Get Auto Insurance Card Form in PDF

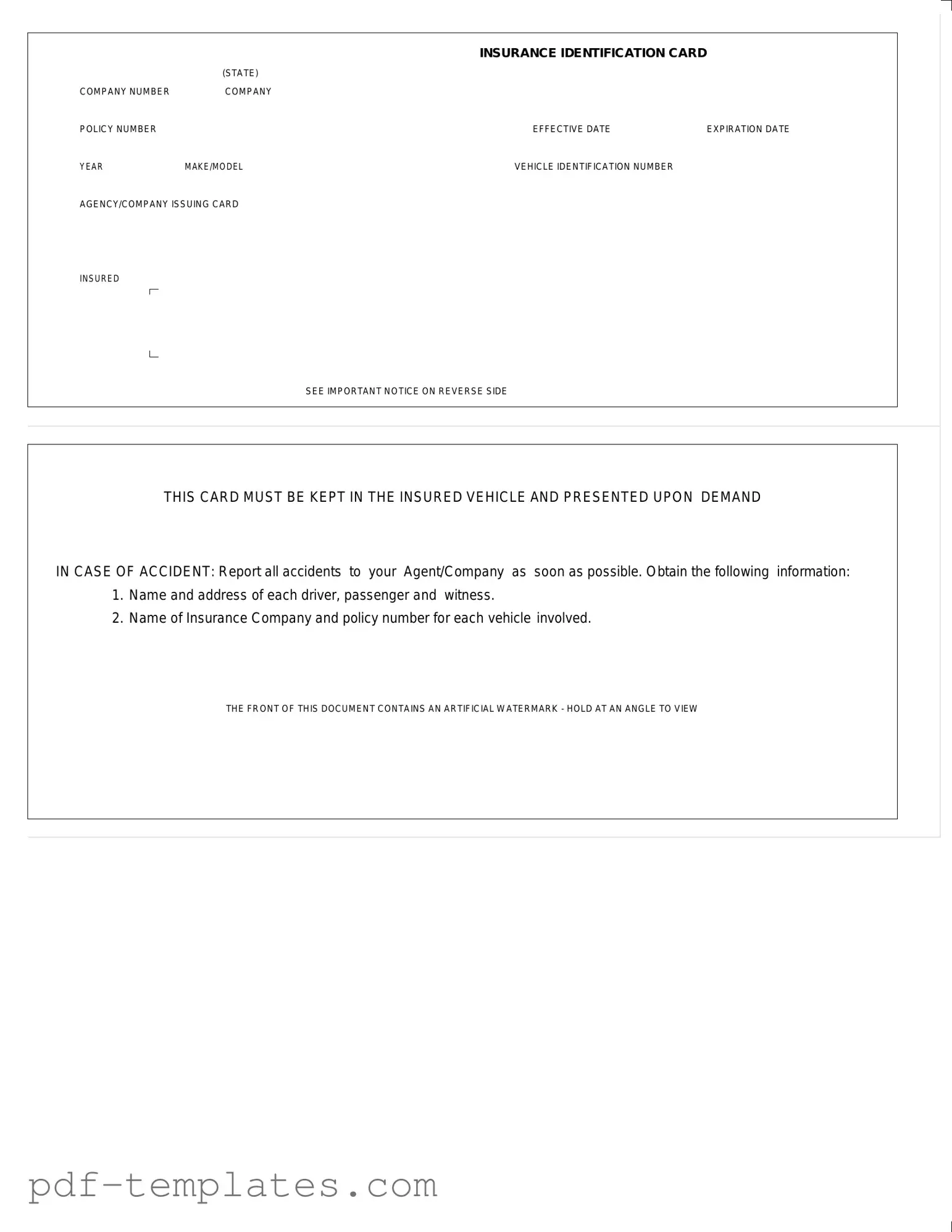

When it comes to driving legally in the United States, having an Auto Insurance Card is essential. This document serves as proof of insurance coverage and must be kept in the insured vehicle at all times. The card contains critical information, including the insurance company name, policy number, and effective and expiration dates. Additionally, it lists the vehicle's year, make, model, and Vehicle Identification Number (VIN). The issuing agency or company is also noted on the card, ensuring that you can easily identify your insurer. In the event of an accident, this card must be presented upon demand, and it is crucial to report any incidents to your insurance agent or company promptly. Collecting details such as the names and addresses of all drivers, passengers, and witnesses, as well as the insurance information for each vehicle involved, is vital for a smooth claims process. Notably, the front of the card features an artificial watermark that can be viewed by holding it at an angle, adding an extra layer of security to this important document.

Misconceptions

Understanding the Auto Insurance Card can be crucial for drivers, yet many misconceptions persist. Here are nine common misunderstandings about this important document:

- It is only needed in case of an accident. Many believe the Auto Insurance Card is only necessary during an accident. However, it should be kept in the vehicle at all times, as law enforcement may request it during routine stops.

- All insurance cards look the same. While many cards may share similar elements, each card is unique to the insurance provider and policyholder. The specific details, such as the company logo and card layout, can vary significantly.

- The card is valid even after expiration. Some individuals mistakenly think that an expired insurance card remains valid. In reality, once the expiration date passes, the coverage may no longer be active, and presenting an expired card can lead to penalties.

- Only the driver needs to carry the card. It is a common belief that only the driver must have the Auto Insurance Card. In fact, all insured individuals should be aware of the card’s location and details, especially in case of emergencies.

- The card contains all necessary information. While the card provides essential details, it does not encompass all the information a driver might need after an accident. For example, it is crucial to gather contact information for all parties involved.

- The watermark is just for decoration. Many overlook the artificial watermark on the card, assuming it serves no purpose. In truth, it is a security feature designed to prevent fraud and verify the authenticity of the document.

- Once I receive the card, I don’t need to update it. Some people believe that their Auto Insurance Card remains unchanged for the duration of their policy. However, any updates to the policy, such as changes in coverage or vehicle details, require a new card.

- It can be stored digitally instead of physically. While digital copies of insurance cards are becoming more common, many states still require drivers to present a physical card during certain situations. Always check local laws to ensure compliance.

- Insurance cards are the same across all states. This misconception overlooks the fact that each state may have different requirements for what must be included on the Auto Insurance Card. Drivers should familiarize themselves with their state’s regulations.

By addressing these misconceptions, drivers can better understand the importance of their Auto Insurance Card and ensure they are prepared for any situation on the road.

Auto Insurance Card: Usage Instruction

Filling out the Auto Insurance Card form is straightforward. This form is essential for proving that you have auto insurance coverage. Ensure you have your insurance details handy, as you will need them to complete the form accurately.

- Locate the INSURANCE IDENTIFICATION CARD (STATE) section at the top of the form.

- Fill in the COMPANY NUMBER. This is typically provided by your insurance company.

- Enter your COMPANY POLICY NUMBER. You can find this on your insurance documents.

- Write the EFFECTIVE DATE of your policy. This is the date your coverage starts.

- Input the EXPIRATION DATE of your policy. This indicates when your coverage will end.

- Provide the YEAR of your vehicle.

- Fill in the MAKE/MODEL of your vehicle.

- Enter your vehicle's VEHICLE IDENTIFICATION NUMBER (VIN). This number can usually be found on your vehicle registration or the driver's side dashboard.

- List the AGENCY/COMPANY ISSUING CARD. This is the name of your insurance provider.

After completing the form, make sure to keep it in your vehicle. It should be presented upon request during any traffic stop or accident. Remember to report any accidents to your insurance agent as soon as possible and gather necessary information from involved parties.

Common mistakes

-

Incorrectly filling out the policy number: Many people overlook the importance of entering the correct policy number. This number is crucial for identifying coverage and processing claims. A simple typo can lead to significant delays in assistance.

-

Forgetting the effective and expiration dates: Failing to include the effective date and expiration date can create confusion about the validity of the insurance. Always double-check these dates to ensure they are accurate and clearly visible.

-

Neglecting to include the vehicle identification number (VIN): The VIN is essential for identifying the specific vehicle covered by the insurance. Omitting this number can result in complications during an accident or claim process.

-

Not keeping the card in the vehicle: It's vital to keep the insurance card in the insured vehicle at all times. If the card is not readily available, it may lead to fines or complications if an accident occurs.

File Specifics

| Fact Name | Description |

|---|---|

| Purpose of the Card | The Auto Insurance Card serves as proof of insurance coverage for the vehicle listed on the card. |

| Required Information | The card must include essential details such as the insurance company number, policy number, effective date, and expiration date. |

| Vehicle Details | Information about the vehicle, including its year, make/model, and Vehicle Identification Number (VIN), is required on the card. |

| Issuing Agency | The card must indicate the agency or company that issued it, ensuring that the insurance provider is clearly identified. |

| Legal Requirement | In many states, including New York and California, it is a legal requirement to keep the card in the insured vehicle and present it upon request during an accident. |

| Accident Reporting | The card includes instructions for reporting accidents, emphasizing the need to contact the insurance agent or company promptly. |

| Watermark Feature | The front of the card contains an artificial watermark, which can be viewed by holding it at an angle, adding a layer of security to the document. |

Dos and Don'ts

When filling out the Auto Insurance Card form, it is important to ensure accuracy and completeness. Here is a list of things you should and shouldn’t do:

- Do provide accurate information for the company number and policy number.

- Do include the effective and expiration dates of your policy.

- Do enter the year, make, and model of your vehicle correctly.

- Do ensure the vehicle identification number (VIN) is accurate.

- Do keep this card in your vehicle at all times.

- Don’t leave any sections of the form blank.

- Don’t provide outdated or incorrect information.

- Don’t forget to report any accidents to your agent or company promptly.

- Don’t ignore the instructions on the reverse side of the card.

Similar forms

The Vehicle Registration Card is a document issued by the Department of Motor Vehicles (DMV) that proves a vehicle is registered for use on public roads. Like the Auto Insurance Card, it contains essential information such as the vehicle identification number (VIN), make, model, and the owner's details. Both documents must be kept in the vehicle and presented when requested by law enforcement or during an accident. They serve as proof of legal compliance for vehicle operation.

The Driver's License is another critical document that shares similarities with the Auto Insurance Card. It identifies the individual authorized to operate a vehicle and includes personal information such as the driver's name, address, and date of birth. Just as the insurance card must be presented during an accident, a driver’s license is also required for identification purposes. Both documents are essential for legal driving and provide a level of accountability.

The Proof of Insurance document, often provided by an insurance company, confirms that a driver has an active auto insurance policy. This document contains similar information to the Auto Insurance Card, including policy numbers and coverage details. While the Auto Insurance Card serves as a quick reference, the Proof of Insurance document is more detailed and can be used for various purposes, such as loan applications or registration renewals.

For those engaging in freelance or contractual work, it is crucial to have legal documents in place, such as the Independent Contractor Agreement form, to define the working relationship, payment terms, and responsibilities clearly, thereby ensuring a professional engagement and protecting the interests of both parties.

The Title of the Vehicle is a legal document that establishes ownership. Like the Auto Insurance Card, it includes the vehicle identification number and the owner's information. Both documents are crucial when selling or transferring ownership of a vehicle. While the insurance card proves that a vehicle is insured, the title proves who owns it, making both documents essential for vehicle transactions.

The Bill of Sale is a document that records the sale of a vehicle. It includes details about the buyer, seller, vehicle, and the sale price. Similar to the Auto Insurance Card, it serves as proof of a transaction and can be required for registration or insurance purposes. Both documents help establish a legal record, ensuring that all parties are protected during the sale process.

The Emissions Certificate is a document that certifies a vehicle meets environmental standards. Like the Auto Insurance Card, it must be presented during vehicle registration and can be required during inspections. Both documents play a role in ensuring compliance with state laws, and having them readily available helps avoid penalties.

The Safety Inspection Certificate is similar to the Auto Insurance Card in that it verifies a vehicle's safety compliance. This document is often required by state law and must be kept in the vehicle. Both the safety inspection and insurance card demonstrate that the vehicle is roadworthy and legally compliant, providing peace of mind for drivers and passengers.

The Lease Agreement for a vehicle outlines the terms under which a vehicle is leased. It includes details about the vehicle, the lessee, and the lease terms. Like the Auto Insurance Card, it is an essential document that must be kept on hand. Both documents ensure that all parties understand their rights and responsibilities regarding the vehicle.

The Roadside Assistance Card is issued by some insurance companies and provides contact information for emergency services. Similar to the Auto Insurance Card, it must be kept in the vehicle and presented when needed. Both documents offer reassurance to drivers, ensuring they have support in case of an emergency while on the road.

Other PDF Forms

U.S. Corporation Income Tax Return - Reviewing prior year submissions can aid in the accurate completion of Form 1120.

To ensure a smooth rental experience, you may want to review our comprehensive Room Rental Agreement guidelines, which detail important aspects related to your tenancy and responsibilities. Access the form through the link below: Room Rental Agreement Form.

Gf Application - Describe a situation where you had to compromise in a relationship.