be responsible for those obligations.

Although both processes involve the transfer of property ownership, they differ significantly. A foreclosure is a legal process initiated by the lender to reclaim the property after the borrower defaults. In contrast, a Deed in Lieu of Foreclosure is a voluntary agreement between the homeowner and the lender, allowing the homeowner to surrender the property without going through the lengthy foreclosure process.

Qualifying for a Deed in Lieu of Foreclosure can be more complex than many realize. Lenders typically require homeowners to demonstrate financial hardship and prove that they have exhausted other options, such as loan modifications or short sales, before considering this option.

This misconception can lead to unpleasant surprises. While a Deed in Lieu of Foreclosure is generally less damaging than a foreclosure, it will still negatively affect the homeowner's credit score. The impact may vary depending on the individual's overall credit profile, but it is important to understand that any form of property surrender can have consequences for creditworthiness.

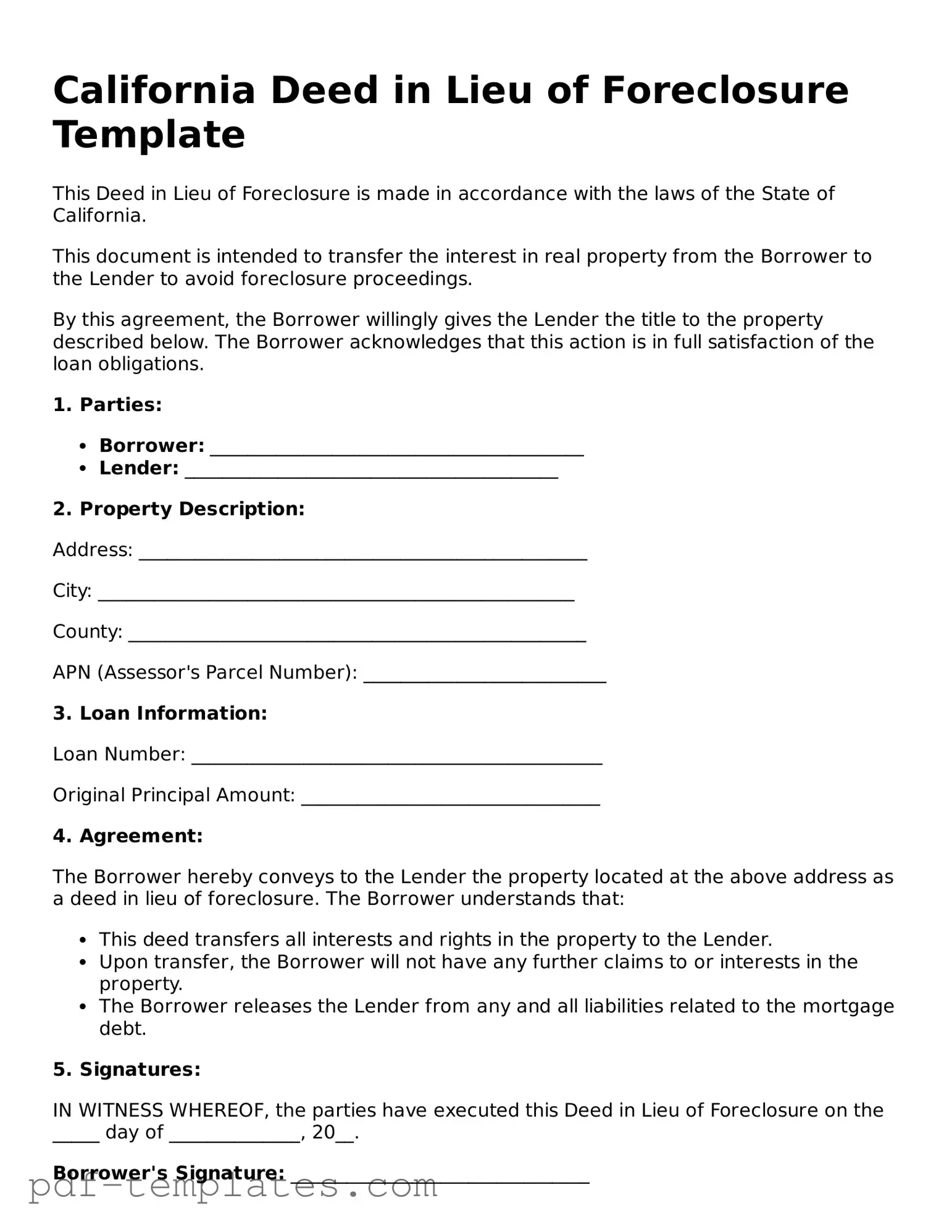

California Deed in Lieu of Foreclosure: Usage Instruction

Once you have decided to proceed with a Deed in Lieu of Foreclosure, you will need to complete the necessary form accurately. This step is crucial as it will help facilitate the transfer of the property back to the lender. Below are the steps to guide you through filling out the California Deed in Lieu of Foreclosure form.

- Obtain the Form: Acquire the California Deed in Lieu of Foreclosure form from a reliable source, such as your lender or a legal website.

- Property Information: Fill in the complete address of the property being transferred. Include the city, state, and ZIP code.

- Grantor Information: Enter your name as the current property owner (grantor). If there are multiple owners, list all names as they appear on the title.

- Grantee Information: Indicate the name of the lender or financial institution receiving the property (grantee).

- Legal Description: Provide the legal description of the property. This may be found on your current deed or property tax statement.

- Consideration: State that the transfer is made without any monetary consideration, as this is typically a voluntary action.

- Signatures: Sign the document in the designated area. If there are multiple grantors, all must sign.

- Notarization: Have the document notarized. This step ensures that the signatures are verified and adds legal weight to the document.

- Submit the Form: Deliver the completed and notarized form to the lender. Keep a copy for your records.

After submitting the completed form to the lender, you can expect them to process the transfer. This may involve additional paperwork or communication from their end. Stay in touch with your lender to ensure a smooth transition and address any questions that may arise during this process.

Common mistakes

-

Incomplete Information: One of the most common mistakes is failing to fill out all required fields. Leaving sections blank can lead to delays or rejection of the form.

-

Incorrect Property Description: Providing an inaccurate or incomplete description of the property can create confusion. Ensure that the legal description matches what is on the title.

-

Not Notarizing the Document: Many people forget that a deed must be notarized to be valid. Without a notary's signature, the document may not hold up in court.

-

Ignoring Lender Requirements: Each lender may have specific requirements regarding the deed in lieu process. Failing to check these can lead to complications.

-

Not Seeking Legal Advice: Many individuals attempt to fill out the form without consulting a legal professional. This can result in misinterpretation of the document's implications.

-

Missing Signatures: Forgetting to sign the document is a simple yet critical mistake. All parties involved must provide their signatures for the deed to be valid.

-

Overlooking Tax Implications: Some individuals do not consider the tax consequences of a deed in lieu. It’s essential to understand how this decision may affect your taxes.

-

Failing to Keep Copies: After submitting the deed, it’s vital to keep copies for your records. This can help in future disputes or clarifications.

-

Not Understanding the Process: Many people rush through the deed in lieu process without fully understanding it. Take the time to educate yourself about what it entails.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal document where a borrower voluntarily transfers the title of their property to the lender to avoid foreclosure proceedings. |

| Governing Law | The process is governed by California Civil Code Sections 1475-1490, which outline the requirements and procedures for executing a deed in lieu of foreclosure. |

| Eligibility | Homeowners facing financial hardship and unable to meet mortgage obligations may be eligible for this option, provided they have no other liens on the property. |

| Benefits | This option can help borrowers avoid the lengthy and costly foreclosure process, allowing for a quicker resolution of their financial difficulties. |

| Impact on Credit | A deed in lieu of foreclosure may have a less severe impact on a borrower's credit score compared to a foreclosure, though it will still be noted on their credit report. |

| Tax Implications | Borrowers should consult a tax professional, as there may be tax consequences related to debt forgiveness or property transfer in a deed in lieu of foreclosure. |

Dos and Don'ts

When filling out the California Deed in Lieu of Foreclosure form, it is important to approach the process with care. Here are some key dos and don'ts to keep in mind:

- Do ensure all information is accurate and up-to-date.

- Do consult with a legal professional if you have questions.

- Do provide clear and complete property descriptions.

- Do sign the document in the presence of a notary public.

- Don't rush through the form; take your time to review each section.

- Don't leave any sections blank unless instructed.

- Don't ignore any outstanding debts related to the property.

- Don't forget to keep copies of all documents for your records.

Similar forms

A Short Sale Agreement is similar to a Deed in Lieu of Foreclosure in that both involve the transfer of property to the lender to avoid foreclosure. In a short sale, the homeowner sells the property for less than the amount owed on the mortgage, with the lender's approval. The homeowner can avoid the lengthy foreclosure process and potential damage to their credit score. Both options aim to provide a solution that is less damaging than foreclosure, allowing the homeowner to move on from the property more smoothly.

A Mortgage Release, also known as a Satisfaction of Mortgage, shares similarities with a Deed in Lieu of Foreclosure. In this case, the lender agrees to release the borrower from their mortgage obligations after the borrower has paid off the loan or when the property is sold. This document signifies that the borrower no longer owes money to the lender. Like a Deed in Lieu, it marks the end of a mortgage relationship, but it usually involves a sale or payoff rather than a direct transfer of property to the lender.

A Forebearance Agreement can also be compared to a Deed in Lieu of Foreclosure. This document allows a borrower to temporarily pause or reduce their mortgage payments due to financial hardship. While it does not involve the transfer of property, it serves as a way to prevent foreclosure. Both options aim to provide relief to the borrower, but a forbearance agreement typically allows the borrower to keep their home while they work through their financial difficulties.

For those interested in leasing commercial space, understanding the terms outlined in a Commercial Lease Agreement is crucial. This template provides a structured approach to setting forth the rental conditions and obligations. To gain access to a customizable form, explore the Texas Commercial Lease Agreement for your business needs.

A Bankruptcy Filing is another document that has similarities with a Deed in Lieu of Foreclosure. When a homeowner files for bankruptcy, it can stop foreclosure proceedings temporarily. In some cases, bankruptcy can lead to a discharge of debts, including mortgage obligations. While a Deed in Lieu involves voluntarily giving up the property, bankruptcy is a legal process that can provide various options for debt relief. Both documents are used to address financial distress and can lead to a resolution of mortgage issues.

Check out Popular Deed in Lieu of Foreclosure Forms for Different States

Deed in Lieu of Foreclosure Florida - Be mindful of any potential tax implications when transferring property through a Deed in Lieu.

Deeds in Lieu of Foreclosure - A Deed in Lieu of Foreclosure can be a strategic financial decision for borrowers facing financial hardship.

The Loan Servicer Might Agree to Put the Foreclosure on Hold to Give You Some Time to Sell Your Home - The lender can initiate the sale or management of the property after the deed has been signed.

The California Transfer-on-Death Deed form is a legal document that allows property owners to pass their real estate to a beneficiary without the need for a will or going through probate. This form is a straightforward way to ensure that your property is transferred according to your wishes upon your death. It offers a simple solution for estate planning, making it easier for Californians to manage the future of their real estate investments. For more details, you can refer to All California Forms.

The Loan Servicer Might Agree to Put the Foreclosure on Hold to Give You Some Time to Sell Your Home - Homeowners are encouraged to seek advice before entering into a Deed in Lieu of Foreclosure.