Get Acord 130 Form in PDF

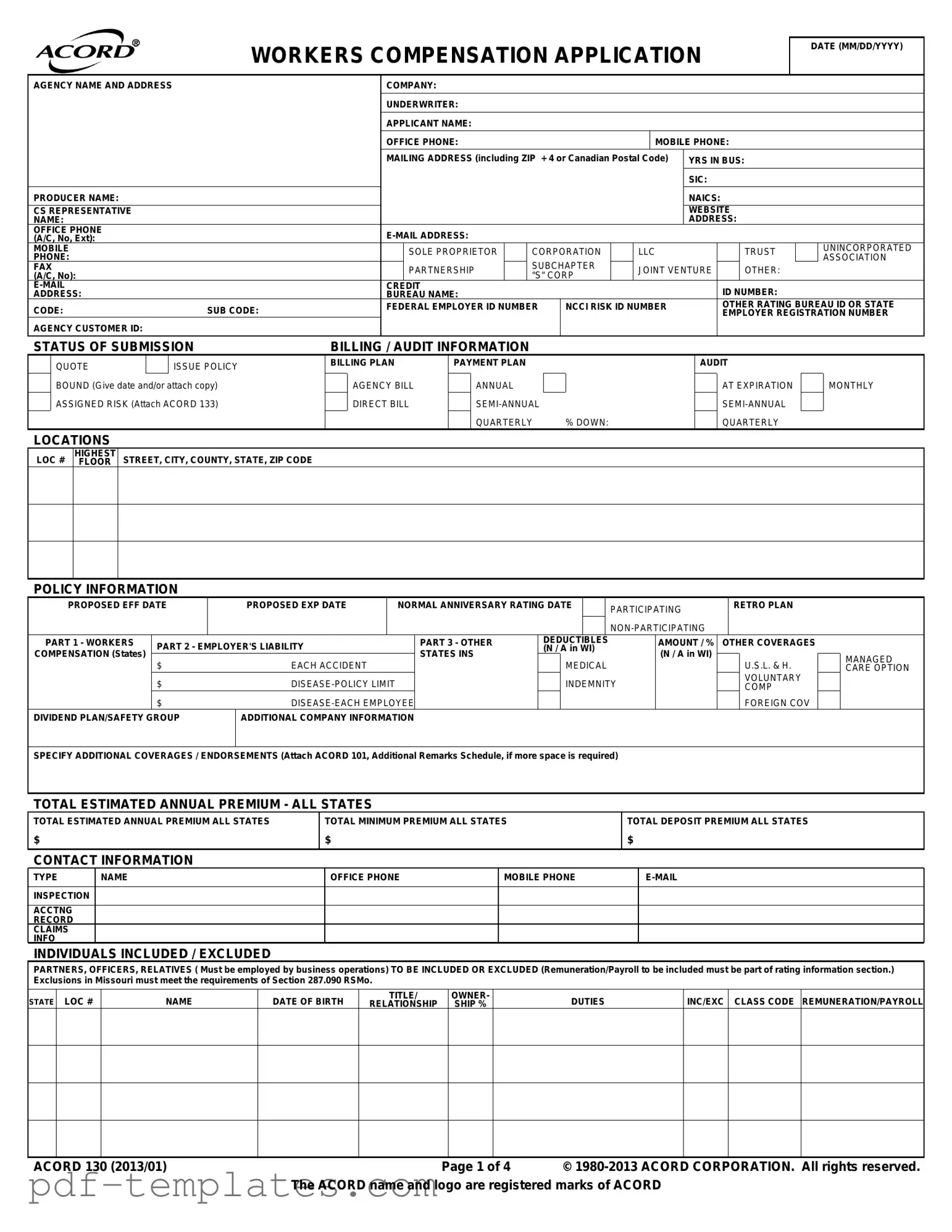

The ACORD 130 form serves as a crucial document in the realm of workers' compensation insurance applications, streamlining the process for both agents and applicants. This form collects essential information about the applicant's business, including its name, address, and contact details, while also requiring specifics about the nature of operations and employee classifications. A comprehensive overview of coverage options is provided, detailing various aspects such as employer's liability and other deductibles. Furthermore, the form includes sections dedicated to prior carrier information and loss history, which are vital for assessing risk and determining premiums. The ACORD 130 also addresses billing and audit preferences, allowing applicants to choose their desired payment plans. With its detailed structure, the form not only facilitates a thorough evaluation of the applicant's needs but also ensures compliance with state regulations, making it an indispensable tool for businesses seeking workers' compensation coverage.

Misconceptions

Misconceptions about the Acord 130 form can lead to confusion and errors in the application process. Here are four common misconceptions, along with clarifications:

- Misconception 1: The Acord 130 form is only for large businesses.

- Misconception 2: Completing the form guarantees approval for coverage.

- Misconception 3: The form only needs to be filled out once.

- Misconception 4: Only the owner needs to sign the form.

This is not true. The Acord 130 form is applicable to businesses of all sizes, including small and medium enterprises. It is designed to collect essential information needed for workers' compensation insurance, regardless of the business's scale.

While submitting a completed Acord 130 form is a critical step in the application process, it does not guarantee that coverage will be issued. Insurers will review the information provided and may require additional documentation or clarification before making a decision.

Many believe that the Acord 130 form is a one-time requirement. However, it often needs to be updated annually or whenever there are significant changes in the business, such as a change in ownership, operations, or employee count.

This is a common misunderstanding. The Acord 130 form must be signed by an authorized representative of the business, which could include an officer, owner, or partner. This ensures that the information is accurate and verified.

Acord 130: Usage Instruction

Completing the Acord 130 form is a necessary step in applying for workers' compensation insurance. This form collects essential information about your business, including its structure, operations, and coverage needs. Follow these steps carefully to ensure that all required information is accurately provided.

- Enter the application date in the format MM/DD/YYYY.

- Fill in the agency name and address.

- Provide the company name and underwriter details.

- Input the applicant's name, office phone, and mobile phone.

- Complete the mailing address, ensuring to include the ZIP + 4 code or Canadian postal code.

- Indicate the years in business and the SIC and NAICS codes.

- Fill in the producer name and contact information including email address.

- Mark the appropriate business structure (e.g., sole proprietor, corporation, LLC).

- Provide the credit ID number and federal employer ID number.

- Detail the billing/audit information, including the preferred billing plan.

- List the locations of your business and the highest floor occupied.

- Indicate the proposed effective and expiration dates for the policy.

- Complete the sections for workers compensation, employer's liability, and any other coverages.

- Provide the total estimated annual premium and any minimum or deposit premiums.

- Fill in contact information for individuals included or excluded from coverage.

- Provide prior carrier information and loss history for the past five years.

- Describe your nature of business and operations.

- Answer the general information questions, providing explanations for any "yes" responses.

- Sign and date the application, ensuring the signature is from an authorized representative.

Common mistakes

-

Incorrect Dates: Entering the wrong date format can lead to confusion. Always use MM/DD/YYYY as specified.

-

Missing Contact Information: Failing to provide complete contact details, such as the office phone or email address, can delay processing.

-

Inaccurate Business Classification: Selecting the wrong SIC or NAICS codes can result in incorrect premium calculations. Ensure these codes accurately reflect your business activities.

-

Omitting Employee Information: Not listing all employees, especially those included or excluded, can lead to compliance issues. Include accurate payroll and remuneration data for all relevant individuals.

-

Failure to Attach Required Documents: Not attaching the ACORD 133 form for assigned risk submissions can lead to rejection. Always check for necessary attachments.

-

Inconsistent Loss History: Providing incomplete or inaccurate loss history for the past five years can raise red flags. Ensure all claims and premiums are accurately reported.

-

Neglecting Safety Program Information: Failing to disclose whether a written safety program is in place can affect coverage eligibility. Be clear about safety measures.

-

Ignoring State-Specific Requirements: Each state may have unique requirements or questions. Familiarize yourself with your state's regulations to avoid issues.

File Specifics

| Fact Name | Description |

|---|---|

| Purpose | The ACORD 130 form is used to apply for workers' compensation insurance, providing essential information about the applicant and their business operations. |

| Governing Law | The form is governed by state-specific laws related to workers' compensation insurance, which can vary significantly across the United States. |

| Required Information | Applicants must provide detailed information, including business structure, estimated payroll, and employee classifications. |

| Submission Types | Submissions can be categorized as 'Bound', 'Quote', or 'Audit', depending on the desired outcome of the application. |

| Exclusions | Certain exclusions apply, such as those outlined in Missouri's Section 287.090 RSMo, which dictate specific criteria for employee classification. |

| Signature Requirement | The form must be signed by an authorized representative, typically an officer, owner, or partner of the business, to confirm the accuracy of the information provided. |

Dos and Don'ts

When filling out the ACORD 130 form, it's important to be thorough and accurate. Here are some key do's and don'ts to keep in mind:

- Do provide accurate dates in the required format (MM/DD/YYYY).

- Do include all relevant contact information for the applicant, including office and mobile phone numbers.

- Do specify the type of business entity, such as corporation or sole proprietor.

- Do ensure that all employees, including partners and relatives, are listed correctly.

- Do attach any additional remarks or schedules if you need more space.

- Don't leave any sections blank. If a question doesn’t apply, indicate that clearly.

- Don't provide misleading information or omit important details, as this could lead to issues later.

- Don't forget to check for any state-specific requirements that may apply.

- Don't sign the application without reviewing it carefully for accuracy.

Completing the ACORD 130 form correctly can help ensure a smoother application process. Take your time and double-check your entries.

Similar forms

The ACORD 125 form is often used alongside the ACORD 130 form in the insurance industry. It serves as a general liability application and provides a comprehensive overview of the insured's business operations. Just like the ACORD 130, it collects essential information about the applicant, including the nature of the business, contact details, and coverage needs. The ACORD 125 focuses more on general liability coverage, while the ACORD 130 zeroes in on workers' compensation, making them complementary documents in the insurance application process.

Another document that shares similarities with the ACORD 130 is the ACORD 133 form, which is specifically designed for assigned risk applications. The ACORD 133 is typically used when a business cannot obtain workers' compensation insurance through the standard market. Like the ACORD 130, it gathers information about the business, its employees, and its operations. Both forms aim to provide insurers with the necessary details to assess risk and determine coverage options, but the ACORD 133 is tailored for situations where standard options are unavailable.

The ACORD 101 form, known as the Additional Remarks Schedule, is also relevant in this context. While the ACORD 130 collects vital information about workers' compensation, the ACORD 101 allows applicants to provide additional details or clarifications that may not fit within the standard form. This document can be attached to the ACORD 130 to enhance the clarity of the applicant's situation, ensuring that all relevant information is available for the insurer's review.

Similar to the ACORD 130 is the ACORD 140 form, which is used for commercial property applications. This form gathers information about the property being insured, including its location, value, and usage. While the ACORD 130 focuses on employee-related risks, the ACORD 140 addresses physical assets. Both forms require detailed descriptions to help insurers evaluate the associated risks, making them essential components of the commercial insurance application process.

In addition to the various ACORD forms discussed, it is crucial for buyers and sellers in Texas to consider utilizing a Texas Vehicle Purchase Agreement, which ensures clarity and legality in vehicle transactions. By documenting the sale terms regarding the vehicle and financial details, both parties are protected. For those looking to create or review such agreements, resources are available at documentonline.org/blank-texas-vehicle-purchase-agreement/, helping to streamline the buying process and mitigate potential disputes.

The ACORD 160 form, which is a Commercial General Liability Application, also bears resemblance to the ACORD 130. It collects information about a business's general liability exposures, such as operations, locations, and coverage limits. While the ACORD 130 is dedicated to workers' compensation, the ACORD 160 aims to address liability concerns. Both forms work in tandem to provide a comprehensive view of a business's risk profile, aiding insurers in making informed decisions.

The ACORD 25 form, known as the Certificate of Liability Insurance, also serves a related purpose. Although it is not an application form like the ACORD 130, it provides proof of insurance coverage for businesses. The ACORD 25 includes details about the type of coverage, limits, and effective dates, similar to the information found in the ACORD 130. While one is an application and the other a certificate, both documents are critical in establishing and verifying insurance coverage for businesses.

Lastly, the ACORD 50 form, which is the Commercial Auto Application, parallels the ACORD 130 in that it gathers specific information related to a different type of coverage. While the ACORD 130 focuses on workers' compensation, the ACORD 50 collects details about vehicles, drivers, and usage. Both forms are necessary for evaluating risk and determining appropriate coverage, ensuring that businesses are adequately protected in various aspects of their operations.

Other PDF Forms

Miscarriage Symptoms - The contents guide families in navigating the process after experiencing a loss.

For individuals in California, using the Motor Vehicle Power of Attorney form can streamline processes related to vehicle management. By designating someone to take care of essential tasks such as registration and sales documentation, car owners can ensure their interests are protected even when they are unavailable. To find this form and other related documents, you can visit All California Forms for more information.

Ms Word Chart Examples - Include relevant details in the fourth column to support the topic.