Get Adp Pay Stub Form in PDF

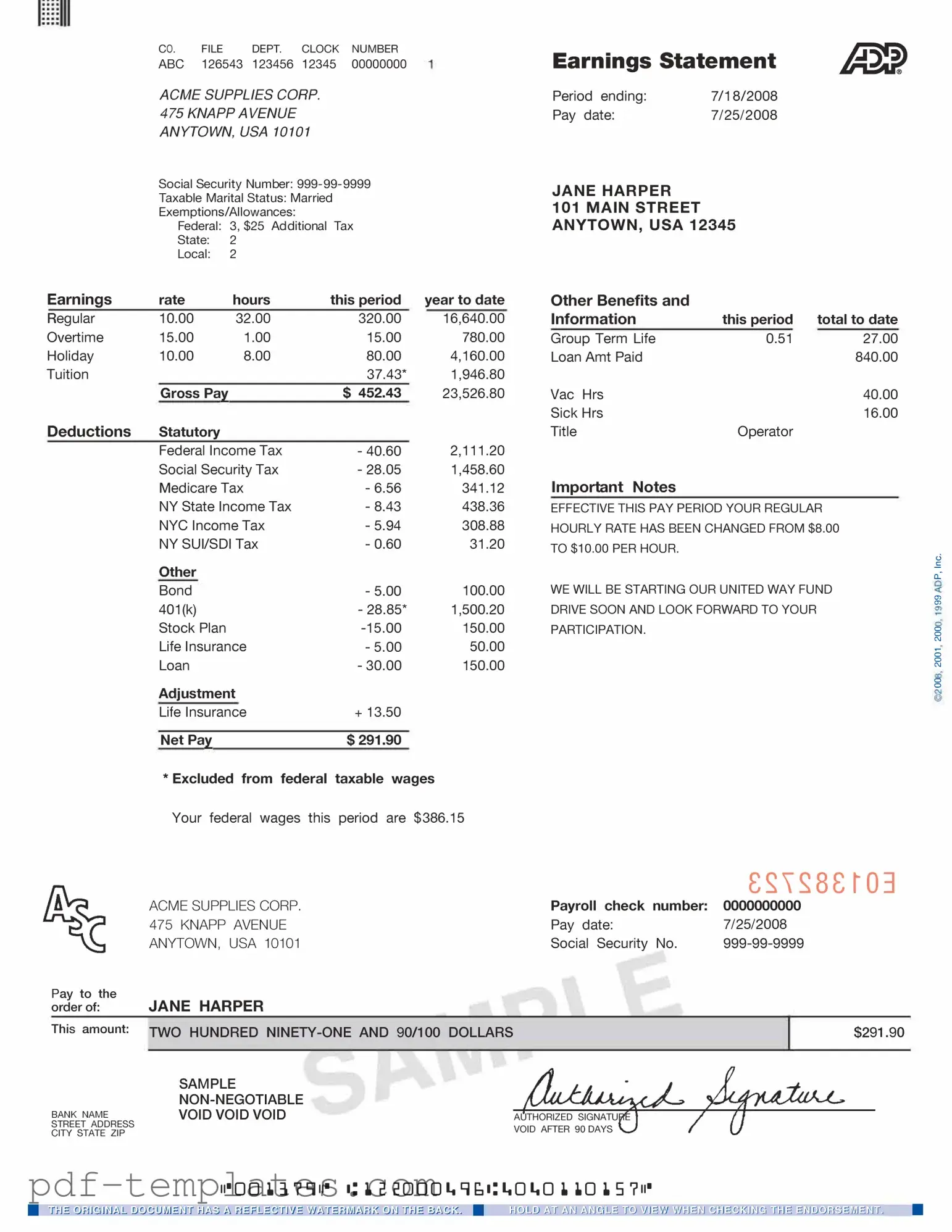

The ADP Pay Stub form is an essential document for employees, providing a clear breakdown of earnings and deductions for each pay period. It typically includes vital information such as gross pay, net pay, tax withholdings, and various deductions like health insurance and retirement contributions. Understanding this form is crucial for employees to verify their compensation and ensure that all deductions are accurate. Additionally, the pay stub often contains year-to-date totals, which help employees track their earnings and tax contributions over time. Familiarity with the ADP Pay Stub form not only aids in personal financial planning but also serves as a valuable resource for resolving any discrepancies with payroll. Therefore, it’s important to review this document carefully each pay period to maintain financial accuracy and transparency.

Misconceptions

- Misconception 1: The ADP pay stub is not an official document.

- Misconception 2: Pay stubs only show gross pay.

- Misconception 3: Employees cannot access their pay stubs online.

- Misconception 4: Pay stubs are only necessary for tax purposes.

- Misconception 5: ADP pay stubs do not show deductions for benefits.

- Misconception 6: All employers use the same format for pay stubs.

- Misconception 7: Pay stubs are not needed if direct deposit is used.

- Misconception 8: Errors on pay stubs cannot be corrected.

This is incorrect. The ADP pay stub is an official record of an employee's earnings and deductions, provided by a reputable payroll service.

In reality, ADP pay stubs detail gross pay, net pay, and various deductions, offering a comprehensive view of an employee's earnings.

Employees can access their pay stubs online through the ADP portal, ensuring they have their financial information readily available.

While pay stubs are useful for tax preparation, they are also important for budgeting, loan applications, and verifying income.

This is not true. ADP pay stubs clearly list deductions for benefits such as health insurance, retirement contributions, and other withholdings.

Each employer may customize the format of their ADP pay stubs, but all must include essential information as required by law.

Even with direct deposit, pay stubs are important for tracking earnings and deductions, providing a record for employees.

Errors can be addressed. Employees should report discrepancies to their payroll department for timely resolution.

Adp Pay Stub: Usage Instruction

Completing the ADP Pay Stub form is a straightforward process that requires careful attention to detail. Accurate information ensures that your pay stub reflects the correct earnings and deductions. Follow the steps below to fill out the form correctly.

- Begin by entering your employee identification number in the designated field.

- Next, fill in your name as it appears on your official documents.

- Provide your address, including street, city, state, and ZIP code.

- Indicate your pay period dates, specifying the start and end dates.

- Enter your gross pay for the pay period, which is the total earnings before deductions.

- List any deductions such as taxes, health insurance, and retirement contributions.

- Calculate your net pay by subtracting total deductions from gross pay.

- Finally, review all entries for accuracy before submitting the form.

Common mistakes

-

Incorrect Personal Information: Many individuals mistakenly enter the wrong name, address, or Social Security number. This can lead to issues with tax reporting and benefits.

-

Inaccurate Hours Worked: Failing to accurately report the number of hours worked can result in underpayment or overpayment. Double-checking hours before submission is crucial.

-

Omitting Deductions: Some people forget to include mandatory deductions, such as health insurance or retirement contributions. This oversight can affect net pay calculations.

-

Misclassifying Employment Status: It's important to accurately identify whether you are an employee or independent contractor. Misclassification can lead to tax complications.

-

Ignoring State-Specific Requirements: Each state may have its own regulations regarding pay stubs. Not adhering to these can lead to compliance issues.

-

Failure to Review Before Submission: Rushing through the process often results in errors. Taking the time to review the completed form can prevent many common mistakes.

File Specifics

| Fact Name | Description |

|---|---|

| Purpose | The ADP Pay Stub form provides employees with a detailed breakdown of their earnings, deductions, and net pay for a specific pay period. |

| Components | This form typically includes information such as employee name, pay period dates, gross pay, taxes withheld, and other deductions. |

| Frequency | Pay stubs are generated with each payroll cycle, which can be weekly, bi-weekly, or monthly, depending on the employer's payroll schedule. |

| Legal Requirement | Many states require employers to provide pay stubs to employees as part of wage and hour laws, ensuring transparency in compensation. |

| State Variations | Some states, like California, have specific laws governing the information that must be included on pay stubs, such as itemized deductions. |

| Access | Employees can typically access their pay stubs through an online portal provided by their employer or receive them in printed form. |

| Importance | Pay stubs are essential for employees to track their earnings, verify tax withholdings, and provide proof of income for loans or other financial transactions. |

Dos and Don'ts

When filling out the ADP Pay Stub form, it's important to be careful and thorough. Here’s a helpful list of things you should and shouldn’t do to ensure accuracy and completeness.

- Do: Read all instructions carefully before starting.

- Do: Use clear and legible handwriting or type your information.

- Do: Double-check all numbers and calculations for accuracy.

- Do: Include all necessary personal information, such as your name and employee ID.

- Do: Keep a copy of your completed form for your records.

- Don't: Leave any required fields blank.

- Don't: Use correction fluid or tape to fix mistakes.

- Don't: Submit the form without reviewing it first.

- Don't: Ignore deadlines for submission.

- Don't: Forget to sign and date the form where required.

Following these guidelines will help ensure your ADP Pay Stub form is filled out correctly, making the process smoother for everyone involved.

Similar forms

The W-2 form is a key document that employees receive from their employers at the end of each year. It summarizes an employee's total earnings and the taxes withheld throughout the year. Like the ADP pay stub, the W-2 provides important financial information, but it covers a longer period. Both documents are essential for tax filing, ensuring that employees have accurate records of their income and deductions.

The pay statement is another document similar to the ADP pay stub. It details an employee's earnings for a specific pay period, including hours worked, gross pay, deductions, and net pay. While the ADP pay stub may be more standardized, pay statements can vary by employer. Both serve the same purpose of informing employees about their compensation and any deductions taken from their paychecks.

The 1099 form is used for independent contractors and freelancers. This document reports income received outside of traditional employment. Similar to the ADP pay stub, the 1099 outlines earnings but does not include tax withholdings. Both documents are crucial for tax reporting, helping individuals understand their income sources and obligations.

The payroll summary report is an internal document used by employers to track overall payroll expenses. It consolidates data from all employee pay stubs, providing a comprehensive view of total wages, taxes, and deductions for a specific period. While the ADP pay stub focuses on individual earnings, the payroll summary report offers a broader perspective, beneficial for financial planning and budgeting.

The earnings statement is similar to the ADP pay stub in that it details an employee's pay for a specific period. It breaks down gross pay, deductions, and net pay. However, an earnings statement may be issued less frequently than a pay stub. Both documents ensure employees are informed about their earnings and any deductions made from their paychecks.

The paycheck is a physical or electronic document that represents payment for work performed. It includes the same essential information as the ADP pay stub, such as gross pay, deductions, and net pay. While the paycheck is the actual payment method, the pay stub serves as a record of that transaction, providing a detailed breakdown for the employee's reference.

The tax withholding statement is another important document that relates to the ADP pay stub. It outlines the amount of federal, state, and local taxes withheld from an employee's paycheck. This document is crucial for understanding tax liabilities and ensuring proper tax payments. Both documents work together to provide clarity on how much an employee earns and what is taken out for taxes.

The benefits statement is similar in that it provides information about employee benefits, including health insurance and retirement contributions. While the ADP pay stub focuses on wages, the benefits statement details the value of non-cash compensation. Both documents are vital for employees to understand their total compensation package, including both cash and non-cash benefits.

Other PDF Forms

Do 1099 Employees Get Pay Stubs - A document that outlines payment details for an independent contractor.

Renewing a Passport - The collected photographs will not be printed in photographic quality due to security measures.