Get Business Credit Application Form in PDF

The Business Credit Application form serves as a vital tool for companies seeking to establish credit with suppliers or financial institutions. This form typically requires essential information about the business, including its legal name, address, and contact details. Additionally, applicants must provide details about their business structure, such as whether they are a sole proprietorship, partnership, or corporation. Financial information is also crucial; businesses often need to disclose their annual revenue, existing debts, and credit history. Moreover, references from other creditors may be requested to assess creditworthiness. Completing this form accurately is imperative, as it not only facilitates the credit approval process but also helps build a trustworthy relationship between the business and its creditors. A well-prepared application can significantly enhance the chances of obtaining favorable credit terms, making it an essential step in managing a company's financial health.

Misconceptions

Many people have misunderstandings about the Business Credit Application form. These misconceptions can lead to confusion and mistakes during the application process. Here are six common misconceptions:

- 1. The application is only for large businesses. Many believe that only large companies can apply for business credit. In reality, small businesses can also benefit from applying for credit. The application is designed for businesses of all sizes.

- 2. A good credit score guarantees approval. While a strong credit score is important, it does not automatically ensure approval. Lenders consider various factors, including income, business history, and overall financial health.

- 3. The application process is the same for all lenders. Each lender has its own requirements and processes. It is essential to review the specific guidelines for each lender before applying.

- 4. You need to provide personal guarantees. Some believe that personal guarantees are mandatory for all business credit applications. However, many lenders offer options that do not require personal guarantees, especially for established businesses.

- 5. Submitting the application is the final step. After submitting the application, many assume they will receive a decision immediately. In reality, the review process can take time, and lenders may request additional information before making a decision.

- 6. Business credit is only for financing large purchases. Some think business credit is only useful for significant expenses. However, it can also help manage day-to-day operational costs, such as inventory and supplies.

Understanding these misconceptions can help business owners navigate the credit application process more effectively. Being informed leads to better decision-making and ultimately strengthens a business's financial position.

Business Credit Application: Usage Instruction

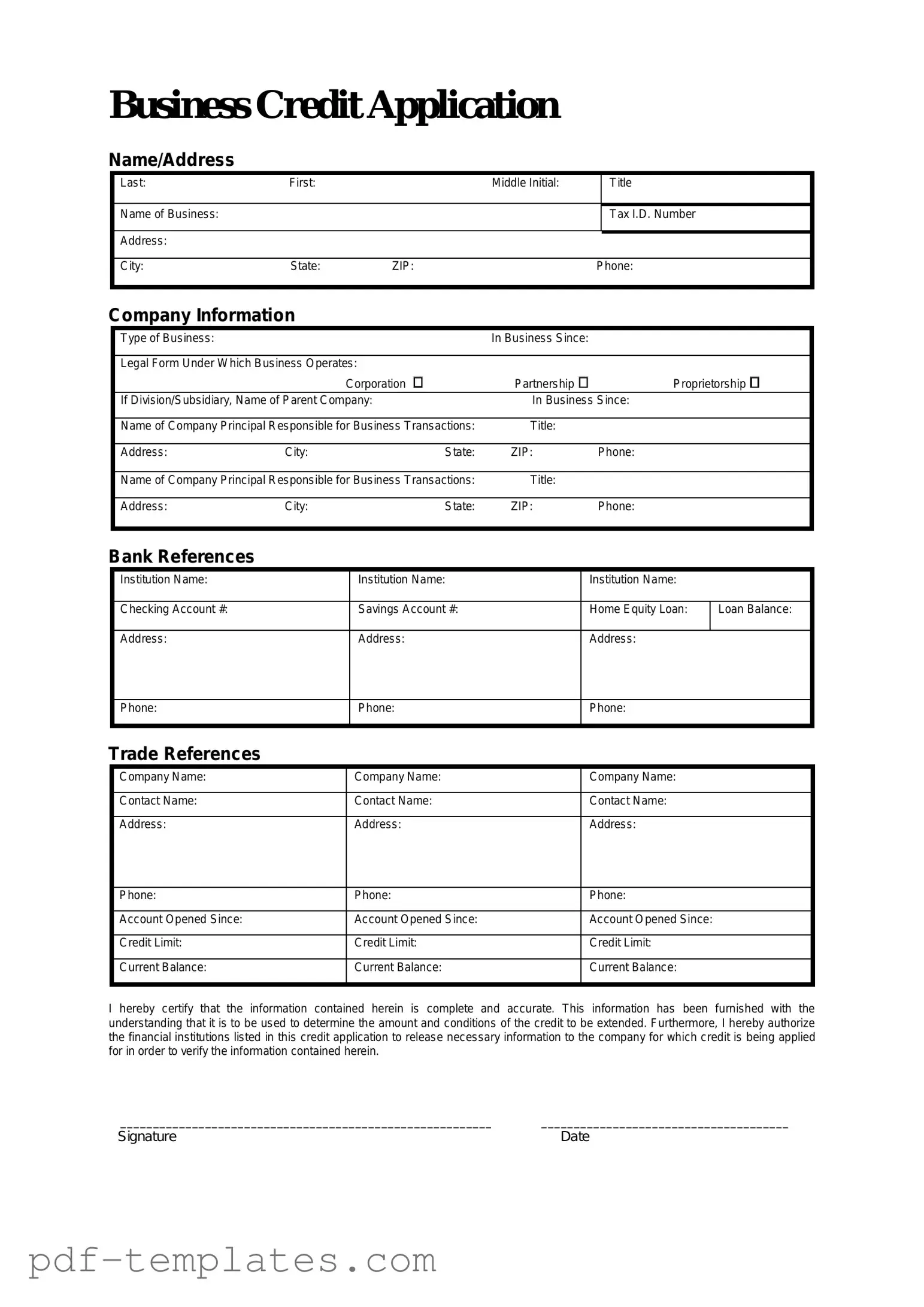

After obtaining the Business Credit Application form, you'll need to complete it accurately to ensure a smooth processing experience. This form typically requires detailed information about your business and its financial status. Follow these steps to fill it out correctly.

- Business Information: Start by entering your business name, address, and contact details. Make sure this information is current and matches your official documents.

- Ownership Details: Provide the names and titles of the owners or partners. Include their contact information as well.

- Business Structure: Indicate your business structure (e.g., sole proprietorship, partnership, corporation). Be clear and precise.

- Financial Information: Fill in your business’s financial details. This may include annual revenue, number of employees, and any existing debts or liabilities.

- Bank References: List your primary banking institution, including the bank's name, address, and contact information. This helps establish credibility.

- Trade References: Provide at least three trade references. Include their names, addresses, phone numbers, and the nature of your relationship with them.

- Signature: Sign and date the application. This confirms that the information provided is accurate and complete.

Once you have filled out the application, review it for accuracy. Double-check all entries to avoid delays. After that, submit the form to the appropriate contact or department as instructed. Keep a copy for your records.

Common mistakes

-

Incomplete Information: Many applicants fail to provide all the necessary details. Ensure that every section is filled out completely to avoid delays.

-

Incorrect Business Structure: Selecting the wrong type of business entity can lead to complications. Be clear about whether your business is a sole proprietorship, LLC, corporation, etc.

-

Missing Contact Information: Providing accurate contact details is crucial. Double-check phone numbers and email addresses to ensure they are correct.

-

Neglecting Financial History: Applicants often overlook the importance of their financial background. Include relevant financial statements or credit history to strengthen your application.

-

Not Disclosing Personal Guarantees: Failing to mention personal guarantees can create issues later. If personal credit is involved, it should be clearly stated.

-

Inconsistent Information: Inconsistencies between the application and supporting documents can raise red flags. Ensure that all information matches across different forms.

-

Ignoring Instructions: Each application may have specific guidelines. Read and follow all instructions carefully to avoid common pitfalls.

-

Rushing the Process: Taking your time can prevent mistakes. Review your application thoroughly before submission to catch any errors.

-

Failing to Update Information: If your business has undergone changes, such as a new address or ownership, be sure to update this information on the application.

File Specifics

| Fact Name | Description |

|---|---|

| Purpose | The Business Credit Application form is used to assess the creditworthiness of a business seeking credit or financing. |

| Information Required | Typically, the form requires details such as business name, address, ownership structure, and financial statements. |

| Authorization | Applicants usually must provide authorization for the lender to conduct a credit check on the business and its owners. |

| State-Specific Forms | Some states have specific requirements that may necessitate using a state-specific Business Credit Application form. |

| Governing Laws | For example, in California, the form may be governed by the California Commercial Code. |

| Submission Process | The completed form is generally submitted to the lender or financial institution for review and processing. |

| Response Time | After submission, businesses can expect a response within a few days to a couple of weeks, depending on the lender's policies. |

| Importance of Accuracy | Providing accurate and complete information is crucial, as discrepancies can lead to delays or denial of credit. |

Dos and Don'ts

When filling out a Business Credit Application form, it’s important to approach the task with care. Here are some key dos and don'ts to keep in mind:

- Do provide accurate and complete information. Incomplete applications can delay the process.

- Do review the application thoroughly before submitting it. Double-check for any errors.

- Do include all necessary documentation, such as financial statements and tax returns.

- Do clearly state your business's purpose and how you intend to use the credit.

- Do ensure that your business credit history is up to date. A strong credit history can improve your chances of approval.

- Don't exaggerate your business's financial situation. Honesty is crucial.

- Don't leave any sections blank. Fill out every part of the application to avoid delays.

- Don't forget to sign the application. An unsigned application may be rejected.

- Don't rush the process. Take your time to ensure everything is accurate and complete.

Similar forms

The Business Credit Application form shares similarities with the Personal Credit Application form. Both documents require detailed information about the applicant's financial history and creditworthiness. They typically ask for personal identification, income details, and existing debts. The key difference lies in the focus; while the Business Credit Application centers on the business's financial health, the Personal Credit Application focuses on an individual's financial status.

The Commercial Lease Application is another document that resembles the Business Credit Application. Both forms assess the financial stability of a business or individual seeking to enter into a financial agreement. They often require similar information regarding income, liabilities, and credit history. However, the Commercial Lease Application specifically pertains to rental agreements, while the Business Credit Application is focused on obtaining credit or financing.

The Vendor Credit Application is similar in that it helps suppliers assess the creditworthiness of a business. Both forms require financial information, trade references, and business history. The Vendor Credit Application, however, is tailored for businesses seeking credit from specific suppliers, whereas the Business Credit Application can apply to various lenders and financial institutions.

The Partnership Agreement also shares some similarities with the Business Credit Application. Both documents require detailed information about the parties involved, including financial contributions and obligations. While the Partnership Agreement outlines the terms of a business relationship, the Business Credit Application focuses on the financial aspects necessary for securing credit.

Lastly, the Financial Statement is akin to the Business Credit Application. Both documents provide insights into the financial health of a business. They typically include information on assets, liabilities, and income. However, the Financial Statement is often a summary of the financial position at a specific point in time, while the Business Credit Application is more focused on the application process for obtaining credit.

Other PDF Forms

Dollar Sheet Fundraiser - Your generosity with a dollar could inspire others!

License Application - Fill out your true full name on the application.