Get Authorization And Direction Pay Form in PDF

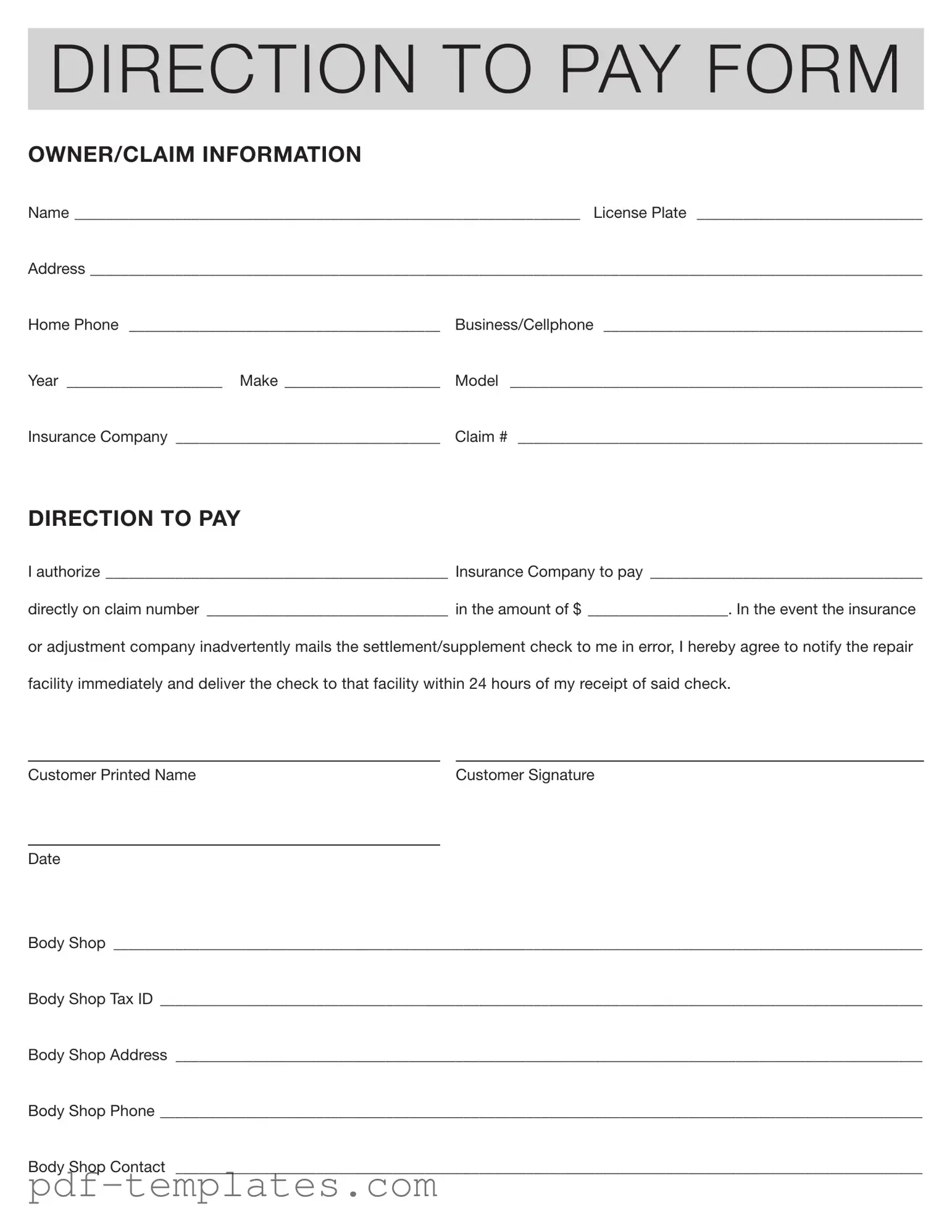

The Authorization and Direction Pay form serves as a crucial document in the claims process, facilitating direct payments from insurance companies to repair facilities. This form captures essential information about the vehicle owner, including their name, license plate number, address, and contact details. It also requires details about the vehicle, such as the year, make, and model, along with the insurance company and claim number associated with the repair. By completing the Direction to Pay section, the vehicle owner authorizes the insurance company to issue payment directly to the designated repair facility. This arrangement helps streamline the payment process, ensuring that repairs can begin promptly. Additionally, the form includes a provision that mandates the vehicle owner to return any mistakenly issued checks to the repair facility within 24 hours. This requirement underscores the importance of clear communication between all parties involved, which helps prevent delays in the claims process and ensures that repairs are handled efficiently.

Misconceptions

Understanding the Authorization And Direction Pay form is crucial for anyone involved in an insurance claim. However, several misconceptions can lead to confusion. Here are seven common misconceptions:

- Only the policyholder can fill out the form. Many believe that only the person who holds the insurance policy can complete this form. In reality, anyone authorized by the policyholder can fill it out, as long as they have the necessary information.

- The form guarantees payment from the insurance company. Some people think that submitting this form ensures that the insurance company will pay the body shop. While it directs payment, the actual payment depends on the insurance company's assessment and approval of the claim.

- It can be submitted at any time. There is a misconception that this form can be submitted whenever it is convenient. However, it should be completed and submitted promptly to avoid delays in the claims process.

- It is only necessary for certain types of claims. Some believe this form is only needed for auto accidents. In fact, it can be used for various claims involving property damage or personal injury where a repair facility is involved.

- All insurance companies accept this form. Not all insurance companies have the same policies. Some may have specific requirements or alternative forms. Always check with the insurance company to ensure compliance.

- Filling out the form is enough to resolve the claim. Many think that completing the form is the final step. In reality, it is just one part of the claims process, and further communication with the insurance company may be necessary.

- There are no consequences for not returning the check. Some individuals believe they can keep any checks sent to them in error. However, it is important to return these checks promptly to avoid potential legal issues.

Being informed about these misconceptions can help individuals navigate the claims process more effectively and ensure that payments are directed properly.

Authorization And Direction Pay: Usage Instruction

After filling out the Authorization And Direction Pay form, it will be submitted to the insurance company. This allows the insurance company to pay the body shop directly for the repairs. Follow the steps below to ensure that you complete the form correctly.

- Begin by entering your name in the designated space for Owner/Claim Information.

- Fill in your license plate number.

- Provide your address, ensuring all fields are completed.

- Include your home phone number.

- Add your business or cellphone number.

- Specify the year of your vehicle.

- Indicate the make of your vehicle.

- Provide the model of your vehicle.

- Enter the name of your insurance company.

- Fill in your claim number.

- In the DIRECTION TO PAY section, write the name of the insurance company you are authorizing to pay.

- Enter the name of the body shop that will receive the payment.

- Fill in the claim number again in the specified space.

- Write the amount you are authorizing the insurance company to pay.

- Understand your responsibility: If the insurance company mistakenly sends the check to you, you must notify the repair facility and deliver the check within 24 hours.

- Print your name in the space provided for Customer Printed Name.

- Sign the form in the Customer Signature section.

- Write the date of signing.

- Complete the body shop information, including the name, tax ID, address, phone number, and contact person.

Common mistakes

-

Incomplete Information: Failing to fill in all required fields, such as the name, address, or license plate number, can delay the processing of the claim.

-

Incorrect Claim Number: Entering an incorrect claim number can lead to confusion and may result in the denial of the payment.

-

Missing Signatures: Not signing the form can render it invalid. Ensure that both the customer and the body shop representative sign where required.

-

Wrong Insurance Company Name: Providing an incorrect name for the insurance company can cause payment delays. Double-check the spelling and accuracy.

-

Failure to Specify Payment Amount: Leaving the payment amount blank can create issues. Always specify the exact amount to be paid.

-

Neglecting to Notify Repair Facility: If a check is received by the claimant, failing to notify the repair facility within 24 hours can lead to complications.

-

Incorrect Body Shop Information: Filling in the wrong body shop name or address can prevent the payment from reaching the correct facility.

-

Not Providing Contact Information: Omitting the body shop's contact phone number can hinder communication and delay the process.

-

Using Unclear Language: Writing unclear or ambiguous instructions can lead to misunderstandings. Be as clear and precise as possible.

-

Ignoring Tax ID Requirement: Forgetting to include the body shop's tax ID can lead to issues with payment processing. This information is often necessary for tax purposes.

File Specifics

| Fact Name | Description |

|---|---|

| Purpose | The Authorization and Direction to Pay form allows a vehicle owner to direct their insurance company to pay a repair facility directly for services rendered on a claim. |

| Information Required | The form requires essential details such as the owner's name, license plate, address, phone numbers, vehicle information, insurance company name, and claim number. |

| Legal Compliance | This form is governed by state-specific insurance regulations, which may vary. For example, in California, it must comply with the California Insurance Code Section 790.03. |

| Obligations | The signer agrees to notify the repair facility and return any mistakenly received checks within 24 hours, ensuring proper handling of funds. |

Dos and Don'ts

When filling out the Authorization And Direction Pay form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are eight things you should and shouldn't do:

- Do fill in all required fields completely and accurately.

- Do double-check the claim number for correctness.

- Do provide clear and legible information to avoid confusion.

- Do sign and date the form before submission.

- Don't leave any sections blank unless specified as optional.

- Don't use abbreviations that may not be understood.

- Don't forget to notify the repair facility if you receive a check by mistake.

- Don't submit the form without reviewing it for errors.

Similar forms

The Authorization and Direction to Pay form is similar to the Power of Attorney document. Both forms grant authority to another party to act on behalf of an individual. In the case of a Power of Attorney, this authority can cover a wide range of decisions, including financial and legal matters. The Authorization and Direction to Pay form, however, is specifically focused on directing payment for a claim, making it a more limited but equally important document.

Another document that shares similarities is the Assignment of Benefits form. This form allows a policyholder to transfer their rights to receive benefits from an insurance policy to a third party, such as a healthcare provider or repair facility. Like the Authorization and Direction to Pay form, it streamlines the payment process by allowing the insurance company to pay the designated party directly, reducing the administrative burden on the policyholder.

The Release of Liability form also bears resemblance to the Authorization and Direction to Pay form. While the former releases one party from liability in exchange for compensation, it often requires the claimant to direct payment to a specific entity, similar to how the Direction to Pay form specifies who should receive payment from the insurance company.

A Settlement Agreement is another document that aligns with the Authorization and Direction to Pay form. In a settlement, parties agree on compensation for a claim, and the agreement often includes provisions for directing payment. This ensures that the agreed-upon amount is paid to the correct party, just as the Direction to Pay form does.

The Invoice is a common document that shares a purpose with the Authorization and Direction to Pay form. An invoice outlines the amount owed for services rendered, and when paired with the Direction to Pay form, it can specify that payment should be made directly to a service provider, facilitating a smoother transaction process.

For those interested in opportunities at Trader Joe's, it's essential to complete the necessary application forms accurately. The Trader Joe's application form is an opportunity for job seekers to highlight their qualifications and stand out to potential employers. To begin this process, you can access the form at https://documentonline.org/blank-trader-joe-s-application, ensuring that you provide all required information to maximize your chances of success.

Similarly, the Claim Form is an essential document in the insurance process. It provides the details of the claim and often includes information on how payments should be directed. While the Claim Form initiates the process, the Authorization and Direction to Pay form finalizes the payment direction, ensuring that funds are allocated correctly.

The Payment Authorization form also aligns closely with the Authorization and Direction to Pay form. This document allows an individual to authorize a business or service provider to withdraw funds directly from their account. Both forms streamline the payment process, ensuring that the right party receives payment without unnecessary delays.

The Direct Deposit Authorization form is another document that shares similarities. It allows individuals to authorize their bank or financial institution to deposit funds directly into their account. While it focuses on bank transactions, the underlying principle of directing payments to a specific recipient is common to both this form and the Authorization and Direction to Pay form.

Another related document is the Third-Party Payment Authorization. This form allows a policyholder to authorize a third party to receive payment on their behalf. It serves a similar function to the Direction to Pay form, ensuring that payments are made to the correct entity without the policyholder needing to intervene.

Lastly, the Endorsement form is akin to the Authorization and Direction to Pay form in that it allows for the transfer of rights or benefits from one party to another. In insurance contexts, endorsements can modify coverage or direct payments, much like how the Direction to Pay form specifies who should receive payment for a claim.

Other PDF Forms

Western Union Receipt - Receive funds within minutes in many cases.

What Does the S in S Corp Stand for - Strategizing ahead for filing Form 2553 can set the foundation for future financial growth.

In addition to providing essential powers for financial decision-making, the California General Power of Attorney form can be complemented by resources such as All California Forms, which offer a comprehensive suite of legal documents that can aid principals in various legal matters, ensuring they have the necessary tools to effectively manage their affairs when they are unable to do so personally.

How to Write Daily Report - Facilitate training sessions based on common report findings.