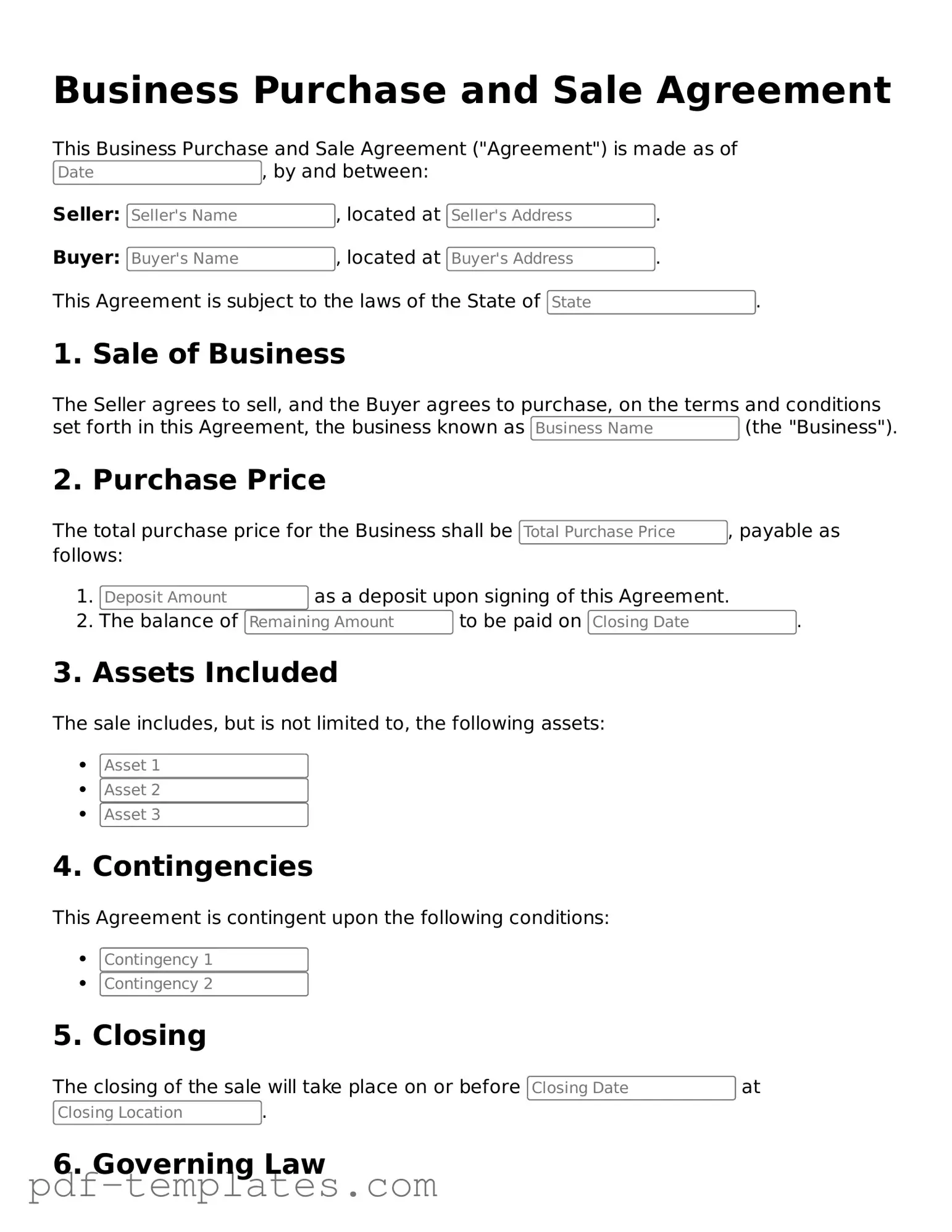

Business Purchase and Sale Agreement Document

When buying or selling a business, having a solid agreement in place is essential to ensure a smooth transaction. The Business Purchase and Sale Agreement serves as a crucial document that outlines the terms and conditions of the sale, protecting both the buyer and the seller. This form typically includes key components such as the purchase price, payment terms, and the assets being transferred. It also addresses any liabilities that may be assumed by the buyer and includes provisions for due diligence, which allows the buyer to investigate the business before finalizing the deal. Additionally, the agreement often contains clauses regarding confidentiality, non-compete agreements, and dispute resolution, all of which help to mitigate risks associated with the sale. By clearly defining each party's rights and obligations, the Business Purchase and Sale Agreement lays the groundwork for a successful business transition.

Misconceptions

When it comes to the Business Purchase and Sale Agreement form, several misconceptions can lead to confusion. Here are four common misunderstandings:

- It’s just a formality. Many believe that signing this agreement is merely a formality. In reality, it serves as a critical legal document that outlines the terms of the sale, protecting both the buyer and the seller.

- All agreements are the same. Some assume that all Business Purchase and Sale Agreements are identical. However, each agreement should be tailored to fit the specific circumstances of the transaction, including the unique details of the business being sold.

- It doesn’t need legal review. There’s a misconception that these agreements don’t require legal scrutiny. In truth, having an attorney review the agreement is essential to ensure that all legal aspects are properly addressed and that the interests of both parties are safeguarded.

- Once signed, it can’t be changed. Many think that once the agreement is signed, it cannot be altered. While it’s true that changes can be complex, amendments can be made if both parties agree to the new terms.

Understanding these misconceptions can help ensure a smoother transaction process and better outcomes for all involved.

Business Purchase and Sale Agreement: Usage Instruction

Completing the Business Purchase and Sale Agreement form is an important step in the process of buying or selling a business. This form outlines the terms and conditions of the transaction, ensuring that both parties are clear on their rights and obligations. Follow these steps to fill it out accurately.

- Gather Necessary Information: Collect all relevant details about the business, including its legal name, address, and any identifying numbers such as tax ID or registration numbers.

- Identify the Parties: Clearly state the names and contact information of both the buyer and the seller. Make sure to include any business entities involved.

- Describe the Business: Provide a detailed description of the business being sold. Include its assets, liabilities, and any other pertinent information that defines the business.

- Outline the Purchase Price: Specify the total purchase price and how it will be paid. Will it be a lump sum, installments, or a combination? Be clear about any deposits or earnest money.

- Include Terms and Conditions: Detail any specific terms related to the sale, such as contingencies, warranties, or representations made by either party.

- Set Closing Date: Indicate the proposed date for closing the sale. This is when the final paperwork will be signed and ownership transferred.

- Signatures: Ensure that both parties sign and date the agreement. This formalizes the contract and indicates acceptance of all terms.

Once the form is completed, it’s essential to review it carefully. Make sure that all information is accurate and that both parties understand the terms. Consulting with a legal professional can provide additional assurance that everything is in order before proceeding with the transaction.

Common mistakes

-

Incomplete Information: Failing to fill out all required fields can lead to delays and misunderstandings. Ensure that every section is completed accurately.

-

Incorrect Dates: Entering the wrong dates for the transaction can create confusion. Double-check all dates to ensure they align with the timeline of the sale.

-

Omitting Contingencies: Not including necessary contingencies can result in unforeseen issues. Clearly outline any conditions that must be met before the sale is finalized.

-

Neglecting to Specify Payment Terms: Vague payment terms can lead to disputes. Clearly state how and when payments will be made.

-

Ignoring Legal Requirements: Each state has specific laws regarding business transactions. Familiarize yourself with these regulations to avoid legal complications.

-

Failure to Include Necessary Attachments: Important documents, such as financial statements or asset lists, should be attached. Omitting these can weaken the agreement.

-

Not Reviewing the Agreement: Skipping a thorough review can lead to overlooked errors. Always take the time to read the entire document before submission.

-

Assuming Standard Clauses are Sufficient: Relying on generic clauses may not address specific needs. Tailor the agreement to reflect the unique aspects of the transaction.

-

Ignoring Signatures: Failing to obtain all necessary signatures can render the agreement invalid. Ensure that all parties sign and date the document where required.

PDF Features

| Fact Name | Description |

|---|---|

| Purpose | A Business Purchase and Sale Agreement outlines the terms and conditions for the sale of a business. |

| Parties Involved | The agreement typically involves a seller, who is transferring ownership, and a buyer, who is acquiring the business. |

| Governing Law | The agreement is governed by state law, which varies by jurisdiction. For example, in California, the Uniform Commercial Code applies. |

| Key Components | Important elements include purchase price, payment terms, and representations and warranties of both parties. |

| Confidentiality | Many agreements include confidentiality clauses to protect sensitive business information during the sale process. |

| Due Diligence | Buyers often conduct due diligence to verify the seller's claims about the business before finalizing the agreement. |

| Closing Process | The agreement outlines the closing process, detailing when and how the transfer of ownership will occur. |

Dos and Don'ts

When filling out a Business Purchase and Sale Agreement form, attention to detail is crucial. Here are five essential do's and don'ts to consider:

- Do read the entire agreement carefully before filling it out.

- Do ensure all parties involved are correctly identified with their full legal names.

- Do provide accurate and complete information about the business being sold.

- Do consult with a legal professional if you have questions or concerns.

- Do keep a copy of the signed agreement for your records.

- Don't rush through the form; mistakes can be costly.

- Don't leave any sections blank; if something doesn't apply, indicate that clearly.

- Don't ignore the terms and conditions; they govern the agreement.

- Don't sign the document until you fully understand all its implications.

- Don't forget to date the agreement when signing.

Similar forms

The Letter of Intent (LOI) is a preliminary document that outlines the basic terms of a potential business transaction. Similar to the Business Purchase and Sale Agreement, the LOI serves as a framework for negotiations. It typically includes key points such as the purchase price, payment terms, and any contingencies that may need to be addressed. While the LOI is not legally binding, it sets the stage for more detailed discussions, much like the initial agreements in a purchase and sale context.

The Asset Purchase Agreement (APA) focuses specifically on the acquisition of a company's assets rather than its stock or ownership. This document details which assets are being purchased, the liabilities being assumed, and the purchase price. Like the Business Purchase and Sale Agreement, the APA outlines the terms and conditions of the sale, ensuring that both parties understand their rights and responsibilities throughout the transaction.

The Vehicle Release of Liability form is a vital component in the transaction of vehicle ownership, as it clearly outlines the responsibilities and liabilities of both parties involved. By using this form, sellers can protect themselves from future claims or issues that may arise after the ownership change. It is essential that both parties thoroughly understand the implications of this document, and it is advisable to access the form through reliable sources, such as https://documentonline.org/blank-vehicle-release-of-liability, to ensure all legal requirements are met and avoid potential disputes.

A Share Purchase Agreement (SPA) is similar in nature but specifically pertains to the sale of shares in a corporation. This document outlines the number of shares being sold, the price per share, and any conditions that must be met before the sale can be completed. Both the SPA and the Business Purchase and Sale Agreement require careful attention to detail and clarity to protect the interests of both buyer and seller.

The Confidentiality Agreement, often executed alongside a Business Purchase and Sale Agreement, ensures that sensitive information shared during negotiations remains protected. This document is crucial for maintaining trust between the parties. Just as the Business Purchase and Sale Agreement outlines the terms of the transaction, the Confidentiality Agreement establishes boundaries for the information exchanged, preventing misuse or disclosure to third parties.

A Due Diligence Checklist is a comprehensive document that outlines the information and documents a buyer needs to review before completing a purchase. This checklist is similar to the Business Purchase and Sale Agreement in that it helps facilitate a thorough understanding of the business being acquired. Both documents aim to ensure that the buyer is fully informed about what they are purchasing, thereby minimizing risks associated with the transaction.

The Purchase Order (PO) is a document that confirms a buyer's intent to purchase goods or services from a seller. While it is more transactional in nature, it shares similarities with the Business Purchase and Sale Agreement in that both documents formalize an agreement between parties. They specify terms such as price and delivery, ensuring that both sides have a clear understanding of their obligations.

The Partnership Agreement is relevant when two or more parties are entering into a business relationship. Similar to the Business Purchase and Sale Agreement, it outlines the terms of the partnership, including profit-sharing, responsibilities, and decision-making processes. Both documents establish a foundation for collaboration and clarify the expectations of each party involved.

The Franchise Agreement is another document that shares similarities with the Business Purchase and Sale Agreement. It outlines the terms under which a franchisee can operate a franchise, including fees, obligations, and rights. Both agreements serve to protect the interests of the parties involved while providing a clear structure for the business relationship.

The Non-Disclosure Agreement (NDA) is designed to protect confidential information exchanged during negotiations. Like the Business Purchase and Sale Agreement, it emphasizes the importance of trust and confidentiality in business dealings. Both documents are essential for ensuring that sensitive information remains secure while discussions are ongoing.

The Employment Agreement can also be related to the context of a business sale. When a business is sold, existing employees may need new agreements that outline their roles and responsibilities under new ownership. Similar to the Business Purchase and Sale Agreement, this document sets clear expectations for both the employer and employee, ensuring a smooth transition during the ownership change.

More Documents

Rent Agreement Format - The lease serves as a binding agreement between landlord and tenant.

Roof Inspection Template - Unforeseen leaks are not the responsibility of the contractor's warranty.

In today's competitive market, having a well-crafted Investment Letter of Intent (LOI) is crucial for investors and sellers alike, as it lays the foundation for clear communication and mutual understanding. For those looking to create or review this important document, resources like OnlineLawDocs.com can provide valuable guidance, ensuring that all necessary details are addressed and that both parties are aligned on the terms of the potential investment.

Da Form 638 Fillable - Each section of the form serves a specific purpose in documenting achievements.