Official Articles of Incorporation Template for California State

In the vibrant landscape of California's business environment, the Articles of Incorporation form serves as a foundational document for those looking to establish a corporation. This essential form outlines crucial details about the corporation, including its name, purpose, and the address of its principal office. Additionally, it requires information about the corporation's initial directors and the number of shares the corporation is authorized to issue. By completing this form, entrepreneurs not only comply with state regulations but also set the stage for their business's operational framework. The clarity and precision with which this document is filled out can significantly impact the future of the corporation, influencing everything from tax obligations to liability protections. Understanding the key components of the Articles of Incorporation is vital for anyone embarking on the journey of starting a business in California, as it lays the groundwork for corporate governance and operational success.

Misconceptions

When it comes to the California Articles of Incorporation form, several misconceptions can lead to confusion. Here are six common misunderstandings:

- It’s only for large businesses. Many believe that only large corporations need to file Articles of Incorporation. In reality, any business entity looking to operate as a corporation in California must complete this form, regardless of size.

- Filing is optional. Some people think that filing Articles of Incorporation is optional for starting a business. However, incorporating is a legal requirement for corporations, and failing to file can result in legal complications.

- All information is public. While certain details in the Articles of Incorporation are public, not all information is accessible to the public. For instance, personal addresses of directors may not be disclosed.

- Once filed, it cannot be changed. Many assume that after filing the Articles of Incorporation, the information is set in stone. However, amendments can be made if necessary, following the proper procedures.

- It guarantees business success. Some believe that simply filing Articles of Incorporation will lead to business success. In truth, success depends on various factors, including management, marketing, and financial planning.

- Only lawyers can file it. While legal assistance can be helpful, individuals can file the Articles of Incorporation themselves. The form is designed to be user-friendly, allowing business owners to complete it without a lawyer's help.

Understanding these misconceptions can help ensure that business owners are better prepared for the incorporation process in California.

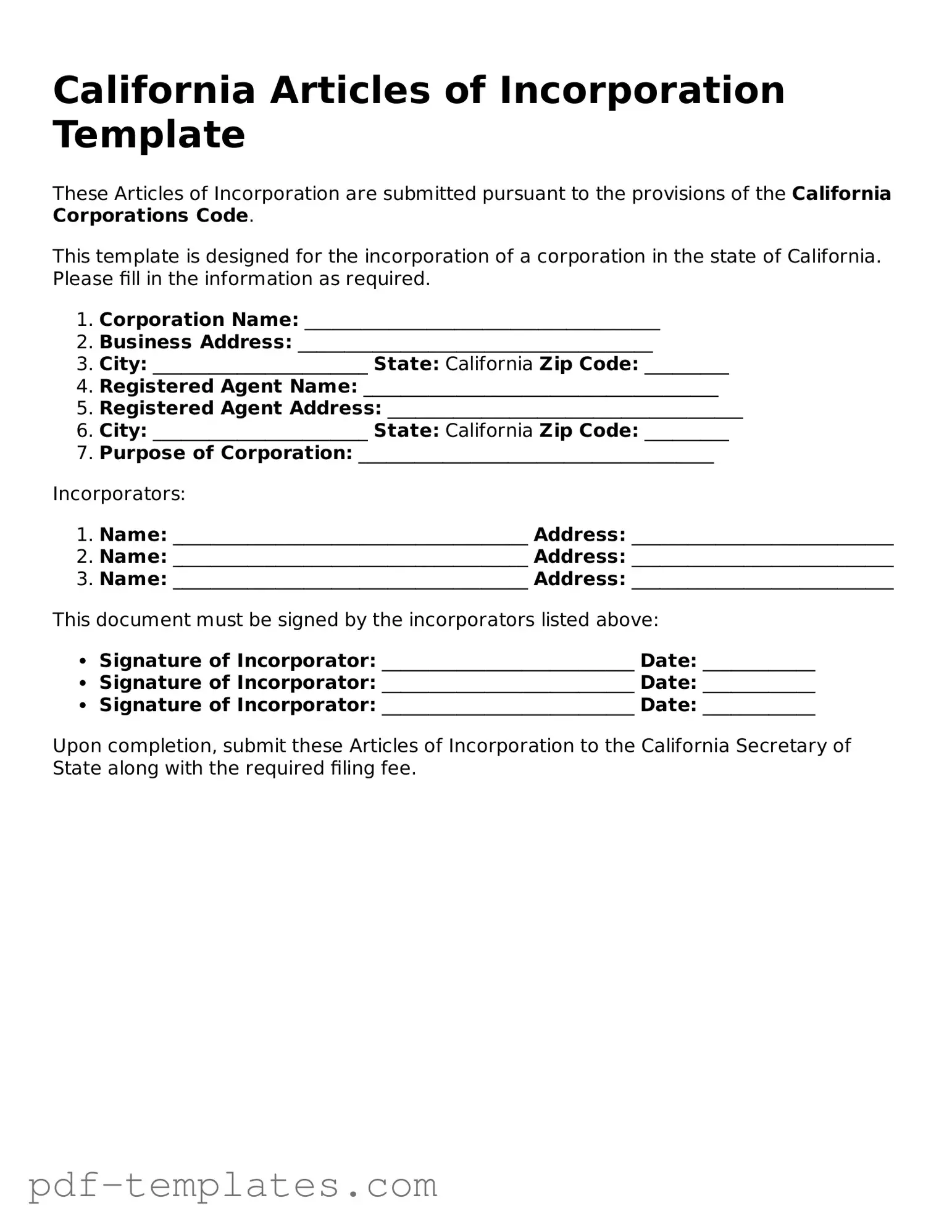

California Articles of Incorporation: Usage Instruction

After obtaining the California Articles of Incorporation form, you will need to complete it accurately to establish your corporation. This form serves as a foundational document for your new business entity. Once you have filled it out, you will submit it to the appropriate state agency along with the required filing fee.

- Begin by downloading the California Articles of Incorporation form from the California Secretary of State's website or obtain a physical copy from their office.

- In the first section, provide the name of your corporation. Ensure that the name complies with California naming requirements and is not already in use.

- Next, indicate the purpose of your corporation. A brief description of the business activities will suffice.

- Fill in the address of the corporation's initial designated office. This should be a physical address, not a P.O. Box.

- Provide the name and address of the initial agent for service of process. This individual or entity will receive legal documents on behalf of the corporation.

- In the next section, specify the number of shares the corporation is authorized to issue. If applicable, indicate the classes of shares and their respective rights.

- Include the names and addresses of the incorporators. These individuals are responsible for filing the Articles of Incorporation.

- Review the form for any errors or omissions. Accuracy is crucial to avoid delays in processing.

- Sign and date the form. The signature should be from one of the incorporators listed in the document.

- Prepare the filing fee, which can vary. Check the California Secretary of State's website for the current fee schedule.

- Submit the completed form and payment to the California Secretary of State, either online or by mail.

Common mistakes

-

Incorrect Business Name: One common mistake is failing to choose a unique business name. The name must not be identical or too similar to existing entities registered in California. It’s essential to check the California Secretary of State’s database before finalizing your choice.

-

Missing Purpose Statement: The Articles of Incorporation require a clear statement of the corporation's purpose. Many individuals either leave this section blank or provide vague descriptions. A well-defined purpose helps clarify the corporation's goals and can affect legal standing.

-

Improperly Listed Agent for Service of Process: An agent for service of process is crucial for receiving legal documents. Some people mistakenly list individuals who are not available or do not reside in California. Ensure the agent is reliable and meets state requirements.

-

Omitting Initial Directors: Failing to include the names and addresses of the initial directors can lead to delays. This information is vital for establishing the governance of the corporation, and it must be provided accurately.

-

Incorrectly Stating the Number of Shares: When specifying the number of shares the corporation is authorized to issue, errors can occur. Some individuals either underestimate or overestimate this number. It’s important to understand the implications of share structure and set it appropriately.

-

Not Including Required Signatures: The Articles of Incorporation must be signed by the incorporators. Sometimes, individuals forget to sign or provide an incomplete signature. Without proper signatures, the filing may be rejected.

-

Neglecting to File with the Correct Office: Finally, some people mistakenly file their Articles of Incorporation with the wrong office or fail to submit them altogether. It’s crucial to file with the California Secretary of State and to keep a copy for your records.

PDF Features

| Fact Name | Description |

|---|---|

| Purpose | The California Articles of Incorporation form is used to legally create a corporation in the state of California. |

| Governing Law | This form is governed by the California Corporations Code, specifically Section 200. |

| Filing Requirement | Filing the Articles of Incorporation with the California Secretary of State is mandatory for all corporations. |

| Information Needed | Key information required includes the corporation's name, purpose, and address, as well as the name and address of the initial agent for service of process. |

| Filing Fee | A filing fee is required when submitting the Articles of Incorporation, which varies based on the type of corporation. |

| Processing Time | The processing time for the Articles of Incorporation can vary, but expedited services are available for an additional fee. |

| Corporate Structure | The form allows for the establishment of different types of corporations, including nonprofit and for-profit entities. |

| Amendments | If changes are needed after filing, amendments to the Articles of Incorporation can be submitted, following specific procedures outlined in the Corporations Code. |

Dos and Don'ts

When completing the California Articles of Incorporation form, it's essential to approach the task with care. Here’s a list of things you should and shouldn’t do to ensure a smooth process.

- Do read the instructions carefully before starting to fill out the form.

- Do provide accurate information about your corporation's name and address.

- Do include the names and addresses of all initial directors.

- Do specify the purpose of your corporation clearly and concisely.

- Do ensure that your corporation name complies with California naming requirements.

- Don't use abbreviations or acronyms in the corporation's name unless permitted.

- Don't leave any required fields blank; all sections must be completed.

- Don't forget to sign and date the form before submission.

- Don't submit the form without checking for typos or errors.

Taking these steps can help you avoid common pitfalls and ensure that your Articles of Incorporation are processed efficiently.

Similar forms

The Articles of Incorporation in California serve as a foundational document for establishing a corporation. Similarly, the Certificate of Formation in Delaware is used to create a corporation or limited liability company (LLC). This document outlines essential details such as the name of the entity, its purpose, and the registered agent. Both documents serve to formally register the business with the state, providing legal recognition and protection to the owners.

Another document akin to the Articles of Incorporation is the Bylaws. While the Articles of Incorporation establish the existence of the corporation, Bylaws govern its internal operations. They detail the rules and procedures for managing the corporation, including the roles of officers and directors. Both documents are crucial for ensuring that the corporation operates smoothly and in compliance with state laws.

The Operating Agreement, often used by LLCs, is similar to the Bylaws. This document outlines the management structure and operational guidelines for the LLC. Like Bylaws, it specifies the rights and responsibilities of members. Both documents help clarify how the entity will function and can prevent disputes among members or shareholders.

The Statement of Information, required by California law, is another document related to the Articles of Incorporation. This form provides updated information about the corporation, such as its address and the names of its officers. While the Articles of Incorporation create the corporation, the Statement of Information ensures that the state has current details about the entity's operations.

Incorporation applications, which vary by state, are also comparable. These applications typically require similar information to the Articles of Incorporation, including the business name and purpose. They serve the same primary function: to formally register a business entity with the state, allowing it to operate legally.

The Assumed Name Certificate, or DBA (Doing Business As) registration, is another relevant document. This certificate allows a business to operate under a name different from its legal name. While the Articles of Incorporation establish the official name of a corporation, the DBA provides flexibility in branding and marketing, allowing businesses to connect with their target audience more effectively.

Partnership Agreements, used by general and limited partnerships, bear similarities to the Articles of Incorporation. This document outlines the terms of the partnership, including profit sharing and responsibilities. While the Articles of Incorporation are specific to corporations, Partnership Agreements serve a similar purpose in defining the structure and governance of a partnership.

In some cases, Nonprofit Articles of Incorporation are also relevant. Nonprofits must file this document to establish their organization legally. Like the standard Articles of Incorporation, it includes the organization's name, purpose, and structure. Both documents serve to create a recognized entity that can operate within the legal framework of the state.

The Federal Employer Identification Number (EIN) application is another document that complements the Articles of Incorporation. While the Articles establish the corporation at the state level, the EIN is necessary for tax purposes at the federal level. This number is essential for opening bank accounts, hiring employees, and filing taxes, making it a crucial step in the business formation process.

Finally, the Business License is a document that may be required depending on the type of business and location. While the Articles of Incorporation provide the legal foundation for the business, a Business License grants permission to operate within a specific jurisdiction. Both documents are essential for compliance with local regulations and ensuring the business can function legally.

Check out Popular Articles of Incorporation Forms for Different States

Pa Corporation - Gives insight into future growth and expansion plans.

Scc Documents - Check your state for online filing options to expedite the process.

Ny Department of State - Confirms the incorporation complies with state regulations.

Florida Incorporation - Properly executed, it lays the groundwork for corporate operations.