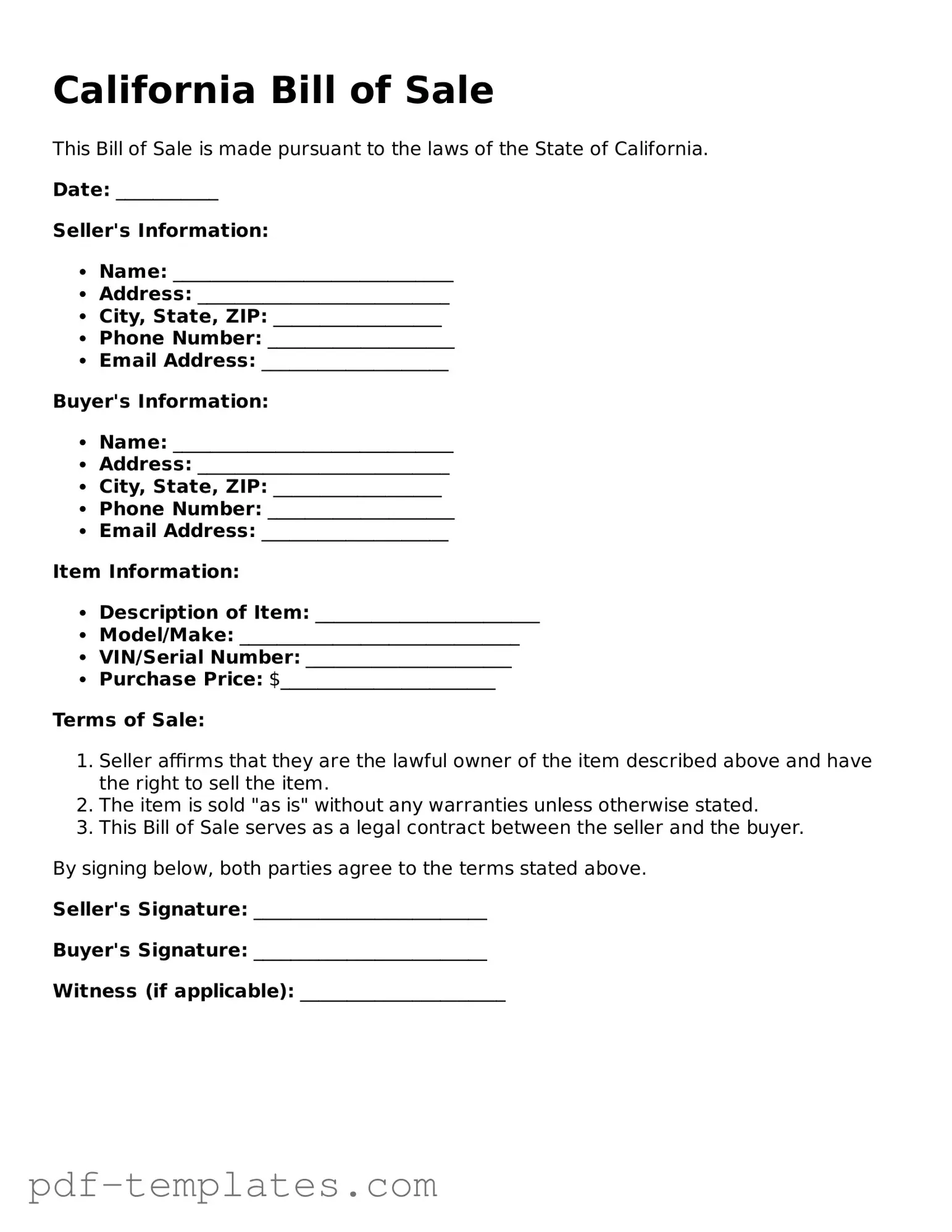

Official Bill of Sale Template for California State

The California Bill of Sale form is an essential document that facilitates the transfer of ownership for various types of personal property, including vehicles, boats, and other tangible items. This form serves as a written record of the transaction, providing both the buyer and seller with legal protection and clarity regarding the sale. Key components of the Bill of Sale include the names and addresses of both parties, a detailed description of the item being sold, the purchase price, and the date of the transaction. Additionally, the form may include warranties or disclaimers, depending on the nature of the sale. By completing this document, both parties can ensure a smooth transfer process and avoid potential disputes in the future. Understanding how to properly fill out and use the California Bill of Sale is crucial for anyone engaging in the buying or selling of personal property in the state.

Misconceptions

Misconceptions about the California Bill of Sale form can lead to confusion and missteps in transactions. Here are ten common misconceptions, along with clarifications to help individuals better understand this important document.

-

It is only necessary for vehicle sales. Many believe that a Bill of Sale is only required for the sale of vehicles. In reality, it can be used for various transactions, including the sale of personal property, boats, and even certain services.

-

A Bill of Sale is not legally binding. Some people think that a Bill of Sale is merely a receipt and has no legal weight. In fact, it serves as a legal document that outlines the terms of the sale and can be used in court if disputes arise.

-

It must be notarized. Many assume that notarization is a requirement for a Bill of Sale to be valid. While notarization can add an extra layer of authenticity, it is not mandatory in California for most transactions.

-

All sales require a Bill of Sale. Some people think that every transaction must include a Bill of Sale. However, for small transactions or gifts, a Bill of Sale is often unnecessary.

-

The form is the same for every type of sale. It is a common misconception that one standard form suffices for all transactions. Different types of sales may require specific information, so it is crucial to use the appropriate form.

-

It protects the seller only. Many individuals believe that the Bill of Sale primarily benefits the seller. In truth, it protects both parties by documenting the agreement and the condition of the item sold.

-

A Bill of Sale is not needed if the buyer pays cash. Some think that cash transactions do not require documentation. However, having a Bill of Sale is advisable to provide proof of the transaction, regardless of the payment method.

-

It can be handwritten and still be valid. While a handwritten Bill of Sale can be valid, it is often better to use a typed form to ensure clarity and completeness. Ambiguities in handwritten notes can lead to misunderstandings.

-

Once signed, it cannot be changed. Many believe that a Bill of Sale is final and unchangeable after signing. However, both parties can agree to amend the document if necessary, as long as changes are documented and signed by both parties.

-

It is only for private sales. Some people think that a Bill of Sale is only applicable in private sales. However, businesses also use Bills of Sale for transactions involving inventory or equipment, making it a versatile document.

Understanding these misconceptions can empower individuals to navigate transactions more confidently and ensure that their rights are protected.

California Bill of Sale: Usage Instruction

Once you have obtained the California Bill of Sale form, you can proceed to fill it out. This document serves as proof of the transaction between the buyer and the seller. Follow the steps below to complete the form accurately.

- Enter the date: Write the date of the transaction at the top of the form.

- Provide seller information: Fill in the seller's full name, address, and contact information.

- Provide buyer information: Fill in the buyer's full name, address, and contact information.

- Describe the item: Clearly describe the item being sold, including its make, model, year, and Vehicle Identification Number (VIN) if applicable.

- State the purchase price: Write the total amount paid for the item in both numerical and written form.

- Include any warranties: If there are any warranties or guarantees, specify them in this section.

- Signatures: Both the seller and buyer must sign and date the form to validate the transaction.

After completing the form, ensure both parties retain a copy for their records. This will help in case any disputes arise in the future.

Common mistakes

-

Failing to include accurate information about the buyer and seller. This includes names, addresses, and contact information.

-

Not providing a complete description of the item being sold. This should include make, model, year, and VIN for vehicles.

-

Overlooking the purchase price. It is important to clearly state the amount agreed upon for the sale.

-

Neglecting to date the form. A date is necessary to establish when the transaction took place.

-

Forgetting to sign the document. Both the buyer and seller must sign the Bill of Sale for it to be valid.

-

Using incorrect or outdated forms. Ensure that the most current version of the California Bill of Sale is being used.

-

Not keeping a copy of the completed Bill of Sale. It is essential for both parties to retain a copy for their records.

PDF Features

| Fact Name | Description |

|---|---|

| Purpose | A Bill of Sale in California is used to document the transfer of ownership of personal property from one person to another. |

| Governing Law | The California Civil Code, specifically sections related to the sale of goods and personal property, governs the Bill of Sale. |

| Required Information | The form typically requires details such as the names of the buyer and seller, a description of the item being sold, and the sale price. |

| Notarization | While notarization is not always required, it can provide additional legal protection and verification of the transaction. |

Dos and Don'ts

When filling out the California Bill of Sale form, it's essential to ensure accuracy and clarity. Here are some key dos and don’ts to keep in mind:

- Do: Double-check all information for accuracy before submitting the form.

- Do: Include the full names and addresses of both the buyer and seller.

- Do: Provide a detailed description of the item being sold, including any identifying numbers.

- Do: Sign and date the form to validate the transaction.

- Do: Keep a copy of the completed Bill of Sale for your records.

- Do: Consult with a legal advisor if you have questions about the process.

- Don't: Leave any fields blank; incomplete forms can lead to issues later.

- Don't: Use abbreviations or shorthand that may confuse the reader.

- Don't: Forget to mention any warranties or conditions of the sale.

- Don't: Alter the form in any way that could misrepresent the transaction.

- Don't: Ignore state-specific requirements that may apply to your sale.

- Don't: Rely solely on verbal agreements; always document the transaction in writing.

Similar forms

The California Bill of Sale form is similar to the Vehicle Title Transfer form, which is used when ownership of a vehicle changes hands. This document serves as proof that the seller has relinquished ownership and the buyer has accepted it. Like the Bill of Sale, it includes essential details such as the vehicle identification number (VIN), the names of both parties, and the sale price. Both forms help protect the interests of the buyer and seller by providing a clear record of the transaction.

Another document that shares similarities with the Bill of Sale is the Receipt for Payment. This receipt is often issued when a buyer pays for goods or services. It confirms that the transaction has taken place and includes information about what was purchased, the amount paid, and the date of the transaction. Just like a Bill of Sale, this receipt can serve as evidence in case of disputes or if proof of purchase is required in the future.

The Purchase Agreement is also akin to the Bill of Sale. This document outlines the terms and conditions of a sale, including the price, payment terms, and delivery details. While a Bill of Sale is often a simpler document that finalizes the transaction, a Purchase Agreement may include more detailed stipulations about the sale. Both documents aim to ensure clarity and protect the rights of both parties involved.

In addition, the Lease Agreement bears resemblance to the Bill of Sale. While a Bill of Sale transfers ownership, a Lease Agreement allows one party to use property owned by another for a specified period. Both documents require clear identification of the parties involved and the items or properties being exchanged. They also serve to protect the interests of both the lessor and lessee, outlining rights and responsibilities.

The Warranty Deed is another document that shares characteristics with the Bill of Sale. This legal document is used to transfer real estate ownership and guarantees that the seller holds clear title to the property. Like a Bill of Sale, it provides a record of the transaction and is often filed with a government office to ensure public record of the ownership transfer.

Similarly, the Assignment of Contract is comparable to the Bill of Sale. This document allows one party to transfer their rights and obligations under a contract to another party. It serves as a formal acknowledgment of the change in parties involved in a contract, similar to how a Bill of Sale acknowledges the transfer of ownership of goods or property.

The Affidavit of Ownership is also similar to the Bill of Sale. This sworn statement is often used to affirm that an individual is the rightful owner of a particular item, especially when a formal title does not exist, such as with certain personal property. Both documents provide a means to establish proof of ownership, which can be crucial in legal matters.

Another related document is the Power of Attorney. While it does not directly involve the sale of goods, it allows one person to act on behalf of another in legal matters, including the transfer of property. Both documents require clear identification of the parties and aim to facilitate transactions while protecting the rights of individuals involved.

Lastly, the Donation Receipt is akin to the Bill of Sale in that it provides proof of a transaction, albeit one that is not for monetary exchange. This document is used when an item is given as a gift or donation, detailing what was given, the value, and the donor and recipient's information. Like a Bill of Sale, it serves as a record of the transaction and can be important for tax purposes or personal records.

Check out Popular Bill of Sale Forms for Different States

How to Transfer Ownership of a Car to a Family Member in Ny - Different jurisdictions may have specific requirements regarding what must be included in the Bill of Sale.

Bill of Sale Car Texas - This document can be easily obtained online or through legal stationery stores.

How to Transfer Title in Florida - Sign a Bill of Sale to finalize the transfer of ownership for your item without any disputes.