Get California Death of a Joint Tenant Affidavit Form in PDF

In California, when a joint tenant passes away, their share of the property does not automatically become part of their estate. Instead, it typically transfers directly to the surviving joint tenant(s) through a legal process that requires documentation. One crucial document in this process is the California Death of a Joint Tenant Affidavit. This form serves as a formal declaration that a joint tenant has died, allowing the surviving joint tenant(s) to establish their ownership of the property without the need for probate. The affidavit includes essential details such as the deceased's name, date of death, and information about the property in question. By completing this form, surviving joint tenants can simplify the transfer of property rights and ensure that their ownership is recognized legally. Understanding how to properly fill out and file this affidavit is vital for anyone navigating the complexities of joint tenancy and property ownership in California.

Misconceptions

The California Death of a Joint Tenant Affidavit form is a crucial document for those dealing with the passing of a joint tenant. However, several misconceptions surround its purpose and use. Here are seven common misunderstandings:

- Misconception 1: The affidavit is only necessary if there is a will.

- Misconception 2: You must file the affidavit with the court.

- Misconception 3: All joint tenants must sign the affidavit.

- Misconception 4: The affidavit can be used for any type of property.

- Misconception 5: There is a specific form that must be used statewide.

- Misconception 6: The affidavit can be completed by anyone.

- Misconception 7: The affidavit eliminates all tax implications.

This is not true. The affidavit is used specifically to transfer property owned as joint tenants, regardless of whether a will exists. It helps establish the surviving tenant's right to the property without needing probate.

In most cases, the affidavit does not need to be filed with the court. Instead, it is typically recorded with the county recorder's office to update the property records.

Only the surviving joint tenant needs to sign the affidavit. The deceased joint tenant cannot sign, and their signature is not required for the affidavit to be valid.

The affidavit is specifically designed for real property held in joint tenancy. It cannot be used for personal property or other types of assets.

While there is a general format for the affidavit, some counties may have their own variations or additional requirements. It is essential to check with the local county recorder's office for specific guidelines.

Only the surviving joint tenant has the authority to complete and sign the affidavit. Others, including family members or friends, cannot do this on behalf of the surviving tenant.

While the affidavit can simplify the transfer of property, it does not eliminate potential tax implications. The surviving tenant may still need to address property taxes or capital gains taxes associated with the property.

Understanding these misconceptions can help individuals navigate the process more effectively and ensure that they comply with the necessary legal requirements when dealing with the death of a joint tenant.

California Death of a Joint Tenant Affidavit: Usage Instruction

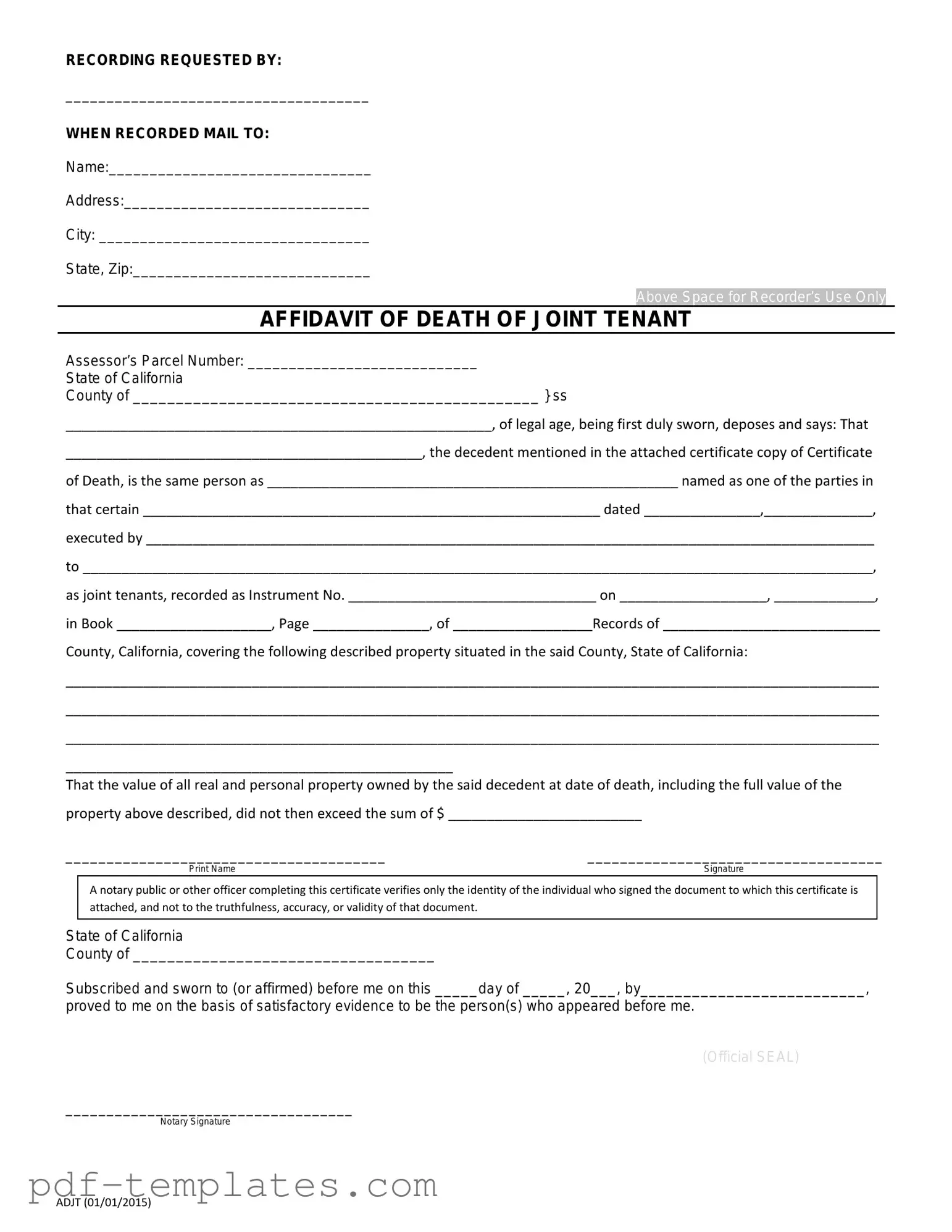

After a joint tenant passes away, the surviving tenant may need to complete the California Death of a Joint Tenant Affidavit form to clarify ownership of the property. This form allows the surviving tenant to assert their rights to the property without going through a lengthy probate process. Following these steps will help ensure that the form is filled out correctly and submitted properly.

- Begin by obtaining the California Death of a Joint Tenant Affidavit form. This form can typically be found online or at your local county clerk's office.

- At the top of the form, provide the name of the deceased joint tenant. Make sure to spell their name accurately.

- Next, enter the date of death of the deceased joint tenant. This is crucial for establishing the timeline of ownership.

- Include the property address. Write the full address of the property that was held in joint tenancy.

- In the appropriate section, identify yourself as the surviving joint tenant. Provide your full name and contact information.

- Fill in any additional required details, such as the relationship to the deceased, if applicable.

- Sign and date the affidavit. Your signature confirms that the information provided is true to the best of your knowledge.

- Finally, have the affidavit notarized. This step is important to ensure the document is legally valid.

Once the form is completed and notarized, it should be filed with the county recorder's office where the property is located. This will officially update the property records to reflect the change in ownership.

Common mistakes

-

Incorrect Information: Providing inaccurate details about the deceased joint tenant, such as their full name, date of death, or property address, can lead to complications. Always double-check these facts.

-

Missing Signatures: Failing to sign the affidavit or obtaining necessary signatures from other joint tenants can invalidate the form. Ensure all required parties sign where indicated.

-

Not Including Supporting Documents: Neglecting to attach a copy of the death certificate or other required documentation can result in delays. Always include these essential documents.

-

Improper Notarization: Forgetting to have the affidavit notarized or using an unqualified notary can create legal issues. Make sure the affidavit is properly notarized as required.

-

Wrong Form Version: Using an outdated version of the affidavit form may lead to rejection. Always download the latest version from the official California government website.

-

Failure to Follow Instructions: Ignoring the specific instructions provided with the form can result in errors. Carefully read all guidelines before completing the affidavit.

-

Inadequate Detail: Providing insufficient information about the property, such as legal descriptions or parcel numbers, can create confusion. Include all necessary details to clarify ownership.

-

Not Filing in Time: Delaying the filing of the affidavit can complicate the transfer of property ownership. File the affidavit promptly after the death of the joint tenant.

File Specifics

| Fact Name | Description |

|---|---|

| Purpose | The California Death of a Joint Tenant Affidavit form is used to establish the death of a joint tenant and transfer their interest in the property to the surviving joint tenant(s). |

| Governing Law | This form is governed by California Probate Code Section 5600, which outlines the rights of joint tenants and the process for transferring property upon death. |

| Eligibility | Only surviving joint tenants may file this affidavit. The deceased must have held the property as a joint tenant for the affidavit to be valid. |

| Required Information | The affidavit must include the name of the deceased, the date of death, and details about the property, including its legal description. |

| Filing Process | After completing the form, the surviving joint tenant must file it with the county recorder’s office where the property is located to effectuate the transfer. |

Dos and Don'ts

When filling out the California Death of a Joint Tenant Affidavit form, it is crucial to approach the process with care. Here are five important do's and don'ts to consider:

- Do ensure that you have the correct form. Verify that you are using the most recent version of the affidavit.

- Do provide accurate information. Double-check names, dates, and other details to avoid errors that could delay the process.

- Do sign the affidavit in the presence of a notary public. This step is essential for the affidavit to be legally valid.

- Don't leave any required fields blank. Omitting information can lead to complications and may result in the form being rejected.

- Don't submit the form without reviewing it thoroughly. Take the time to read through the completed affidavit to ensure everything is correct before submission.

Similar forms

The California Death of a Joint Tenant Affidavit is similar to the Affidavit of Heirship. This document is used to establish the heirs of a deceased individual when there is no will. Like the affidavit for joint tenants, the Affidavit of Heirship provides a way to transfer property without going through probate. Both documents serve to clarify ownership and facilitate the transfer process, making it easier for surviving family members to manage the deceased's estate.

Another document that shares similarities is the Grant Deed. A Grant Deed is used to transfer property ownership from one party to another. In cases where a joint tenant passes away, a Grant Deed may be used to formally transfer the deceased's interest to the surviving joint tenant. Both documents aim to simplify the transfer of property and eliminate confusion regarding ownership rights.

The Affidavit of Death is also comparable to the California Death of a Joint Tenant Affidavit. This document serves to declare the death of an individual and is often used in various legal contexts, including the transfer of assets. Both affidavits provide necessary proof of death, which is essential for updating property records and ensuring that the surviving party can claim their rightful ownership.

In addition to these property transfer documents, it is essential to consider the importance of having a California Medical Power of Attorney form. This legal document ensures that healthcare decisions can be made by a trusted individual if one is unable to do so. It guarantees that a person’s medical preferences are honored during critical times, thereby providing peace of mind. For those looking for comprehensive resources, All California Forms can offer valuable information regarding this and other essential legal documents.

The Revocable Living Trust is another document that operates similarly. A Revocable Living Trust allows individuals to manage their assets during their lifetime and specifies how those assets should be distributed upon death. Like the Death of a Joint Tenant Affidavit, this trust helps avoid probate and ensures a smoother transition of assets to the intended beneficiaries, thereby simplifying the estate management process.

The Durable Power of Attorney is also relevant in this context. While it primarily allows someone to make decisions on behalf of another person, it can also facilitate property transfers upon death. Similar to the Death of a Joint Tenant Affidavit, it ensures that the deceased's wishes are honored and that their assets are managed according to their preferences, thus streamlining the process for surviving family members.

The Will is a fundamental document that outlines how a person's assets should be distributed after death. While the Death of a Joint Tenant Affidavit directly addresses property held in joint tenancy, a Will encompasses all assets. Both documents serve to clarify ownership and ensure that the deceased's intentions are carried out, though they operate in different contexts.

The Assignment of Interest is another document that bears resemblance. This document is used to transfer a person's interest in a property or asset to another party. In the case of a deceased joint tenant, an Assignment of Interest may be necessary to formally transfer the deceased's share to the surviving tenant. Both documents facilitate the transfer of ownership and help avoid legal disputes regarding property rights.

The Certificate of Title also shares similarities with the California Death of a Joint Tenant Affidavit. This document serves as proof of ownership for real property. When a joint tenant passes away, a Certificate of Title may need to be updated to reflect the surviving tenant's ownership. Both documents are essential for ensuring that property records accurately reflect current ownership, thereby preventing potential legal issues.

Lastly, the Notice of Death serves a similar purpose. This document is used to inform relevant parties, including creditors and beneficiaries, about an individual's passing. Like the Death of a Joint Tenant Affidavit, it provides essential information that aids in the administration of the deceased's estate, ensuring that all parties are aware of the situation and can take appropriate actions.

Other PDF Forms

Living Will Downloadable 5 Wishes Printable Version - This form can help you articulate not only medical needs but also how you wish to be treated by those around you.

What Is Signature Release - This authorization is essential for requested delivery in your absence.

A Texas Vehicle Purchase Agreement is a legal document that outlines the terms and conditions of a vehicle sale between a buyer and a seller. This form serves to protect both parties by detailing the specifics of the transaction, including the sale price, vehicle information, and any warranties or representations. Understanding this agreement is essential for ensuring a smooth and legally compliant purchase process. For more information, you can refer to the agreement at https://documentonline.org/blank-texas-vehicle-purchase-agreement.

Progressive Supplement Request - This form protects customer interests by ensuring clarity in pricing.