Articles of Incorporation Document

When embarking on the journey of starting a business, one of the most crucial steps is filing the Articles of Incorporation. This essential document lays the foundation for your corporation, outlining key details such as the business name, purpose, and the address of the registered office. It also specifies the number of shares the corporation is authorized to issue, which can impact future funding and ownership structure. Additionally, the Articles of Incorporation typically require the names and addresses of the initial directors, providing a clear picture of who will guide the company in its early stages. Understanding these components is vital, as they not only ensure compliance with state laws but also establish the framework for governance and operational procedures. By carefully crafting this document, entrepreneurs can set their businesses on a path to success, while also protecting their personal assets from potential liabilities.

Misconceptions

Understanding the Articles of Incorporation is crucial for anyone looking to form a corporation. However, several misconceptions can lead to confusion. Here are nine common misconceptions:

- Filing Articles of Incorporation guarantees business success. Many believe that simply filing this document will ensure their business thrives. In reality, success depends on various factors, including market conditions and management practices.

- All businesses need Articles of Incorporation. Not every business structure requires this form. Sole proprietorships and partnerships, for instance, do not need to file Articles of Incorporation.

- Articles of Incorporation are the same as bylaws. These two documents serve different purposes. Articles of Incorporation establish the corporation's existence, while bylaws outline the internal rules governing the corporation.

- Once filed, Articles of Incorporation cannot be changed. This is incorrect. Amendments can be made to the Articles of Incorporation if necessary, following the proper legal procedures.

- Filing is a one-time process. Some believe that after filing, no further action is needed. In fact, corporations must comply with ongoing requirements, including annual reports and fees.

- Anyone can file Articles of Incorporation. While it's possible for individuals to file on their own, it is often advisable to seek professional assistance to ensure compliance with state laws.

- Articles of Incorporation can be filed in any state. Each state has its own requirements and procedures. It's essential to file in the state where the business will operate or where it is registered.

- There are no fees associated with filing. Filing Articles of Incorporation usually incurs a fee, which varies by state. Budgeting for this expense is necessary.

- Once incorporated, personal liability is eliminated. While incorporation provides some protection, personal liability can still arise from personal guarantees or illegal activities.

By addressing these misconceptions, individuals can better navigate the incorporation process and set their businesses on a path to success.

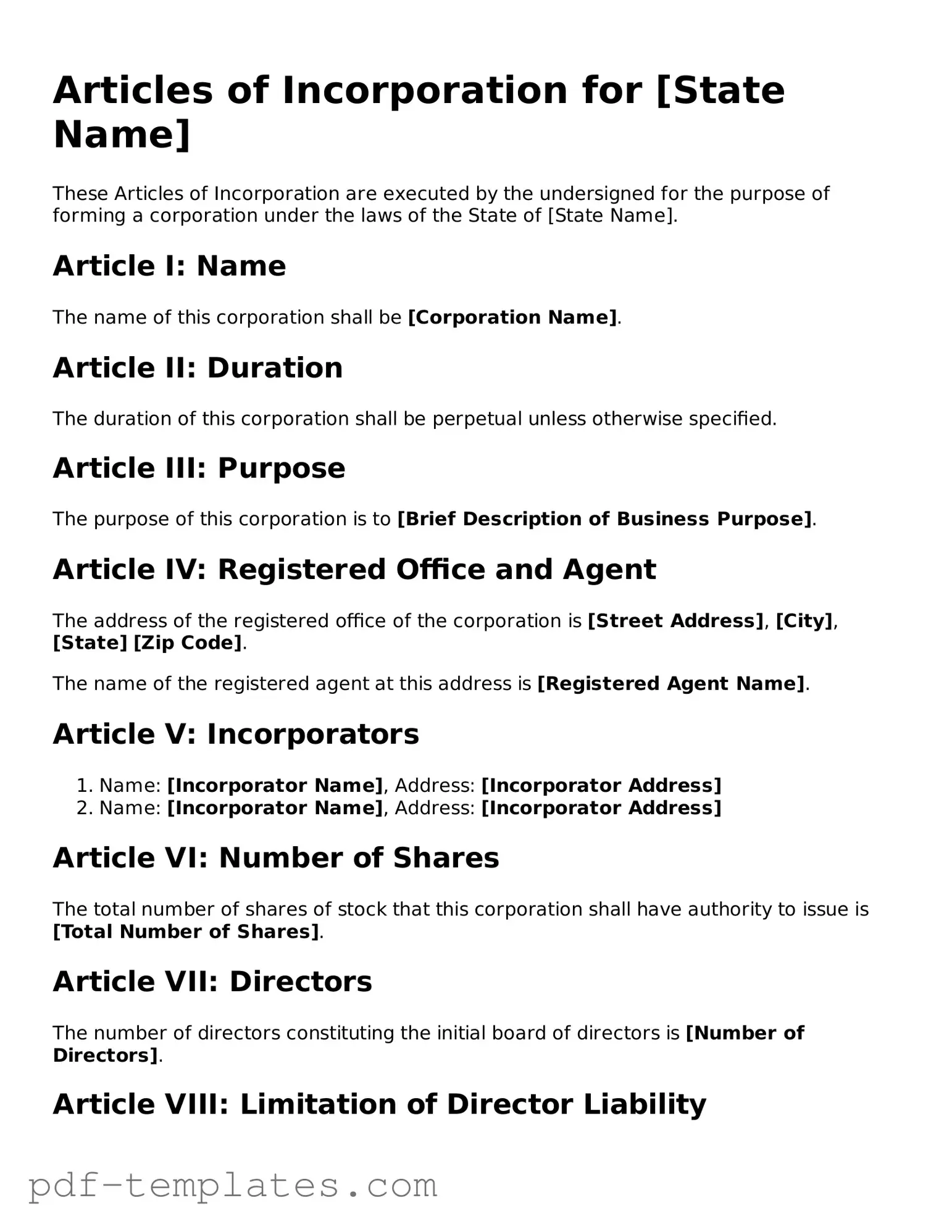

Articles of Incorporation - Customized for State

Articles of Incorporation: Usage Instruction

Filling out the Articles of Incorporation form is an important step in establishing your business. After completing the form, you will need to submit it to the appropriate state agency along with any required fees. This process officially recognizes your business as a legal entity.

- Begin by gathering necessary information about your business, including its name, address, and purpose.

- Clearly state the name of your corporation. Ensure it complies with state naming requirements.

- Provide the principal office address of the corporation. This should be a physical address, not a P.O. Box.

- Specify the purpose of your corporation. This can be a brief statement describing the nature of your business activities.

- List the names and addresses of the initial directors. Typically, you need at least one director.

- Indicate the number of shares the corporation is authorized to issue. Specify the par value if applicable.

- Include the name and address of the registered agent. This person or entity will receive legal documents on behalf of the corporation.

- Review the form for accuracy and completeness. Make sure all required fields are filled out.

- Sign and date the form. An authorized person must sign it to validate the submission.

- Submit the completed form to the appropriate state agency along with any required filing fees.

Common mistakes

-

Failing to include the correct name of the corporation. The name must be unique and comply with state requirements.

-

Not providing a valid registered agent. A registered agent must have a physical address in the state of incorporation.

-

Neglecting to specify the purpose of the corporation. A clear statement of purpose is essential for legal compliance.

-

Inaccurate or incomplete information about the incorporators. All incorporators must be listed with accurate details.

-

Choosing an inappropriate structure for the corporation. The type of corporation (e.g., LLC, S-Corp) should match the business needs.

-

Ignoring state-specific filing requirements. Each state has its own rules, and failing to adhere can lead to delays.

-

Forgetting to include the number of shares authorized to issue. This is a critical detail for stock corporations.

-

Not signing the form. All necessary parties must sign the Articles of Incorporation for it to be valid.

-

Submitting the form without the required fees. Payment is essential to process the incorporation.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | The Articles of Incorporation is a legal document that establishes a corporation in the U.S. |

| Governing Laws | Each state has specific laws governing the incorporation process, such as the Delaware General Corporation Law. |

| Required Information | Typically includes the corporation's name, purpose, registered agent, and number of shares authorized. |

| Filing Process | Must be filed with the appropriate state agency, often the Secretary of State. |

| Fees | Filing fees vary by state and can range from $50 to several hundred dollars. |

| Amendments | Changes to the Articles of Incorporation require filing an amendment with the state. |

| Public Record | Once filed, the Articles of Incorporation become a public document accessible by anyone. |

| Importance | Establishes the legal existence of the corporation, protecting owners from personal liability. |

Dos and Don'ts

When filling out the Articles of Incorporation form, it is important to follow specific guidelines to ensure accuracy and compliance. Below are seven recommendations on what to do and what to avoid during this process.

- Do ensure all required fields are completed accurately.

- Do use clear and concise language to describe the business purpose.

- Do double-check spelling and grammar before submission.

- Do include the names and addresses of all incorporators.

- Don't leave any mandatory sections blank.

- Don't use vague terms that could lead to confusion about the business's purpose.

- Don't submit the form without reviewing state-specific requirements.

Following these guidelines will help ensure that the Articles of Incorporation are completed correctly, facilitating a smoother incorporation process.

Similar forms

The Articles of Incorporation serve as a foundational document for forming a corporation, but there are several other documents that share similarities in purpose and function. One such document is the Bylaws. Bylaws outline the internal rules and procedures for managing a corporation. While the Articles of Incorporation are filed with the state to officially create the corporation, Bylaws govern day-to-day operations, including the roles of officers and how meetings are conducted. Together, they establish both the legal identity and operational framework of the business.

Another related document is the Operating Agreement, particularly for Limited Liability Companies (LLCs). Similar to Bylaws, an Operating Agreement details the management structure and operational guidelines of the LLC. It specifies the rights and responsibilities of members, how profits are distributed, and procedures for adding or removing members. While the Articles of Incorporation are specific to corporations, the Operating Agreement serves a similar purpose for LLCs, ensuring clarity and structure.

The Certificate of Incorporation is closely aligned with the Articles of Incorporation. In some states, these terms are used interchangeably. This document is also filed with the state and includes essential information about the corporation, such as its name, address, and purpose. It essentially serves the same purpose as the Articles of Incorporation, confirming the legal existence of the corporation.

Meeting Minutes are another document that shares similarities with the Articles of Incorporation. While not a foundational document, Meeting Minutes serve to record the decisions made during corporate meetings. They ensure that the actions taken by the board of directors or shareholders are documented, providing a historical account of the corporation's governance. This documentation helps maintain transparency and accountability within the organization.

Shareholder Agreements are also relevant in this context. These agreements outline the rights and obligations of shareholders in a corporation. Similar to the Articles of Incorporation, which establish the corporation's framework, Shareholder Agreements provide additional clarity on how shares are managed, voting rights, and what happens if a shareholder wishes to sell their shares. They serve to protect the interests of all parties involved.

Another important document is the Business License. While the Articles of Incorporation create the corporation, a Business License is often required to legally operate within a specific jurisdiction. This document ensures that the business complies with local regulations and can engage in its intended activities. Both documents are essential for establishing and maintaining the legal status of a business.

For those looking to buy or sell recreational vehicles, it's important to have all necessary documentation in order to make the process seamless. A critical component in this transaction is the Texas RV Bill of Sale, which ensures the proper transfer of ownership. This legal document aids both the buyer and seller, providing essential details that clarify the transaction. To find a suitable form, you can visit documentonline.org/blank-texas-rv-bill-of-sale for more information and resources.

The Tax Identification Number (TIN) is also a crucial document for corporations. Similar to the Articles of Incorporation, obtaining a TIN is necessary for tax purposes. This number is used by the IRS to identify the business for tax reporting and compliance. Without it, a corporation cannot legally conduct business or file taxes, making it an essential component of the corporate framework.

Lastly, the Annual Report is another document that bears similarities to the Articles of Incorporation. Corporations are typically required to file Annual Reports with the state to maintain their good standing. These reports provide updated information about the corporation, such as its address, officers, and financial status. While the Articles of Incorporation establish the corporation, the Annual Report ensures that the state has current information, reinforcing the ongoing legitimacy of the business.

More Documents

What Is a Health Care Directive - Creating an advanced health care directive is an important step in managing your health care future.

In California, it is important to understand the significance of using a Quitclaim Deed, especially in situations where time and clarity are of the essence. This form facilitates the transfer of real estate interests between individuals without the need for title guarantees, as highlighted by its common use among family members or in resolving title disputes. For those looking for a comprehensive understanding of legal documents related to property transfers, refer to All California Forms which provide essential resources and templates.

Skin Assessment Shower Sheets for Cna - Regular use of the form is essential for effective skin monitoring.

What Does a Roof Warranty Cover - Professional cleaning from MCS Roofing is required to keep your warranty in effect.