Get Broker Price Opinion Form in PDF

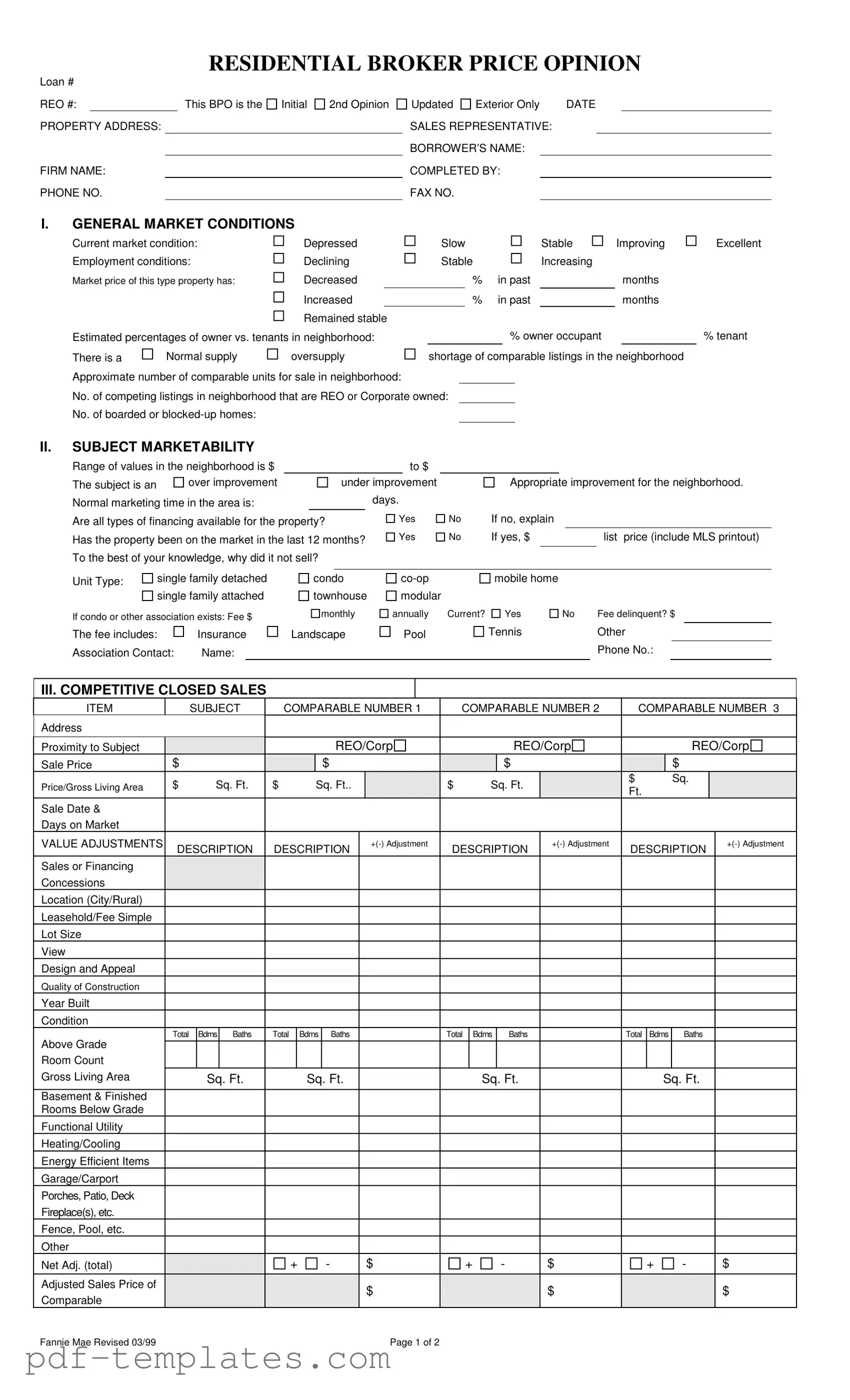

The Broker Price Opinion (BPO) form serves as a crucial tool for real estate professionals, providing a structured way to assess property values in various market conditions. This form captures essential information about the property, including its address, the firm handling the opinion, and the sales representative involved. It evaluates general market conditions, such as employment trends and the supply of comparable listings, to give a clear picture of the property's standing in the neighborhood. Additionally, the BPO outlines the subject property's marketability, detailing its condition, financing options, and any prior market activity. Comparisons with similar properties are made through competitive closed sales, which help to determine a fair market value. The form also includes a section on necessary repairs and potential marketing strategies, ensuring that all aspects of the property's condition and marketability are considered. Ultimately, the BPO provides a comprehensive overview that aids in making informed decisions regarding property sales and purchases.

Misconceptions

Misconceptions about the Broker Price Opinion (BPO) form can lead to confusion and misunderstandings among buyers, sellers, and real estate professionals. Here are nine common misconceptions:

-

The BPO is the same as an appraisal.

While both documents assess property value, a BPO is typically less formal and less comprehensive than an appraisal. Appraisals are conducted by licensed appraisers and are often required for financing, whereas BPOs are often prepared by real estate agents to provide a quick estimate of value.

-

A BPO guarantees a sale price.

A BPO provides an estimated value based on market conditions and comparable properties. It does not guarantee that a property will sell for that price, as actual sale prices can vary based on numerous factors.

-

Only banks can request a BPO.

While banks frequently use BPOs for their internal evaluations, any individual or entity, including homeowners and real estate agents, can request a BPO for various purposes.

-

The BPO is only for foreclosures.

BPOs are useful for a variety of situations, not just foreclosures. They can assist in determining market value for sales, refinances, or investment decisions.

-

A BPO is always accurate.

While BPOs are based on current market data and comparable sales, they are still estimates. Variability in market conditions and subjective judgments can impact their accuracy.

-

All BPOs are conducted the same way.

Different agents may use varying methodologies and criteria when preparing a BPO. The quality and thoroughness of the analysis can differ significantly from one agent to another.

-

A BPO includes a detailed inspection of the property.

A BPO typically relies on visual assessments and available data rather than a thorough inspection. It may not uncover hidden issues that a detailed inspection could reveal.

-

BPOs are not legally binding.

Correct. A BPO is an opinion of value and does not create any legal obligations. It serves as a guideline rather than a definitive statement of value.

-

The BPO process is quick and easy.

While BPOs can be completed faster than appraisals, they still require careful research and analysis. The time taken can vary based on the complexity of the property and market conditions.

Broker Price Opinion: Usage Instruction

Filling out the Broker Price Opinion (BPO) form is a straightforward process that requires careful attention to detail. Each section of the form collects essential information about the property and the market conditions. Once completed, this form will provide a comprehensive overview that can assist in evaluating the property's value.

- Begin with the Loan # and REO # at the top of the form.

- Fill in the PROPERTY ADDRESS and your FIRM NAME along with your PHONE NO.

- Indicate whether this BPO is an Initial, 2nd Opinion, or Updated and if it is for Exterior Only.

- Enter the DATE and the name of the SALES REPRESENTATIVE.

- Provide the BORROWER’S NAME and the name of the person COMPLETED BY.

- Include the FAX NO. for communication purposes.

In the first section, titled GENERAL MARKET CONDITIONS, assess the current market condition by selecting Depressed, Slow, Stable, or Improving. Next, evaluate employment conditions and the market price trend of similar properties.

- Estimate the percentage of owner occupants in the neighborhood.

- Indicate if there is a normal supply, oversupply, or shortage of comparable listings.

- Note the approximate number of comparable units for sale in the neighborhood.

- Count the number of competing listings that are REO or corporate-owned.

- Identify the number of boarded or blocked-up homes.

Next, move to the SUBJECT MARKETABILITY section. Here, you will provide a range of values for the neighborhood, the marketing time, and whether all types of financing are available for the property.

- Indicate if the property has been on the market in the last 12 months and provide the list price if applicable.

- Specify the Unit Type and any applicable association fees.

- Complete the COMPETITIVE CLOSED SALES section by filling in details for comparable properties, including address, sale price, and adjustments.

- Document any necessary repairs in the REPAIRS section and provide a total cost estimate.

In the COMPETITIVE LISTINGS section, enter information for comparable listings, including list prices and adjustments. Finally, complete the MARKET VALUE section by suggesting a market value and list price.

- Include any relevant comments about the property, such as positives, negatives, or special concerns.

- Sign and date the form to validate your assessment.

After completing these steps, review the form for accuracy before submission. This ensures that all necessary information is clearly presented, aiding in the evaluation process.

Common mistakes

-

Incomplete Information: Failing to fill out all required fields can lead to delays and inaccuracies. Ensure every section is addressed thoroughly.

-

Incorrect Property Address: Providing an incorrect or incomplete property address can create confusion. Double-check the address for accuracy.

-

Market Condition Misjudgment: Misrepresenting the current market conditions can skew the valuation. Take time to assess whether the market is improving, stable, or declining.

-

Overlooking Comparable Sales: Not including enough comparable properties can lead to an inaccurate assessment. Aim to provide a robust selection of relevant sales.

-

Neglecting to Itemize Repairs: Failing to list all necessary repairs can misrepresent the property's condition. Be detailed about the repairs needed for marketability.

-

Ignoring Financing Options: Not clarifying financing availability can hinder potential buyers. Clearly indicate if certain types of financing are not available.

-

Inconsistent Value Adjustments: Providing inconsistent or unclear value adjustments can confuse readers. Ensure adjustments are logical and well-explained.

-

Missing Marketing Strategy: Not specifying a marketing strategy can leave the property undervalued. Clearly outline whether the property will be sold as-is or with repairs.

-

Failure to Include Comments: Not providing additional comments about the property can overlook important details. Use this section to highlight unique features or concerns.

File Specifics

| Fact Name | Description |

|---|---|

| Purpose | The Broker Price Opinion (BPO) form is used to estimate the market value of a property, often for lenders or real estate agents. |

| Components | The form includes sections for market conditions, subject property marketability, competitive closed sales, and marketing strategy. |

| Market Conditions | The form assesses current market conditions, including employment trends and the supply of comparable listings. |

| Subject Marketability | It evaluates the subject property's marketability, including its condition and potential financing options. |

| Competitive Sales | The BPO includes a comparison of similar properties that have recently sold, helping to establish a fair market value. |

| Repairs Section | It outlines necessary repairs to bring the property to a marketable condition, along with estimated costs. |

| Marketing Strategy | The form allows for the identification of the most effective marketing strategy, such as selling "as-is" or with repairs. |

| State-Specific Forms | Some states may have specific laws governing the use of BPOs, such as licensing requirements for brokers. |

| Confidentiality | The information on the BPO form is typically confidential and should be handled with care. |

| Signature Requirement | The form requires a signature from the individual completing it, ensuring accountability and accuracy. |

Dos and Don'ts

Do's:

- Fill in all required fields accurately.

- Use current data for market conditions and property values.

- Provide clear and detailed descriptions of the property.

- List any repairs needed for the property.

- Include comparable sales data to support your valuation.

- Indicate the most likely buyer type for the property.

- Document any unique property features or concerns.

- Sign and date the form to validate your submission.

Don'ts:

- Do not leave any fields blank unless specified.

- Avoid using outdated market data.

- Do not exaggerate the condition or value of the property.

- Refrain from making assumptions without supporting evidence.

- Do not forget to check for financing availability.

- Avoid vague descriptions; be specific.

- Do not ignore local market trends and conditions.

- Never submit without a thorough review of the information provided.

Similar forms

The Comparative Market Analysis (CMA) is a document that real estate agents use to determine the value of a property. Like the Broker Price Opinion (BPO), it assesses the current market conditions and compares similar properties in the area. The CMA provides a detailed analysis of recently sold homes, active listings, and expired listings, which helps in establishing a fair market value. Both documents aim to guide sellers and buyers in understanding property values based on local market trends.

The Appraisal Report is another similar document. Appraisals are conducted by licensed appraisers and provide an unbiased estimate of a property's value. While BPOs are often quicker and less formal, appraisals require a more thorough inspection and analysis of the property. Both reports consider comparable sales, market conditions, and property features to arrive at a value, but appraisals are typically used for financing purposes and are more legally binding.

The Listing Agreement is also related to the BPO. This document outlines the terms under which a property will be marketed for sale. It includes details about the listing price, commission, and duration of the listing. While the BPO provides a suggested price based on market analysis, the Listing Agreement formalizes the seller's intent to sell at that price, making it a crucial step in the selling process.

For those looking to ensure their healthcare decisions are respected, the California Medical Power of Attorney form serves as an essential tool. By appointing someone they trust, individuals can guarantee that their preferences are followed even when they are unable to communicate. This legal document plays a critical role in safeguarding one's healthcare wishes, providing peace of mind in times of uncertainty, especially when considering resources like All California Forms for guidance.

The Purchase Agreement is another key document in real estate transactions. This contract outlines the terms and conditions under which a buyer agrees to purchase a property. Similar to the BPO, it reflects the property's value but is focused on the buyer's and seller's obligations. Both documents serve to facilitate the sale, with the BPO providing a basis for negotiation and the Purchase Agreement formalizing the agreement.

The Seller's Disclosure Statement is also relevant. This document requires sellers to disclose any known issues with the property that could affect its value. Like the BPO, it aims to provide transparency in the transaction process. Both documents help buyers make informed decisions, although the Seller's Disclosure focuses more on the property's condition rather than its market value.

Finally, the Rent Roll is another similar document, particularly in investment property transactions. A Rent Roll lists all rental properties owned by an investor, detailing the rent amounts, lease terms, and tenant information. While the BPO assesses market value for sale, the Rent Roll evaluates the income potential of a property. Both documents are essential for understanding the financial aspects of real estate, whether for sale or rental purposes.

Other PDF Forms

Goodwill Donation Receipt California - This document validates your contribution to Goodwill's efforts.

A Texas Vehicle Purchase Agreement is a legal document that outlines the terms and conditions of a vehicle sale between a buyer and a seller. This form serves to protect both parties by detailing the specifics of the transaction, including the sale price, vehicle information, and any warranties or representations. For more information, you can refer to the agreement available at documentonline.org/blank-texas-vehicle-purchase-agreement/. Understanding this agreement is essential for ensuring a smooth and legally compliant purchase process.

Form Dr-835 - Essential for when personalized assistance is needed for tax issues.