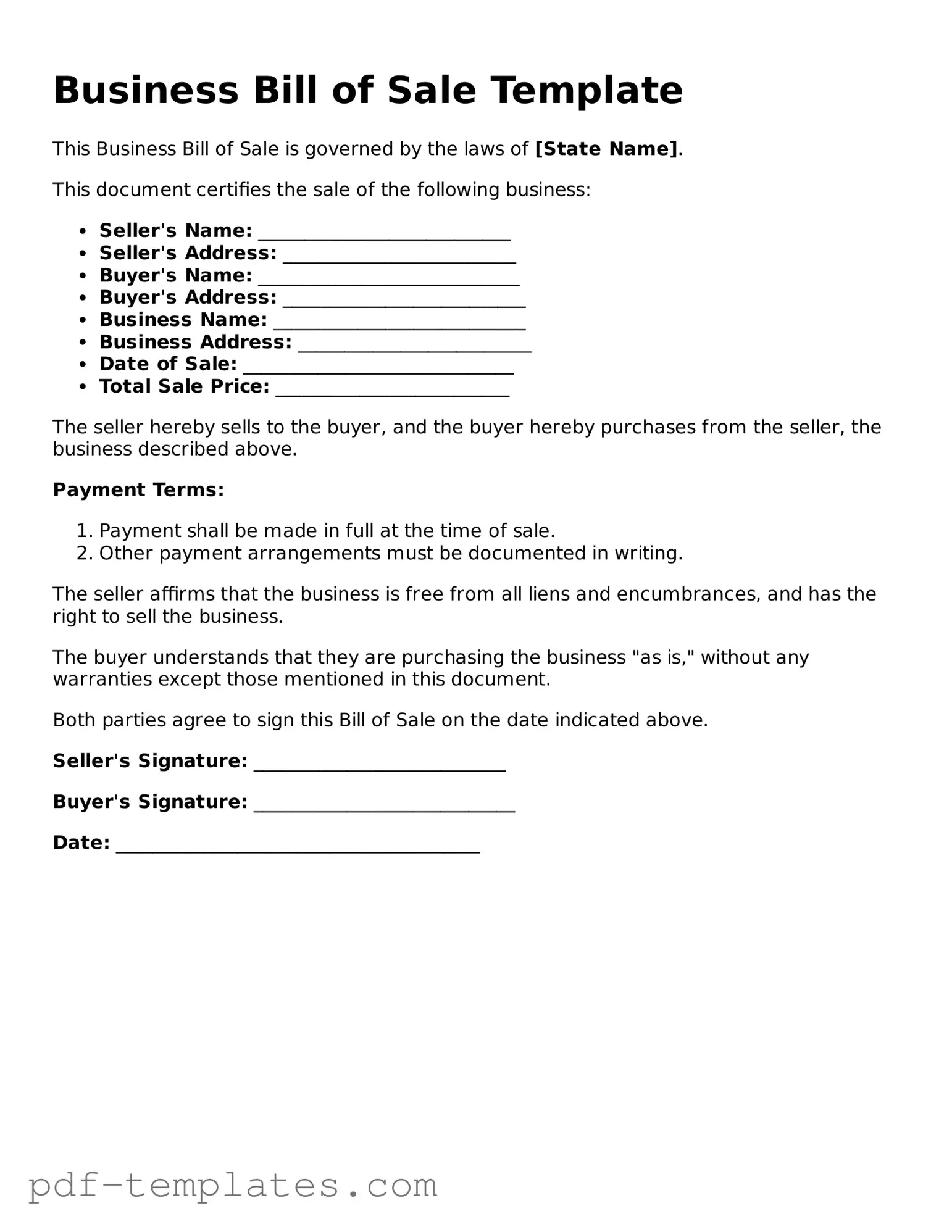

Business Bill of Sale Document

A Business Bill of Sale form is an essential document for anyone involved in the sale or transfer of a business. This form serves as a written record of the transaction, detailing the specifics of what is being sold, including assets, inventory, and sometimes even goodwill. It typically includes information about the buyer and seller, such as their names and addresses, along with the date of the transaction. A clear description of the business assets being transferred is crucial, as it helps prevent misunderstandings later on. Payment terms, including the total purchase price and any deposit made, are also included to ensure both parties are on the same page. Additionally, this form may outline any warranties or guarantees related to the sale, protecting the interests of both the buyer and the seller. By using a Business Bill of Sale, parties can ensure a smooth transition of ownership and maintain a clear record of the transaction for future reference.

Misconceptions

The Business Bill of Sale form is a crucial document for any business transaction involving the sale of goods or services. However, several misconceptions surround its use. Here are ten common misconceptions, along with clarifications.

- It is only necessary for large transactions. Many believe that a Bill of Sale is only needed for significant sales. In reality, it is advisable for any sale, regardless of size, to protect both parties.

- It is not legally binding. Some think that a Bill of Sale is merely a formality. However, when properly executed, it serves as a legally binding contract that outlines the terms of the sale.

- Only businesses need a Bill of Sale. Individuals selling personal property also benefit from using this document. It provides proof of the transaction and protects the seller.

- A verbal agreement is sufficient. While verbal agreements can be valid, they are hard to enforce. A written Bill of Sale offers clear evidence of the agreement.

- It is not required by law. While not always mandated, certain states may require a Bill of Sale for specific transactions, especially for vehicles or real estate.

- Once signed, it cannot be changed. Parties can amend a Bill of Sale if both agree to the changes. It is essential to document any amendments in writing.

- It is only for the sale of physical items. A Bill of Sale can also be used for intangible assets, such as intellectual property or digital goods.

- All Bills of Sale are the same. Different types of transactions may require different forms. Customizing the Bill of Sale to fit the specific transaction is often necessary.

- It does not need to be notarized. While notarization is not always required, having a Bill of Sale notarized can add an extra layer of protection and authenticity.

- It is only useful for the seller. Buyers also benefit from a Bill of Sale. It provides proof of ownership and can be essential for future transactions or legal matters.

Understanding these misconceptions can help ensure that both buyers and sellers are better prepared for their transactions. Proper documentation fosters transparency and trust in business dealings.

Business Bill of Sale: Usage Instruction

Once you have your Business Bill of Sale form ready, it's time to complete it accurately. This document is essential for recording the sale of a business and ensuring that both the buyer and seller have a clear understanding of the transaction. Follow these steps to fill out the form correctly.

- Identify the Seller: Write the full name of the seller or the business entity selling the business. Include any relevant contact information such as an address and phone number.

- Identify the Buyer: Enter the full name of the buyer or the business entity purchasing the business. Just like with the seller, include contact information for clarity.

- Describe the Business: Provide a detailed description of the business being sold. This may include the business name, location, and any relevant assets or inventory included in the sale.

- State the Sale Price: Clearly indicate the total sale price for the business. Be specific about the amount and ensure it reflects any agreed-upon terms.

- Include Payment Terms: If applicable, outline the payment terms. This may include information about deposits, financing arrangements, or payment schedules.

- Specify the Date of Sale: Write the date when the sale is taking place. This is important for record-keeping and legal purposes.

- Signatures: Both the seller and buyer must sign the document. Ensure that each party includes the date of their signature to validate the agreement.

After completing the form, ensure that both parties retain a copy for their records. This will help in any future reference regarding the transaction and provide legal protection for both the buyer and seller.

Common mistakes

-

Incomplete Information: Many individuals forget to fill in all required fields. Missing details can lead to confusion or disputes later on.

-

Incorrect Dates: Entering the wrong date of sale can create issues. Always double-check the date to ensure accuracy.

-

Failure to Include Signatures: A common oversight is neglecting to sign the document. Both the buyer and seller must sign to validate the transaction.

-

Not Providing Accurate Descriptions: Vague or inaccurate descriptions of the business can lead to misunderstandings. Be specific about what is being sold.

-

Ignoring State Requirements: Each state may have specific laws regarding business sales. Not adhering to these can render the bill of sale ineffective.

-

Not Keeping Copies: Failing to make copies of the completed bill of sale can cause problems in the future. Always retain a copy for your records.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | A Business Bill of Sale is a legal document that records the transfer of ownership of a business or its assets from one party to another. |

| Purpose | This form serves as proof of the transaction and can help protect both the buyer and seller by outlining the terms of the sale. |

| State-Specific Requirements | Each state may have different requirements for a Business Bill of Sale, including specific information that must be included and the need for notarization. |

| Governing Laws | The governing laws for the Business Bill of Sale can vary by state. For example, in California, the Uniform Commercial Code (UCC) applies to the sale of business assets. |

Dos and Don'ts

When filling out a Business Bill of Sale form, it's important to follow certain guidelines to ensure everything is completed correctly. Here’s a list of things you should and shouldn't do:

- Do provide accurate information about the business being sold.

- Do include the full names and addresses of both the buyer and seller.

- Do specify the date of the transaction clearly.

- Do describe the items or assets being sold in detail.

- Do have both parties sign the document to make it legally binding.

- Don't leave any fields blank; this could lead to confusion later.

- Don't use vague language; be specific about what is included in the sale.

- Don't forget to keep a copy for your records.

- Don't rush through the process; take your time to ensure accuracy.

- Don't overlook local laws that may affect the sale; research as needed.

Similar forms

A Vehicle Bill of Sale is a document used to transfer ownership of a vehicle from one party to another. Similar to a Business Bill of Sale, it outlines the details of the transaction, including the buyer and seller's information, the vehicle's description, and the sale price. Both documents serve as proof of the transaction and can be used for registration purposes. This ensures that the buyer has legal ownership of the vehicle, just as the Business Bill of Sale confirms ownership of a business asset.

A Personal Property Bill of Sale is another document that functions similarly. It is used to transfer ownership of personal property, such as furniture or electronics. Like the Business Bill of Sale, it includes the names of the buyer and seller, a description of the item, and the sale price. This document serves as evidence of the transaction and can protect both parties in case of disputes, ensuring that the seller has the right to sell the item and the buyer receives what they paid for.

An Equipment Bill of Sale is specifically for the sale of equipment, such as machinery or tools. This document details the transaction in a manner similar to the Business Bill of Sale, including descriptions of the equipment and terms of the sale. Both documents provide a record of the transaction, which can be crucial for tax purposes or future sales. They help establish clear ownership and the terms under which the equipment was sold.

A Real Estate Bill of Sale is used to transfer ownership of personal property that may be included in a real estate transaction, such as appliances or fixtures. While it is closely related to real estate sales, it shares similarities with the Business Bill of Sale in that it documents the transfer of ownership. This ensures that all parties are clear on what is included in the sale and protects the buyer's rights to the property being transferred.

An Asset Purchase Agreement is a more detailed document often used in business transactions. It outlines the terms of the sale of specific assets of a business, similar to what a Business Bill of Sale does. This agreement includes information about the assets being sold, the purchase price, and any conditions of the sale. Both documents aim to formalize the transfer of ownership, although the Asset Purchase Agreement typically covers more complex transactions.

A Boat Bill of Sale is used when transferring ownership of a boat. This document is similar to a Business Bill of Sale in that it includes information about the buyer and seller, a description of the boat, and the sale price. Both documents serve as legal proof of the transaction and can be important for registration and title transfer. They help ensure that the buyer receives clear ownership of the boat.

For those specifically interested in all-terrain vehicles, understanding the Connecticut ATV Bill of Sale form is essential, as it provides the necessary framework for documenting the sale and ownership transfer of ATVs within the state. This form not only captures critical details about the transaction but also acts as a safeguard for both buyer and seller. To learn more about this process, visit vehiclebillofsaleform.com.

A Firearm Bill of Sale is used to document the sale of a firearm between parties. Like the Business Bill of Sale, it includes details about the buyer and seller, the firearm's description, and the sale price. This document can help protect both parties by providing a record of the transaction and ensuring that the sale complies with local laws and regulations.

A Livestock Bill of Sale is used for the sale of livestock, such as cattle or horses. This document serves a similar purpose to the Business Bill of Sale, providing details about the buyer and seller, a description of the livestock, and the sale price. Both documents help formalize the transaction and can serve as proof of ownership, which is important for record-keeping and legal purposes.

Additional Types of Business Bill of Sale Templates:

Trailer Bill of Sale Template - A properly filled out Trailer Bill of Sale can simplify future registration processes.

For those seeking to facilitate the sale process, a reliable option is the comprehensive Motorcycle Bill of Sale documentation, which can streamline ownership transfer and ensure all necessary details are properly recorded. You can find more information at Motorcycle Bill of Sale.